Employer reporting

Denis Pokshan

Expert in taxes, accounting and personnel records

Current as of October 28, 2017

What is the deadline for submitting the 4-FSS calculation for the 4th quarter of 2021? By what date should the calculation be submitted in January 2021? Have the due dates been postponed? Should I submit the payment using the old or new form? Should I send the calculation to the tax office or the Social Insurance Fund? You will find the answers in this article.

Who is required to submit a report in Form 4FSS

Submission of reports to the Social Insurance Fund takes place according to Form 4FSS, approved by the fund. Depending on the number of employees hired, the report in 2017 must be submitted either in the standard way - on a paper form independently or through an authorized representative (companies with up to 25 employees on staff), or in an electronic version free of charge using special telecommunications means. Individual entrepreneur with less than 25 employees. will also be able to provide the report remotely. It is necessary to understand that failure to meet deadlines is fraught with consequences for the entrepreneur, for this reason they must be planned in advance.

For individual entrepreneurs who do not have hired employees, a simplified procedure for filling out and transferring insurance premiums is taken into account; a specialized form 4 is provided for reporting - FSS. If a businessman pays salaries to employees, then reporting to the Social Insurance Fund in 2017 occurs in the standard way, as for legal entities.

The 4FSS report displays all company payments, without exception, associated with the payment of salaries and any other income to employees. It must be submitted to the department to which the company’s place of residence is assigned.

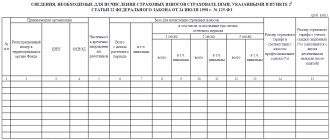

Procedure for filling out form 4-FSS

Form 4-FSS and the procedure for filling it out were approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381.

All policyholders must submit to the fund a title page, tables 1, 2, 5. The remaining tables do not need to be filled out or submitted if there are no indicators.

When filling out the title page, you should first of all pay attention to the “Subordination Code” indicator. Here you need to indicate the 5-digit code assigned to the policyholder, which indicates the territorial body of the fund in which the policyholder is currently registered.

In the “Average number of employees” field, you should indicate the average number of employees for 2021. This indicator is calculated in accordance with Rosstat Order No. 498 dated October 26, 2015.

In the field “Number of working disabled people” you need to reflect the number of such workers as of December 31, 2017.

Table: “Structure of Form 4-FSS”

| Table | How to fill |

| 1 | Here you need to calculate the base for calculating accident insurance premiums on an accrual basis from the beginning of the billing period and for each of the last three months of the reporting period. Determine the size of the insurance rate taking into account the discount or surcharge |

| 1.1 | The table is filled out by insurers sending their workers temporarily under an agreement on the provision of labor for workers (personnel) in the cases and on the conditions established by the Labor Code of the Russian Federation |

| 2 | The table should reflect the following information according to accounting data: - in line 1 - debt on contributions for accident insurance at the beginning of the billing period. This information must correspond to the information about the insured's debt at the end of the previous billing period specified in the form for such period; - in lines 2 and 16 - the amounts of contributions for accident insurance accrued from the beginning of the billing period and paid; - in line 12 - the debt of the territorial body of the FSS of the Russian Federation to the policyholder at the beginning of the billing period. These data must correspond to information on the debt of the territorial body of the fund at the end of the previous billing period, given in the form for such a period; - in line 15 - expenses incurred for accident insurance since the beginning of the year; - in line 19 - debt on contributions for accident insurance at the end of the reporting (calculation) period, including arrears - on line 20; — line 1.1 reflects the amount of debt of the reorganized insurer and (or) the deregistered separate division to the Federal Social Insurance Fund of the Russian Federation; — line 14.1 indicates information about the debt of the Federal Social Insurance Fund of the Russian Federation to the reorganized policyholder and (or) to the deregistered separate division. These lines are filled in by insurers-successors and organizations that included such separate divisions. Other lines contain the rest of the available data. |

| 3 | The insurer's expenses for compulsory social insurance against accidents at work and occupational diseases are reflected. In addition, this table includes data on expenses incurred by the insurer to finance preventive measures to reduce industrial injuries and occupational diseases |

| 4 | Data is reflected based on reports of industrial accidents and cases of occupational diseases at the enterprise |

| 5 | This table must reflect the following information: — on the total number of jobs subject to a special assessment of working conditions, and on the results of the special assessment, and if the validity period of the certification results of the jobs has not expired, then information based on this certification; — on mandatory preliminary and periodic medical examinations of employees. All data in this table must be indicated as of 01/01/2017. That is, information about special assessments and medical examinations that were carried out during the year does not need to be reflected. Therefore, Table 5 in Form 4-FSS for all reporting periods in 2021 will be the same |

Order of the Federal Insurance Service of the Russian Federation dated September 26, 2016 No. 381.

