Specialty vehicles include aerial platforms, fire trucks, truck cranes, concrete mixer trucks, and other vehicles designed to perform specific tasks. For such transport, a waybill has been developed according to form No. 3 special. It is filled out by organizations and entrepreneurs whose activities are related to the operation of special vehicles. We’ll figure out how to properly issue a waybill for a special vehicle in this article.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

New rules for issuing travel documents from 01/01/2021

The Ministry of Transport of the Russian Federation officially published order No. 368 dated September 11, 2020, registered by the Ministry of Justice, which updated the requirements for mandatory details and the procedure for filling out waybills.

The document comes into force on 01/01/2021. The appendix to the order contains updated rules for filling out waybills, replacing those approved by Order of the Ministry of Transport No. 152 of September 18, 2008. The mandatory details in the vouchers have been updated:

- name and number of the waybill;

- information about the validity period of the waybill;

- information about the owner (holder) of the vehicle;

- information about the vehicle;

- information about the driver;

- transportation information.

The list of mandatory details is supplemented with information about transportation, which should reflect information about the types of communication (city, suburb, intercity, international) and types of transportation (passengers, cargo, orders). In the “Information about the vehicle” detail, it is now mandatory to indicate its make.

A voucher should always be issued, and not only when leaving on a flight to transport cargo or passengers. Even an empty flight should be documented according to all the rules.

Separately, new requirements have been established for the waybill registration log. It is allowed to be maintained on paper or electronically. In the second case, all information entered into the journal is certified by an enhanced qualified electronic signature.

The destination is not specified - expenses for fuel and lubricants cannot be written off

Another very noteworthy situation occurred within the framework of arbitration case No. A55-23291/2012. The Supreme Arbitration Court refused to transfer it to the level of the presidium of this instance, thus leaving the cassation decision in force.

The taxpayer filed a lawsuit against the Federal Tax Service, intending to challenge the tax authorities’ decision to refuse to include fuel and lubricants costs in the company’s cost structure. Federal Tax Service inspectors considered these costs unconfirmed, since the travel sheets generated by the taxpayer to confirm the costs of fuel and lubricants did not indicate the destinations to which the drivers traveled.

The amount included in the lawsuit is quite significant - 700,000 rubles. But the taxpayer was unable to sue her. During the hearings at first instance, the judges confirmed that the tax authorities were right. The appeal gave the plaintiff a chance, establishing that the route of the car, as well as the destination of the cargo, should not be recorded in a document such as a waybill by organizations that are not transport companies in their main profile. In addition, as the appellate court considered, the waybill should not be considered as the only source capable of confirming the involvement of the car in the taxpayer’s business activities.

However, the cassation overturned the decision made by the appellate court. The judges considered that the waybill is a document that is created specifically for the purpose of confirming the validity of the company’s costs in the form of fuel and lubricant costs. Therefore, if the waybill does not contain information about the destination, then, according to the judges, it is impossible to reliably establish the fact that the company’s drivers used the car for official purposes. Therefore, this detail of the waybill, if we follow the position of cassation, should be considered as mandatory, reflecting the essence of the business transaction.

Information about the destination recorded in a document such as a waybill, if we follow the logic of the provisions of the ruling of the Supreme Court in this case, must be sufficiently detailed. As VAS believed, the waybill should include the name of the organization where the car is going, as well as the address of the corresponding facility.

What is the document for?

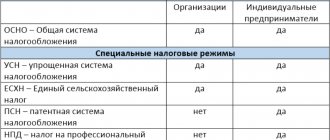

So-called travel vouchers are primary accounting documents, and maintaining travel vouchers at an enterprise is mandatory if organizations or individual entrepreneurs operate vehicles. At the same time, legal entities and individual entrepreneurs providing services for the transportation of goods or people are required to use unified forms of these documents.

Depending on the type of vehicle (VV) and the area of their application, different types of forms are used. Some of their types are designed for owners and tenants:

- passenger cars;

- trucks;

- special transport;

- passenger taxi;

- cargo taxi;

- public and non-public buses.

The forms necessary for entrepreneurs were approved more than twenty years ago by Decree of the State Statistics Committee No. 78 of November 28, 1997. They are still relevant, although over the years various changes have been made to the forms many times. In accordance with the order of the Ministry of Transport No. 476 dated November 7, 2017, additional information about the owner of the vehicle is indicated in the voucher: individual entrepreneurs - OGRIP, and organizations - OGRN.

