An order to change the accounting policy is an administrative document, without the issuance of which no corrections in this fundamental accounting document are possible.

Each organization approves an accounting policy (AP). And not one, but two: for accounting purposes and for tax accounting purposes. But before you start working in accordance with this document, it must be approved by order. If the UE has been approved, but changes have occurred that need to be made to it, an order to make changes is issued (you do not need to wait until the end of the year for this). If there are no changes or additions, but the validity period of the UE is coming to an end, an order is drawn up to extend the accounting policy.

What is accounting policy

Accounting policy refers to a number of methods of accounting and tax accounting used in an enterprise. Each organization has the right to draw up its own accounting policies, which may depend on a variety of parameters. Factors influencing it include:

- federal and local laws and regulations;

- types of taxation of an organization;

- way of conducting business activities, etc.

There are three types of accounting policies enshrined in legislation:

- accounting policies for accounting purposes;

- accounting policies for tax purposes;

- accounting policies for reporting according to international standards.

Other nuances

Other details of the document to note:

- Mandatory individuality . When developing, the specifics of the company’s activities should be taken into account (investment needs, industry characteristics, short-term and long-term management plans and other factors).

- High flexibility . There should be links to the organization’s corporate local standards with their further development.

- Maximum use of rights granted by law . All details of the Accounting Regulations, Chapter 25 of the Tax Code, and other legislative provisions affecting the activities of the enterprise must be signed.

- Validity . References to the acts for which solutions are proposed must be indicated.

What issues does accounting policy address?

The list of issues that are addressed in the accounting policy is very extensive.

If we are talking about accounting, then here are working charts of accounts, methods of accounting for goods and materials, methods of income distribution, templates for primary documents, etc.

Tax accounting policies are also varied in content. It defines:

- system and structure of taxes paid by the organization;

- objects of taxation;

- ways to recognize expenses and income for calculating income tax;

- methods of calculating depreciation, determining the value of production and material assets;

- procedure for fulfilling tax obligations, etc.

Is registration with the Federal Tax Service required?

Often tax authorities will not accept annual reports without this document. But if it remains unchanged, then you can indicate this fact in the cover letter to the reporting. Some regulatory agencies may require documentation when conducting on-site or desk inspections.

All organizations are involved in policy management, but individual entrepreneurs do not have it due to the lack of accounting.

It must provide the following conditions:

- timely and complete reflection of the facts of economic activity in accounting and reporting;

- recognition of liabilities and expenses without the formation of hidden reserves;

- rational accounting in accordance with the size and business conditions of the company.

A company newly created during reorganization forms its chosen accounting policy in accordance with the basic rules no later than 3 months from the time of state registration of the legal entity.

The role of the order

An order approving an enterprise's accounting policy, being a kind of link between the legislation of the Russian Federation on accounting and tax accounting and the company's regulations, is needed for internal use.

The order obliges all divisions of the company, regardless of their location, to comply with the rules of accounting policies, and also appoints persons responsible for monitoring this.

The order is usually written by the secretary of the organization, and he also gives it to the director for signature.

Depreciation

Now let's turn to the procedure for accounting for depreciable property (fixed assets and intangible assets). The first question concerns the procedure for forming the initial cost of fixed assets. The organization has the right to establish a list of expenses for the creation of fixed assets that are not included in their initial cost. Refusal to include any type of expense in the initial cost of fixed assets will lead to disagreements with regulatory authorities. Disclosure of this information in accounting policies is associated with additional risks.

If an organization operates in the field of IT technologies and meets the criteria established by paragraph 6 of Article 259 of the Tax Code of the Russian Federation, then it has the right to choose the option of accounting for the cost of electronic computer equipment as expenses: either as part of material expenses or in the form of depreciation. If the option of accounting as part of material expenses is chosen, then inclusion in current expenses occurs electively either at a time or in certain shares over more than one reporting period, based on the service life or other economically justified indicator.

If an organization leases or plans to lease fixed assets, it needs to indicate how depreciation of non-recoverable capital investments in leased fixed assets (inseparable improvements) is carried out. Such depreciation is based on either the useful life of the leased asset or the useful life of the permanent improvement itself. The choice of one of the options is made by the organization independently.

The organization has the right to provide for a review of the useful life of an object of depreciable property based on the results of its reconstruction, modernization or technical re-equipment, as well as not to carry out such a review.

In relation to fixed assets that were previously operated by previous owners in the same capacity, the organization establishes a special procedure for determining the useful life - taking into account the service life of the previous owner. This option is optional. The organization has the right to determine the general procedure for determining such a period (that is, without taking into account the period of previous operation).

In the next block, we will consider the information that needs to be disclosed regarding the procedure for calculating depreciation. To begin with, one of two methods is selected: linear (even distribution over the useful life) or non-linear (accelerated write-off in the first years of operation). With the non-linear method, depreciation is calculated not individually for each fixed asset object, but in groups.

