Just like other employees, the director of an LLC is classified as hired personnel. But unlike ordinary employees, who can be hired for an indefinite period, the term of a manager’s work always has limitations - it is established by the company’s charter, and after its expiration, the owner, by his decision, can dismiss the director, or extend his contract and the term of powers granted.

In this overview, you will be able to find out how to extend a contract with a director, how to formalize the corresponding decision of the sole participant to extend the powers of a director, and familiarize yourself with a sample administrative document.

Legal status of the director

The term of office is determined by the statutory documents; as a rule, it does not exceed 5 years. While the powers are in effect, the director can exercise general management and carry out all actions related to the implementation of business activities. The manager is subject not only to labor legislation, but also to corporate law. At the same time, such a person is an ordinary employee who has an employment relationship with the enterprise, and on the other hand, he has powers that give him the right to manage the LLC. In addition to the rules of law, the activities of the manager are regulated by local documents:

- job description;

- charter;

- regulations on the director of the LLC;

- employment contract.

Document storage standards

The minutes of a meeting of company participants is a unique document. This document is both one of the elements of personnel records management and an important act that relates to the business activities of the company.

The minimum storage period for this act is five years. It is important to note that each company is given the right to independently choose the retention period for such documentation. The selected period should not be less than the duration of the time period established by the Government.

General rules for renewal of powers

Naturally, if we are talking about a fixed-term employment contract, then you will have to go through the procedure for extending the powers of the director, if after 5 years the company does not want to terminate relations with the director.

The most important thing that should not be forgotten is that it is necessary to take care of the legitimacy of the manager until the employment contract expires. Otherwise, problems may arise; regulatory authorities and banks may file legal claims against the LLC, and counterparties may go to court and challenge the concluded deal.

In addition, if you miss the deadline for extending the director’s powers, then you will have to act according to a different scheme, first fire the director, and then hire him again. And this is all the time and unnecessary paperwork.

You cannot extend powers during the absence of the manager from the workplace, for example, if he was on a business trip or sick.

Can the director of an LLC take a vacation?

If the founder has appointed himself as a director, he is able to claim sick leave and paid leave. The duration of vacation pay and sick leave corresponds to the standards stated in the Labor Code of the Russian Federation. Moreover, vacation must be taken out every year. If a manager works without rest for 2 or more years in a row, the Labor Inspectorate may draw attention to this violation.

The punishment can be a fine of up to 50,000 rubles. Therefore, even if the director is not on vacation, lawyers recommend monitoring its execution on paper anyway.

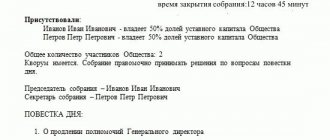

Holding a meeting of shareholders

To extend the powers of a director, it will be necessary to convene shareholders; perhaps the charter documents provide for a procedure for appointment and removal, or extension of legitimacy by a supervisory or other authorized body. Simply put, it is necessary to review the terms of the charter before convening the meeting.

If the LLC has several participants, the results of the agreements reached are recorded in the minutes. Such a document can be certified by a notary if such a procedure is provided for by the legal documents of the enterprise.

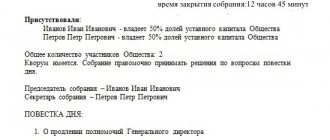

General requirements for the protocol:

- the date and place of compilation are indicated;

- a list of participants present indicating their shares;

- percentage of votes and whether there is a quorum;

- Document number;

- agenda (by the way, it is not recommended to write the “Miscellaneous” item; issues that are not specified in the agenda cannot be considered at the meeting);

- a statement of the essence of the meeting;

- summing up voting results;

- decision;

- signatures and full name with a transcript of the secretary and chairman of the meeting.

Protocol on renewal of director's powers, sample

Protocol No....

meetings of LLC owners... name...

Date of compilation, place

Present

Full name owning...% of the UV, equivalent in rubles....

Organizational and legal form, name, OKPO, owning ...% of the UV, equivalent in rubles ...

All members of the LLC were present at the meeting...

Quorum … %

Information about whether fees are considered eligible

Signatories of the protocol, full name

Agenda:

- On the extension of powers... position... LLC... name....

Listened... Full name...

Voted:

……

Decided

Extend powers... position... full name... for a period of... years.

Signatories... full name... signatures...

