Many enterprises in the course of doing business one way or another encounter foreign currency. Today, the most common foreign exchange transactions are settlements under loan agreements, as well as currency conversion. In the article we will look at the features of carrying out these operations and their reflection in transactions on account 52 using examples.

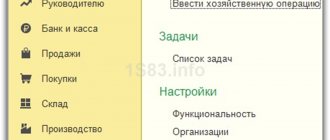

Preliminary setup 1C

Before you start working with currency, you need to configure the program.

In the event that a transfer between a foreign currency and ruble account takes more than a day, you will need to use an intermediate account.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

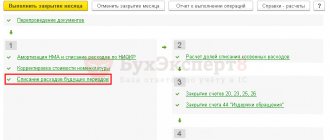

From the “Main” section, go to your company’s accounting policies.

In the window that opens, find the item called “Account 57 “Transfers in transit” is used when moving funds” and mark it with a flag. This add-on does not need to be enabled.

It is also recommended to check the installation of another add-in. In the "Administration" menu, select "Functionality". In the settings window that appears, open the “Calculations” tab and check whether the checkbox for “Calculations in foreign currency and monetary units” is checked. We already had it installed by default.

Contract

You must submit to the bank a contract/agreement between you and a non-resident or an extract from it, which will contain all the essential terms of the agreement.

It is advisable to draw up a contract with the buyer in two languages, otherwise you will have to make a notarized translation.

For services, it is better to include in the contract the condition that payment of the invoice/invoice constitutes acceptance of services, so that you do not have to prepare additional documents. Also, in order to avoid controversial situations with the client, the contract must reflect the party that will bear the costs of banking operations.

We must not forget that the timely receipt of funds under the contract/agreement must be monitored, since fines are provided for failure to receive foreign currency earnings on time.

In addition, in order to avoid delays in the transfer of documents under the contract, you can include in the contract a condition that documents can be exchanged by fax, email, and so on.

Loading exchange rates

In the “Directories” section, select “Currencies”.

You will see a list of all currencies added to the program with their rates. In this form, click on the “Download exchange rates...” button.

The program will prompt you to select those foreign currencies for which you need to download rates. Select the checkboxes and click on the “Download and Close” button. The default is the current date, but it can be changed.

Now you can proceed directly to our example of selling and buying currency in 1C 8.3.

What is a foreign currency account: goals and features

A foreign currency account differs from a ruble account only in the type of funds that are planned to be stored. The practical benefit is obvious: you can pay in foreign currency in Russia or abroad and not lose money during conversion. The basic rules regarding the functioning of the account are stipulated in the Federal Law “On Currency Regulation”.

In particular, the number of banks capable of offering such a service is limited: to carry out activities related to banknotes of other countries, a special license from the Central Bank is required. Depending on the scope of rights and opportunities, there are:

- general license - the bank has the right to carry out transactions with banknotes of other countries, both on the territory of Russia and abroad;

- extended - limits the number of foreign correspondent banks to 6 units;

- one-time - allows for a specific transaction with foreign currency.

Before you finally choose a banking institution for further storage of funds, you should clarify the type of license, as well as its validity period.

Individuals, companies, individual entrepreneurs, according to the law, have the right to open foreign currency accounts. This will make it possible to carry out the following types of transactions with foreign currency:

- current - money transfers for export and import items, obtaining a loan (for up to six months), transfers for interest, dividends, as well as payment of pensions and wages;

- related to monetary transactions - investments (in securities, authorized capital of companies abroad), purchase or rental of real estate, obtaining loans for a period of 6 months or more, any other transactions with foreign currency funds.

After submitting the appropriate application for an individual or legal entity, the bank creates several accounts at once:

- transit - money coming from abroad ends up here;

- current (main) - for crediting funds remaining after the mandatory sale of part of the income;

- special - currency purchased from Russian banks is credited to it.

For legal entities, a foreign currency account expands the boundaries of doing business, and for ordinary citizens it provides a number of advantages over a ruble account:

- you can buy or sell goods and services directly without using exchange offices;

- transfers abroad (for example, to loved ones on vacation in other countries), payment for foreign education and tourist trips - no interest is lost when converting currencies, there is no need to resort to payment systems;

- no need to carry foreign currency in cash when traveling;

- Conveniently manage finances from your mobile phone through online banking.

Sale of currency

Write-off of foreign currency

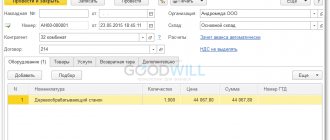

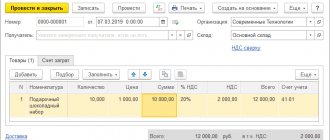

Let's consider an example when our organization needs to sell $7,000 to Sberbank for rubles. Initially, a payment order is created in 1C and, based on it, debited from the current account. We will not consider the payment order itself, and will immediately move on to processing the write-off, since it is this order that makes the necessary transactions.

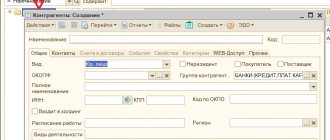

Specify “Other settlements with counterparties” as the type of transaction. The recipient in our case is PJSC Sberbank. We have already concluded an agreement with him with settlements in USD. It is selected in the card of this document. The picture below shows a card of this agreement.

