Have questions? Consult a lawyer (free of charge, 24 hours a day, seven days a week):

8 (800) 350-29-83 - Federal number

8 (499) 938-45-81 — Moscow and Moscow region.

8 (812) 425-61-42 - St. Petersburg and Len. region

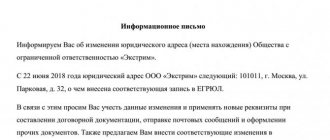

Each enterprise is assigned a legal address, which is registered during company registration and entered into the state register. But in some situations there is a need to change it. The reasons can be very diverse. In this case, you should definitely warn your business partners about this fact. The article discusses the main features and rules for filling out a letter to counterparties about changing the legal address, and a sample of how to write it.

Now the change of legal address is divided into 2 stages.

Step-by-step instruction:

- First stage: preliminary notification of the tax office about the upcoming change of the legal address of the LLC;

- Second stage : registration with the tax authority of a change of legal address.

Please note: in some cases, a simplified procedure for changing the address of an LLC is possible in 1 stage.

At the same time, according to the new rules, it is possible to begin the 2nd stage, that is, directly registering a change of legal address, no earlier than 20 calendar days after making the corresponding entry in the Unified State Register of Legal Entities about the preliminary notification of the tax authority.

In other words, changing the legal address of an LLC faster than 20 days is impossible.

How to send a letter

Since details are the most important part of official documentation, it is advisable to send letters about all changes associated with them in “natural” form. This makes it possible to reliably bring information about new details to the attention of counterparties, especially if you send these messages by registered mail with return receipt requested.

As a last resort, you can combine different sending options: for example, combine an email or fax message with sending via Russian Post. On the one hand, this will allow partners to be notified of changes as quickly as possible, and on the other hand, it will provide the sender with evidence that the corresponding letter was sent to them in a timely manner and received by the addressee.

Times when a change of legal entity. the address was fast, gone forever.

The state's merciless war against fly-by-night companies is leading to a gradual complication of registration procedures.

For reference : a new LLC can be opened for free without special knowledge in 2 different ways.

But do not be afraid of imaginary difficulties, because a simple step-by-step algorithm of actions with sample documents will help you independently change the legal address of your LLC.

So let's get started.

Stage 1 of changing the legal address of the LLC.

Preliminary notification of the tax authority about the upcoming change of legal address

At the first stage, you should prepare several documents:

- decision of the sole participant (or minutes of the general meeting of LLC participants) to change the location of the legal entity.

- application in form p14001.

If the LLC has only one participant, then it is necessary to prepare a decision to change the location of the legal entity.

If the LLC has several participants - 2 or more, then a protocol on changing the location of the legal entity is prepared.

What needs to be indicated in the decision to change the legal entity. addresses?

- LLC name,

- date and place of decision making (city, town, etc.),

- information about the participant(s) who made the decision (last name, first name, patronymic, passport details, place of residence),

- description of the decision made to change the legal address,

- signature of the founder (participants) and seal impressions of the LLC.

Funds, bank and counterparties

There is no need to notify state extra-budgetary funds of a change of location of the organization. This information is presented to them by the tax authority in the manner of interdepartmental information interaction (Clause 3.1 of Art. Law No. 129-FZ).

But the servicing bank and the organization’s counterparties must be notified of the move. The procedure for notifying the bank is usually established by a bank account agreement or a separate document accepted by the bank (clauses 1 and 3 of clause 1 of Article 1 of Federal Law No. 115-FZ dated 08/07/01, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 04/27/10 No. 1307/10).

Ready LLC documents for changing the legal address

Time is up!

Free copies are over!

Get ready-made document samples here. Loading a timer

The free offer is valid while the timer is ticking.

Get ready-made samples now, because they will help you submit documents to the Federal Tax Service to change your legal address in 10 minutes without errors.

The set of document templates includes ready-made decisions, protocols, changes to the charter, forms p13001, and p14001, protocols and decisions on changing the address and approving changes to the charter.

