Commercial organizations that pay income tax do so on an accrual basis. That is, they advance tax payments on income based on the results of each quarter or month.

And then at the end of the year the overall result is summed up. Overpayments in case of low annual profit are returned, the missing amount is added. This method of tax calculations is used on the OSNO (general taxation system).

A complex calculation system provides opportunities for tax fraud and also increases the likelihood of unintentional errors. If such problems are identified, both the guilty and the innocent can count on the assistance of an experienced tax lawyer.

And if you want to prevent all possible troubles in this area, hire a good accountant who will prepare ideal tax reporting for you and, most importantly, suggest 55 legal ways to reduce contributions to the budget.

The reporting form has changed for 2021

The Federal Tax Service, by order dated 09/11/2020 No. ED-7-3/ [email protected] , changed the form of the income tax return; the order will come into force on 01/01/2021 and applies to the return for 2021. We report for the 3rd quarter on the current form and in electronic format.

The amendments are related to changes in legislation and the Tax Code of the Russian Federation since the approval of the previous form. The report has been changed:

- sheet 02 “Tax calculation”;

- Appendix No. 4 to l. 02 “Calculation of the amount of loss or part of a loss that reduces the tax base”;

- Appendix No. 5 to l. 02 “Calculation of the distribution of advance payments and corporate income tax to the budget of a constituent entity of the Russian Federation by an organization that has separate divisions”;

- Section A “Calculation of investment tax deductions from advance payments and taxes subject to credit to the budget of a constituent entity of the Russian Federation” of Appendix No. 7 to l. 02 “Calculation of investment tax deduction”;

- Section D “Calculation of the reduction in the amount of advance payments and corporate income tax subject to credit to the federal budget when the taxpayer applies an investment tax deduction” of Appendix No. 7 to l. 02 “Calculation of investment tax deduction”;

- sheet 04 “Calculation of corporate income tax on income calculated at rates different from the rate specified in paragraph 1 of Article 284 of the Tax Code of the Russian Federation”;

- page with barcode “00214339” in sheet 08 “Income and expenses of a taxpayer who has made an independent (symmetrical, reverse) adjustment”;

- Appendix No. 2 to the declaration.

The FTS form also updated the barcodes. In 2021, the reporting took into account preferential tax treatment for:

- residents of the Arctic;

- IT companies;

- companies that process hydrocarbons into petrochemical products and produce liquefied natural gas.

Check for free that you filled out the new form correctly using ConsultantPlus.

Functions of income tax

This tax can perform several functions:

- fiscal, which allows you to create a budget for the comprehensive development of the state and meet its needs;

- regulatory, aimed at regulating the income of the population and implementing anti-crisis measures. Its main instruments include tax payments and benefits that allow influencing various economic processes;

- controlling, which makes it possible to monitor the effectiveness of taxation and the pace of economic development;

- social, aimed at providing various types of assistance to low-income citizens through payments collected from wealthier ones.

In addition, some categories of taxpayers have tax benefits that affect taxable income.

Taxable amounts

In order to learn how to determine income tax with an example for dummies, you need to know which indicators are subject to this type of tax.

Realization income includes funds the receipt of which is related to the main activities of the company.

These are products produced directly by the organization and purchased for subsequent resale, work performed on orders from third-party organizations or the public.

Non-operating income includes:

- profit of previous years discovered directly in the reporting period;

- amounts of fines and penalties received from other companies;

- bad debts received that were previously written off as losses;

- income received from shares in the capital of other enterprises, not counting funds used to pay for the issue of additional shares distributed among shareholders;

- profit from surplus property discovered during the inventory process;

- property received free of charge and others.

Profit for income tax purposes is generally defined as income from the company's activities minus the amount of established deductions and discounts.

When calculating taxes, it is useful to have an idea of what the total expense includes. It consists of the following items: production costs, including the cost of raw materials, which become part of the manufactured products, electricity, fuel, as well as wages, advertising costs, packaging, and other general production costs.

Due date in 2021

Income tax payers are divided into two categories:

- those who pay advances quarterly;

- those who pay advances monthly.

Companies whose income for the previous 4 quarters does not exceed 15 million rubles (the limit has been increased in 2021 from 10 million rubles) are entitled to submit declarations quarterly. Other companies pay advances once a month from actual profits, so they also fill out reports every month.

Let's present the deadline for filing income tax returns in the form of tables.