Drawing up a protocol on status extension

The laws established by the government do not contain regulations regarding the preparation of a protocol on the extension of powers of the head of the company. Based on this fact, we can conclude that this document can be compiled in any form. In addition, the owners of the company can approve the sample, which will be used in the further work of the company. The main requirement of the law is compliance with all office work standards. The document in question consists of three main parts:

- The header of the form contains information about the company. In this part of the document you need to indicate the details of the company, the name of the locality where the company is registered and the date of drawing up the act. In addition, you must indicate the registration number of the protocol and its name.

- The content part of the form provides information about the issues on the agenda . This section should include a list of people who attended the meeting.

- The final part provides information about the decision made. The form in question must be signed by all participants of the event. The presence of the signature of the company's participants confirms the veracity of the data reflected in the document.

It is necessary to certify a document with a company seal only if this requirement is enshrined in the company’s internal regulations. It should also be noted that this document is generated in a single copy. Event participants have the right to request the preparation of additional copies. Copies of the document must be certified by the signature of the company's participants. The registration number of the protocol must be recorded in internal registers.

The owners of the company have the right to add additional information to this document that is important for the organization itself . The content of the act should indicate the number of people who voted “against” and “for” the decision on the agenda. In the event that one or more company participants refuse to sign the completed act, this fact must be indicated in the content.

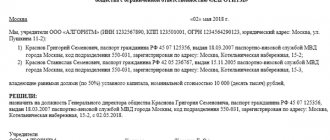

Single owner of LLC

In cases where the company has only one shareholder, no minutes are drawn up, and the LLC participant makes a decision.

General requirements for compilation:

- As a rule, such a document is drawn up on the company’s letterhead;

- if the company’s owner is a legal entity, then it is necessary to indicate all identifying data of the enterprise;

- if the decision is made by an individual, then his passport data;

- the decision is not subject to mandatory certification by a notary, but ideally, it is better to go to a lawyer so that in the future the regulatory authorities do not have questions about the preparation of the document.

Decision to extend the powers of the director, sample:

Decision No....

Single participant of the LLC… name….

Date and place of compilation

I, full name..., passport details..., being a citizen...., passport details..., place of registration...., division code...., being a single participant of LLC... name...

DECIDED:

Extend powers... position... LLC... name... for a period... the period is indicated or written “..according to the terms determined by the Charter...”

Single participant of LLC ... name ...

Full name... signature...

company seal

Preparatory stage

At the first stage, it is necessary to make a decision to hold a general meeting of LLC participants, at which the powers of the old general director will be terminated and a new one will be elected. The procedure for convening and preparing this event is determined by Federal Law No. 14-FZ dated 02/08/1998 “On Limited Liability Companies” (hereinafter referred to as the Law). The decision to convene is made by the executive body of the company. Depending on whether the change of leadership was planned in advance or whether it is unscheduled, preparations are made for a scheduled or unscheduled meeting. The difference in preparation is that the timing of a scheduled meeting is specified in the company’s charter, but an unscheduled meeting is not. Accordingly, society participants must send a demand to the executive body about the need to hold this event.

The following schedule will look like this.

Within 5 days from the date of receipt of the request, the executive body is obliged to consider it and make a decision on approval or refusal to hold a meeting.

Within 45 days after submitting the request for its holding (if approved), the meeting must take place. This is stated in paragraph 3 of Article 35 of the Law.

30 days before the event (no later), those convening the meeting must notify other participants about it. This is done by sending a registered letter with notification to the address indicated in the list of company participants in the company's charter. Also, notification can be made in any other way specified in the regulatory documents of the organization.

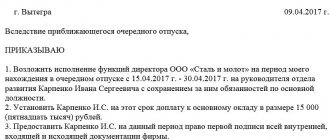

Order for the enterprise

Now the HR department comes into play. It is necessary to create a general order for the enterprise to extend the powers of the director. It is not necessary that this document be drawn up by HR department specialists; it is drawn up by the employee responsible for maintaining administrative documentation. The requirements for the order are general and do not have any special features compared to other administrative documents. They are drawn up on A4 paper, not on the company’s letterhead. The order must contain the following mandatory details:

- LLC name;

- date and place of compilation;

- serial number;

- summary;

- the text part defines a clear date from which the manager’s powers are extended;

- position and full name of the document signatory.

Extension of powers of the director of an LLC, sample order:

Organizational and legal form of the enterprise…. Name…

Order No.___

Date and place of compilation

Short description

Based on the minutes of the general meeting of owners, I begin my official duties on... date...

