Interest-free loan between legal entities tax consequences Good evening! I work as an accountant at a small company. The company is young, turnover is small, so there is not enough money.

And not so long ago, the director asked to find out whether it was possible to issue an interest-free loan between legal entities, so that the tax consequences were minimal.

Having studied the legislative framework, I came to the conclusion that, in general, such operations are allowed. You don’t even have to pay income tax like before. True, for this you need to put the deputy’s money into production.

Our company has production facilities, so we fall under this criterion. Now the main thing is to find a legal entity that is ready to provide us with a loan without interest on it.

Who has the right to provide a loan?

Any activity related to lending to individuals and legal entities is subject to licensing. Banks, credit organizations and microloan companies have the right to issue money. But ordinary organizations whose type of activity is not related to lending can also lend. For example, founders or employees can receive funds from their company. And a cash loan can be issued by counterparties, entrepreneurs or ordinary individuals. To do this, they will not need to obtain a license if the issuance of loans for them is not systematic and is not of an ongoing nature.

Important! Despite the fact that lending activities are subject to licensing, companies that do not have a license also have the right to issue loans. The main thing is that the issuance of loans in such a company is not constant and systematic.

Is a loan considered income under the simplified tax system?

Enterprises and individual entrepreneurs using the simplified system must take into account income and expenses.

Moreover, according to the Tax Code, income under the simplified tax system includes:

- from the sale of goods, works, services;

- non-operating income.

Cash or other things received by an organization or individual entrepreneur in the form of a loan do not have the main signs of income. Tax services adhere to this position.

When considering the question of whether a loan is income under the simplified tax system, you should refer to the following documents:

- Article 251 of the Tax Code of the Russian Federation;

- letter from the Federal Tax Service of the Russian Federation dated May 19, 2010. for No. ШС-37-3/ [email protected]

These documents provide an unambiguous understanding that any things or money received under a loan agreement are not income. Entrepreneurs and organizations using the simplified tax system should not indicate their KUDiR, as well as make appropriate tax assessments on these amounts, regardless of the applied object of taxation under the simplified tax system.

Income Expenses

If, when applying the simplified tax system with the taxable object “Income,” the loan funds are simply not indicated in the KUDiR upon receipt and return. Also, there is no need to include the interest paid on the loan, since the tax base and the amount of tax do not change, then for organizations and individual entrepreneurs who have chosen income-expenses as an object of taxation, the situation is different.

When receiving a loan, it will still not be taken into account in income, but when repaid, it will be included in the expenses of an organization or individual entrepreneur using the “simplified” system according to the “income-expenses” scheme. But interest, after it is paid to the lender, can be included in expenses.

Interest-free loans

Interest-free loans are often practiced in business, especially at the initial stage of company development; for example, the founder often provides financial assistance to his own company to purchase the necessary equipment or goods.

The legislation does not limit in any way the possibility of issuing and receiving interest-free loans. In this case, the entrepreneur or company that received such a loan does not have any income from which it is necessary to pay income.

It is worth noting that regional tax authorities often have their own opinion regarding interest-free loans. They believe that if an interest-free loan is received, the organization makes a profit by saving on interest.

In practice, if an interest-free loan was obtained at the expense of the founders, in most cases there are no disputes with the tax office. In other cases, you should come to terms with the need to pay additional contributions to the budget or defend your own position, including in court.

Comment. In disputes with tax inspectorates regarding profits from interest-free loans, most courts side with the borrower, but the proceedings are quite lengthy and often require the involvement of a competent lawyer, which is expensive for small businesses.

Providing a loan to another organization: accounting procedure

According to the current terms of the agreement concluded between the lender and the borrower, both cash and material assets can be transferred as a loan. For example, you can lend fixed assets, inventories, finished products, raw materials, as well as goods and other property of the organization. When reflecting a loan issued to another organization, the amounts of issued assets are indicated at the cost of material assets that are transferred to the borrower. If the loan is issued in a foreign currency, then the accounting entry must be reflected in rubles (

How to get a loan

If the owner lends money to his company, then the participant and the limited liability company find themselves in a borrowing relationship. There are no restrictions on the size of the share in the authorized capital or the organizational and legal form of the founder (individual or legal entity). The transferred amount is also not limited by law.

