Fixed assets (FPE) may be written off over time for various reasons. OSes can simply become unusable, they can be sold or even donated. How to process various asset disposal transactions in accounting, see below.

First of all, any disposal of fixed assets must be documented and all details of the operation must be indicated in the documents.

When the asset is worn out, a write-off act is drawn up, which is signed by members of a specially created commission.

To register the disposal of fixed assets, there are unified forms of acts. The main form is OS-4, it is suitable for the vast majority of OS. If you need to write off a car, use act OS-4a. For group write-off of fixed assets, form OS-4b is used.

Write-off of OS as a result of physical or moral wear and tear

Wear and tear can be physical - this can include the failure of equipment due to a long period of use.

Obsolescence can be moral - for example, computer technology often becomes obsolete, so companies write off obsolete computers and replace them with modern ones.

The write-off of OS due to wear and tear is recorded with the following entries:

Debit 01 subaccount “Disposal” Credit 01 - the original cost is written off;

Debit 02 Credit 01 subaccount “Disposal” - accrued depreciation is written off;

Debit 91 Credit 01 subaccount “Disposal” - the residual value is written off.

What to do if write-off office equipment contains precious metals?

Information about the presence of precious metals in decommissioned computer equipment can usually be found in the technical passport for this equipment. If the company's technical passport is lost, an examination should be carried out to determine the content of precious metals. To do this, you need to attract specialists from a licensed company.

The presence of precious metals in decommissioned computers (and this is about 80% of cases) means that

- They must be handed over to an appropriately licensed company for disposal.

- The recycling company must not only be licensed for activities related to the management of hazardous waste, but also have a registration certificate issued by the Committee of Precious Metals and Precious Stones under the Ministry of Finance of the Russian Federation (Resolution of the Government of the Russian Federation dated June 25, 1992 No. 431).

The accepted disposal procedure and expert opinions of a licensed company must be reflected in the documents for write-off.

Expenses associated with the disposal of computer equipment can be taken into account as part of the non-operating expenses of the enterprise when calculating income tax (subclause 8, clause 1, article 265 of the Tax Code of the Russian Federation).

Sale of fixed assets

Fixed assets may also be disposed of as a result of sale. For example, you can implement obsolete operating systems. Or, for example, a company decides to update equipment in a workshop and first sells machines that are physically worn out, and then uses the proceeds to purchase new equipment.

When selling a fixed asset, it is important to fill out all the documents correctly and make the correct entries.

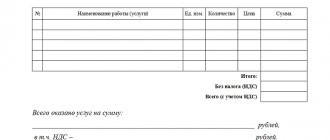

It is customary to formalize the sale of OS using OS or OS-1 acts.

Example. OJSC MTZ sells Opel cars. Depreciation for Opel is 231,000 rubles. The initial cost of the Opel car is 783,000 rubles, the residual cost is 552,000 rubles (783,000 - 231,000). The Opel sale price is set at 512,000 rubles.

The accountant of MTZ LLC made the following entries:

Debit 62 Credit 91 - 512,000 - proceeds from the sale of Opel;

Debit 91 Credit 68 - 78,101.69 - VAT on proceeds from the sale of Opel (512,000 x 18/118);

Debit 01 subaccount “Disposal” Credit 01 - 783,000 - the original cost of Opel is written off;

Debit 02 Credit 01 subaccount “Disposal” - 231,000 - depreciation accrued for Opel during the period of operation at MTZ LLC is written off;

Debit 91 Credit 01 subaccount “Disposal” - 552,000 - the residual value of Opel is written off.

Tax reporting on time and without errors! We are giving access for 3 months to Kontur.Ektern!

Try it

conclusions

Several main conclusions can be drawn on this topic:

- When selling, depreciation (impossibility of further use of the object) or loss of fixed assets, the organization must write them off from the balance sheet.

- The procedure is accompanied by documentation. The main ones are the write-off act, the defective statement (if worn out), the purchase and sale agreement (if sold), etc.

- To carry out the procedure, the company creates a special commission consisting of at least three people. It consists of middle managers and accounting staff. The composition of the commission is approved by order of the head.

- After the commission has inspected the property and issued a conclusion about the impossibility of further use of the OS in the company, an order is issued regarding the fact of write-off.

- It is allowed to write off a fixed asset and capitalize its individual parts for further use.

- All orders will not be considered valid without the manager's visa. Also, all accompanying documentation is signed by members of the commission.

Free transfer (donation) of fixed assets

When transferring free of charge, it is important to charge VAT. You can donate (transfer) the operating system either to your employee or to a third party. The OS must be donated according to the contract. A gratuitous transfer is reflected in accounting at the market value of the fixed assets on the date of donation.

Example. MTZ LLC presented an Opel car to employee of the year A.T. Burov. The Opel car had previously been used by the company for three years. Depreciation for Opel is 231,000 rubles. The initial cost of the Opel car is 783,000 rubles, the residual cost is 552,000 rubles (783,000 - 231,000). The market value of the Opel car on the date of gratuitous transfer is 512,000 rubles.

Postings:

Debit 01 subaccount “Disposal” Credit 01 - 783,000 - original cost written off;

Debit 02 Credit 01 subaccount “Disposal” - 231,000 - accrued depreciation written off;

Debit 91 Credit 01 subaccount “Disposal” - 552,000 residual value written off;

Debit 91 Credit 68 - 92,160 - VAT is charged on the market value (512,000 x 18%).

