Registration has become easier

Also, by Decree of the Government of the Russian Federation of December 29, 2014 No. 1595, adjustments were made to certain legal acts regulating the performance of official assignments outside the place of work. Innovations are aimed at optimizing the flow of documents in the organization, reducing and simplifying such document flow.

Thus, since January 2015, the mandatory requirement has been abolished:

- on issuing a travel certificate to an employee;

- formalization of the official assignment in writing.

According to the newly established rules, the fact of being on a business trip is confirmed by tickets and/or other travel documents.

It is also possible for an employee to use personal transport for business purposes (on a business trip). To confirm such expenses, he must provide reporting documents: receipts, cash receipts, statements, waybills, etc.

The main goals of changes in business travel arrangements in 2017 and earlier were:

- simplification of document flow when sending on a business trip;

- improving the form of the report based on the results of completing the task by order of the employer.

In addition, according to the new rules, an employee sent on a business trip is not required to provide his superiors with a written report on the trip.

Features of a business trip abroad

Registration for a trip abroad is similar to registration for a regular business trip, but has a number of features. Let's take a closer look at them.

In what currency should travel allowances be issued?

In answering this question, the company’s accounting department must first of all determine the number of business trip days when the employee will be in Russia and when in a foreign country.

The rules of law determine that daily allowances when the employee is still in Russia should be paid in rubles. For example, the time it takes him to get to the airport, etc.

Days spent in the territory of a foreign state must be paid to the employee in foreign currency. In this case, a situation arises when on the same day an employee of the company was both in Russia and abroad.

The rule here is that days of departure from the country are subject to payment in foreign currency, and days of arrival in Russia - in Russian currency (rubles).

Attention! A business entity is given the right in its local act to determine a different procedure for issuing daily allowances to an employee going on a business trip.

What if an employee needs to purchase additional currency abroad?

The organization has the right not to give the employee accountable funds in foreign currency, but to transfer the ruble equivalent. Moreover, upon arrival in the country of destination, he will have to independently purchase currency for this amount.

In this case, the supporting documents will be a certificate from the bank, which will indicate the exchange rate and date of purchase.

When spending this currency, the employee must receive supporting documents. They are accepted for accounting at the exchange rate on the date on which the form was drawn up.

Important! Daily travel allowances are taken into account at the rate that was set by the bank on the date of submission of the advance report for the business trip.

Part of the trip in Russia, and part abroad

Arranging for this type of business trip should not be difficult.

The trip must be divided into three segments - the time of travel in Russia, the time of travel in another state, the day of return to Russia and the trip to your enterprise.

A single package of documents is issued for the entire business trip. If a work assignment is issued for a trip, then it details the tasks for each segment of the trip.

Attention! When calculating daily allowances, standard rules are used. Days spent in the country are calculated according to internal standards. After this, the days of stay in a foreign country, including the day of passport control, are according to the standards of the destination country.

After this there will be another segment, at least consisting of one day - this is a return from the country and, possibly, a journey through Russia to your organization. Daily allowances for these days are again paid according to domestic travel standards.

The employee returned from a trip and left again the same day

In the process of production activities, a situation may arise that an employee arrives from one business trip in the morning, and in the evening must leave for another.

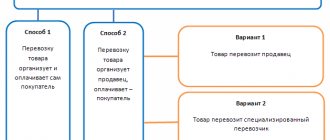

This is not prohibited by law. True, the regulatory documents do not indicate exactly how such a situation should be formalized. As a result, there are two ways.

With the first method, the business trip for each trip is completed in full - two orders, two travel certificates, two assignments, etc. are issued.

The employer is also obliged to pay the daily allowance in full for all days of travel, including days on the road. In this case, the day on which both trips will overlap must be paid in double amount, since it is both the day the first trip ends and the day the second starts.

You might be interested in:

Funeral benefit in 2021 - what is the amount and procedure for processing the payment?

The second way is to combine trips. If you immediately know that you are going on a new trip, you must immediately fill out documents to extend the trip. It must be remembered that according to the law, the duration of a business trip is not limited, and this moment is completely left to the discretion of the organization.