Grounds: Decision or minutes of the meeting of LLC owners... name... No..... Date of.

Signatory position

Director of LLC…. name... signature and full name

If the founder becomes the director of the LLC

If the founder has drawn up an employment agreement with himself, he will have to pay his own salary. Earnings may not be lower than the minimum established in a particular region of Russia. From each salary, the boss must calculate contributions to state insurance funds. Essentially, he is an employee like everyone else in the organization.

What advantage can you take advantage of when calculating tax contributions? Take advantage of the opportunity to reduce your tax base. This can be done by calculating the income tax. But this option is only suitable for those companies that, at the stage of opening an LLC, have registered the simplified taxation system “Income minus expenses” or OSN. Rewards, material incentives and bonuses cannot be used to optimize the tax base.

If the CEO runs a company without concluding an employment agreement, dividends are actually considered his earnings. Moreover, the amount received on the basis of dividends on shares of the enterprise, as well as tax deductions on it, are not costs for reducing the tax base.

Actions of the personnel department

If a fixed-term employment contract has been concluded with the manager, then, naturally, it should be extended based on the decision of the owner of the legal entity. The entire procedure must be completed before the employment contract expires. The text of the addendum will contain information about the extension of the contract, and not about the extension of authority.

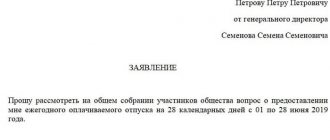

Extension of powers of the director of an LLC, sample additional agreement to the employment contract:

Additional agreement

To …. agreement... contract... Name…

No.... date...

place of compilation, date

LLC ... name..., represented by the chairman of the supervisory board, full name..., acting on the basis of a decision of the supervisory board of LLC ... name... No.... date..., on the one hand,

And

Citizen... full name... ID details..., on the other hand,

have drawn up this additional agreement as follows.

Based on the protocol on the extension of the powers of the director No.... date

1. Extend the above agreement for a period of ... years, until ... date...

or

Paragraph …. agreements... date... No.... shall be stated as follows:

“Clause... The agreement is extended until....”

2. The remaining terms of the above-mentioned contract... agreement... not affected by these agreements remain unchanged.

Details of the parties

If it is entered into the work book that the contract is fixed-term, then changes will have to be made to the same document to extend the powers of the general director.

At the same time, there is another opinion, namely, a fixed-term employment contract cannot be extended. Courts that have adopted this point of view are of the opinion that the contract with the director should be terminated and a new one should be concluded. In this case, in addition to issuing orders for the dismissal and hiring of an official, you will have to make appropriate entries in the work book.

Definitely, a contract concluded on an indefinite basis does not require any changes.

At the same time, there is a third opinion. You can prepare in advance and “turn” a fixed-term contract into an open-ended one. More precisely, do not warn the director about the upcoming dismissal within the time frame stipulated by law and the contract. If this is not done and the official is not fired, then the contract becomes permanent. Although this scheme is recommended to be used only in extreme cases, that is, when the contract is concluded for less than 5 years.

Do I need to renew

If the director’s powers are ending or have already ended, the question of their extension arises. There are no restrictions on this if both parties agree to continue employment.

Until a decision is made, the General Director continues to perform his functions in accordance with his previous appointment. His powers do not terminate automatically.

The answer to the question of whether the powers of the general director terminate with the expiration of his term of office has long been given in judicial practice. The courts take the position that in order to terminate the powers of a previously appointed sole executive body, a decision of the general meeting of participants or another body appointing the general director is necessary.

Expert opinion

Labor Lawyer Olga Smirnova

For example, in the Determination of the Supreme Arbitration Court of the Russian Federation dated October 17, 2012 No. VAS-13633/12, a situation was considered in which the bank refused to accept payment orders from the general director after the expiration of his term of office. The court found the behavior of the bank employees to be inconsistent with current legislation.

The powers of the director do not terminate in the Unified State Register of Legal Entities (USRLE). The entry in it remains unchanged until the legal entity submits an application to change the data in the register.

All contracts, powers of attorney and other documents signed by such general director are valid.

However, many organizations try to promptly reappoint a manager for a new term. This makes it easier to confirm his authority when communicating with contractors and to comply with internal office work standards. This also allows you to enter into fixed-term employment contracts with the general director.

