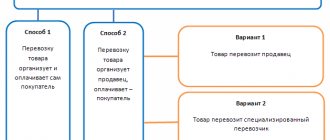

Method 1. Intermediary services

This method of rebilling transportation costs is the most common, although it is quite labor-intensive in terms of its documentary maintenance.

- Agreement

In the contract with the buyer, we fix a clause that we undertake on our own behalf to find a suitable carrier, enter into an agreement with him on the transportation of goods and monitor the implementation of this agreement until the goods are transferred to the buyer. That is, we indicate that we undertake the obligations of an intermediary between the buyer and the carrier organization. The main condition is to specify at least a symbolic amount of remuneration, since intermediary agreements must be compensated (Articles 990, 1005 of the Civil Code of the Russian Federation).

- Source documents

For transport services, we provide the buyer with a bill of lading on our behalf, generated on the basis of primary documents from the carrier organization. Don't forget to attach a copy of the carrier's bill of lading to it.

For intermediary services, we present to the buyer a report from the intermediary indicating the amount of his remuneration (Article 999 of the Civil Code of the Russian Federation). We develop the report form independently with its mandatory approval in the accounting policy.

- Invoice

We record the invoices received from the carrier organization in the journal of received and issued invoices (clause 1, subclause “a”, clause 11, section II, appendix 3 to the Decree of the Government of the Russian Federation “On filling out documents for VAT calculations” dated December 26, 2011 No. 1137).

For the buyer:

- we issue an invoice for transport services on our behalf and attach to it a copy of the invoice of the carrier organization (clause 1, subparagraph “a”, clause 7, section II, appendix 3 of the Decree of the Government of the Russian Federation “On filling out documents when making payments for VAT" dated December 26, 2011 No. 1137), registered in the invoice journal;

- We register the invoice for the brokerage fee in the sales book.

NOTE! When re-issuing an invoice for transport services, in lines 1 (date), 2, 2b, put the information of the carrier organization, not yours (subparagraphs “a”, “c”, paragraph 1, section II, appendix 1 to the resolution of December 26 .2011 No. 1137).

Read more about issuing invoices by intermediaries in our article “How to issue invoices when selling goods through an intermediary?”

Risk Reduction Reminder

In the situation under consideration, in order to reduce the risks of possible claims from the tax authorities against both the parent company and subsidiaries, it is advisable to follow a few simple rules.

1. When re-invoicing by an intermediary for reimbursable expenses, indicate directly as the seller the details of the service provider, and not the intermediary.

2. When re-issuing invoices by the intermediary, also attach certified copies of the original invoices received by the intermediary from the seller of services.

3. The intermediary shall keep logs of issued and received invoices and reflect data on intermediary transactions in Sections 10, 11 of the VAT tax return.

4. Subsidiary companies as final buyers of services should indicate in columns 11 and 12 of the purchase book the details of the parent company as an intermediary, and reflect information from the purchase book in Section 8 of the VAT return.

5. When the parent company or subsidiaries receive requests (demands) from the tax authorities related to possible discrepancies in the amounts of VAT calculated and accepted for deduction, provide the necessary explanations with references to primary documents and norms of legislation on taxes and fees, in accordance with in which the parent company acts as an intermediary and reissues invoices to subsidiaries in the manner established by Resolution No. 1137 for intermediaries.

Method 2. Changing the cost of the product

This type of re-invoicing of transport costs is not common in practice, but it is simpler in terms of documentation compared to the first.

- Agreement

Clause 3 Art. 485 of the Civil Code of the Russian Federation provides that in the sales contract it is possible to include a clause on changing the value of the goods upon the occurrence of certain circumstances. Alternatively, you can add a condition: if the delivery of the goods to the buyer is organized by the supplier, then the cost of the goods increases by the cost of transporting the goods to the buyer.

- Source documents

At the time of transfer of the goods to the carrier organization, you will already have an agreement on the provision of transport services and an invoice for payment for these services. Using these documents, we determine the amount of transportation costs (including VAT) and add it to the cost of the goods shipped to the buyer. We indicate the amount received in the delivery note. If several types of goods are shipped, then we distribute transportation costs between them in equal shares.