The entire travel time must be divided into segments based on the location in different countries, and for each of them the daily allowance must be calculated based on the norm accepted for that country.

The date of arrival is calculated according to the ticket or customs control

Resolution No. 749 directly states the answer to this question - the dates for crossing state borders are established by a stamp at customs control posts.

This rule is used when determining the amount of daily allowance, since the day of departure from Russia is considered as a day of being abroad, and the day of entry is considered as a day on the territory of Russia.

The day of arrival may differ from the day stamped in the passport. For example, the plane landed at the airport of a foreign country before 24-00, but the employee went through customs control on the next day, i.e. after 24-00. In this regard, the day of his actual arrival will be considered as a day in Russia, and the day of customs clearance will be considered as a day of a business trip abroad.

However, there is an exception to this rule. When traveling between countries of the Customs Union, passports are not stamped. In this situation, the days of border crossing will be determined by the marks on the travel certificate, and in its absence, by travel documents.

Attention! The same rules apply - the day of departure or arrival is considered a foreign business trip, and the day of departure or departure is considered a business trip within Russia.

Key document in 2021

According to the same decree of the Government of the Russian Federation (No. 1595 of December 29, 2014), in 2021 business trips are issued on the basis of a written decision of the employer - an order, a directive. These changes to business travel in 2021 should already become a habit.

Keep in mind: business trips now include not only business trips on the instructions of the employer outside the place where the employee performs his official duties, but also trips to a structural unit of the enterprise (branch, representative office, etc.). It is located separately at a different address, in a different locality. Including within the administrative territory in which the employer’s organization is registered.

For more information about this, see “A separate division of an organization: what is it?”

The simplified business trip procedure does not require extensive paperwork, however, changes introduced to the legislation require more thorough documentary evidence of the costs incurred. This is done in order to control the financial activities of the enterprise. As a consequence, there is a complication in accounting for the property and financial position of the organization and its results.

Departure day and arrival day must be paid

As for the payment of daily allowances for the day of departure and day of arrival, they must certainly be paid regardless of what time the employee departed (arrived). This is explained as follows.

Day of departure on a business trip

The day of departure for a business trip is the day of departure of the vehicle that will take the employee to the place of business trip from the locality where his place of work is located. Even if a plane or train departs at 23:59, this day is considered the departure day. Therefore, the daily allowance for that day must be paid in full.

Cost structure

Accounting transactions and reports on travel expenses are subject to the requirements of the Law; business trips in 2021 were not affected by changes in the structure of expenses. This still includes:

- earnings calculated on the basis of the average daily salary for the entire period of the official trip;

- payment for tickets for travel to the destination in the forward and return directions by air, railway, bus (except for taxi);

- compensation for expenses for the use of a subordinate’s own car when performing an official assignment as part of a business trip;

- hotel expenses (accommodation fees) or rental expenses;

- additional costs (this may include shoe repair, dry cleaning of clothes, purchase of goods and components for equipment, entertainment expenses).

Compensation for living expenses occurs in 2 ways:

- according to the documents provided - receipts, invoices;

- management allocates a clearly fixed amount established by the internal rules of the enterprise.

Also see “Travel Regulations: What the 2021 Model Should Look Like.”

Necessary documents for payment for a work trip

As soon as the business trip ends, the employee who was away must provide management with all receipts confirming the fact of spending government money.

If documentary evidence of the waste invested in the trip is made public, then all amounts will be reimbursed in full. It is advisable to keep all receipts in order to avoid additional questions about where this or that amount was spent.

The main documents that are required after the official “travel” include:

- a round-trip ticket, where the cost is clearly stated;

- daily expenses receipts;

- cost of travel accommodation;

- receipts from all public vehicles;

If during a business trip an employee makes personal expenses and also goes beyond the daily limit established by the enterprise, then such expenses are not paid by the management.

The main change in 2021

Please note that the main change for business travel in 2021 affected daily allowance rates, which were not previously established for insurance premiums.

