From January 1, 2021, payment orders for the payment of insurance premiums, penalties and interest on them will need to indicate new budget classification codes (BCC). Moreover, payments for insurance premiums will need to be sent to tax authorities, and not to funds. Should I pay insurance premiums for one or more KBK in 2021? Do I need to prepare several payment orders for payment? What happens if you send contributions to the “old” KBK? You will find more details about the new codes, their application, as well as a table with the new BCCs in this article.

Introductory information

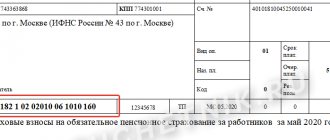

The budget classification code (BCC) is part of the group of details that allow you to determine the ownership of the payment. Therefore, when transferring insurance premiums in 2021 to the tax inspectorates, you must fill out the payment slips correctly. New BCCs for insurance premiums from 2021 must be indicated in field 104 of the payment order. KBK consists of 20 digits. If you send insurance premiums to the old KBK in 2021, the payment will be attributed to unidentified revenues. And then you will need to clarify the payment, contact the funds and, possibly, undergo reconciliation.

New BCCs from 2021 are provided for pension, medical contributions and contributions for temporary disability and in connection with maternity. To transfer these contributions, you will need to draw up different payment orders and make payments to the tax inspectorates.

When to pay tax

General approach

As a general rule, personal income tax must be paid in 2021 no later than the day following the day the employee (individual) was paid income. So, let’s say the employer paid the salary for January 2021 on February 9, 2021. The date of receipt of income will be January 31, 2021, the date of tax withholding will be February 9, 2021. The date no later than which personal income tax must be paid to the budget, in our example – February 11, 2021.

Benefits and vacation pay

Personal income tax withheld from temporary disability benefits, benefits for caring for a sick child, as well as from vacation pay must be transferred no later than the last day of the month in which the income was paid. For example, an employee goes on vacation from March 6 to March 23, 2017. Vacation pay was paid to him on March 1. In this case, the date of receipt of income and the date of withholding personal income tax is March 1, and the last date when personal income tax must be transferred to the budget is March 31, 2021.

In general, pay the withheld personal income tax in 2021 to the details of the Federal Tax Service with which the organization is registered (paragraph 1, clause 7, article 226 of the Tax Code of the Russian Federation). Individual entrepreneurs, in turn, pay personal income tax to the inspectorate at their place of residence. However, individual entrepreneurs conducting business on UTII or the patent taxation system transfer tax to the inspectorate at the place of registration in connection with the conduct of such activities.

Also see “Personal Income Tax Payment Deadline in 2021: Useful Tables.”

Pension contributions from payments to employees

Note!

From January 1, 2021, new BCCs for insurance contributions to the Federal Tax Service are in effect. In particular, the administrator codes (the first three digits of the KBK) have changed - 182 instead of 392. All contributions must be paid to the tax office, and not to funds (except for contributions for injuries).

Basic payments

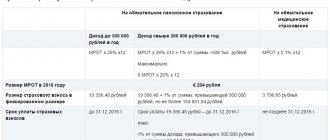

Pension insurance contributions from payments to employees within the limit (for 2021 it is 876,000 rubles) are charged at a rate of 22%, and from payments above the limit - at a rate of 10%. See “Limit value of the base for calculating insurance premiums for 2021: table.”

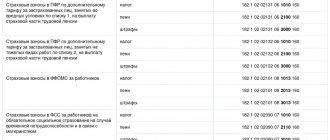

Such tariffs for 2021 have been determined and established for most organizations and individual entrepreneurs. To pay pension insurance contributions in 2021 from payments within the limit and from payments accrued in excess of the base limit, the same BCC is used - 182 1 0210 160. This is a new code.

Please note that pension insurance contributions for December 2021 must be transferred to a “special” KBK. Even if insurance premiums are transferred in January 2021 and later. For December contributions use code 182 1 0200 160.

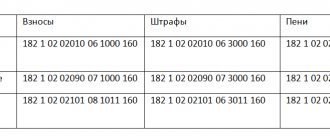

Penalties and fines

If you pay pension insurance contributions in 2021 later than established by the Tax Code of the Russian Federation, you will have to pay a penalty. Also, payers of insurance premiums may face the need to pay fines. New BCCs are provided for these payments. However, in 2021, you may have to pay interest and penalties for the period before 2021. Then you need to use other codes. We present in the table the new BCCs for penalties and fines.

| Payment type | KBK 2021 | KBK 2021 |

| Penalties on pension insurance contributions | 182 1 0200 160 | 182 1 0210 160 |

| Penalties on pension insurance contributions | 182 1 0200 160 | 182 1 0210 160 |

KBK for paying taxes for organizations and individual entrepreneurs in special modes

| Name of tax, fee, payment | KBK (field 104 of payment) |

| Tax under the simplified tax system, when the object of taxation is applied: | |

| 182 1 0500 110 |

| 182 1 0500 110 |

| UTII | 182 1 0500 110 |

| Unified agricultural tax | 182 1 0500 110 |

Organizations and individual entrepreneurs using the simplified tax system need to pay attention to the fact that a separate BCC for transferring the minimum tax has been abolished.

