The accounting policy (AP) is a “particularly important” document that contains aggregate information on the maintenance of accounting and tax accounting methods at the enterprise (primary observation, cost measurement, current grouping and generalization of the results of economic activity facts).

The purpose of creating a management program is to ensure the possibility of combining all accounting information about the situation in the company. The UP contains the financial and economic indicators of the company, the procedure for their formation and what these indicators reflect.

In trade, as well as for other industries, accounting policy is an important element of the system of internal control over activities.

The regulations of the legislation of the Russian Federation stipulate that the UE is formed by the chief accountant, or the person responsible for this area of work.

Each individual economic entity independently forms its own management system, which is based on the facts/conditions of conducting business activities.

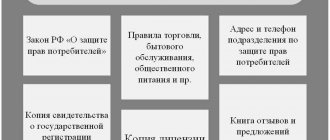

When drawing up the UE, the following regulations must be applied:

| • Law “On Accounting” dated December 6, 2011 No. 402-FZ; • PBU 1/2008 “Accounting policy of the organization”, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n; • Tax Code of the Russian Federation (Article 313); • other regulations (Standard recommendations for organizing accounting for small businesses, approved by Order of the Ministry of Finance of Russia dated December 21, 1998 No. 64n, letters and clarifications of the Ministry of Finance, etc.); |

These regulations set out the basic principles and requirements for drawing up accounting policies necessary for carrying out activities.

Structure of the accounting policy of a trading company

Trade can be wholesale or retail; regardless of this, when developing accounting policies, the following important points must be taken into account:

- Application of the system for taxation;

- Methods of maintaining (organizing) accounting and tax accounting;

- Certain aspects (for example, maintaining simplified accounting for a small business entity, correcting errors, etc.)

- Application of a working chart of accounts, maintaining tax registers for tax accounting;

- Other important points for the correct conduct of tax and accounting records.

The nuances when forming the accounting policy of a trading company will be the following:

- the procedure for accounting for goods;

- the procedure for calculating trade margins;

-procedure for accounting for transportation costs, etc.

Many companies formulate accounting policies separately, i.e. on tax accounting and accounting, but the law does not prohibit the formation of a single UP, so it is possible to form one policy with tax and accounting sections.

Accounting policy for the purposes of accounting settlements with personnel for wages

The accounting policy for accounting settlements with personnel for wages should be focused on the choice of form, methods and methods of accounting and its organization.

A basic model of accounting policy, consisting of three parts: organizational, methodological and methodological, is capable of systematizing accounting policy information on labor costs.

The organizational part of the basic model is characterized by the presence of various management decisions regarding the organization of an accounting system for managing labor costs, such as:

- — installation of the form and system of remuneration;

- — linking the form and system of remuneration with the goals of the organization;

- — automation of accounting, analysis and reporting, as well as choice of organizational form;

- — systematization of information on workers’ compensation in local regulations;

- — establishing responsibility in the accounting system and reporting;

- — clarification of users of information generated in the accounting system for labor costs.

The content of the organizational part of the accounting policy is presented in Table 1.

Thus, the use of the organizational part of the accounting policy for the disclosure of information is capable of systematizing all organizational issues that are directly related to accounting for settlements with personnel for wages.

Along with organizational decisions, you should choose a technique for reflecting information on labor costs in the accounting accounts.

Table 1

Organizational part of the accounting policy on the disclosure of information for the purposes of accounting of settlements with personnel for remuneration

| Accounting policy indicator | Possible options |

| Remuneration system |

|

| Form of remuneration |

|

| Accounting automation level |

|

| Method of presentation of management reporting |

|

| Availability of local regulations on wages |

|

| Responsibility |

|

| Users of information |

|

Methods for keeping records of labor costs are contained in the methodological part of the accounting policy (Table 2).

table 2

Methodological part of the accounting policy on the disclosure of information for the purposes of accounting of settlements with personnel for remuneration

| Accounting policy indicator | Possible options |

| Grouping of payment expenses labor |

|

| Choosing a method for accounting for labor costs |

|

| Reservation of labor costs |

|

| Formation of sources of information on labor costs |

|

| Using documents for initial monitoring of labor costs |

|

The methodological part of the accounting policy on labor costs is characterized by the following information:

- — about the possibilities of grouping labor costs;

- — about current methods of accounting for labor costs;

- — on reserving labor costs for equal inclusion in the cost price in the reporting period;

- — on the formation of sources of information on labor costs in the form of documents, registers and reporting.