Notification to tax authorities

Regarding the notification of the tax authorities, one point - if in the extract from the Unified State Register of Legal Entities there are no time restrictions on the term of office of the head, then no changes need to be made. If for some reason, when registering an enterprise or making changes to the registration data, restrictions on the duration of the management were added, then you will have to notify the tax authority about the extension of the powers of the director of the LLC. In this case, it is necessary to submit data to the registration authority within 3 days from the date of making the relevant decision.

Labor relations and powers

The General Director is the sole executive body appointed for a time period regulated by the Charter. The head of a business entity can be elected for an unlimited period of time. Extension of powers in such a situation is carried out by the Board of Directors, the competence of which must be reflected in the statutory documentation.

The director of the company is considered a full-fledged employee, with whom a fixed-term or open-ended employment agreement is drawn up. Upon expiration of the term of authority, the contract is extended provided that the founders of the business entity do not plan to change the manager.

Confirmation of the authority of the general director for the bank

- Notice: Undefined index: 1 in user_node_load() (line 3582 of /var/www/modules/user/user.module).

- Notice: Trying to get property of non-object in user_node_load() (line 3582 of /var/www/modules/user/user.module).

- Notice: Undefined index: 1 in user_node_load() (line 3583 of /var/www/modules/user/user.module).

- Notice: Trying to get property of non-object in user_node_load() (line 3583 of /var/www/modules/user/user.module).

- Notice: Undefined index: 1 in user_node_load() (line 3584 of /var/www/modules/user/user.module).

- Notice: Trying to get property of non-object in user_node_load() (line 3584 of /var/www/modules/user/user.module).

1.

An approximate list of documents confirming the authority of the head of the organization[1]:

- extract from the Unified Register of Legal Entities;

- minutes (decision) of the general meeting of participants (shareholders, shareholders, etc.);

- an agreement on the transfer of powers of the sole executive body to a management organization or manager;

- order (resolution) on appointment to a position;

- court ruling (decision);

- charter (regulations);

- an extract from the Unified Register of Individual Entrepreneurs and a Certificate of state registration of an individual as an individual entrepreneur (for an individual entrepreneur).

2. An approximate list of documents confirming the powers of a representative of a person participating in the case[2]:

- power of attorney (power to conduct a bankruptcy case; the right of a representative to sign a statement of claim and a response to the statement of claim, applications for securing a claim, transfer of a case to an arbitration court, complete or partial waiver of claims and recognition of a claim, changing the basis or subject of a claim, conclusion settlement agreement and agreement on factual circumstances, the transfer of one’s powers as a representative to another person (subassignment), as well as the right to sign an application for review of judicial acts based on new or newly discovered circumstances, appealing a judicial act of an arbitration court, receiving awarded funds or other property, must be specifically provided for by the power of attorney (Article 36 of the Federal Law “On Insolvency (Bankruptcy)”, Article 62 of the Arbitration Procedure Code of the Russian Federation).

- documents confirming the authority of the legal representative (identity document of the parent, indicating the surname, name, patronymic of the person represented (in the absence of such data in the parent’s identity document, a birth certificate of the minor is additionally required); Certificate of transfer of the child to a foster family , issued by the guardianship and trusteeship authorities; Certificate of adoption; Certificate of guardian/trustee (for guardians and trustees - individuals); Decision of the authorized body to place the child in a special institution and power of attorney (for persons who are not the head of the institution), confirming the authority of the person applying act on behalf of the institution (if the functions of the guardian/trustee are carried out by such institution).

[1] The specific list and types of documents depend on the legal form of the legal entity [2] The specific list and types of documents depend on the type of representation

A reader of our forum, the head of an LLC, is outraged by the actions of the bank, which blocked the organization’s current account, which is why the company lost ability to pay taxes, pay salaries and benefits.

The reason for blocking is the end of the director's term of office. The indignant director has already visited the Federal Tax Service and the Social Insurance Fund. Labor inspectorate, where he was informed that it was necessary to pay taxes and wages. Fiscal officials are not interested in how these payments will be made.

You may ask, what’s so difficult about extending the director’s powers? The problem is the founders who have lost interest in their business and their whereabouts are unknown.

The general director, my authority, has expired. The bank, citing financial monitoring of Federal Law 115, stopped all movements on the account - salary, child benefits, bill payments, etc. I went to the tax office, consulted, they say that unconfirmed credentials do not exempt you from obligations - you must pay all taxes, payments, salary, etc.

