What applies to business travel expenses?

Most of the employee's duties must be performed directly at his main place of work.

However, there are often situations in which it is necessary to send an employee to another location. For example, to submit reports to a higher authority, to undergo retraining, or to conclude an agreement. Regardless of the purpose of the trip, travel expenses must be paid by the employer and then reflected in the organization's accounting records. What is required by law (Article 168 of the Labor Code of the Russian Federation):

- The employee’s workplace, as well as the position, will be retained for the entire period of absence - being on a business trip.

- Average salary for all days of stay on a business trip. Let us remind you that days of downtime, days of departure and arrival, as well as days of travel are subject to payment.

- Travel and accommodation expenses. The employer is obliged to pay at his own expense for rented housing, as well as the employee’s transportation costs.

- Costs that compensate for the inconveniences associated with a specialist living outside his home, that is, outside his main place of residence. Such costs are also called per diem.

- Other expenses. For example, purchasing teaching aids or additional supplies. However, such expenses must be agreed upon separately with management. Otherwise, the employee will not be reimbursed.

Duration of business trips

The duration of a business trip is set by the head of the company, who fixes this period when issuing an order for sending on a business trip.

The decision on how many days an employee should leave is determined by the production goals that are set for him, as well as the expected deadline for their implementation.

Attention: if the current regulations require the execution of a work assignment, then it is also necessary to indicate the duration of the trip.

Since sometimes it is not possible to take into account the influence of all factors, the duration of a business trip can be either reduced or increased. In these cases, it is necessary to issue a separate order from the company administration.

Previously, there were regulations that established that a business trip should be a trip of more than 1 day and a duration of no more than 40 days. If the travel period exceeded the specified limits, then it was necessary to issue an order for the transfer of the employee.

Attention: currently the current documents do not establish either the minimum duration of the trip or the maximum.

Sometimes there is confusion between the concept of business travel, as well as employees who are constantly traveling to perform their work functions.

In this case, it is necessary to understand what is a business trip and what is work that, on the basis of a formalized employment agreement, has a traveling nature. It is also necessary to distinguish a business trip from a transfer to work in another location.

Limit on travel expenses in 2021

For a long time, Russian legislation had limited norms for expenses on business trips. That is, the employee was calculated an advance for expenses during the trip, based on the current limits. It was not possible to obtain a refund for the overdrawn funds.

Currently, such limits have been abolished. They were preserved only for certain federal government employees. Consequently, organizations now determine their own limits.

IMPORTANT!

For public sector employees, different rules are established. The maximum permissible amounts for them are established by the local government body or the founder. Such norms can be circumvented; for example, autonomous institutions can set their own limit based on the economic situation of the state institution, or pay extra from business funds. This exception is not provided for government and budgetary types of organizations.

Let us remind you that such restrictions are established not only on daily costs. That is, during the financial crisis, most organizations introduced limits on both accommodation and travel, which does not allow employees to make unreasonable expenses.

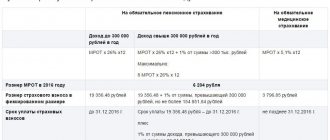

At the same time, the Tax Code of the Russian Federation establishes a limit on the taxation of daily allowances. Thus, for travel expenses abroad there is a limit of 2,500 rubles per day, for trips within our country - 700 rubles per day. That is, amounts exceeding the specified limits must be included in the base for calculating personal income tax and insurance premiums.

Can I extend or reschedule my business trip?

The current regulations do not provide for a ban on extending an employee’s business trip. It can also be transferred to a future trip when all the documents for it have already been prepared.

However, the regulations do not determine how to formalize this.

Extension of a business trip should occur on the basis of the publication and corresponding order of management, which is drawn up in any form.

It must include in its contents not only all the necessary details, but also the reason for the extension of the business trip and new dates for the business trip.

Attention: adjustments must be made to all previously issued documents. In them you need to carefully cross out the old date of the trip with one line, and indicate the new date on top. All this must be done so that the old record can be read.

The administration and responsible employees are responsible for recalculating previously issued daily allowances and increasing the amount of funds for a business trip due to an increase in its duration.

If the employee is already on a business trip, then all these funds must be transferred to him either by bank transfer, or by postal order or other method provided for this.

The law prohibits an employee from using his personal funds for these purposes. This rule applies to cases even when, by order of the administration, these expenses were reimbursed.

Attention: in order to reschedule business trips, you also need to prepare a corresponding order, which necessarily records the new dates of the employee’s trip on a business trip.

Corresponding changes must be made to previously issued documents, where old travel dates are crossed out and new dates are indicated at the top. There is no need to recalculate the daily and other expenses of an employee on a business trip, this is only a transfer; the duration of the trip remains the same.

Example: claim for travel expenses

If an employee wishes to receive an advance in cash for travel expenses, an invoice does not need to be specified.

Please note that the application must be checked by the responsible accountant before being submitted to the manager. The accounting employee must verify the correctness of calculations for the number of days, according to the limits established by the institution and other conditions.

Then the manager endorses the application. Based on the document, you can immediately issue funds or draw up an order.

