From November 25, 2021, changes in information about an LLC must be reported using application P13014. This form combined the previous forms P13001 and P14001.

The rules for filling out form P13014 are provided for by Order of the Federal Tax Service dated August 31, 2020 N ED-7-14/ [email protected] We suggest you figure out how to inform the tax office about a change of address of the LLC. Below you will find a sample application form.

Changes to the Unified State Register of Legal Entities in Moscow on a turnkey basis

Title page design

Title page (form P13014)

On the title page of the new form, you must indicate the registration data (OGRN and TIN) of the organization that is submitting the application. The name of the organization is not required to be entered.

Then it is indicated why the application is being submitted. There are several options here:

- It is necessary to change only the wording of the charter or the changes concern the charter and information in the Unified State Register of Legal Entities;

- The Charter remains in the same edition, the changes concern only the data contained in the Unified State Register of Legal Entities;

- The organization operates according to a standard charter or refuses to use it. Another option: switching to a standard charter or abandoning it with amendments to the Unified State Register of Legal Entities;

- Error correction. Which were admitted when submitting the previous application.

If the number “1” indicates, then you must choose how the new edition of the charter is presented. There are two options:

- Attached is the new full version of the charter;

- Necessary changes must be submitted as a separate document.

Additionally, in paragraph 3 on the title page, you can put a note that information on the appointment of several heads of the organization is included, excluded or changed in the charter.

To enable or change the authority of managers, you must enter the number “1”. If the organization will be managed by one manager, the number “2” is indicated.

When choosing number 1, you then need to clarify how the directors will act. In case of joint management of the company, the number “1” is indicated; in case of independent management, the number “2” is indicated.

Form and forms 3-NDFL

Declaration 3-personal income tax: declarations or fill out online

Below you can download or fill out an online 3-personal income tax declaration form for the year you need.

The declaration for a specific year must be submitted in the form that was in force at that time. The same rule applies to filing an amended tax return.

For example, if a taxpayer wants to file a tax return in Form 3-NDFL for 2021, then he needs to use the declaration form that is valid in 2021. The tax office will not accept a declaration filled out for 2021 income, for example, on a 2021 form.

You can download the program from the official tax website for filling out yourself or the declaration form for the year you need, using the link below. Please note the alternative filling options.

As a general rule, the 3rd personal income tax declaration is submitted on time - no later than April 30 of the current year for the income of the previous year that is subject to declaration. If April 30 falls on a weekend, then the filing deadline is extended to the next working day. And the calculated tax based on the results of the declaration must be paid before July 15.

When filling out a 3-personal income tax return for a tax refund, the filing deadline is not limited to any date in the current year. In other words, you have the right to submit such a declaration whenever you want, but no later than three years. For example, in 2021 you can submit 3-NDFL for 2021, 2021 and 2021 to receive tax deductions - a tax refund. Being retired, in certain cases, you can fill out and submit for 2021.

The declaration form changes every year, but the composition remains largely the same:

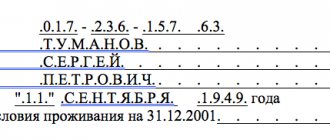

- Title page - general information about the individual is indicated: full name, passport details, address of the place of registration (stay), TIN and other data. It should be noted that individuals who are not individual entrepreneurs, having entered their TIN, have the right not to indicate passport data. The TIN can be found on the official website of the tax office.

- Section 1 and Section 2 - serve to calculate the tax base, the amount of tax at different tax rates, the amount of tax to be paid/additional/refunded from the budget.

- Appendices 1-8, as well as Calculations for Appendices, are filled out only as necessary. For example, they reflect the following indicators: - income generated from activities both in Russia and abroad; — income of individual entrepreneurs; — income that is not subject to income tax; — sheets for calculating standard, social, property and professional tax deductions, etc.

Thus, there is no need to fill out all 15 sheets of the declaration. Only the first 3 and plus additional ones are filled out depending on the purpose of preparing the declaration.

It should also be noted that, starting with the declaration form for 2020, the Tax Refund Application does not need to be filled out separately. Now it is part of the declaration form itself and has a corresponding sheet - Appendix to Section 1.