Unified forms are not suitable for all organizations, and they are not required for everyone. Therefore, a legal entity (or individual entrepreneur) has the right to develop its own version, which takes into account all the mandatory details and necessary indicators. The use of your own modified form is indicated in the accounting policy of the organization, as defined in paragraph 4 of PBU 1/2008. Do not forget that the rules regulated by Article 9 of Federal Law No. 402-FZ of December 6, 2011 on accounting also apply to primary documents of strict reporting.

Waybill form for 2021

A vehicle waybill is required when leaving any vehicle for work purposes, regardless of whether it is the organization’s own car or a rented one. Strict requirements for filling out this primary document are established not only for motor transport companies, but also for all others; it is a document of strict accountability, therefore it must contain mandatory details.

In 2018–2019 There is more such information - officials have added the obligation to indicate information about the driver undergoing pre-trip control of the technical condition of the car. In addition, the mandatory round stamp on the issued form was abolished.

By Order of the Ministry of Transport No. 467 of December 21, 2018, several important amendments were made to waybills from March 1, 2019:

- There are more mandatory details. Now entrepreneurs should enter odometer readings when leaving a vehicle from a parking lot (parking area).

- Dispatchers need to record the date (day, month, year) and time (hours, minutes) of the vehicle leaving the parking lot and entering it.

- The maximum period for which a voucher is issued has changed. At the beginning of 2021, once executed, the document was valid for one month. Now you can’t do this: the paper is issued for one working day or one working shift. If during this time the driver makes several flights, the rules allow the issuance of one waybill before the start of the first flight. It is allowed to close it upon the driver’s return to the parking lot.

- In situations where several drivers drive one vehicle, a personal ticket is issued for each of them. But when leaving, a mark on technical condition control is placed only in the document of the driver who was the first to leave the parking lot.

- We were allowed to carry out technical inspection of the vehicle either before a shift or before a flight (depending on the situation).

- The health care provider's stamp has become optional. This does not mean that the need to undergo a medical examination has been abolished, but the medical worker now does not have to confirm it with a stamp. He has the right to write that the driver has passed the inspection, indicate the date and time of the inspection, and sign. If the organization has a stamp, you can continue to use it. But due to the lack of an imprint on the waybill, they will no longer be able to punish you.

So, taking into account the amendments, new waybills for 2021 must include the following information:

- name and number of the document itself;

- information about the car owner;

- period of validity (period - one or several days) during which the waybill is allowed to be used, in the format “day, month, year”;

- information about the vehicle driver: full name, date and time of pre-trip and post-trip medical examination;

- information about the vehicle: type and model, including trailer, if any;

- registration number;

- odometer reading;

- date and time of departure and arrival to the parking lot;

- data on passing technical inspection before the flight (shift).

If a unified form is not suitable for an organization, its own form of waybill for a passenger car or other vehicle is developed, but taking into account all the mandatory details and necessary indicators. The use of the new form must be indicated in the organization’s accounting policies, as defined in paragraph 4 of PBU 1/2008. Do not forget that the rules regulated by Article 9 of Federal Law No. 402-FZ of December 6, 2011 on accounting also apply to primary documents of strict reporting.

The document is certified by the signature of the dispatcher who issued it and the head of the organization. The seal is affixed only by those organizations that use it in accordance with the charter. The form is prepared in one copy and given to the driver. After this, the document is returned to the authorized person for signature, in this case it is considered closed and goes to the accounting department. From this point on, you need to find out what the waybills are for.

Instructions from ConsultantPlus experts will help you correctly fill out waybills for cars and trucks. Use it for free by accessing the link below.

Validity

Until March 1, 2019, it was possible to issue a voucher for both one day and a full month. After the amendments reflected in Order No. 467, the voucher is issued on the eve of each shift or assignment. The driver is given a ticket on the eve of departure. The standard form allows you to change the duration of the voucher, since the flight may be delayed, and traveling without a voucher is a violation.

At the end of the validity period of the issued voucher, the form is returned to the responsible employee against signature and then sent to the accounting department for revision.

Who needs waybills and why?

Waybills are necessary for organizations to control the movement of vehicles, calculate wages for drivers, record fuel consumption, calculate depreciation on a vehicle, and account for total transport costs. In addition, if a driver in a company vehicle is stopped by a traffic police inspector to check his documents, this document confirms:

- validity of the flight;

- legality of transportation of cargo and passengers;

- good condition of the vehicle;

- the driver's right to drive the vehicle.

Article 12.3 of the Code of Administrative Offenses of the Russian Federation (Part 2) provides for a fine of 500 rubles for the absence of a waybill in the hands of the driver, when it is obligatory.