The application of the methodological and methodological parts of the accounting policy on labor costs makes it possible to consistently describe the methodology and methodology of the accounting system chosen by the enterprise.

The presented sequence of disclosure of information on labor costs in the accounting policy allows, in practice, to competently construct accounting in relation to labor costs based on full disclosure of information.

Determining the procedure for accounting for goods and trade margins

Goods in trading companies are taken into account:

- At cost (actual);

- At prices, for sale.

In accounting, accounting for goods is formed on “account-41-“Goods”. Companies (organizations) engaged in trading activities and using Account-41 take into account purchased packaging.

The following subaccounts can be opened for the “41-Goods” account:

“41-1-“Goods in warehouses”;

“41-2-“Goods in retail trade”;

“41-3-“Container under the goods and empty”;

“41-4-“Purchased products”, etc.

According to the “cost” method, goods are recorded on account “41” at the purchase price, according to the “selling prices” method, respectively, at the “sale” cost. The trade margin on goods accepted for accounting is reflected by the posting “D-t-41, K-t-42.

When selling goods wholesale, there are certain issues, for example, in the case of goods being shipped from a warehouse, but not yet delivered to the buyer, i.e. they are on the way with a transport company transporting this product, then in this case the goods are accounted for on account 45 “Goods shipped”. The posting upon the fact of release of goods from the warehouse is reflected by the posting “D-t -45, K-t-41”.

Write-off from account 45 occurs in the same way as write-off from account 41 “D-t-90, K-t-45”.

The cost of goods sold is written off using the following methods:

- "in FIFO";

- “average s/s;

- “according to the cost of each unit of goods.

The company (company), depending on the specifics of the goods sold, can use any of the methods; this method is subject to reflection in the accounting policy.

Features of accounting policies in trade organizations Doctor of Economics, Professor V.S. Yakovenko - presentation

Features of accounting policies in trade organizations Doctor of Economics, Professor V.S. Yakovenko

In accordance with the Federal Law of the Russian Federation “On Accounting” dated 402-FZ, the accounting policy of a trade organization is an element of the accounting regulation system at the enterprise. According to this law, organizations independently formulate their accounting policies based on their own production structure, industry specialization and other characteristics of their activities. The basis for the formation and disclosure of the organization’s accounting policy is the Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008).

According to this provision, the accounting policy of a trade organization is understood as the set of accounting methods adopted by it: - primary observation, - cost measurement, - current grouping - and final generalization of the facts of economic activity.

The methods (elements) of accounting adopted in the formation of the organization's accounting policy and subject to disclosure in accounting statements include: - methods of depreciation of fixed assets, intangible and other assets; - the procedure for reflecting in accounting the process of acquiring and procuring inventory; - establishing the boundary between fixed assets and assets in circulation; -method of distribution of indirect costs between objects of calculation; — method of accounting for product output; — assessment of finished products and goods in trade; — evaluation of materials when they are released into production; — valuation of goods when they are released for sale in trade, etc.

The ACCOUNTING POLICY of a trade organization covers all components of accounting: - methodological; — organizational; - technical. THE METHODOLOGICAL ASPECT of accounting policy includes: - accrual of depreciation of fixed assets, - accrual of depreciation of intangible assets, - accounting for repairs of fixed assets, - valuation of inventories, ORGANIZATIONAL ASPECT includes: - organizational structure of the accounting service, - place of the accounting service in the management structure of the organization, - the procedure for conducting inventories, - the procedure for monitoring business transactions, - the interaction of the accounting service with other services.

