What are dividends

The term “dividends” refers to income paid to the owners of an organization based on the results of its activities. The amount of dividends is directly dependent on the size of the share of the LLC participant.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Dividends can be issued for different periods (most often half a year or a year is taken), while the profit of the enterprise can be distributed in full or only partially. Also, the type of payment may be individual in each case: in cash or by non-cash transfer to the bank card of the LLC participant. The period for transferring income should not be more than two months from the date of the decision and issuance of the corresponding order.

Sample resolution of the founders

- the authorized capital is fully paid;

- the company has no signs of bankruptcy;

- moreover, these signs cannot arise even after the payment of dividends (for example, withdrawal of part of the profit will not lead to a situation of non-fulfillment of obligations to partners under the supply agreement);

- the amount of net assets is greater than the amount of the authorized capital, as well as the special reserve fund, and even after payment this ratio will remain the same.

Do I need to have the decision certified by a notary?

When paying dividends, the founders should proceed from the fact that such a decision will not lead to a default on individual obligations, as well as other signs of bankruptcy. It is important to understand that a dividend is the part of the profit that will remain after paying taxes, contributions and other obligatory payments. In addition, the amount must exceed the contribution of each individual founder to the authorized capital of the LLC.

- dividends from the net profit of the current year in proportion to shares in the authorized capital (clause 1, article 43 of the Tax Code of the Russian Federation);

- dividends from the net profit of previous years, if it was not used to form funds (Letters of the Ministry of Finance of the Russian Federation dated 08/11/2021 No. 03-04-05/39854, dated 03/20/2021 No. 03-03-06/1/133).

Dividend payment procedure

In order to issue dividends, it is necessary to hold a general meeting of the founders and participants of the organization, in the amount of at least 50% of their total number - only in this case the meeting will be recognized as having taken place. It must be properly recorded, taking into account the opinions of all participants, then a decision must be made indicating to whom and in what amount the money should be transferred as dividends. The basis for the decision is the company’s reporting papers based on the results of financial activities. Based on the decision, an order is then issued on behalf of the director of the enterprise.

If the company has one founder, he must make a decision on the payment of dividends individually, while such stages as a meeting, and therefore the preparation of minutes of the meeting, are excluded, but the written execution of the decision and order remain.

It should be noted that when issuing dividends, several important conditions must be met. In particular, the net assets of the enterprise must be higher than the authorized and reserve capital, there should be no debts to the private owners of the LLC that have left, and the organization itself must remain firmly afloat, i.e. There should be no prerequisites for bankruptcy. Otherwise, in the future, during the liquidation or bankruptcy procedure of a limited liability company, interested departments may have serious questions for the company’s management.

When does an organization have the right to pay dividends?

There are a number of restrictions for companies that intend to pay dividends. They are imposed by the same Federal Law No. 14-FZ, in Article 29. You cannot make decisions about payments if:

- There is a threat of bankruptcy at the enterprise or there will be one if dividends are paid.

- The authorized capital has not been formed and contributions have not been fully paid into it.

- The cost of the LLC participant's share has not been paid or has not been paid in full.

- If the payment of dividends will entail a decrease in the company's assets (together with the reserve fund) to such an extent that they become less than the authorized capital.

The source of dividend payments to meeting participants is the organization’s net profit. The company's accountants know more about the amount of this net profit. It depends on many factors and is determined on the basis of the relevant documents of the organization.

Important! If at some time in the past the organization made a profit, then it can also be used to pay dividends. However, it should be taken into account that taxes on dividends will be calculated based not on the past, but on the tax system in force at the time of payment.

As for tax levies specifically, the income tax rate, which includes the payment of dividends, in our country for Russian companies is 9%, for foreign ones – 15.

We invite you to familiarize yourself with What is recovery by way of recourse, a sample statement of claim for recovery of damage by way of recourse | Legal Advice

How to write an order

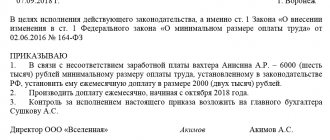

An order for the payment of dividends can be written in free form - there is currently no unified form for it. There is only one exception here: if an organization has a document template approved in its accounting policy, then, of course, the order must be created according to its type.