Construction machines for which the ESM-2 form is issued

Typically, ESM-2 (construction vehicle waybill) is issued by the company's dispatch service when specialized vehicles are released onto the line and sent to sites to perform work corresponding to their purpose and specialization. Such machines include:

- tractors with and without trailed platforms;

- bulldozers;

- trailed or self-propelled motor graders;

- excavators;

- pipelayers, etc.

Filling rules

The procedure for issuing waybills is established by Order of the Ministry of Transport No. 152 dated September 18, 2008. Waybills are taken into account in a special journal. Let’s take a closer look at what changes occurred in waybills in 2020 and how to draw up this document so that the inspectors from the tax authorities and the traffic police, who most often look at this document, do not have any questions.

Filling out this form in motor transport organizations is carried out by dispatchers, and in other companies - by an employee authorized to release cars for a trip. Such responsibilities are established by order of the head of the organization, since the one who fills out the document is responsible for errors made in it. Sometimes the drivers themselves do the paperwork. But as a general rule, drivers are required to fill out only their part of the document - record data on the car’s mileage in accordance with the indicators of the instruments in the car.

A voucher is issued only for one flight, one working day or shift. The unified form provides the opportunity to extend the validity of this document, since various situations can happen to a car during a trip, and driving without a waybill is a violation.

The waybill has several different forms depending on the type of vehicle. These forms differ in content and requirements for completion. We have collected them in a table so that each organization can easily navigate and choose the one they need.

| Unified waybill form | Who fills it out and how? |

| Form No. 3 for passenger cars | It is allowed to be used for registration of passenger vehicle flights both in specialized organizations and in ordinary companies. Features of filling out this form are given in Rosstat letter No. ИУ-09-22/257 dated 02/03/2005. |

| Form No. 4-c for trucks with piecework wages for drivers | The form is intended for motor transport companies engaged in cargo transportation. It contains columns for marks by representatives of the customer of the cargo. A new document is issued only after the driver has submitted the previous one to the accounting department. The form contains a tear-off coupon on the basis of which the salary is calculated. In form No. 4-p it is mandatory to indicate the numbers of waybills for the transported cargo. Such waybills should be stored together with transport documents. This form is valid for two flights within one business day. The waybill contains tear-off counterfoils, which are filled out by the vehicle owner for each flight. They are needed for further presentation of the invoice to the flight customer. |

| Form No. 4-p for freight transport with time-based wages for drivers | |

| Form No. 3-special for special vehicles (truck cranes, cement trucks, garbage trucks, fuel tanks, concrete mixers, etc.) | |

| Form No. 4 for passenger taxi | The form has a field for recording taximeter readings. Such a waybill is issued for the driver for only one shift, after which he submits it to the dispatcher. |

| Form No. 6 - bus waybill | Form for carrying out bus routes on city routes. It contains a column about pre-trip medical monitoring of the driver’s condition. |

If such waybills are suitable for the organization, download the forms directly from the links in the table from the relevant resolutions. Each registration document must be stamped with the stamp of the organization that owns or rents the vehicle in order for it to have legal force. In addition, it is necessary to indicate the time of departure from the garage and the exact time of return of the car to its place. Please take into account other requirements for their design.

In particular, both when the vehicle leaves the garage and after it returns to the garage, the records are checked for compliance with the indicators of the instruments in the car, such as the fuel gauge, odometer, etc. The technical condition of the vehicle must be endorsed by an authorized employee, for example, an organization mechanic. The data on the pre-trip medical examination must be filled out by a health worker indicating the date. The record must indicate that the driver “passed a pre-trip medical examination and was cleared to perform work duties.” If necessary, a note about the medical examination after the flight is placed.

Sometimes a special program is used to fill out vouchers. It allows you to hide unnecessary areas of a document, determine exactly how long the journey took, and put an exact number on each document. The announcement of the use of the program must be made to all dispatchers so that vouchers are issued in the same way. In addition, this will make life easier for drivers, who will be able to take into account every ruble spent on the road and display the exact balances. The absence of such a program is not a violation, since new forms are not prohibited from being filled out manually.

The delivery date has changed

According to the latest amendments to the legislation of the Russian Federation, it is not allowed to issue one ticket for multiple routes on different working days. The new rules state that the travel form must be issued the day before:

- each departure - if the flight is longer than a working day;

- the beginning of the first trip - if the scope of the task is less than a day and the driver receives one or many tasks.

The form in which the validity period of the form is displayed on the ticket depends on the duration of the route. If its duration is no more than a work shift, the duration of the voucher is displayed as one date. If the duration of the route is more than one shift, the “validity period” column displays the start date of the route and the date of its completion.