THE TECHNICAL ASPECT of accounting policy includes: - the applied working chart of accounts, - document flow rules, - forms of primary accounting documents (not standard), - forms of internal accounting integrity, - documentation processing technology (memorial order, journal order, automated and etc.). The accounting policy changes in the following cases: - if there are changes in legislation or regulations on accounting; — if the organization has developed new methods of accounting; — if the conditions of the organization’s activities have changed significantly.

Features of the accounting policy of a trading enterprise when recording the movement of goods in accounting RECEIPT STAGES OF GOODS MOVEMENT IN THE WAREHOUSE OF A TRADE ORGANIZATION DISPOSAL STORAGE

Firstly, the price of purchasing goods (receipt at the warehouse) is formed in two ways: 1. Based on the actual costs associated with the purchase of goods (supplier price plus transport and other costs for delivering the goods); 2. At the supplier’s selling price with the inclusion of transport and other costs for delivery of goods as part of sales costs as a separate item of costs

I Option for forming the purchase price of goods D-t K-Amount, rub. Contents of the operation Goods have been capitalized to the warehouse according to the supplier's invoice (TORG-12) Transport services of the carrier for delivering goods from the supplier to the buyer's warehouse have been capitalized Insurance services for goods in transit have been capitalized II Option for forming the purchase price of goods: Dt Kt Amount, rub. Contents of the operation Goods have been capitalized to the warehouse according to the supplier's invoice (TORG-12) Transport services of the carrier for delivering goods from the supplier to the buyer's warehouse have been capitalized Insurance services for goods in transit have been capitalized

Secondly, the accounting policy of a trading organization establishes one of the methods for recording the book value of goods in a warehouse: 1. At purchase prices. 2. At sales prices. With the sales price accounting method, the cost of the goods in account 41 “Goods” includes the purchase price of the goods and the trade margin, which is reflected separately in account 42 “Trade margin”. Only retail trade enterprises can choose the option of recording the cost of goods at purchase or sales prices, and wholesale trade enterprises account for goods only in the valuation at purchase price.

Two options for recording the cost of goods in a warehouse: At purchase prices At sales prices Retail trade enterprises 1. Wholesale trade enterprises 2. Retail trade enterprises

Features of the accounting policy of a trading enterprise when recording the procedure for releasing goods from a warehouse for sale and for other purposes Due to the fact that in a trading organization the same goods can be received at different times from different suppliers at different prices, the problem arises of determining the price of their write-off at sale and for other purposes. Options for valuing goods when they are released for sale are fixed in the accounting policy of the enterprise on the basis of the Accounting Regulations “ACCOUNTING FOR INVENTORIES” PBU 5/01.

When goods are released for sale or otherwise disposed of, they are assessed by a trading organization using one of the following methods: - at the cost of each unit (continuous identification method); — weighted average cost method; - at the cost of the first goods purchased (FIFO method).

The most accurate is the continuous identification method, in which each product item is taken into account separately, and identical goods purchased at different prices are also taken into account separately. A specific copy of a product is written off for sale at the purchase price of that particular copy. It reliably reflects the value of goods in stock and written off for sale in the event that both warehouse and accounting are organized according to the same principle - by batches of goods (batch accounting). However, this method is applicable for a narrow product range.

The weighted average cost method involves calculating the average price as the sum of the purchase price of the balance of goods at the beginning of the month and the purchase cost of goods received for the month, divided by the sum of the quantity of goods at the beginning of the month and the number of goods received for the month. Estimating the disposal of goods using the FIFO (first in, first out) method means that the first goods to go on sale should be valued at the cost of the first purchases, taking into account the cost of inventory listed at the beginning of the month. When applying this method, the inventory of goods at the end of the month is assessed at the actual cost of the most recent purchases of goods. That is, the use of the FIFO method leads to an understatement of the cost of sales of goods and, accordingly, an overestimation of the profit of a trading organization and an increase in the value of property (inventory) at the end of the period.