Option No. 1. Limits approved

If the institution has limits on business travel expenses in separate local regulations, then ask to provide this information. Calculate the amount of the requested advance using the formula:

Cost rate = number of days × limit per day.

Transport costs are rarely limited, since tickets (travel) are paid upon delivery. However, it should be borne in mind that the employer has the right to refuse reimbursement of expenses for travel on certain types of transport. For example, a taxi ride when there are regular flights (train, bus). They may also refuse to pay for a premium seat (business or first class ticket).

Example.

The employee is sent to Tver for 11 days. The institution has the following limits:

- daily allowance - 200 rubles per day;

- accommodation - 700 rubles per day;

- actual travel.

Therefore, a specialist has the right to claim:

Daily allowance - 2200 (11 × 200 rubles), accommodation - 7000 (10 × 700) and 2000 for tickets at actual cost (1000 one way).

Documents to confirm expenses

After returning from a trip, the employee draws up a business trip report. Documents that confirm the use of the received accountable amounts must be attached to it.

Such forms include:

- Documents that can confirm that accommodation was rented. This could be a receipt, a hotel bill, or a rental agreement for a private apartment. Any document must indicate the number of days and the cost of living for one day.

- Documents establishing the fact of travel to the place of business trip and return home. This includes tickets, boarding passes, bedding receipts, etc.;

- Documents confirming the use of taxi services - tickets, receipts, checks, etc.

- An official note issued by the employee with attached receipts from the gas station - if he used personal transport during the trip;

- An official note stating that the employee does not have supporting documents, for example, due to their loss.

- Documents for other expenses (luggage storage receipt, receipt for payment of communication services, etc.).

Daily allowances for business trips in 2021 and the direction of their use do not need to be confirmed in any way.

Option number 2. No limits

If the institution does not provide restrictions on who. expenses, estimates can be drawn up for a larger amount. However, you should not escape reality. All the same, the costs will have to be documented. In addition, a luxury hotel room and a business class flight are unlikely to be paid for using budget money.

How to plan costs correctly:

- Check the cost of tickets (train, bus, plane, etc.). Include the best travel option to your destination in your travel cost estimate.

- Book your hotel room. When making a reservation, immediately check the cost per day. Take this price into account in your calculations.

- Daily allowance. The amount of such costs should be agreed with management. Let us remind you that there are no restrictions in the legislation. However, if the amount exceeds 700 rubles per day when traveling within Russia and 2,500 rubles per day for foreign business trips, then the difference is subject to taxation (personal income tax and insurance contributions).

IMPORTANT!

To eliminate problems with supervisors, develop and approve a travel policy in the institution. And also establish in a separate local order the norms of expenses for business trips.

If this is not done, then some of the institution’s costs may be considered inappropriate. As a result, the manager will be fined and forced to return the money to the budget. When approving standards, follow the recommendations and orders of higher ministries and departments.

Results

Per diem as an expense item is under the close attention of tax authorities, since it affects the tax base for two taxes at once: income tax and personal income tax, and also, starting from 2021, for insurance premiums. That is why you should thoroughly follow all the rules for rationing and payment, so that during inspections you do not receive unexpected sanctions.

See also “What are the types of entries for accounting for travel expenses?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What documents are needed for a business trip?

Let's say the application for an advance payment is approved. What to do next?

First of all, draw up an order to send a specialist on a business trip. In the administrative act it is necessary to indicate not only the full name. and the position of the employee, but also the period of business trip, destination, purpose of the trip. It is acceptable to provide additional information about the job assignment. For example, write in the order “sent for submission of annual financial statements to the Ministry of Education.”

Use the unified order form No. T-9 (OKUD 0301022), approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1.

The use of a unified order form is not necessary. The institution has the right to use a form developed independently. However, regardless of the chosen form of the document, it must be fixed in the accounting policy.

Example of filling out a unified document

In addition to the order to send on a business trip and pay an advance for travel expenses, the employer must issue a work assignment. This document contains a list of duties that the employee must perform while traveling. However, the formation of a job assignment is not mandatory. It is quite enough to list the duties and purposes of the trip in the order.

Just a couple of years ago, it was possible to confirm travel expenses only with a special document - a travel certificate. Other checks and receipts were considered secondary documents. Currently, legal norms have changed. Now you do not need to issue a special certificate. But many institutions continue to issue the canceled form. Why?

Firstly, the validity of the form was preserved. Officials only determined that the document has now become optional. However, it can be issued at the discretion of the company management. Secondly, the ID allows you to confirm your daily expenses. Thirdly, the form allows you to mark the receiving party. That is, confirm that the employee has arrived at his destination.

You can develop your own certificate form or use the unified form No. T-10 (OKUD 0301024), approved by Resolution of the State Statistics Committee of the Russian Federation No. 1 of 01/05/2004.

How to report travel expenses

Expenses incurred on a business trip must be reimbursed by the employer. Of course, within the established norm, in compliance with expediency and validity, as well as in the presence of supporting documents. So, how to confirm a specific type of cost:

- Transport. For this category of expenses, supporting documents are tickets, checks and taxi receipts, electronic receipts (for example, when issuing an electronic ticket).