You can familiarize yourself with the form of the consignment note in the article “Unified form TORG-12 - form and sample.”

IMPORTANT! Do not include the cost of transport services as a separate line in the invoice. You do not provide services for the transportation of goods, therefore such a service should not be included in the invoices you issue.

If the cost of transport services changes after the buyer receives the invoice, adjustments are made to it in one of two ways:

- registration of a new adjusted invoice;

- making corrections to already completed 2 copies of the invoice: yours and the buyer’s.

For information on making changes to primary documents, read the material “Correcting errors in primary documents: The Federal Tax Service introduces new rules.”

The invoice received from the carrier organization will be considered the basis for reflecting expenses associated with the sale of goods (subclause 1, clause 1, article 253 of the Tax Code of the Russian Federation).

- Invoice

We issue an invoice for the amount indicated in the delivery note: the cost of the goods, increased by the cost of transport services. We record it in the sales book. If the cost of transport services included in the price of the goods changes, we generate an adjustment invoice for the amount of the increase (decrease) in transport costs (paragraph 3, clause 1, article 169 of the Tax Code of the Russian Federation). There is no need to correct the old invoice.

For an example of filling out adjustment invoices, see the article “Sample of filling out an adjustment invoice (2017-2018)”.

We register the invoice received from the carrier organization in the purchase book.

How to reflect the re-invoicing of transportation costs in transactions?

After we have dealt with the documentation of the re-billing of transport services to the buyer, we will consider the reflection of these operations in postings using a clear example.

Example

- The seller sold goods to the buyer in the amount of 895,420 rubles. (including VAT RUB 136,589.42).

- The purchase price of the goods is 762,710 rubles. (including VAT RUB 116,345.59).

- The cost of delivery of goods by the carrier under agreement with the seller amounted to 26,630 rubles. (including VAT RUB 4,062.20).

NOTE: with method No. 1, the intermediary reissues the delivery note and invoice for the cost of delivery (the sale of goods is not reflected in the intermediary’s accounting); With method No. 2, the shipping cost increases the cost of the product.

- The cost of intermediary services, reflected in method No. 1, is RUB 1,200.00. (including VAT RUB 183.05).

- The costs of transporting the goods are reimbursed by the buyer.

| Operation | Method 1. Intermediary services | Method 2. Change in product cost | ||||

| Dt | CT | Sum | Dt | CT | Sum | |

| Product purchased by seller | 646 364,41 | 646 364,41 | ||||

| 116 345,59 | 116 345,59 | |||||

| 116 345,59 | 116 345,59 | |||||

| Item sold to buyer | 895 420,00 | 922 050 = 895 420 + 26 630 | ||||

| 136 589,42 | 140 651,62 = 136 589,42 + 4 062,20 | |||||

| The costs of transporting the goods to the buyer are reflected (included in the price of the goods) | – | – | – | 22 567,8 | ||

| 4 062,20 | ||||||

| 4 062,20 | ||||||

| The cost of goods sold is written off | 646 364,41 | 668 932,21 = 22 567,8 + 646 364,41 | ||||

| Reflected intermediary remuneration for transport services | 1 200,00 | – | – | – | ||

| 183,05 | ||||||

| The results at the end of the month are reflected | 112 466,17 = 895 420 – 136 589,42 – 646 364,41 | 112 466,17 = 922 050 – 140 651,62 – 646 364,41 – 22 567,8 | ||||

| 1 016,95 = 1 200 – 183 | ||||||

| Profit tax accrued | 22 697 = (112 466,17 + 1 016,95) ×20% | 22 493 = 112 466,17 ×20% | ||||

| VAT paid | 20 427 = 136 589,42 + 183,05 – 116 345,59 | 20 243 = 140 651,62 – 116 345,59 – 4 062,20 | ||||

You can learn more about the accounting of intermediary transactions in our article “Features of an agency agreement in accounting.”

Read about the specifics of taxation of transport services in the article “What is the procedure for assessing VAT on transport services?”