Features of the accounting policy of a trading organization in accounting for sales expenses Expenses associated with the direct support of the sales process of goods are taken into account in account 44 “Sales expenses”. In cases where a trading enterprise, along with trading activities, carries out other types of activities (providing transport services, advertising, etc.), as well as in the presence of wholesale and retail trade at the same time, the costs of maintaining the management staff of the trading enterprise are reflected in account 26 “General expenses” with subsequent distribution at the end of the period to the relevant types of activities.

Account 44 “Sales expenses” Account 44 “Sales expenses” Account 26 “General business expenses” TRADE ENTERPRISE One type of activity - wholesale trade Two or more types of activity - wholesale trade, retail, transport and other services

Transport costs for delivering goods from the supplier to the warehouse of a trading enterprise are reflected in accounting in one of two ways: 1. Included in the accounting value of the goods on 41 accounts. 2. Included in sales expenses as a separate cost item on account 44. With this accounting option, transportation costs for delivering goods to the warehouse are written off at the close of the period in a special manner in proportion to the balance of goods in the warehouse.

An example of a calculation for the distribution of transport costs when closing an accounting period: 1. Balance of transport costs at the beginning of the accounting period (Tr. at the beginning) Transportation costs for the accounting period (Tr. for what.) Goods sold for the accounting period (Items for what. ) The balance of goods at the end of the period (Item on con.) Transportation costs written off as expenses of the period (Tr. on publication)? CALCULATION FORMULA: Transport per ed. = (Trans. at the beginning + Tr. for what. ) – (Trans. at the beginning + Tr. for what.) x Item. on the line (Commodity for what.+ Commodity on con.)

Transport cost accounting

| The procedure for accounting and distribution of TZR for accounting purposes is determined in the order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n. It also provides several possible options for accounting for TRP: • using a separate calculation and distribution account 15 “Procurement of materials and materials” for goods and materials; • using a subaccount on the accounts for recording incoming goods (for example, on account 41); • with the inclusion of TZR in the cost of goods. The trading company chooses the accounting method itself and necessarily reflects it in the UP. |

In tax accounting, the procedure for accounting for transport costs is carried out in accordance with Article 320 of the Tax Code of the Russian Federation.

Accounting for expenses in a trading company

| The list of expenses for trading companies is larger than for manufacturing companies. Accounting for expenses should be specified in the accounting policy. For example, the costs of delivering goods to customers are recognized as expenses related to sales. Selling expenses are usually written off monthly: 1.According to the accumulated amount for the corresponding period in full; 2. Distribution of the accumulated amount to the actual goods sold. The remaining expenses are formed on the “44-account”, corresponding to the balance of goods in the warehouse. |

Nuances of VAT accounting

In terms of VAT, the UP of a trading enterprise should include at least:

1. Application (or non-application) of VAT exemption on the list of goods in accordance with Art. 149 of the Tax Code of the Russian Federation. As well as the procedure for maintaining separate accounting for groups of goods with different VAT taxation.

2. If there are transactions taxed at a rate of 0% (in particular, exports), the procedure for maintaining separate accounting for goods taxed at a rate of 0% and taxed at regular rates.

3. Basic aspects of document flow, for example:

• principle of numbering of invoices;

• the procedure for maintaining records of received and issued invoices, the purchase book and the sales book (for example, the method of entering data by department).

Certain questions regarding inventory

The nuances that will need to be included in the UE will depend on the specifics of the trading activity. For example,

• For those who sell food products, it is necessary to stipulate in the UP that the frequency of inventory is more frequent than for those who sell non-food products. It is necessary to provide for nuances associated with such specific issues as natural loss rates. In addition, it is necessary to establish a procedure for promptly identifying and writing off expired goods that have lost their consumer properties.

• For pharmacy organizations, it is necessary to provide in the UP both the procedure for identifying and writing off medical products by expiration date, and compliance with certain conditions for the storage and release of certain goods.