There are also no special nuances or reservations regarding the design, that is, it is allowed to be done both printed and handwritten, but if the first method is chosen, then the electronic order must be printed out - for signatures. For an order, either a form formed in a corporate style, with the logo and details of the company, or a regular sheet of paper is suitable.

When can I apply?

The protocol on the payment of dividends of an LLC is a document that can be filled out either every quarter of the current year or once a year.

Moreover, if this is done once every 365 days, then dividends are paid at the end of the year, when the income tax period ends. Moreover, there is a nuance: if there is no profit for the year, then there are no dividends. Thus, if dividends were paid quarterly, and at the end of the year it turned out that there was no net profit, then these funds will be officially considered gratuitously transferred to the owners of the company. Thus, in this case, the tax service charges penalties for these funds, since personal income tax was not paid on them on time.

How to keep records and organize storage

All administrative acts emanating from the company’s management must be recorded in a separate accounting journal. It contains the name and number of the order, the date of its issue. With the help of a journal, which is usually the responsibility of the head of the personnel department, a secretary or a lawyer, not only the fact of the formation of a document is recorded, but also, if necessary, one or another form can be quickly and without much hassle.

If we talk about storage, then everything is not much more complicated: after the order is issued, all the workers designated in it are familiar with it, and also its accounting, the document must be filed in a folder along with other similar papers. It should remain here for the entire period of its validity, after which it can be redirected to the archive or disposed of (but also in compliance with specially established regulations).

General rules for distribution of income to founders

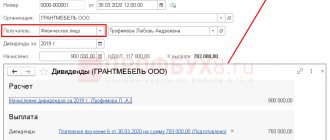

The decision to pay dividends is an administrative document for the director of the organization, who must issue an order for the execution of this decision by his subordinates. The order for the payment of dividends (sample) contains information about the amount of dividends in rubles.

Accrual and payment of dividends: postings

The timing of dividend payments in 2021 in a joint stock company (JSC) is determined in accordance with clause 6 of Art. 42 of Law No. 208-FZ and is 10 working days for nominee holders and trustees and 25 working days for other shareholders.

(2) If a procedural document is issued by a bailiff under the director of the Federal Bailiff Service - the chief bailiff of the Russian Federation of the Office for the Execution of Particularly Important Enforcement Proceedings, the specified wording is used.

Sample order for payment of dividends to founders

If you are tasked with creating an order for the issuance of dividends that you have never dealt with before, look at the sample below and take into account our recommendations - this way you will easily create the order you need.

- The beginning of the document should not cause any difficulties: indicate here the name of the enterprise (full or abbreviated, it makes no difference), the name and number of the order (according to internal document flow), the date and place where the order was issued.

- Next, add a justification to the order - here you need to enter the reason why dividends are paid (for example, in connection with the end of the calendar year), then the basis, that is, a link to an article of law or an internal regulatory act of the company.

- After this comes the main section. Everything here is purely individual: the number of points and their wording. Be sure to note the period for which the owners of the company are paid their income (it is better to indicate the start and end dates), last names, first names, patronymics of the owners of LLC shares and the amount due to each of them.

- After this, enter the form of payment (cash or non-cash transfer to a bank card), as well as the period within which this must be done. If you consider it necessary, supplement the form with other information that is important in your particular case (for example, information about applications).

- Finally, designate the person responsible for the execution of this order and provide the necessary signatures.

Sources of dividends

- The company's profit is determined (net, after paying absolutely all taxes).

- The sole founder makes an informed decision on payment, including the amount, form and timing.

- The decision is made in writing.

- After the decision is made, an order for the payment of dividends is written. This order will be the basis for employees of the company’s financial unit to calculate and pay dividends to its founder.

- Then the accrual and payment of dividends occurs.

The decision of the sole participant of the LLC on the distribution of profits as dividends

After the decision to pay money has been made, an order is drawn up to pay dividends to the sole founder (2021 sample) or to several participants, if there are many of them. Our experts have prepared a sample of this document especially for readers. It can be downloaded for free via a direct link on the website .

