In this article we will look at how to calculate dividends in 1C 8.3 Accounting 3.0. Let's assume that our organization is a limited liability company with several founders. Each of the owners has a certain block of shares. There can be any number of share owners. Even ordinary employees of an enterprise have several shares. They will also receive dividends.

The recipient of dividends can be either an individual or a legal entity. Dividends can also be received by owners of joint-stock companies, closed joint-stock companies, open joint-stock companies, etc. In essence, this is an investment of your own funds at interest. Only, unlike a regular bank deposit, the amount of profit received from investments is not fixed, but depends on the company’s profit.

In our example, we will consider step by step not only the calculation of dividends in 1C Accounting 8.3, but also the calculation of personal income tax, since this type of income of individuals is subject to it.

A little about the legislative framework

Dividends are a portion of profits that owners can distribute to themselves as a reward for profitable operation based on the performance of their enterprise. At the same time, it is important to understand that the presence of money in the current account is not an indicator of the profitability of the activity; accordingly, this is not enough to transfer dividends.

According to paragraph 1 of Art. 28 No. 14-FZ, as well as clause 1 of Art. 42 the company has the right to distribute profits once a quarter, half a year or once a year. The entire process of distributing funds must be prescribed in the company's charter so that each distribution procedure is legal and justified. If the profit has not been distributed among the owners, it is recorded in the retained earnings account.

According to the financial statements, net profit is determined, which is the source of funds for paying income to the founders.

At the same time, it is completely unclear where to look, if not at the balance in the current account. But often the opposite situation arises: there is profit, but there is no money in the current account to make payments for the distribution of profit. Therefore, later we will look at how to determine the amount of dividends in the program.

The amount of dividends is subject to personal income tax, as well as to any type of income of an individual, if the founder of the company is an individual, and income tax, if an organization. In this case, the payer organization will be a tax agent for personal income tax for income recipients, in simple words - you will pay the tax amount to the budget on part of the profit paid, and transfer the rest to the founders. You must pay the tax on the day or the next business day you receive income (take into account weekends and holidays). These are all the tax obligations that you will have when distributing your company's profits.

The general meeting of founders (or shareholders) makes a decision on the payment of dividends; its decision based on the results of the meeting must be formalized in the minutes of the meeting. It specifies the amount and timing of payments, dates and form of payments, as well as a list of founders and shareholders who are entitled to a portion of the company’s profits.

There are cases when a company does not have the right to distribute the income of an enterprise among the founders, these include:

— not all participants contributed their shares to the authorized capital in full and on time;

— at the time of distribution of dividends, the organization is in a state of bankruptcy, or will be in bankruptcy after payment;

- if it turns out that the value of net assets is lower than the authorized capital of the enterprise (we will show their calculation below in the article);

- before the repurchase of shares of the joint-stock company, which are subject to repurchase in accordance with the law, etc.

The procedure for distributing net profit in relation to legal entities does not have any distinctive features and is subject to the general procedure prescribed in legislative acts. There is a peculiarity with the taxes paid. For legal entities, a profit tax is also established, which is paid by the tax agent when transferring income to the founders-legal entities on the day of transfer or on the next business day. Income tax is 13%, and is reflected in the tax return of the quarter in which the income was paid.

So, let's summarize. What to do when a company plans to distribute its profits:

— We determine the amount of profit on the date specified in the charter (based on the results of the quarter, half a year, year);

— We hold a meeting of participants, draw up a protocol with the recommended amount of dividends, the timing and method of payment, as well as a list of income recipients;

— We calculate them in the program, pay them, and transfer the tax to the budget.

— Don’t forget to include all amounts accrued to the owners in the 6-NDFL and 2-NDFL certificate, as well as in the income tax return for legal entity founders.

Payment of dividends in 1C 8.3 Accounting

To issue a payment order in 1C, we recommend using the Pay , since in this case a Payment order is created not only for the payment of dividends, but also for the payment of taxes.