Accounting Policy of the simplified tax system and UTII

Limited Liability Company "ХХХХХ"

ORDER No. ___

on approval of accounting policies for tax purposes

___________ 12/31/20____

For the purpose of organizing tax accounting at XXXXX LLC

I ORDER:

1. Approve the developed accounting policy for tax purposes in accordance with Appendix 1 to this order.

2. Apply accounting policies for tax purposes starting from January 1, 20__.

3. Control over the execution of this order is entrusted to the Chief Accountant Ivanova I.I.

General Director P.P. Petrov

Appendix 1 to order No. __ dated 12/31/20 __

Accounting policies for tax purposes

1. Tax accounting is carried out by the accounting department of XXXXX LLC, headed by the Chief Accountant.

Possible options:

- tax accounting is maintained by a third party organization that provides specialized services in accordance with the contract;

- tax accounting is carried out by the director of the organization.

2. The object of taxation is the difference between the income and expenses of the organization.

Reason: Article 346.14 of the Tax Code of the Russian Federation.

3. In relation to retail trade carried out through shops and pavilions with a sales area of less than 150 square meters, a special UTII regime is applied.

Reason: paragraph 1 of Article 346.28 of the Tax Code of the Russian Federation.

4. Accounting for transactions under various special tax regimes is carried out on the basis of accounting data for the organization as a whole.

Income and expenses from activities taxed under the simplified taxation system are reflected in the book of income and expenses.

Business transactions involving activities subject to UTII are accounted for in the general manner.

Reason: paragraph 8 of Article 346.18, Article 346.24, paragraph 7 of Article 346.26 of the Tax Code of the Russian Federation, part 1 of Article 6 of the Law of December 6, 2011 No. 402-FZ.

5. Property, liabilities and business transactions for activities subject to UTII are reflected in accounting using subaccounts and additional analytical features separately.

Reason: part 1 of article 6 of Law No. 402-FZ, paragraph 7 of article 346.26 of the Tax Code of the Russian Federation.

6. The book of accounting for income and expenses is kept automatically using the standard version of “1C: Simplified Taxation System”.

Reason: Art. 346.24 of the Tax Code of the Russian Federation, clause 1.4 of the Procedure approved by order of the Ministry of Finance of Russia dated 22 No. 135n.

7. Entries in the book of income and expenses are made on the basis of primary documents for each business transaction.

Reason: clause 1.1 of the Procedure approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n, part 2 of Article 9 of Law No. 402-FZ.

Accounting for depreciable property

Fixed Assets

8. For the purpose of applying the simplified taxation system, fixed assets are property used for carrying out commercial activities (performing work, providing services) and for managing an organization, with an initial cost of more than 40,000 rubles. and a useful life of more than 12 months.

Reason: paragraph 4 of article 346.16, paragraph 1 of article 257, paragraph 1 of article 256 of the Tax Code of the Russian Federation.

9. To determine the initial cost of a fixed asset, accounting data for account 01 “Fixed Assets” is used.

Reason: subparagraph 3 of paragraph 3 of Article 346.16 of the Tax Code of the Russian Federation, part 1 of Article 2 and part 1 of Article 6 of Law No. 402-FZ.

10. Subject to payment, the initial cost of the fixed asset and the costs of its additional equipment (reconstruction, modernization and technical re-equipment) are reflected in the book of income and expenses in equal shares, starting from the quarter in which the paid fixed asset was put into operation until the end of the year.

When calculating the share, the cost of partially paid fixed assets is taken into account in the amount of partial payment.

Reason: subparagraph 3 of paragraph 3 of Article 346.16, subparagraph 4 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation.

11. The share of the cost of a fixed asset (intangible asset) acquired during the period of application of the simplified tax system, subject to recognition in the reporting period, is determined by dividing the original cost by the number of quarters remaining until the end of the year, including the quarter in which all conditions for writing off the cost of the object as expenses are met .

If a partially paid fixed asset is put into operation, then the share of its cost recognized in the current and remaining quarters until the end of the year is determined by dividing the amount of partial payment for the quarter by the number of quarters remaining until the end of the year, including the quarter in which partial payment for the fixed asset was made. operation of the facility.

