Each organization is obliged to comply with the storage periods for accounting and tax documents, regardless of the organizational form and type of economic activity.

The chief accountant or head of the company is responsible for storing tax registers and other documentation. The storage period for accounting documentation, reporting, and primary documents is at least 5 years after the reporting year. Tax information for the calculation and payment of taxes, as well as documentation confirming income and expenses, are stored for 4 years. In addition, electronic documentation between the bank and the company must be preserved for 4 years. But for some cases, the law specifies the storage periods for accounting documents and other reports. So, for example, the shelf life of RSV-1 PFR is 6 years.

What changes to consider

The new storage periods for tax documents from February 18, 2020 are determined by clause 4.3 of Section II of the mentioned order of the Federal Archive.

Now there is an obligation to keep the certificate for 5 years:

- on the fulfillment of the obligation to pay taxes, fees, contributions, penalties and fines;

- on the status of settlements with the budget.

In addition, there was a direct reference to calculations of insurance premiums. Both annual and quarterly documents must be kept for 50 or 75 years (depending on when the paperwork is completed).

Note that there were two articles previously. One stipulated that annual payroll statements for insurance contributions to the Social Insurance Fund must be kept permanently, and for a quarter - for 5 years. According to the second, a 5-year period was provided for declarations and calculations of advance payments for pension contributions, if there are personal accounts. But it was not clear which documents were meant in both norms.

The table below shows all the storage periods for tax documents effective from 2021.

| DOCUMENT TYPE | STORAGE LIFE | NOTE |

| Documents (certificates, tables, information, correspondence) on accrued and transferred amounts of taxes to budgets of all levels, debts on them | 5 years (1) | (1) After debt removal |

| Documents (calculations, information, statements, decisions, lists, statements, correspondence) on tax exemption, provision of benefits, deferrals or refusal of payment of taxes and fees | 5 years | – |

| Certificate of fulfillment of the obligation to pay taxes, fees, insurance premiums, penalties and tax sanctions, certificate of the status of settlements with the budget | 5 years | – |

| Documents (tables, acts, calculations) on additional taxation for a certain period of time due to the revision of the tax legislation of the Russian Federation | 5 years | – |

| Registers for calculating land tax | 5 years | – |

| Calculations for insurance premiums: | – | |

| a) annual; | 50/75 years | |

| b) quarterly | 50/75 years | |

| Cards for individual accounting of the amounts of accrued payments and other remunerations and the amounts of accrued insurance premiums | 6 years (1) | (1) In the absence of personal accounts or payroll records – 50/75 years |

| Tax returns (calculations) of legal entities and individual entrepreneurs for all types of taxes | 5 years (1) | (1) Tax returns of individual entrepreneurs up to and including 2002 – 75 years |

| Documents (calculation of tax amounts, messages about the impossibility of withholding tax, tax accounting registers) on personal income tax | 5 years (1) | (1) In the absence of personal accounts or payroll records – 50/75 years |

| Certificate of income and tax amounts of an individual | 5 years (1) (2) | (1) In the absence of personal accounts or payroll records - 50/75 years (2) With the tax authorities, at least 3 years after receiving the death certificate of the taxpayer or a document recognizing the taxpayer as deceased |

| Registers of information on the income of individuals submitted by tax agents | 5 years | – |

| Documents (correspondence, notifications, demands, acts, decisions, resolutions, objections, complaints, statements) about disagreements on taxation issues, collection of taxes and fees to budgets of all levels | 5 years | – |

| Documents (certificates, statements, correspondence) on the restructuring of debt on insurance premiums and tax debt | 6 years | – |

| Documents (lists of taxable objects, lists of benefits, explanations, information, calculations) on the calculation of the tax base by legal entities for the tax period | 5 years | – |

| Invoices | 5 years | – |

| Books of accounting of income and expenses of organizations and individual entrepreneurs using a simplified taxation system | 5 years | – |

| Logbook of accepted certificates of income, expenses, property and property-related obligations and clarifications thereto | 5 years | – |

| Journals, cards, accounting databases: | – | |

| a) amounts of income and income tax of employees; | 5 years | |

| b) sales of goods, works, services, subject to and not subject to value added tax | 5 years |

Read also

31.01.2020

Procedure for saving documentation

Having determined the storage periods for primary accounting and tax documents, they must be kept in a designated room or locked furniture in the accountant’s office until they are put into the archive. Safes or locked cabinets contain strict reporting forms. In the absence of supporting documents for calculating taxes, the Federal Tax Service has the right to issue a fine and penalties to the taxpayer for non-compliance with the security conditions. In addition, legal entities can store documentation electronically, but the presence of an electronic signature is considered a mandatory detail.