As can be seen from the example discussed above, method No. 2 is beneficial not only from the point of view of simpler documentation, but also as one in which the tax burden is lower - in this case, you do not need to pay taxes on income in the form of remuneration for intermediary.

Results

Rebilling of transportation costs can be done through the seller's mediation between the buyer and the carrier. But it can also be carried out in the form of an increase in the cost of the goods by the amount of transportation costs incurred. The second method is preferable. Firstly, it is easier in terms of documentation. Secondly, it is financially more profitable, because the tax burden is lower.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

VAT: the buyer reimburses the seller for transportation costs

Commentary to the Letter of the Ministry of Finance of Russia dated August 15, 2012 N 03-07-11/299 “On the application of VAT deductions and issuing invoices for transport costs reimbursed by the buyer of goods to their seller”

How to correctly calculate VAT in one of the special cases arising during the transportation of goods is described in the commented Letter of the Ministry of Finance of Russia dated August 15, 2012 N 03-07-11/299.

In practice there may be several options.

This is precisely the situation that financiers commented on in the Letter in question.

The Letter emphasizes two points.

However, by and large, the current civil legislation does not oblige the conclusion of a mediation agreement. The conditions for organizing the delivery of goods to the buyer may well be regulated directly in the purchase and sale (supply) agreement.

The judges also agree with this approach. For example, in the Resolution of the Federal Antimonopoly Service of the Moscow District dated April 12, 2011 N KA-A41/957-11, the following points were emphasized:

If you don’t want to enter into a mediation agreement, but re-issuing invoices seems too complicated and troublesome, you can formalize the relationship in a different way.

In such a situation, it also makes sense to prescribe a specific method for revising the price.

In this case, both parts of the price will form a single final price, which will determine the full cost of the goods sold, that is, the proceeds from its sale.

That is, accounting and taxation will be carried out in exactly the same way as in the case when the supplier organizes the delivery of goods to the buyer at his own expense, including transport costs in the final price of the goods.

Re-billing of transport services

Company A finds a carrier and pays him for transport services.

The question is how to re-list them to company B.

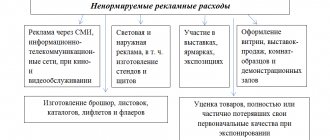

Services are included on a separate line and are not included in the price of the product.

1. The carrier works with VAT.

Those. he bills services at 30,000 including VAT. Company A pays him. And he issues 30,000 to company B.

So?

And the immediate question is whether there are any design nuances in these cases. I mean regular contracts or some kind of agency contracts, etc.?

And I reject this option in order to complicate my work?

So are my options working or not?

And here there are 2 options: 1) as an intermediary - with re-invoicing of transportation costs (report from the agent or forwarder) and a statement of remuneration.

Pros - if the carrier is without VAT, there is no charge for VAT.

2) as a performer - the act of providing transportation services (only performed by a third party carrier).

And this is where it’s not profitable if the carrier is without VAT, and the seller is with VAT.

That’s why I think there’s no point in bothering with all this. We agreed with the buyer on the price of transportation and added it to the price.

The question is, we can’t resell services, to be honest, I accepted the idea that we can’t, from the previous account, since something like a transportation license is needed. I didn't check it myself.

And the manager has already said, only this way and no other way.

We worked with one carrier company, now the transportation has become very bad, it seems that because of Plato.

They gave me the task to study the issue.

Company A, let’s say Alice, is us.

Company B, let's say Beads, is the buyer.

The Romashka company is a carrier.

We have chamomile without VAT. Shows services -10000.

The Alice company entered into an agency agreement with Romashka. Issues 500 rubles - remuneration including VAT.

10,000 excluding VAT? Or if they need 500 rubles including VAT and 11,800 rubles including VAT.

Are these working options? Can we offer them to choose from?

The Alisa company does not add extra charges for transport.