Purpose, definition

Before creating any document, it is worth understanding the terminology. The technical condition report with a conclusion represents a form with a detailed description of the operating condition of the equipment. It indicates possible shortcomings and breakdowns of equipment. The document can be used to justify equipping an enterprise with new equipment and writing off obsolete models.

Inspection of the technical base on a regular basis requires documentation. An inspection report is drawn up.

The form is filled out by members of the commission from competent employees. If we consider the required columns in the form, experts highlight the need to indicate the serial number, year of manufacture and article number of the equipment undergoing diagnostics. Additionally, an authorized member of the commission must note the number of the technical unit received at the time of the inventory.

The document must be accompanied by the results of measurements and examinations that were assigned to assess performance. The section indicates the degree of suitability for use at the time of inspection. If obvious defects are identified, a representative of the commission indicates this with clarification of the possibility of repair and the required time to return to its former performance. Papers will be needed to evaluate non-working devices and determine the extent of defects. Experienced managers also schedule scheduled inspections of enterprise equipment to identify problems at the initial stage of their occurrence, which can significantly reduce the cost of equipment restoration.

This type of act allows you to perform several tasks:

- reflect the actual state of the equipment;

- identify deficiencies that need to be corrected;

- confirm the fact of verification;

- protect interests at court hearings;

- make a claim regarding the quality of services provided;

- resolve controversial issues.

Composition of the commission

Only responsible and experienced workers have the right to draw up a report on the condition of equipment and prescribe recommendations for write-off. These should be professionals with specialized higher education, experience in filling out similar documents, and also competent in their industry.

The head of the organization has the right to invite outside experts to form an audit commission and include employees of the enterprise in the list of participants. Objective diagnostics with a competent conclusion will ensure the proper functioning of the organization and the continuity of the work process.

The act of decommissioning of equipment must be supplemented with the conclusion of a technical expert and a certificate of technical condition. As a rule, a third party who is more competent in this field is invited as a technical expert.

Other Disclaimers

In addition to these features, there are also several other important nuances that need to be taken into account in the process of writing off fixed assets.

Depreciation process

Depreciation is carried out from the moment the production assets were registered with the organization until the full repayment of the cost or in the case of write-off of fixed assets due to their excessive wear and tear. Any entries made for depreciation charges are made to account 02, while the credit for passive and balance sheet accounts fully reflects the total amount of accruals for the specified object.

By debit, the depreciation amount is written off only in the case of write-off of non-current assets, and the procedure itself can be carried out using the following methods:

- linear;

- write-off due;

- by reducing balance"

- in proportion to the ratio of the volume of production of commercial products.

The choice of methods remains with the enterprise, and must be reflected in the accounting policies. Taking into account the chosen scheme, which is determined on the basis of information about the fund’s inventory objects, this amount is posted on loan 02.

Such expenses can lead to an increase in the cost of property of certain divisions that operate fixed assets.

Trading companies include all depreciation charges in costs.

Defective statement

When preparing a defective statement, you must indicate the following information:

- justification for why this procedure is advisable from an economic point of view;

- a source of information within the company to analyze the reason for the depreciation of fixed assets;

- a document indicating the expert's decision.

This statement contains information confirming the fact that there is no possibility of further operation of fixed assets, which led to the need to write them off.

Service memo

The preparation of a memo should be carried out in accordance with some recommendations:

- on the right side the full name and position of the addressee are indicated;

- You must indicate the title of the document;

- the date and registration number of the note are indicated;

- the specific subject of this document is reflected;

- description of the situation;

- signature of an authorized person.

An official note when writing off fixed assets is required only if the object has suffered wear and tear or its material and technical base is considered obsolete.

Legislative regulation and write-off features

During the inventory, goods that are subject to spoilage and expired are identified, as well as those on which an expiration date should be indicated, but in fact it is not. All these goods are classified as unusable and withdrawn from trade.

Write-off of goods that have become unusable is carried out on the basis of:

- Civil Code of the Russian Federation, art. 469, 470, 472;

- Federal Law-2300-1 dated 07/02/92

According to the norms of the Civil Code, the seller is obliged to offer the buyer only high-quality, usable goods. The sale of goods with an expired expiration date is prohibited, and this period must be set in such a way that the consumer can use the product before its expiration.

The Federal Law “On the Protection of Consumer Rights” requires the transfer to the buyer of goods that meet the mandatory requirements for it (Article 4), and also names goods on which the manufacturer must indicate an expiration date: medicines, household chemicals, cosmetics, perfumes, products (Article . 5).

Goods that are expired or do not have an expiration date indicated on the packaging are returned by the trading establishment to the supplier, destroyed or disposed of.

Federal Law No. 446 dated November 28, 2018 introduced a ban on the return of perishable goods of good quality (with a shelf life of less than a month). Requests for refunds or replacements for items subject to perishable deterioration have also been prohibited since the end of last year.

If the unusable product is not returned to the supplier, it is destroyed or disposed of. Without the participation of third parties, this can be done in relation to spoiled products or goods whose exact origin is unknown. In other cases, an expert assessment from a supervisory government agency (veterinary, merchandising, etc., depending on the type of product) is required.

Procedure for recycling computers in the presence of precious metals

Computer equipment contains various elements, including precious metals and harmful substances. Detailed information on the composition is contained in the attached technical data sheet. If the technical passport is lost, it becomes necessary to conduct an additional examination for the presence of precious metals in the computer.

If the presence of these components in a computer unit is confirmed, then such equipment should be given for disposal to an organization that has the competence to resolve these issues. The recycling organization must have a license for this type of activity and proper registration with the Assay Office.