Methods for reimbursement of transportation costs under a supply agreement

The supply agreement may provide for several options for reimbursement of transportation costs by the buyer. For clarity, we presented them in the form of a diagram:

When reimbursement of transportation costs using method No. 1, the supplier does not participate in the transportation of goods. He simply gives the goods to the buyer or the carrier hired by him. This is where his obligations end. Therefore, this method of reimbursement of transportation costs is not taken into account in any way in the accounting and tax accounting of the seller.

But the options for reimbursement of transportation costs provided for in method No. 2 require their reflection in the supplier’s accounting. Let's look at each of them in detail.

Legal information

The commission agent's remuneration is 3,300 rubles. (RUB 22,000 × 15%), and the compensation received is RUB 5,546. (RUB 2,021 + RUB 3,540). Despite the fact that Alfin LLC applies the simplified tax system with the object of taxation being income minus expenses, it does not have the right to take into account the cost of storage and transportation in expenses. These expenses will be included in the tax base of Marlet CJSC. On July 13, 2021, only 3,300 rubles need to be reflected in the commission agent’s income. The amount of compensation received is not income (subclause 1, clause 1.1, article 346.15 and subclause 9, clause 1, article 251 of the Tax Code of the Russian Federation).

- 3000 rub. (3540 rubles - 540 rubles) - the cost of delivery of goods without VAT (subclause 23, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- 540 rub. — VAT on the cost of delivery of goods (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- 1700 rub. (2021 rub. - 306 rub.) - rent excluding VAT (subclause 4, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- 306 rub. — VAT on rent (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- 3300 rub. — remuneration to the commission agent (subclause 24, clause 1, article 346.16 of the Tax Code of the Russian Federation).

We recommend reading: What are the benefits for young families?

Reimbursement of expenses for own transport services

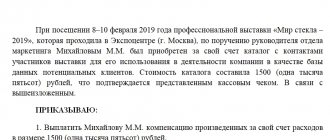

Agreement

Before delivering the goods, the seller needs to decide on the method of accounting for transport services:

- in the cost of goods - in the supply contract;

- a separate amount - in the contract for transport services.

When taking into account the costs of transporting goods in the cost of goods, fix the amount of transport costs in the supply agreement. In particular, you enter the cost of the goods including VAT and indicate below that it includes the costs of transporting the goods to the buyer in the amount of NNNNN,NN rubles. If you wish, please note that when returning the goods, payment received from the buyer in relation to shipping costs incurred will not be refunded.

If the seller does not highlight the conditions and amount of reimbursement for the transportation of goods, but simply indicates the cost of the goods, then he may encounter troubles:

- firstly, when returning the goods, the buyer will have to return the entire cost specified in the contract, including the cost of delivery added to it;

- secondly, tax authorities can exclude the costs of transporting goods from the calculation of income tax on the principle “there are no conditions in the contract for the delivery of goods, i.e. the seller does not have to make it, and therefore the costs of transporting goods are not justified in any way” .

The best option for reimbursement and confirmation of transport services provided would be to form a separate contract (or additional agreement) for the transportation of goods. It will clearly indicate that the buyer is provided with services for the delivery of goods to the address specified by him. And he must pay them within a certain period. With this option, the seller maintains separate records for the sale of goods and the provision of transport services.

Source documents

When taking into account the services for transporting goods in its cost, the supplier issues a consignment note. The cost of transport services should not be indicated separately from the cost of the goods. This is due to the fact that the delivery note is intended to confirm the sale of goods and materials. And services do not belong to inventory items.

You can familiarize yourself with filling out the consignment note in our article “Unified form TORG-12 - form and sample.”

To confirm to the tax authorities that the goods have been transported, the supplier must issue a waybill. Details about the rules for filling it out are set out in our article “What is the procedure for filling out waybills (sample, form)?”

If the seller highlights the cost of transportation in a separate agreement (additional agreement), then the paperwork can be completed in 3 options:

- waybill;

- waybill and transport bill of lading;

- consignment note and certificate of provision of transport services.

Invoice

If the cost of transporting the goods is already taken into account in its cost, then the seller draws up 1 invoice for the entire amount intended to be paid by the buyer. There is no need to issue a separate invoice for transportation services.