Transport - a difficult case

Quote (First-rite): The organization attributes the costs of transport services for the supply of goods to costs (Debit 44.3 Credit 60.1). In accordance with the terms of supply contracts, delivery of goods is carried out by the supplier, but at the expense of the buyer. The organization does not have its own transport. How is transportation costs rebilled to the organization’s customers in this situation? In accordance with Art. 510 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), delivery of goods is carried out by the supplier by transport provided for in the supply agreement, and on the terms specified in the agreement, while the supplier and buyer have the right to independently determine the terms of the agreement. Based on the terms of the contract concluded with the buyer, the procedure for accounting for transportation costs is determined. In this case, the supply agreement may provide for reimbursement by the buyer of the supplier’s expenses for payment of transport services in excess of the price of the goods specified in the agreement (as in your case). The procedure for reflecting expenses for the delivery of goods performed by third-party organizations and persons in the seller’s accounting is specified in clause 215 of the Methodological Instructions for accounting for inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n (hereinafter referred to as the Methodological Instructions). The question notes that transport services are accounted for by you on account 44 “Sales expenses”, and the amount of VAT is taken as a deduction. According to paragraph 215 of the Methodological Instructions, this procedure for accounting for the costs of transporting goods indicates that in this case they are not reimbursed by the buyer in excess of the price determined by the contract, but are included in the cost of goods sold and, accordingly, should be included in the price of goods sold without highlighting them as a separate line in invoices. In this case, VAT is charged on the entire amount indicated in the invoice, including the amount of transportation costs. This procedure for accounting for transportation costs does not comply with the terms of the contracts you have concluded, according to which the buyer reimburses the costs of transporting the goods in excess of the cost of the goods determined by the contract. That is, transport services should not be included in the cost of goods sold, but are billed to the buyer separately, with a separate line on invoices. At the same time, such issuance of invoices highlighting transport costs is unjustified, since in accordance with clause 3 of Art. 168 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), invoices are issued upon the sale of goods (work, services), and since transport services are actually provided not by your organization, but by the carrier, then their re-issuance on behalf of your organization with highlighting in invoices a separate line in this case is illegal. There are no grounds to classify funds paid by the buyer in order to compensate the supplier’s expenses under contracts, the terms of which do not provide for their inclusion in the cost of goods (work, services), as operations for the sale of goods for the purposes of calculating VAT, and, consequently, recognizing them as objects of VAT taxation, and issuing invoices for such transactions, says the letter of the Ministry of Finance of Russia dated 03.03.2006 N 03-04-15/52, regarding compensation of the lessor’s expenses for paying for electricity. Thus, if, in accordance with the supply agreement, the seller’s expenses for delivering the goods are not included in the price of the goods, but are transferred by the buyer in order to compensate the seller’s expenses for payment of delivery with VAT, then invoices for transport costs are not issued by the seller to the buyer, since the seller of the goods transport services are not provided. Re-issuance of invoices to the buyer in this situation is not provided for by regulations. On the issue of overbilling transport costs, regulatory authorities have repeatedly given clarifications, but it should be noted that in the case when the cost of transport services is paid by the supplier and presented to buyers for payment in excess of the price of the goods, the opinions of the Russian Ministry of Finance and the tax authorities do not coincide. Thus, in the letter of the Ministry of Finance of Russia dated March 10, 2005 N 03-03-01-04/1/103 it is stated that in the case when the supply agreement reflects that the buyer compensates for transportation costs in addition to the price, the amount of compensation for delivery by the buyer will be the income of the organization -supplier, and, accordingly, payment by the supplier for the delivery of goods will be recognized as an expense that reduces the tax base for income tax. That is, the Russian Ministry of Finance believes that overbilled expenses should be reflected as part of the organization’s non-operating income, while agreeing that they can also be taken into account as part of non-operating expenses. The tax authorities believe that since transport costs in accordance with the terms of contracts concluded by the supplier organization are not included in the price of the goods, they cannot be included in the costs taken into account when calculating income tax, since such costs do not comply with the requirements of Art. . 