The agreement must be drawn up in writing, as a separate document, preferably on company letterhead. If you do not formalize it in this way, but limit yourself only to documents confirming the receipt of money (payment order or cash receipt order), then there is a risk that the courts will refuse to recognize the borrowing relationship of the parties.

You can lend not only money, but also any valuables that must have generic characteristics. The borrower undertakes to return not the same thing, but a similar one, so the subject of the agreement may be building materials, goods, raw materials, etc. Of course, the owner of the organization most often lends money rather than anything else.

The owner of the company can direct the money for certain purposes, then the loan will be targeted. In this case, the agreement must contain not only a condition on the intended purpose, but also a procedure for monitoring the use of transferred funds. For example:

- transfer of documents confirming the intended use (supply agreements, invoices, receipts, payment orders, checks);

- notification of the date and place of delivery of purchased valuables;

- providing access to the place of storage of purchased property.

If the borrower does not fulfill the condition of the intended purpose, then the other party has the right to demand the return of money ahead of schedule or the application of additional sanctions provided for in the agreement.

By default, a loan agreement is considered compensated, i.e. involves the accrual of an interest rate, even if the terms and conditions do not say anything about this. In this case, interest is calculated at the refinancing rate on the day the debt is repaid. To ensure that this condition does not apply automatically, the provisions of the contract must explicitly state that interest is not charged for the use of funds.

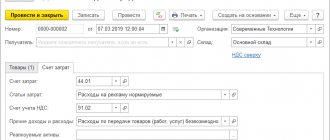

Providing a loan to another organization at interest: transactions

If an interest-bearing loan agreement is concluded, then the postings will include a special account 58 “Financial investments”, to which a separate sub-account “Funds transferred for a loan” is opened.

| Operation | Debit | Credit |

| A cash loan was issued | 58 | 50 51 52 |

| Loan issued in kind | 58 | 01 10 41 |

| Loan repayment | 50 51 52 01 10 41 | 58 |

Loan repayment

Repay the loan (depending on the type of property being transferred and the terms of the agreement) by writing:

Debit 51 (50, 41, 10...) Credit 58-3 – reflects the return of the interest-bearing loan;

Debit 51 (50, 41, 10...) Credit 76 – reflects the return of the interest-free loan.

When repaying a loan in kind, reflect the amount of “input” VAT on the cost of incoming property using the following posting:

Debit 19 Credit 58-3 – input VAT on property received from the borrower when repaying an interest-bearing loan is taken into account;

Debit 19 Credit 76 – input VAT on property received from the borrower when repaying an interest-free loan is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – accepted for deduction of input VAT (if the organization is a VAT payer).

An example of how a loan issued to an organization in kind is reflected in accounting. The terms of the agreement establish an interest rate; interest is paid in cash

On January 31, Alpha LLC provided an interest-bearing loan in kind to Proizvodstvennaya LLC.

"Alpha" and "Master" are VAT payers.

The subject of the contract is 12,000 sheets of galvanized iron in the amount of 600,000 rubles. (including VAT – RUB 91,525). The actual cost of the goods is 508,475 rubles. The loan repayment deadline is March 2. The interest rate under the terms of the agreement is 20 percent per annum. Interest is paid in cash.

The refinancing rate on the date of interest payment was conditionally 11 percent per annum, not a leap year.

In accordance with Alpha's accounting policy, for accounting purposes, the organization recognizes income from the provision of interest-bearing loans as part of other income.

The following entries were made in Alpha's accounting.

January 31:

Debit 58-3 Credit 10 – 508,475 rub. – the amount of the loan issued is reflected in the amount of the actual cost of the transferred goods;

Debit 58-3 Credit 68 subaccount “VAT calculations” – 91,525 rubles. – the amount of the loan issued is reflected in the amount of VAT accrued on the cost of materials transferred to the borrower.

28th of February:

Debit 76 Credit 91-1 – 9206 rub. (RUB 600,000 × 20%: 365 days × 28 days) – interest accrued on the loan for February.

2nd of March:

Debit 76 Credit 91-1 – 658 rub. (RUB 600,000 × 20%: 365 days × 2 days) – interest accrued on the loan for the period from March 1 to March 2.