How reporting is submitted

There are several options on how to do this. For example, it is possible to take it to the post office and send it by registered mail, or deliver the document personally to the branch. In addition, it is possible to submit a report through a special FSS Portal for reporting, and you need to sign it with an electronic digital signature.

You need to pay special attention to the electronic method of filing reports, since the number of companies that submit them in paper form has recently decreased significantly. Since the beginning of 2015, companies with more than 25 employees must submit reports electronically.

To submit reports, an individual entrepreneur is required to purchase an electronic signature issued only by specialized companies. This document detail cannot be falsified, which is why more and more companies are switching to it. However, if there is no electronic signature, the report is considered unfulfilled; for this reason, it must be obtained in advance.

On video: Filling out form 4-FSS 2021

Results

Speaking about the deadlines for submitting 4-FSS for the 2nd quarter of 2021, you should focus on one of two reporting dates: July 20 or 27 (for a paper or electronic report, respectively). But you should not wait until the last reporting day. If the fund finds errors while monitoring the report, there will be no time left to correct them. 4-FSS will be considered failed. This may subject the policyholder to a fine.

Sources: Federal Law of July 24, 1998 No. 125-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What are the deadlines for submitting the report?

Reporting is considered submitted by the date of mailing or delivery directly to the fund. If the report is sent by mail, then the date the letter is received by the postal worker is the date of delivery; the payer is left with a receipt and a list of the contents. When submitted using telecommunication systems, the document is assigned a personal number by the company operator. The deadlines for submitting reports are the same for absolutely everyone . For this reason, delivery is carried out according to the general rules, regardless of the amount and the fact of accrual of income.

All companies must take 4FSS 4 times a year. New reporting deadlines came into force in 2015. In accordance with the fund’s resolution, a paper report must be submitted by the twentieth day of the month following the previous quarter, and electronic reporting must be sent by the twenty-fifth. For example, for the 4th quarter of 2021 the report is due on 01/20/17.

The deadlines for submitting reports for 2021 established by the Social Insurance Fund are considered strict, but if the reporting date falls on a holiday or weekend, the date is postponed to the next working day.

1% in the Pension Fund of the Russian Federation from “extra income” reduces special regime taxes for individual entrepreneurs

An additional part of the fixed payment, equal to 1% of the annual income of an individual entrepreneur over 300,000 rubles, can reduce:

- tax according to the simplified tax system - income, including from individual entrepreneurs with employees;

- UTII - for an entrepreneur who does not have hired personnel.

Officials confirm this.

Let us remember that about a year ago the Ministry of Finance spoke differently, making the public nervous. But then he withdrew this clarification and returned to his previous, business-friendly position, which, as we see, he still adheres to.

Changes in reporting in 2021

Now the 4FSS form is in force in accordance with the FSS resolution dated 07/04/16 No. 260. Report for 9 months. must be submitted directly on this form. New changes await him soon. What changes could happen in 2017?

The administration of social tax is transferred to the tax jurisdiction. This was done in order to improve supervision over incoming funds and reduce the burden on the Social Insurance Fund. There will no longer be a need to submit a report there from 2021. Instead of the previous document, it is planned to use a Unified Calculation, which will be submitted to the tax authority quarterly. It will also combine pension and health insurance contributions. It must be provided until the thirtieth day of the month following the reporting quarter.

However, the FSS report on social insurance for cases of injuries at work will still need to be submitted to the fund. For this purpose, a special calculation will be developed using a new form. At the same time, reconciliation of payments and submitted reports will be carried out.

On video: Submit a report to the Social Insurance Fund in 2021

Will there be a fine if the arrears are not paid off before the amendment is submitted?

If there are grounds for a fine, paying the arrears and penalties after submitting the clarification will not save you from it. Before submitting the corrective return, all calculations on it must be completed. Only in this case is it possible to be released from liability. The Ministry of Finance emphasizes this.

How to submit a report

The reporting form changes from time to time and corrections are made to it, but the main design rules always remain the same.

The report contains a title page, which contains mandatory information about the policyholder. It is through them that his identification will be made in the FSS. The main details are: the name of the company and the registration number that was assigned by the fund. In addition to this information, on the title page you need to indicate: OGRN, location of the company, SSCH, etc.

You only need to take those sections that contain digital data. In certain cases, the FSS will require additional documentation to confirm the expenses incurred.