But if the cost of transport services is taken into account in a separate agreement (additional agreement), then in this case you need to generate 2 invoices:

- by goods sold;

- for transport services provided.

All invoices issued by the supplier must be noted in the sales ledger. Invoices for materials and services received by the seller (fuels and lubricants, accompanying services, loading and unloading services, etc.) are recorded in the purchase book.

Find out how to take VAT into account from the seller when receiving reimbursement of transportation costs from the buyer in ConsultantPlus. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

For details of the calculation of VAT on transport services, see our article “What is the procedure for assessing VAT on transport services?”

How to easily refund VAT

In connection with the calculation (and especially the refund) of VAT, disputes often arise with inspectors. There are especially many problems with tax authorities if deductions on the declaration exceed the amount of accrued tax.

Safe share of VAT deductions in 2021

In any situation, we are able to help businessmen choose the most profitable payment option and defend their rights. If, when preparing a VAT return, we determine that the tax is subject to refund, we offer the client a choice: receive a refund from the budget or transfer deductions to the next period.

If the client chooses a refund, we complete the declaration and submit it to the Federal Tax Service. Next, we provide full support for the entire return procedure. As part of the desk audit, we provide the necessary documents and give reasonable answers to requests from tax officials. If necessary, we prepare documents for the court and take an active part in the conduct of the case.

For us, refunding VAT from the budget is a standard procedure that has been successfully carried out many times. This is the advantage of 1C-WiseAdvice over full-time accountants, who rarely encounter tax refunds and perceive them as force majeure.

The high qualifications and diverse experience of the company’s employees allow us to provide reasoned answers to the inspectors’ questions. As a result, our clients receive a refund of all claimed amounts.

Reimbursement of expenses for transport services of third parties

When the buyer reimburses expenses for transport services that are provided not by the seller, but by a third party in the form of a carrier, in essence, transport services are rebilled to the buyer through the seller according to the following scheme:

We described in detail the seller’s procedure for this option of reimbursement of transportation costs, in particular about the execution of contracts, documents and accounting entries for them, in our article “The procedure for rebilling transportation costs to the buyer.”

Do I need to issue a waybill when picking up goods from the supplier’s warehouse? The answer to this question is in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

External correctable marriage

If a correctable defect is discovered, the buyer has the right:

- demand a proportionate reduction in the price of a low-quality product (i.e., discount it);

- return the goods to the seller;

- demand elimination of defects;

- independently eliminate the defects, while demanding compensation from the seller for the costs of eliminating the defect.

This follows from Articles 475 and 482 of the Civil Code of the Russian Federation, Law of February 7, 1992 No. 2300-1.

If the buyer demands that the defect be corrected, the seller can:

- transfer the goods for correction to the organization from which such goods were previously purchased;

- correct the defect on your own (with or without compensation from the supplier for low-quality goods);

- correct the defect with the involvement of service centers (third party organizations).

Postings reflecting reimbursement of transportation costs by the buyer

We have already written about the preparation of entries for reimbursement of transport services provided by specialized carriers in the article “The procedure for rebilling transport costs to the buyer.”

Therefore, now we will use a simple example to look at postings that reflect the procedure for reimbursement of only our own transport services.

Example

During August the following operations were performed:

- Products sold:

- for method 1 - in the amount of 96,740 rubles. (including VAT 16,123.33 rubles), of which the cost of transporting goods including VAT is 19,965.60 rubles;

- for method 2 - in the amount of 76,774.40 rubles. (including VAT RUB 12,795.73).

- The purchase price of goods sold was written off - RUB 56,420.

- An invoice was issued for payment of transport services in the amount of RUB 19,965.60. (including VAT RUB 3,327.60). Note: This is the condition for method 2.

- The cost of transporting the goods amounted to 17,740 rubles. (including VAT on loading work provided by a third party - 820 rubles).