Reason: subparagraph 3 of paragraph 3 of Article 346.16, subparagraph 4 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation.

12. For the purpose of separate accounting of expenses by type of activity, the direction of use of fixed assets in the reporting period is reflected in primary documents, organizational and administrative documents (orders) and in tax accounting registers.

Expenses for the acquisition of fixed assets are taken into account when calculating tax under the simplified tax system only for the period of use of the object in this activity in accordance with the procedure approved by the head of the organization.

The amount of expenses for such fixed assets, recorded in the book of income and expenses, is determined in proportion to the number of days the object is used in activities taxable under the simplified tax system, in the total number of working days in the reporting period.

If part of the retail premises in the building is used in activities subject to UTII, then the costs of such fixed assets recognized in the reporting period are determined by calculation.

In the book of income and expenses for the reporting period, costs are recorded in proportion to the share of the area used in activities taxed under the simplified tax system in the total area of the building indicated in the technical passports of the BTI.

Reason: clause 8 of article 346.18, clause 7 of article 346.26 of the Tax Code of the Russian Federation,

Accounting for inventory items

13. Material costs include:

- purchase price of materials;

- expenses for commissions to intermediaries;

- import customs duties and taxes;

- transportation costs;

- expenses for information and consulting services related to the purchase of materials.

Amounts of value added tax paid to suppliers when purchasing material inventories are reflected in the income and expense book as a separate line at the time materials are recognized as costs.

Reason: subparagraph 5 of paragraph 1, paragraph 2 of paragraph 2 of Article 346.16, paragraph 2 of Article 254, subparagraph 8 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

14. Material costs are included in costs as they are paid.

Material costs are adjusted to the cost of materials used in activities subject to UTII.

The adjustment is reflected in a negative entry in the book of income and expenses at the time of transfer of materials for use in activities subject to UTII.

To determine the amount of adjustment, the average cost method of valuing materials is used.

Reason: subparagraph 1 of paragraph 2 of Article 346.17, paragraph 8 of Article 346.18, paragraph 7 of Article 346.26 of the Tax Code of the Russian Federation.

15. Expenses for fuel and lubricants are taken into account as part of material expenses as they are accepted for accounting and paid for.

Reason: subparagraph 5 of paragraph 1 of Article 346.16, subparagraph 1 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation.

16. Standards for recognizing expenses for fuel and lubricants as expenses are calculated as trips are made based on waybills.

An entry is made in the book of income and expenses in the amount of amounts not exceeding the standard.

Reason: paragraph 2 of article 346.16 of the Tax Code of the Russian Federation.

17. The cost of goods purchased for further sale is determined based on the price of their acquisition under the contract (reduced by the amount of VAT presented by the supplier of the goods). Transportation and procurement costs are included in costs as expenses associated with the acquisition of goods, on an independent basis, separately from the cost of goods.

Reason: subparagraphs 8, 23 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation.

18. The cost of goods sold within the framework of activities taxed under the simplified tax system is taken into account as part of costs as the goods are sold.

All goods sold are valued using the average cost method.

Reason: subclause 23 of clause 1 of article 346.16, subclause 2 of clause 2 of article 346.17 of the Tax Code of the Russian Federation.

19. Amounts of value added tax presented on goods sold within the framework of activities taxed under the simplified tax system are included in costs as such goods are sold.

VAT amounts are reflected in the book of income and expenses as a separate line.

Reason: subparagraphs 8 and 23 of paragraph 1 of Article 346.16, subparagraph 2 of paragraph 2 of Article 346.17 of the Tax Code of the Russian Federation.

20. Expenses associated with the purchase of goods, incl. expenses for servicing and transportation of goods are taken into account as expenses upon actual payment.

Reason: subclause 23 of clause 1 of article 346.16, paragraph 6 of subclause 2 of clause 2 of article 346.17 of the Tax Code of the Russian Federation.

21. An entry in the book of income and expenses on the recognition of materials as costs is made on the basis of a payment order or other document confirming the entry in the book of income and expenses on the recognition of goods as costs is carried out on the basis of an invoice for the release of goods to the buyer.