Be sure to access each Payment Order using the link and check them before sending them to the bank.

Clicking the Send to Bank will launch the Client—Bank.

How to set up Client-Bank in 1C, as well as quickly and easily download bank statements, see topic 6.12: Electronic exchange through Client Bank course Accounting and Tax Accounting in 1C: Accounting 8th ed. 3 from A to Z.

If you do not use Client Bank selecting unpaid payment orders Select button in the bank statement journal.

Payment of dividends to the founder-individual - postings in 1C 8.3

Use the Pay and generate payment orders.

When you receive your bank statement, please show the actual debit.

Postings

Upon actual payment, the personal income tax registers will set the actual Date of receipt of income , and the old data on the planned date will be displayed with a minus.

Payment of dividends to the founder-organization - postings in 1C 8.3

The payment to the founder-organization is processed in the same way, only the postings will not contain personal income tax data.

Use the Pay and generate payment orders.

When you receive your bank statement, please show the actual debit.

Postings

Personal income tax payment

After paying dividends, do not forget to pay personal income tax to the budget. This must be done no later than the next business day.

When you receive your bank statement, please show the actual debit.

Postings

Payment of income tax

After paying dividends, do not forget to pay income tax to the budget. This must be done no later than the next business day.

When you receive your bank statement, please show the actual debit.

Postings

We have looked at how to reflect dividends and transactions in 1C 8.3.

How to calculate dividends

First, you need to understand whether at the end of the quarter the organization can distribute the profit received among the owners. First you need to make sure that the company has a profit. The most convenient way is to create a balance sheet for the period of issuing dividends and look at the amount of net profit on line 2400 of the “Income Statement”.

To do this, go to the “Reports” section - “Regulated reports” - Create. We are looking for an accounting reporting form, setting a period, say January-June. A report form opens, fill it out.

Having made sure that the company has a profit, you need to make sure that the net assets of the enterprise exceed the value of its authorized capital. The procedure for calculating net assets was approved by Order of the Ministry of Finance dated August 28, 2014 No. 84n.

| Indicator name | Balance line code | For the 1st half of the year |

| Assets | ||

| Assets (Sections I and II) | 1600 | 26 258 |

| — | ||

| Short-term liabilities | 1400 | 2 000 |

| — | ||

| long term duties | 1500 | 18 711 |

| + | ||

| revenue of the future periods | 1530 | 0 |

| — | ||

| Debt of participants on contributions to the authorized capital | 1170 | 0 |

| Total net assets | 5547 thousand rubles. | |

The authorized capital of the enterprise is indicated on line 1310 of Section III of the balance sheet.

You can also see its value in the balance sheet for account 80.

Net assets are well above the minimum threshold, so the company's profits can be distributed without harming its financial condition.

The credit of account 84.01 shows the company's profit.

This shows the amount of net profit that the owners of the enterprise can distribute among themselves.

The owner of this company is one individual. The program did not have a separate operation for the formation of the authorized capital, so participants were entered through manual transactions, as well as the accrual of dividends. Now there are specially designated operations for this.

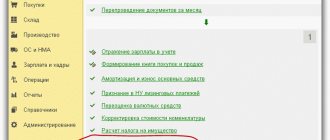

To accrue dividends to it, go to the “Operations” section - Accrual of dividends.

In the list that opens in the top panel, wait for “Create”.

You need to enter the date, the recipient, who is selected from the drop-down list using the down arrow, the period for receiving dividends and their amount for each recipient. Note that in this case the amount of tax is calculated on the amount of money paid and the amount payable is shown. Let's go through the document and look at the postings.

In debit 84.01 of the account, the amount of dividends in the amount of 250,000 rubles was written off. They were accrued on credit 75.02, and personal income tax in the amount of 32,500 rubles was also accrued on credit account 68.01.

Now let’s return to the document and click the “Pay” button in the upper right part.