The total amount is distributed among the participants in proportion to the share of each, unless the charter provides for a different procedure (Clause 2, Article 28 of Law No. 14-FZ), therefore it is enough to establish its value. Although the protocol can also record specific amounts intended for distribution to each participant in accordance with the distribution rules.

- The management company is fully paid;

- the withdrawn participant was given the value of his share;

- net assets exceed the sum of the authorized capital and the reserve fund, and this ratio will remain after the issuance of dividends;

- There are no signs of bankruptcy and will not arise as a result of the issuance of dividends.

Who makes a decision on the payment of dividends to an LLC and how?

The issue of profit distribution can be either one of several discussed at the meeting, or the subject of a separate meeting. Regardless of the number of issues on the agenda, the decision of the meeting is formalized by drawing up a protocol, the indispensable details of which will be:

All this is present in paragraph 1 of Article 43 of the Federal Law of July 31, 1998 No. 146-FZ “Tax Code of the Russian Federation (Part One).” But sometimes it happens that payments to a participant in the liquidation of an organization, if they do not exceed his own payment, are not recognized as dividend payments.

General procedure for making decisions on profit distribution

To determine the percentage and timing of payments, it is necessary to organize a meeting of all shareholders. Founders' meetings are held every year. Profits are also distributed depending on the decision made: quarterly, once a year according to financial reports. The order for the meeting of founders indicates the reason for the meeting and the time of its holding. As a rule, the chief accountant is appointed as the document manager.

Payment of dividends to founders: sample order for 2021

But the form of this decision is not established in any regulatory documents, so it is written arbitrarily, in compliance with the rules for drawing up documentation. The only requirement is that the following necessary information must be mentioned there:

Starting from September 2021, the minutes of the meeting of participants must be certified by a notary. This requirement can be circumvented in the following way: to add to the agenda an item stating that decisions made are certified by the signatures of all present participants, or to add in advance to the charter an item with approximately the following content: “The adoption of a decision by the general meeting of the Company’s participants and the composition of the company’s participants who were present at its adoption, confirmed by the signing of the minutes by the chairman and secretary of the general meeting, who are participants in the company"

.

The reserve fund is a kind of “insurance” for the company in case of compensation for losses from business activities. It is created at the request of the LLC participants, in the amount provided for by the company’s charter, but not less than 5% of the value of the authorized capital.

Payment of dividends in LLC to the sole founder in 2021

The procedure for paying dividends to the sole founder of an LLC is regulated by the provisions of the Law on LLC dated 02/08/1998 No. 14-FZ. In Art. 8 of the law states that the founders are given the right to participate in the disposal of the company’s profits, and the nuances of implementing such a distribution function are described in Art. 28 of Law No. 14-FZ.

Payment of dividends to the sole founder in 2021

Part of the net profit can be issued in the form of dividends to the founder at a frequency specified in the charter of the enterprise. The distribution of assets can be carried out quarterly, based on the results of each half-year or once a year.

All payment decisions must be made in writing.

In a standard situation, a decision is drawn up at the general meeting of participants, but if there is only one founder, a sufficient basis will be the decision of the sole founder to pay dividends (this is confirmed by the provisions of Article 39 of Law No. 14-FZ).

Making a decision on the disposal of profit must be preceded by the stage of deducing the financial result in accounting. Based on these data, the amount that can be used for dividend payments is determined.

In Art. 29 of Law No. 14-FZ specifies cases when payment of dividends in an LLC to the sole founder is impossible:

- the declared authorized capital was not contributed in full by the participant;

- the enterprise has problems with the liquidity of assets and is at the stage of bankruptcy (or will find itself in such a situation after paying dividends);

- the balance between the volume of net assets and the size of the authorized capital is disturbed (the asset indicator is lower than the sum of the authorized and reserve capital).

Dividend payments cannot be counted as part of the company's expenses when calculating the tax base for income tax (under OSNO) or for the main tax in a special regime (USN, UTII, Unified Agricultural Tax).