252 of the Tax Code of the Russian Federation. True, they agree that the supplier’s income should include only a markup in the form of an excess of compensation for delivery costs incurred over the amounts of actual payments made on invoices issued for payment by cargo carrier organizations (see, for example, the letter of the Department of the Tax Administration of the Russian Federation for the city of No. Moscow dated January 19, 2004 N 11-14/2887). In our opinion, in order for the re-invoicing of transport costs not to cause claims from the tax authorities either against the supplier of goods or the buyer, it is necessary to optimize the procedure for accounting for these transport costs by registering them as part of an agency service. In our opinion, it is not necessary to conclude a separate agency agreement; it is possible to stipulate the conditions for delivery of goods within the framework of the supply agreement, that is, to conclude a mixed agreement (clause 3 of Article 421 of the Civil Code of the Russian Federation). In this case, in addition to the direct delivery of goods, the supplier is obliged under the contract to conclude an agreement with the transport organization in the interests of the buyer, that is, the supplier is given the responsibility of the buyer's agent in relations with the carrier organization. In this case, it is enough to indicate in the delivery agreement that the seller can enter into an agreement on his own behalf, but at the buyer’s expense, with the carrier for the delivery of goods to the destination station. We also recommend that the contract provide the supplier with a remuneration (even symbolic) for this service. In this case, after shipment of the goods, the supplier sends the buyer a report on the execution of the order to organize the delivery of the goods to the destination station, attaching copies of documents received from the carrier organization, and also reissues transport costs (invoice, invoice) on its behalf in the manner provided for intermediary agreements. The general scheme for issuing invoices by intermediaries is set out in the Rules for maintaining logs of received and issued invoices, purchase books and sales books for value added tax calculations, approved by Decree of the Government of the Russian Federation dated December 2, 2000 N 914, as well as in a letter from the Ministry of Taxes of Russia dated May 21, 2001 N VG-6-03/404. According to these documents, when purchasing services through an intermediary (supplier of goods), if the invoice is issued by the carrier in the name of the intermediary, then the basis for the principal (buyer of the goods) to accept VAT for deduction is the invoice received from the intermediary. An invoice is issued by the intermediary to the principal reflecting the figures from the invoice issued by the carrier to the intermediary. Both invoices from the intermediary (supplier of the goods) are not registered in the purchase book and sales book. In a similar manner, the intermediary reissues invoices to the principal for other expenses associated with the delivery of the goods sold. In the accounting of the supplier of goods, expenses subject to reimbursement by buyers, in accordance with the above paragraph 215 of the Methodological Instructions, are written off from the settlement account (account 76 “Settlements with various debtors and creditors”) with a debit to the account of settlements with buyers (account 62 “ Settlements with buyers and customers"), including the amount of VAT due (paid) to a third-party transport organization. This amount of VAT is presented to the buyer of the goods for payment. A similar procedure for reflecting the costs of delivering goods, reimbursed by the buyer, in the accounting records of the supplier of goods is set out in the letter of the Ministry of Finance of Russia dated March 10, 2005 N 03-03-01-04/1/103. Thus, in the accounting records of the goods supplier, the considered transactions are reflected in the following entries: Debit 76, subaccount “Settlements with the transport company” Credit 51 - paid for the carrier’s services for the delivery of products; Debit 62 Credit 76, subaccount “Settlements with transport organizations” - reflects transport services subject to reimbursement by the buyer; Debit 62 Credit 90 - remuneration accrued for organizing delivery (if provided for in the contract); Debit 90 Credit 68, subaccount “Calculations for VAT” - VAT is charged on the amount of remuneration (clause 1 of Article 156 of the Tax Code of the Russian Federation); Debit 51 Credit 62 - transport services paid by the buyer. The answer was prepared by: Irkutsk TsPS Expert Obedkova Natalya The answer was checked by: NPP reviewer professional accountant Rodyushkin Sergey October 17, 2008 PS “GARANT”