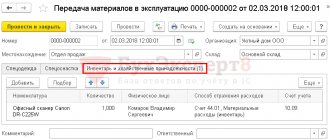

| Operation | Method 1 The cost of transportation is included in the price of the goods under the supply agreement | Method 2 The cost of transportation is allocated to a separate agreement (additional agreement) | ||||

| Dt | CT | Sum | Dt | CT | Sum | |

| Product sold | 62 | 90-1 | 96 740 | 62 | 90-1 | 76 774,40 |

| 90-3 | 68 | 16 123,33 | 90-3 | 68 | 12 795,73 | |

| The purchase price of the goods has been written off | 90-2 | 41 | 56 420 | 90-2 | 41 | 56 420 |

| Transport services provided | — | — | — | 62 | 90-1 | 19 965,60 |

| — | — | — | 90-3 | 68 | 3 327,60 | |

| Costs associated with the provision of transport services are taken into account | 44 | 02, 10, 60, 69, 70, 76 | 16 920 = 17 740 – 820 | 44 | 02, 10, 60, 69, 70, 76 | 16 920 = 17 740 – 820 |

| VAT on loading services of a third party has been allocated and accepted for deduction | 19 | 60, 76 | 820 | 19 | 60, 76 | 820 |

| 68 | 19 | 820 | 68 | 19 | 820 | |

| Transportation costs written off | 90-2 | 44 | 16 920 | 90-2 | 44 | 16 920 |

Postings of the plaintiff and defendant using the example of payment of state duty

During the trial, M.’s organization filed a claim against the actions of IP K. of a non-property nature, the assessment of which cannot be made. The amount of state duty was 6,000 rubles. The amount of expenses reimbursed by the losing party is recognized as part of other income.

| Operation name | Correspondence from the plaintiff | Correspondence from the defendant | Amount (in rubles) |

| Payment of state duty | Dt 68 Kt 51 (50) | Not produced | 6 000 |

| Reflection of state duty as part of expenses | Dt 91/2 Kt 68 | Not produced | 6 000 |

| Recognition by the court of expenses for payment of state duty | Dt 76/2 Kt 91/1 | Dt 91/2 Kt 76/2 | 6 000 |

| Reimbursement of expenses has been made | Dt 51 Kt 76/2 | Dt 76/2 Kt 51 | 6 000 |

Results

Reimbursement of shipping costs by the buyer can be made in two ways. First: the buyer himself organizes and pays for the delivery of the purchased goods. Second: the buyer only pays for delivery, and the seller organizes it. In the first method, the seller does not record reimbursable costs at all. When using the second method, accounting for reimbursable transportation costs depends on how the seller transports the goods: himself or through a specialized carrier.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Returning goods to the supplier: accounting entries

In accounting, the procedure for reflecting a return by the buyer depends on the moment the defect was discovered. If discrepancies are identified before the values are accepted for accounting, a report is drawn up and the goods are returned to the supplier. Ownership remains with the seller. The buyer credits the goods to off-balance sheet account 002 “Inventory in custody”, and when returned, writes them off from the credit. Posting DT51 KT76 reflects the receipt of money from the supplier for the claim. Thus, only three operations need to be displayed in the BU:

When accepting valuables, the buyer must carefully inspect them for defects, damage to packaging and other inconsistencies. If there are any deviations, the goods are returned to the supplier. The wiring will be different in each specific case. Read more about the features of this operation below.

Determination of legal costs by the judicial authority

Recognition of costs incurred is carried out by the court in each specific case. Costs cannot be allocated to the losing party without filing a claim. The need to cover expenses must be addressed to the court and a request must be included in the statement of claim or in the form of additional demands stated during the hearing. When covering expenses, several repayment options arise.

| Procedure | Compensation of expenses |

| The fee was paid by the plaintiff, the application was not submitted to the court | Refunds are made by the territorial office of the Federal Tax Service before the expiration of 3 years. |

| The fee has been paid, the claim has been satisfied pre-trial | In some cases, the amount of fees and costs is returned in a separate claim. |

| The claims were partially satisfied | The costs incurred by the plaintiff are partially compensated, in part of the recognition of the claim or at the discretion of the court |

| The defendant has no obligation to pay state duty | Only expenses are subject to compensation; the amount of state duty to the plaintiff is not covered. |

Expenses incurred by the plaintiff in the course of pre-trial consideration of claims are not covered. Expenses often include costs for the services of lawyers. The courts do not recognize such expenses and do not attribute them to the losing party.

In some cases, the losing party may be able to avoid paying the winning party's costs. In order for the court to make a decision, it is necessary to apply to the court to provide documentary evidence of the difficult financial situation, the unintentionality of the motives for causing the damage, and to pay off the claims during the proceedings or upon receipt of a deferment.