A link to download sample documents will appear within 5 - 10 seconds after payment.

How to fill out application p14001 when changing your legal address?

In the application form p14001 you need to fill out only a few sheets:

- on the first page of form p14001 indicate the OGRN, INN and full name of the LLC,

- on sheet “B” of form p14001, fill out only points 1 to 5. Items 6 to 9 do not need to be filled out.

- fill out sheet “P” of form 14001.

As the applicant, indicate the head of the permanent acting executive body “1” and fill out section 3, in which you indicate all the details of the director of the LLC.

After you have drawn up a decision (protocol) to change the location of the LLC and filled out the application form p14001, you need to certify the signature of the applicant (in our case, the director of the LLC) on the application p14001.

To certify the signature on the application p14001, the director comes to the notary with this application and all constituent documents and signs the form p14001 in the presence of the notary.

After notarization of form p14001, documents can be submitted to the registration authority (this is usually the tax office) at the place of registration of the LLC, that is, at the old legal address.

The set of documents should include:

- decision (protocol) on changing the location of the LLC,

- application in form p14001,

- copies of documents confirming that the LLC or director or participant of the LLC, owning at least 50% of the votes of the LLC, has the right to use the real estate property or part thereof, which is located at the new address of the legal entity.

As a rule, supporting documents are a lease agreement for the same new legal address or a certificate confirming ownership.

At the 1st stage, the entire set of documents is submitted to the registration authority at the place of tax registration of the LLC no later than 3 working days from the date of the decision.

After receiving the specified documents, the tax office makes an entry in the Unified State Register of Legal Entities stating that the company has made a decision on the upcoming change of its legal address.

For information. Summary Table of all types of liability of legal entities, individual entrepreneurs and citizens in connection with the coronavirus COVID-19.

For violations, not only fines are established, but also imprisonment of up to 7 years.

After no less than 20 calendar days have passed since the entry was made in the Unified State Register of Legal Entities, you can proceed to the 2nd stage of changing the legal address of the LLC.

Re-register cash register equipment

To re-register an online cash register that transfers checks to the tax office, you only need an application and an agreement with the fiscal data operator (FDO).

Application form for registration, re-registration and deregistration of the cash register

If the installation location of the cash register did not change when you moved, then you do not need to re-register the cash register.

Stage 2 of changing the legal address of the LLC.

At the second stage you should prepare:

- decision (minutes) on approval of changes made to the charter of the LLC,

- changes to the LLC charter,

- application for registration of changes made to the constituent documents in form p13001.

The decision (protocol) contains the same data as the previous decision (protocol). Additionally, it must reflect that this decision approves changes made to the charter of the LLC.

You can get ready-made samples of the decision (protocol) on approval of changes to the charter of the LLC, as well as the changes themselves, here.

Registration of legal address.

The changes made to the LLC charter reflect the new legal address.

In the application form p13001, we fill out only a few sheets:

- on the first page of form p13001 indicate the OGRN, INN and full name of the LLC,

- on sheet “B” of form p13001, fill out all points from 1 to 9, which indicate the new legal address of the LLC.

- fill out sheet “P” of form 13001.

Just as when filling out form p14001, indicate the head of the permanent acting executive body “1” as the applicant and fill out section 3, in which you indicate all the details of the director of the LLC.

When you have filled out all the documents, you need to have a notary certify the director’s signature on application p13001.

As a rule, to save time, we immediately prepare all applications in both form p14001 and form p13001 and at the same time sign them with a notary.

At the same time, documents are submitted to the registration authority (tax office) in the sequence described above with an interval of at least 20 days.

At the second stage, to register a change of legal address, you must submit the following documents to the registration authority:

- decision (minutes) on approval of changes made to the charter of the LLC,

- changes to the charter (in 2 copies, each copy must be bound if it contains more than 1 sheet),

- application in form p13001,

- payment document confirming payment of the state fee in the amount of 800 rubles for registration of changes made to the constituent documents of the LLC,

- copies of documents confirming that the LLC itself or its director, or a participant in the LLC with a share of more than 50 percent of the authorized capital, has the right to own the property in which the new legal address will be located.