What the parent company needs to consider as an intermediary

The rules for filling out an invoice used in VAT calculations (hereinafter referred to as the Rules for filling out an invoice), approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 (hereinafter referred to as Resolution No. 1137), provide for the procedure for issuing invoices within the framework of intermediary agreements ( commissions, agency). According to this procedure, in the case of the acquisition of goods (works, services) on his own behalf, the commission agent (agent), when issuing invoices to the principal (principal), reflects in them the indicators of the invoices that were issued to him by the sellers of these goods (works, , “in”, “d”, “e”, “h” clause 1 of the Rules for filling out an invoice).

Position of regulatory authorities

Tax authorities consider it possible to apply this procedure for filling out invoices to other contracts that contain intermediary elements (see letter of the Federal Tax Service of Russia dated March 14, 2013 No. ED-4-3 / [email protected] ). For example, in terms of freight forwarder services purchased on its own behalf from third parties and re-billed to the customer.

It should be noted that if an intermediary purchased goods (work, services) for several principals under one invoice, in the re-issued invoices the intermediary must reflect data on the goods (work, services), their cost, the amount of accrued VAT in the part attributable to the share of each of them (letter of the Ministry of Finance of Russia dated March 14, 2014 No. 03-07-15/11221 - sent to local inspections by letters of the Federal Tax Service of Russia dated April 18, 2014 No. GD-4-3/ [email protected] , dated August 2, 2013 No. 03-07-11/31045).

According to para. 3 subp. “c” clause 1 of the Rules for filling out an invoice when purchasing services by an intermediary on its own behalf and re-issuing invoices to the final buyer of services, line 2 of the invoice indicates the full or abbreviated name of the seller of services, and not the intermediary. According to regulatory authorities, in the “Seller” line of the invoice, the actual seller of services (communication operator, transport company, etc.) should also be indicated, and not the intermediary. In this case, the invoice is signed by authorized persons of the intermediary company (letters of the Ministry of Finance of Russia dated November 27, 2013 No. 03-07-09/51186, dated May 10, 2012 No. 03-07-09/47).

Court position

The above conclusions are confirmed by the decision of the Supreme Arbitration Court of the Russian Federation dated March 25, 2013 No. 153/13, which para. 3 subp. “c” clause 1 of the Rules for filling out an invoice is recognized as complying with the Tax Code of the Russian Federation.

Let us recall that in this case the taxpayer tried to challenge the said norm, according to which, when re-issuing invoices by an intermediary purchasing goods (work, services) on his own behalf, not the intermediary, but the seller was indicated as the seller.

According to the taxpayer:

- such filling out of the invoice could give rise to claims from the tax authorities, for example, if the tax authority sent a request to the seller indicated in the invoice, who did not confirm the existence of an economic relationship with the final buyer, in whose interests the intermediary purchased goods (work, services);

- indicating the name, address, identification number of the intermediary, instead of the seller, in invoices sent to the buyer in case of purchasing goods (works, services), property rights through an intermediary, will allow identifying the head and accountant of the organization that signed the invoices with the organization that produced and sent the invoices, and thereby eliminate the possibility of disputes with the tax authorities.

However, the Supreme Arbitration Court of the Russian Federation did not support the taxpayer’s position and indicated that:

- regardless of whether an intermediary is involved or not, goods (works, services) are purchased at the expense of the buyer, to whom ownership rights are transferred from the seller;

- when drawing up invoices by an intermediary who has entered into a transaction for the acquisition of goods (work, services) in his own name in the interests of the principal, the principal, the full or abbreviated name, address and identification numbers of the seller, who is the taxpayer of the VAT amounts paid to him by the buyer, must be indicated.

Additional lines and additional responsibilities

The intermediary, together with information about the actual seller of goods (works, services) (communication operator, transport company, etc.), can indicate in the invoice his name as an intermediary, since the reflection of additional information in the invoice is not prohibited. In this case, additional information should not violate the sequence of arrangement of the mandatory details of the invoice form (letters of the Ministry of Finance of Russia dated 02.08.2012 No. 03-07-09/103, dated 31.07.2012 No. 03-07-09/97, dated 20.07.2012 No. 03-07-09/87).