From January 1, 2021, insurance premiums are not charged only for a certain fixed amount of daily allowance:

- 700 rubles – for business trips within the Russian Federation;

- 2500 rubles – for foreign business trips.

However, please note that the Labor Code of the Russian Federation does not contain any restrictions on the employer’s right to set certain daily allowance rates when sending personnel on business trips to perform official assignments.

In 2021, an enterprise can independently determine the amount of daily allowance, which is also provided for in Art. 346.16 of the Tax Code of the Russian Federation (subparagraph 13, paragraph 1), and enshrine them in their internal acts. In this case, the organization deducts insurance premiums from the difference between the standard and the actual amount of daily allowances issued.

For more information about this, see “How per diem is assessed in insurance premiums from 2021.”

Read also

15.01.2021

Daily allowance for business trips abroad in 2020: table

Here are some daily allowances for business trips abroad in 2021, established by the Government of the Russian Federation for federal public sector employees (Resolution No. 812 dated December 26, 2005). If desired, they can be used as a guide for any legal entities and individual entrepreneurs.

| A country | Daily allowance in US dollars | |

| When traveling from Russia to the territory of another country | When employees travel abroad. institutions of the Russian Federation within the territory of the country where the foreign office is located. institution | |

| Abkhazia | 54 | 38 |

| Australia | 60 | 42 |

| Austria | 66 | 46 |

| Azerbaijan | 57 | 40 |

| Albania | 67 | 47 |

| Algeria | 65 | 46 |

| Angola | 80 | 56 |

| Andorra | 62 | 43 |

| Antigua and Barbuda | 69 | 48 |

| Argentina | 64 | 45 |

| Armenia | 57 | 40 |

| Afghanistan | 80 | 56 |

| Bahamas | 64 | 45 |

| Bangladesh | 67 | 47 |

| Barbados | 68 | 48 |

| Bahrain | 66 | 47 |

| Belize | 59 | 41 |

| Belarus | 57 | 40 |

| Belgium | 64 | 45 |

| Benin | 66 | 46 |

| Bermuda | 69 | 48 |

| Bulgaria | 55 | 39 |

| Bolivia | 63 | 44 |

| Bosnia and Herzegovina | 60 | 42 |

| Botswana | 64 | 45 |

| Brazil | 58 | 41 |

| Brunei | 57 | 40 |

| Burkina Faso | 72 | 50 |

| Burundi | 74 | 52 |

| Vanuatu | 68 | 48 |

| Great Britain | 69 | 48 |

| Hungary | 61 | 43 |

| Venezuela | 64 | 45 |

| Vietnam | 63 | 44 |

| Gabon | 70 | 49 |

| Haiti | 61 | 43 |

| Guyana | 67 | 47 |

| Gambia | 62 | 43 |

| Ghana | 66 | 46 |

| Guatemala | 68 | 48 |

| Guinea | 66 | 46 |

| Republic of Guinea-Bissau | 91 | 64 |

| Germany | 65 | 46 |

| Gibraltar | 69 | 48 |

| Honduras | 75 | 53 |

| Grenada | 92 | 64 |

| Greece | 58 | 41 |

| Georgia | 54 | 38 |

| Denmark | 70 | 49 |

| Djibouti | 75 | 53 |

| Commonwealth of Dominica | 69 | 48 |

| Dominican Republic | 59 | 41 |

| Egypt | 60 | 42 |

| Zambia | 68 | 48 |

| French overseas territories | 65 | 46 |

| Zimbabwe | 57 | 40 |

| Israel | 70 | 49 |

| India | 62 | 43 |

| Indonesia | 69 | 48 |

| Jordan | 62 | 43 |

| Iraq | 81 | 57 |

| Iran | 62 | 43 |

| Ireland | 65 | 46 |

| Iceland | 70 | 49 |

| Spain | 62 | 43 |

| Italy | 65 | 46 |

| Yemen | 66 | 46 |

| Cape Verde | 64 | 45 |

| Kazakhstan | 55 | 39 |

| Cayman islands | 69 | 48 |

| Cambodia | 68 | 48 |

| Cameroon | 69 | 48 |

| Canada | 62 | 43 |

| Qatar | 58 | 41 |

| Kenya | 66 | 46 |

| Cyprus | 59 | 41 |

| Kyrgyzstan | 56 | 39 |

| Republic of Kiribati | 75 | 52 |

| China | 67 | 47 |