Two payment orders will be created based on the calculation: for the payment of dividends and for the transfer of personal income tax to the tax office.

Everything discussed above related to the situation when the owner is an individual; now let’s imagine that the participants of the company are legal entities.

We also follow the link “Accrual of dividends” in the “Operations” section and create a new document.

This time we will select a legal entity as the recipient and select the founder we need from the list of counterparties. We indicate the period for which dividends are accrued and enter the amount. The amount of tax to be transferred to the budget and the amount of income to be paid excluding tax will also be calculated. Let's review the document and move on to postings.

The amount of income paid is also reflected in the credit of account 75.02, and is written off from account 84.01, i.e. Retained earnings will decrease by the amount of the dividend; this will also be reflected in the balance sheet. But the personal income tax subaccount has changed, the tax was calculated on account 68.34.

ZUP

In this version of 1C, in the “Primary documents” section there is a subsection “Payroll calculation...”, in which there is a document “Calculation of dividends”. Next you need to go to “Payroll calculation...”, “Primary documents”.

You must fill out the “Total amount” field, then select the data in “Employee selection”. The number of shares (shares) is entered in each window. After clicking on “Calculate all” the program calculates the amounts for:

- salary;

- to the mutual settlements section;

- in taxable income.

Personal income tax is calculated automatically for D70, K68.01.

Didn't find the answer to your question? Find out how to solve your specific problem. via the form (below), and our specialists will promptly prepare the best options for solving your problem and call you back on the day you submit your application. It's free!

Fill out the declaration

We are required to report to the regulatory authorities that the company has paid income to its founders, calculated tax on them and transferred it to the budget. As already mentioned in the first section of the article, in the reporting quarter they fill out a report on Form 6-NDFL to reflect payments to individuals, and an income tax return for legal entities.

Regulated reports are located in the “Reports” section.

Using the “Create” command, select the 6-NDFL report from the list and fill it out.

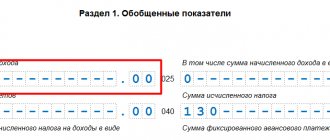

In the first section, the amount of dividends is included in line 020, like other payments on an accrual basis, and is separately included in line 025. Similar to personal income tax, which is filled out in lines 040 and 045. Withheld tax is reflected in the general order in line 070.

Let's move on to the second section.

The date of actual receipt of income and the date of deduction of income are equal to the date of accrual and payment, and the transfer period is the next business day. The amount of income received is indicated in full, taking into account personal income tax.

Then we will fill out a 2-NDFL certificate for the individual who received the income.

Now let's create an income tax return. The path to it lies there.

Fill out Sheet 03. Section A. In the header you must select the category of the tax agent, the type of dividends, indicate the period and year for which the payment is made. Next, in line 001, fill in the amount of income paid to the legal entity. It is automatically copied to line 010. And we enter the amount in line 022 as income taxed at a rate of 13%. The income of organizations that own 50% or more of the authorized capital for more than 365 days is taxed at a rate of 0%. The exercise of this right is confirmed by a notification from the tax authority.

Next, in section B of sheet A, information is filled in about the legal entities that are named in the register of participants and to whom the dividends were transferred. The type line is entered as 00, which corresponds to the primary report; it characterizes the order of the corresponding adjustments to the declaration.

The director of the organization, the date it received income and the amount of income and tax related specifically to this legal entity are indicated. It is clear that the total amounts of accrued dividends were listed above on an accrual basis; in section B they are detailed by recipient. In our example, there is only one recipient, so the amounts will be the same.

Note. If the owners include both individuals and legal entities to whom dividend payments are made, then it is necessary to fill out separate pages in the income tax return for payments to individuals in Sheet 03 of Section A, and for legal entities. If the participants include only individuals, then there is no need to fill out an income tax return. For them, only 6-NDFL and 2-NDFL certificate for the year are submitted.

We recommend reading the article: “1C Cloud - what is it? In simple words"