In this case, it is advisable for the intermediary, when re-billing expenses, to transfer to the subsidiary dependent company certified copies of invoices issued to the intermediary directly by sellers of goods (works, services) (for example, a telecom operator, transport company, etc.) (subclause “a” of clause 15 of the Rules of Conduct log of received and issued invoices used in calculations of value added tax, approved by Resolution No. 1137, letter of the Ministry of Finance of Russia dated March 14, 2014 No. 03-07-15/11221, sent by letter of the Federal Tax Service of Russia dated April 18, 2014 No. GD- 4-3/ [email protected] ).

Please note that from January 1, 2015, in terms of organizing accounting for VAT purposes, special obligations have been established for organizations that receive and (or) issue invoices as part of business activities carried out by them in the interests of another person, for example, on the basis an agency agreement providing for the purchase of goods (work, services) on behalf of the agent. Such taxpayers are required to keep a journal of received and issued invoices used in calculations of value added tax (hereinafter referred to as the journal of invoices) in relation to intermediary activities (clause 3.1 of Article 169 of the Tax Code of the Russian Federation).

Features of registering invoices by an intermediary

Invoices received by the intermediary from the seller are registered by the intermediary in part 2 of the accounting journal, and invoices issued to subsidiaries - the final buyers of services are registered in part 1 of the invoice journal. In this case, the invoice data is not reflected in the intermediary’s purchase book and sales book (subclause “d” of clause 19 of the Rules for maintaining a purchase book used in calculations for value added tax (hereinafter referred to as the Rules for maintaining a purchase book) and clause 3 Rules for maintaining a sales book used in calculations of value added tax, approved by Resolution No. 1137).

The columns of the re-issued invoice shall indicate:

- data given in the seller’s invoice - if all the goods indicated in the seller’s invoice were purchased for one principal;

- names, quantity, price and value of only those goods (work, services) that are purchased for a specific principal, as well as the VAT related to them - if the goods (work, services) indicated in the seller’s invoice are purchased for several principals (para. 3 subparagraph "a" clause 2, paragraph 2 clause 2(1) of the Rules for filling out an invoice, letter of the Ministry of Finance of Russia dated March 14, 2014 No. 03-07-15/11221).

At the same time, the obligation to submit invoice logs to the tax authorities is provided only for certain categories of taxpayers - intermediaries, subject to the simultaneous fulfillment of the following conditions (clause 5.2 of Article 174 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated 04/08/2015 No. GD-4-3/ 5880):

1) the organization itself is not a VAT payer (for example, it applies the simplified tax system) or has received an exemption from the duties of a VAT payer;

2) the organization is not recognized as a tax agent for VAT for any reason.

The intermediary, as a VAT payer, does not need to separately submit to the tax authorities invoice journals that reflect intermediary transactions.

Reflection of intermediary transactions in the declaration

According to clause 2 of the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected], the VAT tax return in the new form and formats is submitted starting from the first tax period of 2015.

The new Procedure for filling out a tax return for value added tax (hereinafter referred to as the Procedure for filling out a VAT return), approved by the same order, provides for filling out by an intermediary:

- Section 10 of the declaration - in the case of issuing invoices when carrying out business activities in the interests of another person, in particular, on the basis of commission agreements, agency agreements or on the basis of transport expedition agreements;

- Section 11 of the declaration - in case of receipt of invoices when carrying out such business activities in the interests of another person (clauses 49, 50 of the Procedure for filling out a VAT declaration).

Thus, with regard to intermediary operations of the parent company, as an intermediary, it is necessary to keep a journal of invoices and reflect data on such operations in Sections 10, 11 of the tax return (clause 5.1 of article 174 of the Tax Code of the Russian Federation, clauses 49, 50 of the Procedure for filling out the tax return). VAT).

Let's summarize what has been said.

When re-billing expenses (for example, for communication services, transport services, etc.), an intermediary is indicated in the invoice as the data seller of the parent company (without reflecting this invoice in the sales book of such parent company and calculating VAT), and not the actual seller of services, does not meet the requirements of paragraph. 3 subparagraph "c" clause 1 of the Rules for filling out an invoice and may entail tax risks. For the parent company, this is the risk of additional VAT charges, and for subsidiaries, this is the risk of non-acceptance of VAT on such an invoice for deduction.