| China (Hong Kong) | 67 | 47 |

| China (Taiwan) | 67 | 47 |

| Colombia | 65 | 46 |

| Comoros | 86 | 60 |

| Congo | 85 | 60 |

| Democratic Republic of the Congo | 76 | 53 |

| Democratic People's Republic of Korea | 65 | 46 |

| The Republic of Korea | 66 | 46 |

| Costa Rica | 63 | 44 |

| Ivory Coast | 74 | 52 |

| Cuba | 65 | 46 |

| Kuwait | 59 | 41 |

| Laos | 64 | 45 |

| Latvia | 55 | 39 |

| Lesotho | 61 | 43 |

| Liberia | 78 | 55 |

| Lebanon | 73 | 51 |

| Libya | 70 | 49 |

| Lithuania | 57 | 40 |

| Liechtenstein | 71 | 50 |

| Luxembourg | 61 | 43 |

| Mauritius | 63 | 44 |

| Mauritania | 67 | 47 |

| Madagascar | 64 | 45 |

| Macau | 67 | 47 |

| Macedonia | 60 | 42 |

| Malawi | 66 | 46 |

| Malaysia | 60 | 42 |

| Mali | 70 | 49 |

| Maldives | 67 | 47 |

| Malta | 61 | 43 |

| Morocco | 58 | 41 |

| Mexico | 64 | 45 |

| Mozambique | 68 | 48 |

| Moldova | 53 | 37 |

| Monaco | 65 | 46 |

| Mongolia | 59 | 41 |

| Myanmar | 65 | 46 |

| Namibia | 61 | 43 |

| Nauru | 60 | 42 |

| Nepal | 65 | 46 |

| Niger | 78 | 55 |

| Nigeria | 72 | 50 |

| Netherlands | 65 | 46 |

| Nicaragua | 68 | 48 |

| New Zealand | 65 | 46 |

| New Caledonia | 60 | 42 |

| Norway | 79 | 55 |

| United Arab Emirates | 60 | 42 |

| Oman | 62 | 43 |

| Pakistan | 69 | 48 |

| Palau island | 63 | 44 |

| Palestine | 70 | 49 |

| Panama | 64 | 45 |

| Papua New Guinea | 68 | 48 |

| Paraguay | 57 | 40 |

| Peru | 63 | 44 |

| Poland | 56 | 39 |

| Portugal | 61 | 43 |

| Puerto Rico | 72 | 50 |

| Rwanda | 72 | 50 |

| Romania | 56 | 39 |

| Salvador | 68 | 48 |

| Samoa | 64 | 45 |

| San Marino | 65 | 46 |

| Sao Tome and Principe | 74 | 52 |

| Saudi Arabia | 64 | 45 |

| Swaziland | 65 | 46 |

| Seychelles | 71 | 50 |

| Senegal | 70 | 49 |

| Saint Lucia | 69 | 48 |

| Serbia and Montenegro | 60 | 42 |

| Singapore | 61 | 43 |

| Syria | 62 | 43 |

| Slovakia | 59 | 41 |

| Slovenia | 57 | 40 |

| Solomon islands | 56 | 39 |

| Somalia | 70 | 49 |

| Sudan | 78 | 55 |

| Suriname | 69 | 48 |

| USA | 72 | 50 |

| Sierra Leone | 69 | 48 |

| Tajikistan | 60 | 42 |

| Thailand | 58 | 41 |

| Tanzania | 66 | 46 |

| Togo | 65 | 46 |

| Tonga | 54 | 38 |

| Trinidad and Tobago | 68 | 48 |

| Tunisia | 60 | 42 |

| Turkmenistan | 65 | 46 |

| Türkiye | 64 | 45 |

| Uganda | 65 | 46 |

| Uzbekistan | 59 | 41 |

| Ukraine | 53 | 37 |

| Uruguay | 60 | 42 |

| Fiji | 61 | 43 |

| Philippines | 63 | 44 |

| Finland | 62 | 43 |

| France | 65 | 46 |

| Croatia | 63 | 44 |

| Central African Republic | 90 | 63 |

| Chad | 95 | 67 |

| Czech | 60 | 42 |

| Chile | 63 | 44 |

| Switzerland | 71 | 50 |

| Sweden | 65 | 46 |

| Sri Lanka | 62 | 43 |

| Ecuador | 67 | 47 |

| Equatorial Guinea | 79 | 55 |

| Eritrea | 68 | 48 |

| Estonia | 55 | 39 |

| Ethiopia | 70 | 49 |

| South Ossetia | 54 | 38 |

| South Africa | 58 | 41 |

| Jamaica | 69 | 48 |

| Japan | 83 | 58 |

Read also

20.05.2020

Payment for a business trip based on average earnings

In order to calculate travel allowances for a full-time employee, it is necessary to calculate the employee’s average salary. In practice, an accountant should use the following methodology:

- It is necessary to determine what time interval will be taken into account when summing up payments to an employee. In most cases, 12 consecutive months are taken into account.