It is important to remember that at the second stage of registering changes in legal address, documents are sent to the registration authority located at the location of the new legal address.

In other words, an application in the form with an incomprehensible number No. p13001 with the entire package of documents should be submitted to the registration tax authority where the LLC has a new legal address.

After submitting the documents, after 5 working days, not counting the days of submission and receipt of documents, the tax registration authority will issue a certificate of entry, a new certificate of tax registration of the LLC, registered changes to the charter of the LLC.

This completes the procedure for an LLC to change its legal address. All you have to do is notify the bank about the move to a new legal address and your counterparties.

The above procedure for changing the legal address of an LLC is general and standard for most situations.

However, in addition to the general procedure for changing the address, which provides for 2 stages of registration, the law provides for a simplified procedure, which consists of 1 single stage.

What is a simplified change of legal address of an LLC?

With the simplified procedure, there is no need to go through the 1st stage and prepare documents in form p14001.

In other words, there is no need to first notify the tax office (registration authority) about the change of address and then wait 20 days.

With a simplified procedure, you can immediately submit documents to the 2nd stage with form p13001.

In what cases is a simplified change of legal address applied?

The answer is simple.

A simplified procedure for changing an address is possible if the new legal address of the organization is:

- place of residence of the director of the LLC,

- place of residence of the LLC participant who has at least 50% of the share in the authorized capital.

Place of residence, as in ancient Soviet times, is determined by the place of registration. Registration is a stamp in a passport.

If the new legal address of the LLC completely coincides with the address of the director or founder (with a share of 50% of the authorized capital), in other words, the LLC moves to the registration address of the director or majority participant, then you can change the legal address according to a simplified procedure, without prior notification of the Federal Tax Service.

And in conclusion, it is necessary to mention that the tax office often refuses to register a change of legal address.

Why can they refuse to change their legal address and how to avoid this?

It's no secret that changing the legal address has been used for many years for the so-called merger of companies to other regions.

Tax authorities really don’t like it when a problematic LLC moves to them from some region, which has a bunch of tax debts that are impossible to collect. This greatly spoils the inspection statistics.

Therefore, tax authorities in most cases carefully check the fact that the LLC has actually moved to a new legal address.

For this purpose, the tax office is checking the new legal address. Visits the site, interviews personnel, draws up a report.

If the tax officer does not find an LLC at the new legal address, then registration of the change of legal address will be refused.

Sometimes, the tax inspectorate finds the reasons for refusal in the documents submitted for registration, in particular, in the lease agreement.

The lease agreement for premises at a legal address must be valid, that is, not have any signs of a void or voidable transaction.

The authority of the persons signing the lease agreement must be confirmed. Confirmation of authority is especially important if the lease agreement is signed by persons by proxy. In other words, power of attorney data must be attached to the registration documents.

It also wouldn’t hurt to attach to the registration documents, in addition to the lease agreement and power of attorney, a document confirming the Landlord’s ownership of the premises.

You need to understand that the more complete the set of documents provided for registering a change of legal address, the less chance the tax office has of refusing to register you.

How to fill out p13001 and p14001 using the free Federal Tax Service program in 5 minutes?

Report according to the simplified tax system and pay contributions to the new tax office

After changing your registration, you will need to pay the simplified tax system and individual entrepreneur contributions to the new tax office. Before paying, make sure that the Unified State Register of Individual Entrepreneurs has the current tax information.

In the simplified tax system declaration at the end of the year, it is important to show in which quarters you worked according to one OKTMO, and in which - according to another. OKTMO is a detail that depends on the registration address.

In Elbe, you can indicate different OKTMO in the declaration under the simplified tax system. If Elba notices that during the year you changed OKTMO in the Details, the “Registration Addresses” step will appear in the “Pay tax and report according to the simplified tax system” task. All you have to do is enter the correct dates.