Sample of filling out the 3-personal income tax declaration:

- deduction for treatment expenses

- deduction for training expenses

- deduction for expenses when buying an apartment

— declaration of income from the sale of an apartment

How to fill out the 3rd personal income tax declaration you need:

CHOOSE A CONVENIENT FILLING OPTION:

| Our program prepares declarations, both in pdf format - For submission on form, and in xml format – for submission via the Internet (no need to download the program, everything is online). The service will ask simple questions, answering which will automatically generate a declaration. You can do it in 15 minutes. Then our specialist will definitely check it. This is very important as it ensures that the declaration is completed correctly and is completely ready for filing. If, while answering the questions, you made a mistake somewhere, don’t worry: you can always go back and change your answer to any question! The declaration is always available for editing. Our specialist will also check the changes made. Fill out the 3-personal income tax declaration online |

and tax return 3-NDFL for 2021 – 2017:

| Tax return in form 3-NDFL for 2020: Order of the Federal Tax Service of Russia dated August 28, 2021 N ED-7-11/ [email protected] “On approval of the tax return form for personal income tax (form 3-NDFL), the procedure for filling it out, as well as the format for submitting a tax return for personal income tax in electronic form" (Registered with the Ministry of Justice of Russia on September 15, 2020 N 59857) | or Fill out online |

| Tax return in form 3-NDFL for 2019: Order of the Federal Tax Service of Russia dated October 3, 2021 N ММВ-7-11/ [email protected] (as amended on 10/07/2019 N ММВ-7-11/ [email protected] ) “On approval of the form of the tax return for personal income tax (form 3-NDFL), the procedure for filling it out, as well as the format for submitting the tax return for personal income tax in electronic form” (Registered with the Ministry of Justice of Russia on October 16, 2019 N 56260) | or Fill out online |

| Tax return in form 3-NDFL for 2018: Order of the Federal Tax Service of Russia dated October 3, 2021 N ММВ-7-11/ [email protected] “On approval of the tax return form for personal income tax (form 3-NDFL), the procedure for filling it out, as well as the format for submitting a tax return for personal income tax in electronic form" (Registered with the Ministry of Justice of Russia on October 16, 2018 N 52438) | or Fill out online |

| Tax return in form 3-NDFL for 2017: Order of the Federal Tax Service of Russia dated December 24, 2014 N ММВ-7-11/ [email protected] (as amended on October 25, 2017 N ММВ-7-11/ [email protected] ) “About approval of the form of the tax return for personal income tax (form 3-NDFL), the procedure for filling it out, as well as the format for submitting the tax return for personal income tax in electronic form" (Registered with the Ministry of Justice of Russia on December 15, 2017 N 49266) | or Fill out online |

You can also go to the developer’s website and try to fill out the declaration yourself. If you are going to do this for the first time, the process is quite labor-intensive, and the likelihood of errors is very high. You will submit the declaration “as is”, since tax officials do not look at it first.

During a desk audit by the inspectorate (within 3 months), if errors are detected, you will need to submit an Updated Declaration (the tax refund is deferred again for 3 months, provided that the Updated Declaration is filled out correctly).

Or you can try to fill out the declaration yourself by downloading the appropriate form above for the year you need. Declarations are presented in a convenient pdf format and allow you to enter data into cells directly from the keyboard.

The 3-personal income tax declaration is a rather serious and complex document; treat it with all the attention. It is based on the results of this document that the amount of tax to be paid or refunded is calculated, and the right to tax deductions is claimed.

Along with the declaration, documents confirming the right to deduction, income or expenses are also submitted to the tax office. In particular, these may be purchase and sale agreements (copies), 2-personal income tax certificates, tax refund applications, payment documents (receipts, bank statements) and other documents (copies), depending on the purpose of filling out the 3-personal income tax form.

The tax inspector then reviews the submitted return within three months. If errors are discovered that affect the result (they underestimate the tax payable), you will have to submit an Adjusted Declaration. If the 3-NDFL declaration is completed for a tax refund, then after checking it, the tax inspectorate is given another month to transfer the tax to the details specified by the taxpayer (provided that the Tax Refund Application has been completed).

You may also be interested in:

How and where you can fill out a declaration for free or why you should choose a paid option for filling it out

Second page design

Second page (form P13014)

This page is a continuation and therefore the top item is indicated by the number four. This column provides information on changes in the authorized capital of the organization.