- The next stage involves determining how the average salary level is calculated. Companies have the right to use two possible methods: using average daily earnings or average hourly earnings. Measuring the average salary level for travel allowances directly depends on the methods of recording working hours in a particular company. If a company uses cumulative accounting of time worked by an employee, the calculation is made using average hourly earnings. In other situations, the average daily earnings are provided.

- Next, the length of working time actually worked by the staff is measured in the time interval accepted for accounting. In accordance with the general requirements, it should exclude time intervals during which the employee was on vacation, received benefits due to the onset of illness, or in the event that the organization was not active for some time (downtime, strike).

- In order to determine how to pay for a business trip, you should sum up the amount of all funds paid to the employee during the billing period. It includes all transfers to personnel, with the exception of those that are not directly related to payment for work duties (for example, payment of social benefits).

- The calculation of the average daily earnings, which is necessary to pay for a business trip, is carried out as a quotient of dividing the amount of wages in the billing period by the actual number of days worked during this period.

- A measurement of the time interval during which an employee was absent from the workplace due to business travel and for which the company must compensate him.

- Measuring the average level of a worker's earnings.

Procedure for calculating travel allowances

The official basis for referral is the order of the employer. In most cases, the order is issued in the form of an Order. There is an official form of the Referral Order numbered T-9 (for one person) or T-9A (for a group of people). The use of this form is not necessary, since the order form developed in the given organization can be used.

The order contains the following information:

- Employer details (full name, position) and organization details.

- Employee details (full name, position).

- Destination.

- Duration. As a rule, the date of departure and the date of arrival at a permanent place of work are indicated.

Important! The beginning is considered the day of departure of transport to the destination, and the end is considered the day of arrival of transport at the place of permanent work. Until 23:59 the current day is considered, and from 00:00 - the next day.

- Target.

If the advance is issued in rubles

If an advance payment for a business trip abroad is issued to an employee in rubles, and expenses on a business trip abroad are incurred in foreign currency, then in this case the procedure for accounting for foreign currency expenses is different. According to the Russian Ministry of Finance (see, for example, letters dated June 19, 2020 No. 03-03-06/1/52967, dated January 21, 2016 No. 03-03-06/1/2059), travel expenses in foreign currency are recognized on the date of approval advance report:

- at the conversion rate on the date of the transaction (on the date of purchase of currency by the employee or the date of debiting funds from his bank card), confirmed by a certificate or bank statement;

- at the exchange rate of the Central Bank of the Russian Federation on the date of issue of the advance, if the conversion rate is not documented;

- at the exchange rate of the Central Bank of the Russian Federation on the date of approval of the advance report - in the part not covered by the advance payment).

In this case, exchange rate differences on advances in rubles do not arise.