The refinancing rate during the loan period was 11 percent per annum.

The amount of interest calculated based on the refinancing rate will be: RUB 600,000. × 31 days : 365 days × 11% = 5606 rub.

The accountant charged VAT on the amount of excess interest received over the amount of interest calculated based on the refinancing rate. The excess amount is RUB 4,258. (9206 rubles + 658 rubles – 5606 rubles).

VAT on the amount of excess interest received over the amount of interest calculated based on the refinancing rate amounted to 650 rubles. (RUB 4,258 × 18/118).

The following entries were made in accounting:

Debit 91-2 Credit 68 subaccount “VAT calculations” – 650 rubles. – VAT is charged on the amount of excess interest calculated based on the terms of the agreement over the amount of interest calculated based on the refinancing rate;

Debit 51 Credit 76 – 9864 rub. (9206 rubles + 658 rubles) – interest was received from the borrower for using the loan in kind;

Debit 10 Credit 58-3 – 508,475 rub. – materials received to pay off the loan debt were capitalized;

Debit 19 Credit 58-3 – 91,525 rub. – input VAT on the cost of returned materials is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 91,525 rubles. – accepted for deduction of input VAT.

An example of how a loan issued to an organization in kind is reflected in accounting. The terms of the agreement establish an interest rate; interest is paid in cash. The organization applies a special tax regime

On January 31, Alpha LLC provided an interest-bearing loan in kind to Proizvodstvennaya LLC.

Alpha uses a simplification.

The subject of the contract is 12,000 sheets of galvanized iron in the amount of 600,000 rubles. The actual cost of the goods is 600,000 rubles. The loan repayment deadline is March 2. The interest rate under the terms of the agreement is 20 percent per annum. Interest is paid in cash. It's not a leap year.

In accordance with Alpha's accounting policy, for accounting purposes, the organization recognizes income from the provision of interest-bearing loans as part of other income.

The following entries were made in Alpha's accounting.

January 31:

Debit 58-3 Credit 10 – 600,000 rub. – the amount of the loan issued is reflected in the amount of the actual cost of the transferred goods.

28th of February:

Debit 76 Credit 91-1 – 9206 rub. (RUB 600,000 × 20%: 365 days × 28 days) – interest accrued on the loan for February.

2nd of March:

Debit 76 Credit 91-1 – 658 rub. (RUB 600,000 × 20%: 365 days × 2 days) – interest accrued on the loan for the period from March 1 to March 2.

Debit 51 Credit 76 – 9864 rub. (9206 rubles + 658 rubles) – interest was received from the borrower for using the loan in kind;

Debit 10 Credit 58-3 – 600,000 rub. – materials received to pay off the loan debt were capitalized.

Providing an interest-free loan to another organization: transactions

If a loan was issued to another company under an interest-free loan agreement, then transactions are generated using account 76 “Settlements with other debtors and creditors.”

| Operation | Debit | Credit |

| A cash loan was issued | 76 | 50 51 52 |

| Loan issued in kind | 76 | 01 10 41 |

| Loan repayment | 50 51 52 01 10 41 | 76 |

If the company transfers the loan in kind, then VAT will need to be charged. To do this, the following posting is generated: D76 or 58 and K 68. When returning this debt, VAT may be charged to the lender, and the posting will be as follows: D19 and K 76 or 58 (

Loans provided to other organizations. Accounting and tax accounting.

The organization can issue loans to any other organizations or individuals. Under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him of the same kind and quality (Clause 1 of Article 807 of the Civil Code of the Russian Federation). A loan agreement in which the lender is an organization must be drawn up in writing. As a general rule, a loan agreement is for compensation. This means that even if the contract itself does not stipulate that the borrower must pay any interest to the lender, the contract is not interest-free. The borrower will still have to pay interest, the amount of which will be determined based on the refinancing rate of the Central Bank of the Russian Federation on the day the debt is paid (clause 1 of Article 809 of the Civil Code of the Russian Federation). If the parties really want to enter into an interest-free loan agreement, then such a condition must be included in the text of the agreement. The procedure for paying interest on the use of borrowed funds is established by the terms of the loan agreement. Interest can be paid monthly, quarterly, in a lump sum upon repayment of the loan, and in other ways.