We will also write off accounting account 52 (Currency accounts) and settlement account 57.22 (Sales of foreign currency). In addition, you must indicate your organization and bank account.

Let's review the document and look at its postings. You can see that not only the write-off itself was reflected, but also exchange rate differences.

If the currency has changed its value since the last currency transaction, a posting will be added to 1C for calculating the revaluation of currency balances (if revaluation is configured).

Receipt to the current account

After the bank receives $7,000, it will transfer it to us in ruble equivalent. The program takes into account the document receipts to the current account.

The receipt is filled in automatically after unloading from the client bank. However, it is recommended to check the completed details, especially the account and amount.

The movements of this document are shown in the figure below.

What to do if you don’t meet the 15 days?

If for some reason, for example, due to a delay in processing documents, you cannot identify the received funds in a timely manner, it is better to return the erroneously credited funds to the sender.

If the money does not arrive on time from abroad, you can terminate the contract with the foreign company and submit documents on termination of the transaction to the bank.

Fines are a reason to “lay out straws” in advance: when working with a non-resident company, write down in the documents the dates and deadlines for payment, provision of primary documents, as well as penalties/fines for late payment or provision of services. And remember that you cannot neglect the norms of currency legislation . Huge fines are provided for non-compliance, especially for repeated violations, and no one can escape punishment.

Mandatory sale of part of foreign currency earnings: is this legal provision now in effect?

Until 2007, all individuals and legal entities who are residents of the Russian Federation were required to sell (that is, convert into rubles at the current rate) 25-75% of the funds received in their accounts in the form of foreign currency. Not long ago, deputies reintroduced a bill to the State Duma reintroducing this measure for individual entrepreneurs, commercial companies and enterprises.

After a series of disputes and considerations, the draft law was rejected. Moreover, the Central Bank issued an explanation, saying that a return to mandatory sales could slow down foreign investment in Russian industry and the economy. In addition, there is a risk of unplanned inflation growth and market destabilization.

Therefore, today the norms for the mandatory sale of foreign currency earnings have been reduced to 0, that is, there is no need to sell funds from a transit account, they can be immediately transferred to the current one.

Tips for clients: how to get a statement without problems

It is best for the accountant to agree in advance with the bank employees how often he will collect statements of the company’s account: daily, once a week, etc. This will allow you to organize your work most efficiently.- If the statement is lost, you should contact the bank for a duplicate. To do this, you need to write a corresponding application. Typically, the provision of a duplicate statement is charged separately.

- From the account statement of an individual, you can find out information about the insurance contributions transferred by the employer towards the future pension, about its funded part.

- If an individual needs an account statement for personal use, there is no need to visit the bank. You can connect to the Internet service and view all the information you are interested in remotely (at home, at work, on the road). But to submit it to any institution or organization (court, Rospotrebnadzor), a certified extract will be required.

- At OTP-Bank, a statement is sent to the client by email on a monthly basis. Distribution of statements by Russian Post is an additional paid service and is activated at the request of the client. An express statement of OTP Bank can be generated in the OTPdirect online service.

- If the bank refuses to provide the client with a statement (for example, there is an overdue amount and you want to revise the total amount of the debt), the following measures should be taken:

- write an official letter to the bank asking for an extract;

- register your application as entering the bank, your copy must be stamped and signed;

- write a pre-trial claim to the bank if you have not received a response or have been refused;

- file a lawsuit if your issue is not resolved amicably.

Why is a bank statement issued for individuals?

A bank statement is sometimes necessary for individuals. Why is a bank statement issued for individuals and when is it necessary?

- When closing a loan agreement, such a document confirms that the borrower has fulfilled his obligations to the bank.

- The extract will be useful when considering a credit case in court regarding overdue debt. The document reflects all withheld penalties, fines and payments. If you bring the loan agreement and extract to Rospotrebnadzor, you can receive a recommended letter, which the court sometimes takes into account and this will help write off fines and penalties.

- An account statement is required when obtaining a visa; it confirms the person’s solvency.

An account statement helps you monitor your debit card finances.

How to get a current account statement in Sberbank Online

This service can be used continuously and is free. First, you need to register in the system online and log in to your personal account.

The statement can be printed on paper. The information in this case is for informational purposes only. An official document can only be obtained from a bank.

On the official website in your personal account, the following actions are required:

- Go to the link “Online transaction history”;

- Enter the operation you want to find. By clicking “advanced search”, you can specify the period for which you want to receive a receipt of all transactions;

- Click “Apply” by filling out the required fields on the page;

- Get a list of required operations.

Providing statements of open current accounts of the organization

The list of situations when a legal entity needs to obtain documentary evidence of the existence and total number of open current accounts includes:

- preparation of a business plan;

- negotiations with business partners;

- participation in the tender;

- loan processing;

- judicial or prosecutorial request;

- liquidation or reorganization of the company.

In cases where it is necessary to obtain expanded information about account movements, the financial institution supplements the report with the following information:

- geographic location of transactions performed, indicating the addresses of companies and terminals;

- list of counterparties indicating their names;

- the amount of commission fees withheld by the bank.

You can receive an extended statement at a bank branch by paying a small commission, or for free in your personal account for an Internet banking user.