Medical contributions from payments to employees

Basic payments

From 2021, insurance premiums for compulsory health insurance must also be transferred to the Federal Tax Service. Limits on medical contributions are not approved, so they must be calculated and paid from all amounts made in favor of employees. At the same time, from 2021, for medical contributions, you also need to use the new BCC - 182 1 0213 160.

Please note that medical insurance premiums for December 2021 must also be transferred to a “special” KBC. Even if insurance premiums are transferred in January 2021 and later. For December contributions, use the new code 182 1 0211 160.

Penalties and fines

If you pay medical insurance premiums in 2021 later than established by the Tax Code of the Russian Federation, you will have to pay a penalty. Also, payers of insurance premiums may face the need to pay fines. New codes apply for these payments. For payments until 2021, the codes are different. Let's list them in the table.

| Payment type | KBK 2021 | KBK 2021 |

| Penalties for medical insurance premiums | 182 1 0211 160 | 182 1 0213 160 |

| Penalties for medical insurance premiums | 182 1 0211 160 | 182 1 0213 160 |

Who needs to apply for 3-NDFL

Declaration 3-NDFL is intended for calculating the tax that must be paid on income received by an individual, or determining the amount of its compensation as a result of applying a tax deduction declared to the Federal Tax Service.

Deductions can be received from the Federal Tax Service:

- for the purchase of real estate;

- tuition fees;

- payment for medications and treatment;

- transfers to charity;

- transfers to the funded part of the pension.

Of these, the first 3 types of deductions through 3-NDFL are declared to the Federal Tax Service, if these deductions are not provided at work.

3-NDFL must be submitted upon receipt of income:

- As a result of the sale of property, with the exception of the sale:

- movable property that has been owned for more than 5 years; real estate, the ownership of which arose before 2021 and at the time of sale was owned for more than 5 years;

- real estate, the ownership of which arose from 01/01/2016 and at the time of sale was owned for at least the minimum period of ownership.

Read about the nuances of taxation of income from the sale of real estate in the article “Sale of real estate below cadastral value - tax consequences.”

- From individuals and organizations that are not tax agents.

- From which tax agents did not withhold tax and did not submit information to the Federal Tax Service.

- Residents - individuals from sources located outside the Russian Federation (except for military personnel).

- From the financial activities of individual entrepreneurs.

- From the private practice of a notary and lawyer.

- As a result of winning.

- From the sale of shares, shares in the authorized capital.

- As a reward from the use of inherited intellectual property.

- From property and funds received as a gift, if such income is not exempt from taxation due to this transaction between family members or close relatives (clause 18.1 of Article 217 of the Tax Code of the Russian Federation).

- Foreign citizens working on a patent if:

- the tax calculated on the income they received for the year exceeds the amount of fixed payments paid;

- a foreigner leaves Russia before the end of the year and his income for the period of work exceeded the amount corresponding to the amount of fixed payments paid;

- the patent was revoked in accordance with the Law “On the Legal Status of Foreign Citizens in the Russian Federation” dated July 25, 2002 No. 115-FZ.

3-NDFL must also be submitted (Clause 2, Part 1, Article 20 and Part 1, Article 20.1 of the Law “On the State Civil Service of the Russian Federation” dated July 27, 2004 No. 79-FZ, Article 8 of the Law “On Anti-Corruption” dated December 25, 2008 No. 273-FZ):

- civil servants included in special lists (Decree of the President of the Russian Federation dated May 18, 2009 No. 557) and the register of positions (Decree of the President of the Russian Federation dated December 31, 2005 No. 1574);

- employees of the Ministry of Internal Affairs (order of the Ministry of Internal Affairs of Russia dated December 16, 2016 No. 848);

- family members of civil servants.

The declaration must be submitted to the tax office by April 30 of the following reporting year. At the same time, the taxpayer can apply for a tax refund.

Insurance premiums for disability and maternity in favor of employees

Basic payments

In 2021, insurance premiums for temporary disability and maternity in favor of employees must be transferred to the Federal Tax Service. These contributions are paid until payments to employees exceed the limit of 755,000 rubles. See “Limit value of the base for calculating insurance premiums for 2021: table.”

To do this, you need to draw up a separate payment order. And you need to indicate the new BCC - 182 1 0210 160.

Insurance premiums for disability and maternity for December 2016 must be transferred to a “special” CBC. Even if insurance premiums for 2021 are transferred in January 2021 and later. For December contributions, use the new code 182 1 02 02090 07 1000 160.