Quarterly reporting

| Period | Term |

| 2020 | Until March 28, 2021 |

| 1st quarter 2020 | Until 04/28/2020 |

| Half year | Until July 28, 2020 |

| 9 months | Until October 28 |

Monthly reporting

| 1 month 2020 | Until February 28 |

| 2 months 2020 | Until March 30 |

| 3 months 2020 | Until April 28 |

| 4 months 2020 | Until May 28 |

| 5 months 2020 | Until June 29 |

| 6 months 2020 | Until July 28 |

| 7 months 2020 | Until August 28 |

| 8 months 2020 | Until September 28 |

| 9 months 2020 | Until October 28 |

| 10 months 2020 | Until November 30 |

| 11 months 2020 | Until December 28 |

| 2020 | Until 01/28/2021 |

Example of tax base calculation

Let us explain this with an example.

Let's say the reporting periods for an organization are quarter, six months and 9 months.

For the first quarter, its income amounted to 900 thousand rubles, and expenses - 750 thousand rubles.

For the second quarter: income - 600 thousand, expenses 800 thousand rubles, respectively.

For the third quarter: 1 million and 700 thousand rubles.

For the fourth quarter - 700 thousand and 800 thousand.

Let's present the calculation of the tax base in the table:

| I quarter | Half year | 9 months | Year | |

| Revenues, thousand | 900 | 1500 (900 + 600) | 2500 (900 + 600 + 1 000) | 3200 (900 + 600 + 1000 + 700) |

| Expenses, thousand | 750 | 1550 (750 + 800) | 2250 (750 + 800 + 700) | 3050 (750 + 800 + 700 + 800) |

| Financial results, thousand | +150 | -50 | +250 | +150 |

Thus, during the year the organization received both profit and loss, but as a result, the cumulative total was a profit.

See also: “How is profit before tax calculated (formula)?”

What has changed in the declaration in 2021

The current form of the income tax return was approved by order of the Federal Tax Service of Russia dated September 23, 2019 No. ММВ-7-3/ [email protected] Compared to the previous form, it has undergone significant changes: the barcode has changed, new taxpayer identification codes have appeared. For the majority of organizations this is still 01, but there are also the following:

- 07 and 08 - for participants in investment projects and investment contracts;

- 09 and 10 - for educational and medical organizations;

- 11 - for those who combine medical and educational activities;

- 12 - for social service organizations;

- 13 - for travel agencies;

- 14 - for regional MSW operators.

If, in accordance with regional legislation, the taxpayer has the right to a reduced tax rate, in line 171 on sheet 02 we indicate the details of the regional regulatory act.

In addition, lines have appeared to indicate the tax base for participation in an investment partnership; new appendix No. 7 to l. 2 must be completed by those applying the investment deduction.

What are advance payments?

The amount of the advance payment is calculated not from actual income, but based on data from the past quarter.

Monthly payments are made by enterprises whose average income was above 15 million rubles over the previous 4 quarters. Such payments can be made in any form until the 28th of each month.

The base interest rate applied to income tax is no more than 20% and depends on the territorial location of the organization in a given region.

Companies whose average revenue is less than this amount based on the last four quarters are allowed to make advance payments quarterly. They are calculated from income actually received, the advance is transferred in the last month of each quarter, but no later than the 28th.

Let's look at an example of how to calculate an advance payment for income tax. But before getting down to business, it would be a good idea to find out how the company is obliged to make payments quarterly or every month. How to make a calculation?

- Calculate the tax base from the cumulative results of each of the last four quarters.

- Display the quarterly average. To do this, you need to add all the indicators and divide by four. If the tax base turns out to be above 15 million rubles, then contributions will have to be paid monthly, if not, quarterly.

Advance payments for income tax: calculation example

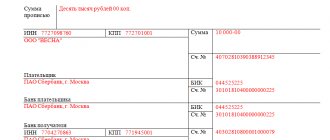

For the first quarter, the profit subject to taxation of Profi Plus LLC amounted to 12 million rubles.

Calculation of quarterly payment: 12 million rubles. x 20% to the transfer of 2.4 million rubles. The amount of the advance payment is found as the difference between 2.4 million rubles of the quarterly payment and the amount of monthly contributions already deducted. Since there were none, the entire amount must be paid in the first quarter.

In the second quarter, an advance payment was made - 800 thousand rubles (2.4 million rubles: 3).

- The tax base calculated for the six months is 30 million rubles.

- This means that the payment amount for the quarter will be 6 million rubles (30 million rubles x 20%).

- Additional payment for 6 months 1.2 million rubles: (6 -2.4 -800 x 3).