Sample filling

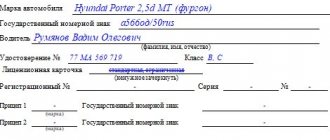

Let us consider in detail how to fill out each field using the example of form No. 3 (for a passenger car) for an individual entrepreneur. The sample, taking into account the latest changes, was prepared using the commercial version of ConsultantPlus.

IMPORTANT!

Organizations and individual entrepreneurs have the right to change the sequence of filling out the waybill. The main thing is that the content of the columns complies with the requirements established by the Ministry of Transport.

Let's start by indicating the series, number and validity period of the document. The series is an optional element, so it is sometimes missing. As for numbers, they are assigned to waybills in accordance with the approved numbering.

The validity period is determined depending on the situation. In our example, the document was issued for one shift.

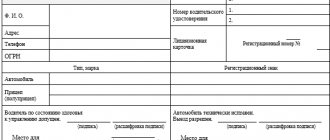

The next section is for information about the owner or lessee of the vehicle.

Legal entities enter:

- Name;

- organizational and legal form;

- location address;

- contact number;

- OGRN.

IP indicate:

- Full name (patronymic if available);

- mailing address;

- contact number;

- OGRIP.

Information about the vehicle itself must be indicated as stated in the documentation. When filling out you must write:

- car make (can be in Latin or Cyrillic);

- number received during state registration;

- parking number, if available, if not, the field is skipped, this is not a violation.

The next large section is necessary to indicate who is driving the vehicle. The driver must be reported as follows:

- Full name (patronymic if available);

- Personnel Number;

- data from the driver's license (number, category or class).

Admission of a vehicle is not permitted without monitoring the technical condition of the vehicle and a medical examination. The corresponding marks are placed on the waybill indicating the specific travel time. The specified data is confirmed by authorized persons.

But there is one caveat: individual entrepreneurs operating exclusively passenger cars have the right not to conduct a pre-trip check of the technical condition of the vehicle. The rest are required to do this, so for most motor transport enterprises, technicians’ marks on waybills are mandatory.

Please note that the organization may not have its own medical worker and/or mechanic. In this case, to organize medical examinations and technical control, they either hire part-time workers or outsource this work.

Immediately before departure, the waybill must indicate the meter readings (integer numbers only) and the time they were taken. Next, you should enter data about what fuel was issued, in what quantity (if fuel is provided). All data is confirmed by the signature of the employee himself.

Many people have questions about what data to write down in the “Driver Tasks” section. If we are talking about a passenger car, then in the waybill issued for it they write at whose disposal the vehicle is being transferred. On forms for trucks it is allowed to write the person who ordered the transportation, and on forms for buses - the destination.

The driver is prohibited from changing the task. This can only be done by an authorized person of the owner or lessee of the vehicle, who acts as a representative of the employer. If the vehicle is used for special purposes, for example by law enforcement officers or road services, a note about this is placed on the waybill.

When the vehicle leaves the parking lot (garage), the dispatcher must record the time. In the future, this data is important for calculating time worked and, of course, wages.

Upon return, the travel voucher records the time of arrival, odometer readings, and information about the movement of fuel. Data on fuel consumption rates are taken from the Ministry of Transport order No. AM-23-r dated March 14, 2008, which approved fuel and lubricant consumption rates for road transport.

All data is confirmed by the signatures of authorized employees of the motor transport company.

If there were any delays along the way, the driver records this in a special section. Some people recommend indicating lunch time in this field.

The reverse side consists of a table and a few more lines. The table is filled out by the driver, entering the number of trips - one or several. He should write the destination and time of departure and arrival. If we are talking about a car that has been transferred to a private person, he is obliged to confirm the driver’s records.

The last section is the result of the vehicle's work per shift and payroll calculation. It is filled out to calculate wages. If the driver receives money based on the distance traveled, only 2 fields are filled in: “traveled, km” and “per kilometer, rub. cop." If the payment is time-based, fill out two other fields: “total in work order, hours” and “per hours, rub. cop." It is permissible to fill in all lines if necessary.

As a rule, this part is filled out in the accounting department, since only accountants are responsible for calculating and issuing wages to employees.

Responsibility for errors

Responsibility for the correct execution of documents rests personally with the head of the organization and authorized persons who are responsible for the operation of the vehicle. Those who sign the form are responsible for the accuracy of the data they certified. If, during an inspection, representatives of the Federal Tax Service reveal violations in filling out the waybill, they have the right to exclude fuel and lubricants written off on it from expenses for profit tax purposes. Then the organization will have to pay additional tax, fines and penalties assigned by inspectors.