Penalties and fines

If you pay insurance premiums for temporary disability and maternity in 2021 at a later date than established by the Tax Code of the Russian Federation, you will have to pay a penalty. Also, payers of insurance premiums may face the need to pay fines. The codes for these payments depend on the period for which penalties and fines are transferred.

| Payment type | KBK 2021 | KBK 2021 |

| Penalties for social insurance contributions | 182 1 0200 160 | 182 1 0210 160 |

| Penalties for social insurance contributions | 182 1 0200 160 | 182 1 0210 160 |

KBK for payment of other taxes for all organizations and individual entrepreneurs

| Name of tax, fee, payment | KBK (field 104 of payment) |

| Personal income tax on income the source of which is a tax agent | 182 1 0100 110 |

| VAT (as tax agent) | 182 1 0300 110 |

| VAT on imports from the EAEU | 182 1 0400 110 |

| Income tax on dividend payments: | |

| 182 1 0100 110 |

| 182 1 0100 110 |

| Income tax on the payment of income to foreign organizations (except for dividends and interest on state and municipal securities) | 182 1 0100 110 |

| Income tax on income from state and municipal securities | 182 1 0100 110 |

| Income tax on dividends received from foreign organizations | 182 1 0100 110 |

| Corporate income tax on income in the form of CFC profits | 182 1 0100 110 |

| Transport tax | 182 1 0600 110 |

| Land tax | 182 1 06 0603x xx 1000 110, xxx depends on the location of the land plot |

| Fee for the use of aquatic biological resources: | |

| 182 1 0700 110 |

| 182 1 0700 110 |

| Water tax | 182 1 0700 110 |

| Payment for negative impact on the environment | 048 1 12 010×0 01 6000 120, x—type of pollution |

| Regular payments for the use of subsoil, which are used: | |

| 182 1 1200 120 |

| 182 1 1200 120 |

| MET | 182 1 07 010xx 01 1000 110, xx - type of mineral |

Insurance premiums for injuries

In 2021, insurance premiums for accidents at work and occupational diseases must, as before, be transferred to the Social Insurance Fund as a separate payment account. The BCC for this type of contribution did not change in 2017.

| Payment type | KBK 2021 | KBK 2021 |

| Insurance premiums for injuries | 393 1 0200 160 | 393 1 0200 160 |

| Penalty | 393 1 0200 160 | 393 1 0200 160 |

| Fines | 393 1 0200 160 | 393 1 0200 160 |

What is KBC and why is it necessary?

KBK or budget classification code is the same payment details of the regulatory authority as TIN or KPP. This code should be indicated in the payment order so that the funds sent to the insurance fund actually reach the recipient and are distributed for their intended purpose. It is on the basis of this detail that the distribution of received amounts is carried out.

If the BCC is indicated incorrectly, then the transferred amount will still be considered paid, however, it may remain undistributed and the payer will have arrears. To solve this problem, a company representative will have to contact the regulatory authority with a payment order and write a corresponding application for the redistribution of the received amount. Only after this will penalties and arrears on contributions be eliminated.

The payment procedure is further complicated by the fact that the recipient of the funds will also change and now companies and individual entrepreneurs will have to transfer funds to the tax authority, and not to extra-budgetary funds.

Insurance premiums for individual entrepreneurs

Below in the table we present the BCCs that individual entrepreneurs must apply in 2017 when paying insurance premiums “for themselves.”

| KBK in 2021 | IP contributions |

| 182 102 0214 006 111 0160 | Insurance contributions for pension insurance of individual entrepreneurs for themselves in the Pension Fund of the Russian Federation with income exceeding 300,000 rubles. |

| 182 1 0213 160 | Insurance premiums for medical insurance for individual entrepreneurs for themselves in the Federal Compulsory Compulsory Medical Insurance Fund in a fixed amount (based on the minimum wage) |

In 2021, payment orders for payment of insurance premiums must be completed as follows:

- in the TIN and KPP field of the recipient of the funds - TIN and KPP of the relevant tax authority administering the payment;

- in the “Recipient” field - the abbreviated name of the Federal Treasury body and in brackets - the abbreviated name of the inspection that administers the payment;

- in the KBK field - budget classification code, consisting of 20 characters (digits). In this case, the first three characters indicating the code of the chief administrator of budget revenues should take the value “182” - Federal Tax Service.

Read also

03.11.2016

KBK for paying taxes for organizations and individual entrepreneurs on OSN

| Name of tax, fee, payment | KBK (field 104 of payment) |

| Income tax, including: | |

| 182 1 0100 110 |

| 182 1 0100 110 |

| VAT | 182 1 0300 110 |

| Property tax: | |

| 182 1 0600 110 |

| 182 1 0600 110 |

| Personal income tax (individual entrepreneur for himself) | 182 1 0100 110 |