In the third quarter, the advance payment for the month will be 1.2 million rubles (6 million rubles – 2.4 million rubles: 3).

- For the first 9 months, taxable profit is calculated in the amount of 41.0 million rubles. Therefore, the advance payment will be equal to 8.2 million rubles (41.0 million rubles x 20%).

- As a result, the company overpaid 1.4 million rubles (8.2 million rubles - 6.0 - 1.2 million rubles x 3).

When an enterprise does not make monthly payments, the tax base is calculated on an accrual basis on a quarterly basis. The established interest rate is applied to it to calculate the advance payment.

When calculating contributions for 6 and 9 months, an offset mechanism is used, thanks to which payments transferred earlier are taken into account when calculating quarterly amounts.

Reflection of wages in expenses

In the meantime, let’s take into account another type of expense – labor costs. To do this, we will create a document “Reflection of salaries in accounting” (Fig. 8).

Fig.8

When conducting, both accounting and tax entries are also generated (Fig. 9).

Fig.9

Write-off of materials for production and release of products

Now let’s write off the necessary materials for production (Fig. 10).

Fig.10

In the entries we see the amounts for both accounting and tax accounting (Fig. 11).

Fig.11

It remains to reflect the production and sales of products.

Figure 12 shows the postings generated by the document “Production Report for a Shift”. The main thing to remember is that the amount in the transactions depends on the planned price set in advance and has no direct connection with actual expenses.

Fig.12

The last document in our chain – “Sales (act, invoice)” – reflects the sale of all manufactured products (Fig. 13) and forms our income.

Fig.13

So, all planned expenses and income have been taken into account. You can start calculating your income tax. This is the second and final stage of tax calculation in 1C.

Depreciation

We will complete the closing in three months – January, February and March. In February (Fig. 14), that is, next after the equipment is accepted for accounting, operations will be carried out to account for the depreciation bonus.

Fig.14

Figure 15 shows depreciation entries. The depreciation bonus “edited” the depreciation amount for tax accounting, resulting in temporary differences.

Fig.15

How to fill out correctly for the 3rd quarter of 2021

The current tax return for corporate income tax consists of:

- title (sheet 01);

- subsection 1.1 of section 1;

- sheet 02;

- appendices No. 1 and No. 2 to l. 02.

This is a required part.

The remaining applications and pages are completed if the following conditions are met:

- subsections 1.2 and 1.3 of section 1;

- appendices No. 3, No. 4, No. 5 to l. 02;

- sheets 03, 04, 05, 06, 07, 08, 09;

- appendices No. 1 and No. 2 to the declaration.

See the detailed procedure for filling out the income tax return in 2021 in the appendix to order No. ММВ-7-3/ [email protected]

How to determine the amount of profit for tax purposes?

To form a national bank and subsequently calculate income tax, you must:

- have properly executed primary documents for each income and expense accounted for in the National Bank;

- organize grouping and generalization of data on income and expenses in special tax registers.

How to develop tax registers for income tax, see the publication.

Income and expenses must be determined in accordance with the accounting policies adopted by the company.

We'll tell you how to draw up the tax section of your accounting policy.

To calculate the NB, use the tips from the table below:

| Sequence for determining NB | Article of the Tax Code of the Russian Federation | Hints |

| Sum up sales income and non-operating income | Art. 249–250 | We’ll tell you whether overdue creditors and gratuitously received property are taken into account in your income. |

| Exclude income that is not recognized for tax purposes from all receipts. | Art. 251 | Find out about the features of tax accounting of income from the publication |

| Evaluate each expense for the possibility of taking them into account when calculating the NB, taking into account the basic principles - validity and documentary evidence of the expense | Art. 252–269 | Are taxi costs taken into account when calculating income tax, see the article |

| Do not include as expenses expenses that are not recognized when calculating income tax. | Art. 270 | We will tell you in the publication whether fines and voluntary insurance contributions affect the reduction of profits |

| Check the standard expenses (advertising, hospitality, etc.) | Art. 264 | A message to help you |

| Specify the amount of non-operating expenses taken into account when calculating income tax | Art. 265 | Find out what documents help you take into account fire losses as part of non-operating expenses |

| Calculate NB | Art. 274–283 | We will tell you about the nuances of calculating NB for income tax in the article |

| If you received losses in previous years, take them into account when calculating the NB - remember that the current year's NB can be reduced by the amount of the loss by no more than 50% | Art. 283 | How the Tax Code of the Russian Federation interprets tax loss, we will tell you in the material |

See below for an example of calculating profit for the year.