I went to the Social Insurance Fund, they say that benefits are generally inviolable by anyone and no circumstances can interfere with payment. I went to the bank, it’s useless, let’s take the protocol and we’ll continue to talk.

I went to the labor office, I tell it like it is, they answer that they don’t care, sort out your shit yourself, and if there is a statement about non-payment of salary or benefits, we will rush to check)) I have several LLCs, there are no co-founders, what are their names? I have no idea how to search, should I write a wanted report to the police? While the police are looking for them, what to do with payments and current obligations, can I say that my credentials have not been confirmed, wait until the police find the right People (sarcasm). It is clear that I can draw up the minutes of the meeting myself and put the necessary signatures, but this cannot be done and I will not do this, this is my principled position. CRAP! What should I do?

— Mad_Shurik

The discussion participants noted that the only legal option is to extend the powers and it is impossible to force the bank to allow the use of the account when the director is no longer a director.

If you know a way out of this impasse, you can give advice to the director of the company in the forum topic “the powers of the general director have not been confirmed.”

Source: https://lawsexp.com/juridicheskie-sovety/podtverzhdenie-polnomochij-generalnogo-direktora.html

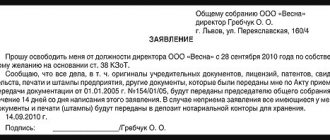

Special cases of dismissal

The law also provided for special cases of dismissal of a manager (Article 81 of the Labor Code of the Russian Federation):

- the owner of the company has changed;

- the manager made an unreasonable decision, which resulted in damage to the company;

- The manager grossly violated his job duties one time.

· When a manager is dismissed on the initiative of the owner of the company or the board of directors, the entry in the work book must contain a reference to a specific paragraph of Article 81 of the Labor Code.

A change of ownership of a company means a transfer of ownership of the company's property as a whole from one person to another. For example, during purchase and sale, privatization, etc.

note

But a change in the composition of participants (shareholders) is not considered a change of owner (clause 32 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2 “On the application of the Labor Code by the courts of the Russian Federation”).

When a manager is dismissed and the owner of the organization’s property changes, the new owner is obliged to pay compensation to the manager in the amount of at least three average monthly earnings (Article 181 of the Labor Code of the Russian Federation).

In order to fire a manager for an unreasonable decision, it is necessary to prove that his actions led to damage to the company. This can be done during an audit, the procedure for which is usually established by the company’s charter.

The audit is carried out by a special commission, the decision to create which is made by the founders of the company at a general meeting. If the company, in addition to the director, is managed by a board of directors, its members can also be included in the commission.

The purpose of the commission’s activities is to find out whether the damage could have been avoided if the manager had made a different decision (clause 48 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 17, 2004 No. 2).

The Labor Code does not say which violations of a manager’s labor discipline can be considered gross.

One of such violations may be failure to fulfill the duties of a manager, which could result in harm to the health of employees or damage to the property of the company. For example, when a manager refused to install an automatic fire extinguishing system, and as a result of the resulting fire, an employee was injured, and part of the company’s property was destroyed by fire.

The head of the organization (including the former) bears full financial responsibility for direct actual damage caused to the organization (Part 1 of Article 277 of the Labor Code of the Russian Federation). Direct actual damage is understood as a real decrease in the employer’s available property or deterioration in the condition of said property (including property of third parties located at the employer, if the employer is responsible for the safety of this property), as well as the need for the employer to make costs or excessive payments for the acquisition, restoration of property or compensation for damage caused by the employee to third parties (Part 2 of Article 238 of the Labor Code of the Russian Federation). In this case, it is possible to involve the head of the organization on the basis of Chapters 37 and 39 of the Labor Code (clause 5 of Resolution of the Plenum of the Armed Forces of the Russian Federation of June 2, 2015 No. 21, hereinafter referred to as Resolution No. 21).

The head of the organization (including the former) compensates the organization for losses caused by his guilty actions only in cases provided for by federal laws (Part 2 of Article 277 of the Labor Code of the Russian Federation). For example, a manager is liable to the company or shareholders for losses caused by their guilty actions (inaction) that violate the procedure for acquiring shares in an open company (Article 71 of Law No. 208-FZ). The calculation of losses is carried out in accordance with Article 15 of the Civil Code, according to which losses mean actual damage, as well as lost income (lost profits) (clause 6 of Resolution No. 21).