- Housing. A receipt from a hotel or a rental agreement can confirm the rental of housing. Please note that when renting a home from third parties, it is necessary to check the correctness of the lease agreement. You should also be given a check, receipt or receipt indicating that you have received money to pay for the rent. Incorrectly completed documents cannot be accepted for registration.

- Daily allowance. It will not be possible to confirm this category of travel expenses with a special document. Previously, an identity card was used for this; now it is not necessary to use this form. You can confirm the number of days using your tickets.

- Other expenses. To receive reimbursement for other types of expenses while traveling, please attach receipts, sales receipts, receipts, invoices and other documents. Please note that such costs should be agreed upon with management in advance. Otherwise, you may be denied payment.

If you received money from someone. expenses in advance, that is, a report, then upon return you must fill out an advance report. Attach all supporting checks, tickets and receipts to it and submit it to the accounting department.

IMPORTANT!

The advance report must be submitted within three days of returning from a business trip. Exception: the employee fell ill immediately after completing the trip. In this case, you should report for the advance on travel expenses no later than 3 days from the date of closing the certificate of incapacity for work.

The accountant will check the advance report, check the authenticity and correctness of filling out the supporting documents. Based on the results of the inspection, final calculations will be made. The excess will have to be returned, and the overexpenditure will have to be paid extra.

Changes to daily allowance in 2021

For several years now, regulatory authorities have been trying to get away from per diem allowances, but authorities still retain these payments as part of travel expenses.

The procedure for calculating daily allowances, as well as the method for determining the number of days for which these amounts are due to be paid, have not changed. As well as the procedure for processing business trips for employees.

Per diems are the monetary equivalent of additional expenses incurred by the employee, which he incurs in accordance with the assignment received from management. They are normalized.

Each enterprise must approve in its internal regulations the daily allowance standards that are established for each day of a business trip. These amounts must be given to the employee by order of the employer before the start of the trip.

An innovation in this area will be the introduction of a resort tax in Russia from May 1, 2018. When sending an employee on a trip to certain regions, the daily allowance for business trips in 2021 should be increased by its amount.

Attention! Resort fees will exist only in four regions of the Russian Federation: Krasnodar Territory, Republic of Crimea, Altai and Stavropol Territories. It has been established that its amount will be 50 rubles for each day.

Therefore, if a person working in an organization needs to be sent on a trip, he needs to be given, for example, an additional 250 rubles for five days of stay on site.

Features of accounting

In the accounting of a budgetary institution, travel expenses should be reflected in the appropriate account:

- to reflect daily allowances - 0 208 12 000 “Settlements with accountable persons for other payments”, according to KVR 112 and KOSGU 212;

- to reflect other costs - according to subaccount 0 208 26 000, according to KVR 112 and KOSGU 226.

The new provisions have been in effect since 2021 (Orders of the Ministry of Finance No. 132n and No. 209n).

However, if the payment for housing is carried out by the organization itself, for example, an agreement for the provision of services has been concluded between the institution and the hotel, then such costs are reflected in account 0 302 26 000. And if payment for the hotel is carried out under an agreement between the organization and the hotel, but with accountable money through an employee, such costs We reflect on the account 0 208 26 000.

A similar procedure is provided for purchasing tickets. So, for example, if an employee himself bought a ticket for a train (bus, plane), then travel expenses for transport are reflected in account 0 208 26 000, according to CVR 112. If the institution entered into an agreement with a transport company and transferred money for the ticket from the current account , reflect the costs at 0 302 22 000, use KVR 244. But if the employee paid under such an agreement with accountable money, then reflect the transaction at 0 208 22 000, KVR 244, KOSGU 222.

KOSGU

As noted above, travel expenses are considered in the context of the Labor Code of the Russian Federation as reimbursements (compensations) related to the employee’s performance of work duties. In international statistical practice, such payments are not considered as payments in the interests of employees, but belong to the category of expenses made by the employee for the purpose of performing work duties. In this regard, reimbursement of expenses related to business trips (travel, accommodation, other expenses related to the performance of official assignments on a business trip), starting in 2021, were transferred to subarticle 226 “Other work, Other payments” * (3) KOSGU ( clause 7, clause 10.2.6 clause 10 of Procedure No. 209n, clause 2.1.4 of the Methodological recommendations for the procedure for applying KOSGU, communicated by letter of the Ministry of Finance of Russia dated June 29, 2018 No. 02-05-10/45153).

More on the topic: Linking KBK and KOSGU. Common mistakes (Video materials for annual reporting 2021: topic 1)

If we are not talking about reimbursement of expenses, but about providing the employee with everything necessary before a business trip (when the institution independently purchases tickets, pays for a hotel, etc.), then the institution’s expenses will include, in particular:

- to subarticle 222 “Transport Other work, Payment for work, services” of KOSGU, articles and subarticles of group 300 “Receipt of non-financial assets” of KOSGU, based on the economic sense.

Note! Expenses regarding daily allowances are still included in subarticle 212 “Other non-social payments to staff in cash” of KOSGU (clause 10.1.2 clause 10 of Procedure No. 209n).