The fifth paragraph is intended for joint stock companies. If filling out the document is carried out by an LLC, then leave the paragraph blank.

The sixth paragraph is completed if a decision was made to change the legal address of the organization. There are two options that require filling out: The number “1” means that the decision has been made, the number “2” means the decision has been cancelled.

The following is background information.

In the seventh paragraph, you can indicate information about the existence of a corporate agreement.

The eighth point allows you to specify or change the existing email address of the organization. You can also select the option to exclude data.

In the ninth paragraph, you can allow or restrict the ability to obtain data about the organization’s existing licenses.

The tenth paragraph concerns legal successors. It allows you to allow or block the receipt of such information.

New application in form P13014

Application P13014 (new form) combines the still valid forms P13001 and P14001. The document is intended to be filled out by legal entities if there is a need to inform the tax service:

- about changes in constituent documents;

- on changes in information about the organization in the Unified State Register of Legal Entities;

- on the LLC’s decision to apply the standard charter;

- to correct errors in a previously submitted application.

The document must be submitted to the territorial bodies of the Federal Tax Service.

Deadline

The territorial departments of Rosstat are waiting for the 1-personnel report form completed by the organization by February 3 of the year following the reporting year. This document is not required to be submitted to Rosstat every year; its frequency is once every 3–4 years. Every year, statistical authorities compile an updated list of respondents and send them notifications about the need to report. In 2021, respondents were required to submit information for 2021. The standard deadline for submitting the 1-personnel form (statistics) in 2021 has been established - until 02/03/2021, since this is a working environment and there are no transfers.

Location and address of the legal entity

Officially, the concept of a legal address does not exist. Instead, the Civil Code of the Russian Federation mentions “location” and “address of a legal entity within the location”. The procedure for filling out form P13014 depends on whether the LLC is moving within its locality or not. And this needs to be looked into in detail.

- The easiest option is to move within your locality. In many cases, this does not require changing the charter (if only the locality is indicated in it). But there are also charters where the previous address is indicated in full, then you will have to make changes to the text of the constituent document.

- When moving to another city, a change of legal address is completed in two stages. First, you need to notify the Federal Tax Service about the decision to change the address, after which an entry is made in the Unified State Register of Legal Entities. And only after 20 days the changes will be finally registered, so form P13014 is submitted twice.

- If an LLC moves to another locality based on the registration of a director or participant with a share of at least 50%, then the two-step procedure does not apply.

A detailed description and example of filling out form P13014 for each option can be found below.

Important: according to the new rules, the spelling of the LLC address must correspond to the municipal division according to FIAS. But there is an exception - if the organization moves to Moscow, St. Petersburg, Sevastopol or Baikonur, then the locality is not indicated.

Unified forms of primary accounting documents - what does this mean?

For many years, until 2013, only documents compiled according to specially approved forms could be used as primary documents for accounting and tax accounting purposes.

These forms are called unified. It was allowed to draw up in free form only those documents for which there was no unified form. With the entry into force of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, economic entities received the right to develop document forms independently, subject to compliance with certain requirements for them.

However, many companies continue to use unified forms, because... they comply with all legal requirements. ConsultantPlus experts have collected all the forms into a single material. Get trial access to the system and go to Help information for free.

After this, most of the unified forms of primary documents became recommended, but some remained mandatory. We will talk about them further.

What does “album of unified forms of primary accounting documentation” mean (examples)

An album of unified forms is usually called the so-called thematic selection of document forms. So, there are accounting albums:

- personnel, working hours and settlements with personnel for wages;

- cash transactions;

- trading operations;

- fixed assets and intangible assets;

- materials;

- products, inventory items in storage areas;

- inventory results;

- works in capital construction and repair and construction work, etc.

Obligation to submit form 1-cadres

This personnel report must be completed and submitted to Rosstat by all legal entities, including non-profit organizations, if they are included in the sample for this year. Find out exactly what your responsibilities are directly on the website of the statistics service using a special service. However, while some employers will theoretically be included in the sample, some will not be included at all. For clarity, they are presented in the table:

| Who passes the 1st frame (statistics) is required | Should not report on the 1-personnel form |

|

|