After accrual of dividends, the paying company must withhold personal income tax amounts from them in order to perform the functions of a tax agent: 13% if the founder is a resident, 15% if he is a non-resident. If the recipient of the funds is a legal entity, instead of personal income tax, you must pay income tax at the rates specified in clause 3 of Art. 284 Tax Code of the Russian Federation.

Example 1

The company applies the simplified tax system with a profitable object (6% tax). At the end of the year, the volume of revenue receipts amounted to 985,650 rubles, the amount of expenses – 188,500 rubles. Tax according to the simplified tax system was paid to the budget in the amount of 59,139 rubles. (985,650 x 6%).

The amount of net profit will not coincide with the tax base according to the simplified tax system, since it should be derived according to accounting data, not tax accounting. The profit will be 738,011 rubles. (985,650 – 59,139 – 188,500).

The sole founder is an individual with tax resident status. They decided to pay in the form of dividends an amount equal to half the profit, that is, 369,005.50 rubles. (738,011 x 50%), the decision was recorded by order.

Payment of dividends to the sole founder will be made minus income tax:

- Personal income tax is 47,971 rubles. (369,005.50 x 13%);

- The founder is entitled to an amount equal to 321,034.50 rubles. (369,005.50 – 47,971).

Example 2

The company applies the simplified tax system with an income-expenditure object (15% tax). The sole founder is an individual (tax non-resident). The financial performance of the company for the year is as follows:

- income is equal to 988,700 rubles;

- costs taken into account for tax purposes amounted to 455,500 rubles;

- expenses that were actually accounted for, but did not affect the size of the tax base under the simplified tax system, amounted to 105,700 rubles.

Based on the given data, the tax base according to the simplified tax system is derived: 988,700 – 455,500 = 533,200 rubles. The simplified tax system amounted to 79,980 rubles. (533,200 x 15%).

You can use the funds remaining after deducting all costs and taxes in the amount of RUB 347,520 for dividends. (988,700 – 455,500 – 79,980 – 105,700).

From the payment amount it will be necessary to withhold income tax at a rate of 15% (the increase in the personal income tax rate from 13% to 15% is due to the fact that the founder is not a resident of the Russian Federation): 347,520 x 15% = 52,128 rubles.

The founder will receive 295,392 rubles. (34 7520 – 52 128).

How to arrange the payment of dividends to the sole founder in 2019

The payment of dividends must be preceded by a number of organizational measures that must be carried out even in cases where the enterprise is formed by a single founder.

All intentions must be made in writing. The sample resolution for the payment of dividends to the sole founder is not unified (you can find it here).

The structure of the document must correspond to the requirements of the company’s internal regulations; it is recommended to reflect the following data:

- the amount of funds allocated for the payment of dividends;

- form of payment – cash or non-cash;

- timing of the payment transaction.

The payment period cannot exceed 60 days from the date of the decision on payment (Clause 3, Article 28 of Law No. 14-FZ).

When the decision (protocol) on the payment of dividends to the sole founder is drawn up, an order is issued for the accrual and transfer of funds. Based on the order, the accounting department calculates the amount of the dividend payment, withholds taxes and records this in accounting.

Payment of dividends to the sole founder, sample of typical correspondence:

- D84/Retained earnings - K84/Profit allocated for dividends - this entry reflects the amount of profit to be distributed;

- D84/Profit allocated for dividends – K70 (75) – dividends have been accrued, which are the company’s debt to the founder;

- D70 (75) – K68 – income tax or profit tax is withheld from the amount of dividends;

- D68 – K51 – income tax or profit tax has been paid to the budget;

- D70 (75) – K51 or 50 – dividends were paid to the founder.

An order for the payment of dividends to the sole founder (a sample is presented in our article) must be drawn up according to the administrative documentation template in force at the enterprise. It must indicate the date the decision was made, the amount of profit allocated for dividends, and provide information about the recipient of the funds and the form of disbursement of money.

Source: https://spmag.ru/articles/vyplata-dividendov-v-ooo-edinstvennomu-uchreditelyu-v-2019-godu