Important nuances of filling out the declaration

Need to consider:

- The title contains information about the organization; successors of reorganized companies indicate the Taxpayer Identification Number (TIN) and KPP assigned before the reorganization. The codes of the reorganization forms and the liquidation code are indicated in Appendix No. 1 to the procedure for filling out the declaration.

- Two additional sheets - 08 and 09. Sheet 08 are filled out by organizations that have adjusted (lowered) income tax due to the use of below-market prices in transactions with dependent counterparties. Previously, this information was placed in Appendix 1 to l. 02.

- Sheet 09 and Appendix 1 to it are intended to be filled out by controlling persons when accounting for the income of controlled foreign companies.

- Sheet 02 contains fields for taxpayer codes, including the new taxpayer code 6, which is indicated by residents of territories of rapid socio-economic development. It also contains lines for the trade fee, which reduces the payment, and fields filled in by participants in regional investment projects.

- Sheet 03 shows the current dividend rate of 13%. In section “B”, the following codes are now entered in the field for the type of income:

- 1 - if income is taxed at the rate provided for in paragraphs. 1 clause 4 art. 284 Tax Code of the Russian Federation;

- 2 - if income is taxed at the rate provided for in paragraphs. 2 clause 4 art. 284 Tax Code of the Russian Federation.

- Filling out the income tax return for 2021 on lines 241 and 242 occurs by reflecting in them deductions for the formation of property for statutory activities and the insurance reserve; there are no separate lines for reflecting losses - current or carried forward to future periods - on this sheet.

- To reflect non-operating income after self-adjustment of the tax base for controlled transactions, a separate sheet 08 is provided.

- In Appendix 2 l. 08 there is a field for indicating taxpayer codes.

Determining the amount of income tax (example)

Let's consider an example of calculating income tax for the year and the profit itself, which is the basis for calculating this tax.

Industrial Technologies LLC applies OSNO and pays income tax. At the end of 2021, specialists from Industrial Technologies LLC calculated the company’s tax profit based on the following indicators:

- revenue from the sale of works (services) - RUB 7,458,231;

- non-operating income - 527,000 rubles;

- costs associated with production and sales - RUB 6,349,354, including:

— material costs — 2,897,562 rubles;

— depreciation of fixed assets — 287,320 rubles;

— labor costs and insurance premiums — RUB 3,164,472;

- other expenses - RUB 1,547,262, including:

— advertising expenses (advertising on vehicles) — RUB 189,300;

— other miscellaneous expenses — RUB 1,357,962.

Calculation: NB2017=(7,458,231+527,000) – (6,349,354+1,547,262 – 114,718)=RUB 203,333,

Where:

114,718 - the amount of advertising expenses that did not meet the limit of 1% of revenue at the end of the year (RUB 189,300 - RUB 7,458,231 × 1% = RUB 114,718).

Find out why advertising on transport is regulated in this article.

In 2021, Industrial Technologies LLC received a tax loss in the amount of 312,988 rubles, so the company’s specialists adjusted the NB2017 for the amount of the loss and calculated the income tax:

Income tax =(RUB 203,333 – RUB 101,667) × 20%=RUB 20,333,

Where:

RUB 101,667 - the maximum amount of loss by which the profit of 2021 can be reduced according to the norms of Art. 283 of the Tax Code of the Russian Federation (203,333 rubles × 50% = 101,667 rubles).

The remaining loss in the amount of RUB 211,321. (RUB 312,988 – RUB 101,667) is carried forward to future periods.

Who submits form P-4

All legal entities must submit the form, regardless of the commercial component of their work. The form of ownership and type of activity also do not affect the obligation to submit a report. The following forms are submitted on a general basis:

- simplified organizations;

- branches, representative offices and divisions of foreign organizations operating in the Russian Federation;

- temporarily suspended the company's activities;

- organizations in the process of bankruptcy before liquidation;

- subsidiaries and dependent companies;

- organizations that manage an enterprise as a property complex on the basis of trust management.

The exceptions were organizations where over the previous 2 years the average number of employees did not exceed 15 people and annual revenue did not exceed 800 million rubles. Instead of Form P-4, they submit similar information once a year using Form No. 1-T. This does not apply to all companies, but only to the organizational and legal forms listed in the instructions for filling out the report.

Also, in lieu of reporting on the form, respondents who did not have employees or payroll during the reporting year may submit a formal letter of explanation or a signed blank form with a completed cover page.