Accordingly, when choosing a non-linear method, the organization faces the need to disclose additional information. In particular, it may provide for the liquidation of a depreciation group with a total balance of less than 20,000 rubles (with a one-time transfer of the under-depreciated balance to non-operating expenses) or not to do this (in this case, depreciation is charged until the cost is fully repaid). The choice of option is entirely at the discretion of the organization.

The organization has the right to provide for the use of a “depreciation bonus” (one-time inclusion in expenses of part of the cost of depreciable property). Its use (subject to the restrictions imposed by the Tax Code of the Russian Federation) is permitted both in relation to the initial cost and the costs of increasing it. It is possible to apply a depreciation bonus only in one of the two indicated areas.

With regard to the depreciation bonus, it is possible to either establish a lower threshold for the initial cost of fixed assets and expenses for its increase to which it applies, or waive such a limitation. In the latter case, it is applied to all fixed assets (except for those for which the Tax Code of the Russian Federation directly prohibits its use).

Organizations that have fixed assets that meet the criteria given in paragraphs 1–3 of Article 259.3 of the Tax Code of the Russian Federation have the right to apply appropriate increasing factors to depreciation rates.

If several increasing factors are applied to a fixed asset for different reasons, the organization must choose only one. This is the maximum, minimum or other intermediate coefficient.

In relation to absolutely any fixed depreciable assets, the organization establishes the use of coefficients that reduce the depreciation rate. The accounting policy should indicate a list of groups of depreciable property for which such coefficients are applied, and a link to the document containing this list.

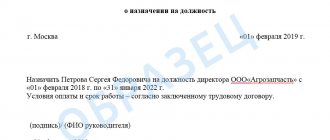

How to create an order

Since 2013, the use of unified standard forms of primary personnel and accounting documents has been abolished. Now any orders can be written in any form or, if the organization has its own document template, based on its sample.

In this case, in any case, it is necessary that the order in its structure corresponds to certain parameters of office work, and in its content includes a number of mandatory information. These include:

- Title of the document;

- date of its compilation and number;

- the name of the company where it is produced.

Then comes the main part:

- the essence of the order is described, that is, the fact of approval of the accounting policy is recorded, indicating the exact date from which it is put into effect;

- a link is given to the appendices to the order - documents that, in fact, determine the main provisions of the accounting policy;

- the obligation of department heads to familiarize their subordinates with it is prescribed.

Finally, the order should designate the employees responsible for its implementation. If the administration of the organization believes that the order needs to be supplemented with some other information, it should also be included in the form in separate paragraphs.

Alteration

The document can be changed in the following situations:

- when using a new method of accounting with a more reliable representation of the facts of activity in the company’s reports and accounting or low labor intensity without reducing the reliability of the information;

- when Russian laws or regulations on accounting change;

- when developing new methods of accounting within the company;

- with a significant change in working conditions.

A significant change in the operating conditions of an organization occurs when there is a change of owners, reorganization, change in specialization, reduction or expansion of production volumes, restructuring, etc.

Changes in documentation must be justified and executed in the appropriate manner. They are introduced from the beginning of the new year, which follows after their approval.

The assessment of the consequences of changes that may affect the financial flow, cash position or results of operations of the company is expressed in money. The assessment is carried out based on verified data for the period from which the changed accounting methodology is used. Significant methods of its maintenance must be disclosed in the explanatory note attached to the reports for the past period. Interim reports may not include accounting policies if there have been no changes to them during the previous year.

Changes that may have a significant impact on the financial flow, cash results or position of the company are subject to separate disclosure in the financial statements. Such information should reflect the reason for the changes, their assessment in financial terms, and an indication of the correction of data included in the financial statements.

How to fill out a form

An order approving a company’s accounting policy can also be drawn up freely: it can be written on an ordinary blank sheet of paper or on the company’s letterhead, both on a computer and in handwritten form.

After the contents of the order have been formulated, it must be signed by the director or his deputy/representative, who has the power of attorney to sign documents (in this case, the use of facsimile, i.e. printed by any method, autographs is unacceptable, i.e. the signature must be “live”).

In addition, the employees responsible for its implementation should be familiarized with the order against signature.

Today, it is only necessary to certify an order using stamps (stamps and seals) in one case - if this rule is enshrined in the local regulatory documents of the organization. The order is always written in one copy, but if necessary, you can make additional, properly certified copies. The completed order must be registered in the administrative documentation journal.

Who signs the document

Regardless of who exactly forms the order, the document must be signed by the highest official of the enterprise - the director or an employee temporarily in his place.

This is due to the fact that all orders are always issued on behalf of the chief executive of the company - this is established by law, i.e. Without his signature, the document will not be considered valid.

In addition, all employees indicated in it, as well as those who are obliged to monitor its implementation, must sign the order. Thus, all these persons indicate that they have read the order and are ready to carry it out.