Reason: paragraph 2 of article 346.17, article 346.24 of the Tax Code of the Russian Federation, paragraph 1.1 of the Procedure approved by order of the Ministry of Finance of Russia dated December 31, 2008 No. 154n.

Cost accounting

22. The costs of selling goods purchased for resale include the costs of storing and transporting goods to the buyer and the costs of servicing the goods, including the costs of renting and maintaining retail buildings and premises, advertising costs and remuneration of intermediaries selling goods.

Expenses for the sale of goods related to activities taxed under the simplified tax system are taken into account as expenses after their actual payment.

Reason: subclause 23 of clause 1 of article 346.16, paragraph 6 of subclause 2 of clause 2 of article 346.17 of the Tax Code of the Russian Federation.

23. The amount of expenses (except for expenses for fuel and lubricants) taken into account when calculating tax according to the simplified tax system within the limits of the standards is calculated quarterly on an accrual basis based on the paid expenses of the reporting (tax) period.

An entry on the adjustment of standardized costs is made in the book of income and expenses after the corresponding calculation at the end of the reporting period.

Reason: paragraph 2 of article 346.16, paragraph 5 of article 346.18, article 346.19 of the Tax Code of the Russian Federation.

24. Interest on borrowed funds is included in expenses within the refinancing rate of the Central Bank of the Russian Federation, increased by 1.1 times, for ruble obligations and 15 percent per annum for foreign currency obligations.

Reason: paragraph 2 of Article 346.16, paragraph 1 of Article 269 of the Tax Code of the Russian Federation.

25. Income and expenses from the revaluation of property in the form of currency values and claims (liabilities), the value of which is expressed in foreign currency, are not taken into account.

Reason: paragraph 5 of Article 346.17 of the Tax Code of the Russian Federation.

26. Income and expenses received from activities for which the simplified taxation system is applied are accounted for separately from income received from activities transferred to UTII.

Reason: clause 8 of article 346.18, clause 7 of article 346.26 of the Tax Code of the Russian Federation.

27. The participation of each employee in various types of activities is taken into account on the basis of a working time sheet.

The amount of monthly labor costs related to each type of activity is determined in proportion to the time the employee participates in the corresponding type of activity for the current month.

Reason: clause 8 of article 346.18, clause 7 of article 346.26 of the Tax Code of the Russian Federation.

28. The organization’s expenses, for which it is impossible to organize separate accounting by type of activity in accordance with this accounting policy, are distributed in proportion to the shares of income from the type of activity in the total income of the organization.

Reason: clause 8 of article 346.18 of the Tax Code of the Russian Federation.

29. Distribution of expenses that cannot be divided by type of activity is carried out monthly based on revenue (income) and expenses for the month.

Reason: paragraphs 5 and 8 of Article 346.18 of the Tax Code of the Russian Federation.

Accounting for compulsory insurance premiums

30. Contributions for compulsory pension (medical, social) insurance, as well as compulsory insurance against accidents at work, are distributed by type of activity taxed under different tax regimes, based on data on the distribution of labor costs.

Contributions accrued for employee benefits, classified in accordance with the working time sheet to activities subject to UTII, also apply to this activity.

Reason: clause 8 of article 346.18, clause 7 of article 346.26, clause 2 of article 346.32 of the Tax Code of the Russian Federation.

Accounting for losses

31. The organization reduces the tax base under the simplified tax system for the current year by the amount of the loss received over the previous 10 tax periods when carrying out this type of activity. In this case, the loss is not transferred to that part of the current year’s profit for which the amount of the single tax does not exceed the amount of the minimum tax.

Reason: clause 7 of article 346.18 of the Tax Code of the Russian Federation.

32. The organization includes in expenses the difference between the amount of the minimum tax paid and the amount of tax calculated in the general manner. This includes increasing the amount of losses carried forward to the future.

Reason: paragraph 4 of paragraph 6 of Article 346.18 of the Tax Code of the Russian Federation.