What to do with documents after liquidation of a business

The “life” of a business can be much shorter than the document storage period. If a legal entity or individual entrepreneur is liquidated , then the documents to be stored must be archived.

You can use the services of any archive – both municipal and private. If there is a heavy workload, the institution may refuse to accept documents with a short shelf life (for example, tax documentation).

In this case, the founders must independently ensure the safety of the papers until the end of the established period. But documentation with a long shelf life (more than 10 years), and this mainly includes personnel documents, will definitely be accepted by the archive.

In some constituent entities of the Russian Federation, tax authorities do not issue a sheet of entry on the exclusion of a company from the Unified State Register of Legal Entities without a certificate of submission of documents to the archive.

In addition, the liquidation commission is obliged to complete all the affairs of the organization, including taking care of documentation. If this is not done, then the liquidators may be brought to administrative liability under Art. 13.25 Code of Administrative Offenses of the Russian Federation. The fine for an official in this case will range from 2.5 to 5 thousand rubles.

How many years is a taxpayer’s report kept in the tax and extra-budgetary funds?

The storage period for tax reporting is approved by order of the Federal Tax Service and is 5 years. The countdown for maintenance is established from January 1 of the new year after the reporting period has passed. And the storage period for tax registers proving the validity of accrual of VAT deductions begins from the date of entering the last information. The storage period for quarterly budget reports is set for 5 years, and the annual one – indefinitely, throughout the existence of the organization. Until 2017, legal entities and individual entrepreneurs submitted reports to the Pension Fund and the Social Insurance Fund; today, the unified RSV form is accepted and stored by the Federal Tax Service for 5 years as tax reporting. But the storage period for RSV-1 according to the list of insurance contributions (for pension, social, medical insurance) is 6 years. The storage periods for accounting documents, registers and reports are regulated by No. 125-FZ of October 22, 2004 “On archiving in the Russian Federation.” If company documentation is lost, the manager assembles a commission that determines the facts of loss or destruction (for example, theft, emergency, etc.). To avoid disagreements with the tax service during calculations, it is better to restore the documentation.

Retention periods for documents for government agencies

Previously, the requirements of state archival affairs for the storage of documents were contained in the List of standard management documents generated in the activities of organizations with an indication of their storage period, approved by the Federal Archive Service of Russia on October 6, 2000. In accordance with the order of the Federal Archives of August 26, 2010 No. 63, the specified List lost its power.

Currently there is a List of standard management archival documents generated in the process of activities of state bodies, local governments and organizations, indicating storage periods. In general, documents according to storage period are divided into the following groups:

- documents with a limited storage period (1 year, 3 years, 5 years, etc.),

- permanent storage documents;

- storage until no longer needed;

- storage until replacement with new documents.

Thus, analytical documents (tables, reports) for annual financial statements must be stored for 5 years. Transfer, separation, liquidation balance sheets, appendices, explanatory notes to them, certificates of registration must be stored permanently. Workers' writs of execution - until the need has passed.

Document storage location

Place of storage of documents in the LLC

The company is obliged to store documents provided for by federal laws and other regulatory legal acts of the Russian Federation, the company's charter, internal documents of the company, decisions of the general meeting of the company's participants, the board of directors (supervisory board) of the company and the executive bodies of the company (Article 50 14-FZ). Until December 2021, this article contained an indication of the location of the executive body, but it was removed.

Place of storage of documents in the joint-stock company

Federal Law of December 26, 1995 N 208-FZ (as amended on July 31, 2020) “On Joint Stock Companies”

The company is obliged to store documents provided for by this Federal Law, the company's charter, internal documents of the company, decisions of the general meeting of shareholders, the board of directors (supervisory board) of the company, the management bodies of the company, as well as documents provided for by regulatory legal acts of the Russian Federation. The company stores documents at the location of its executive body in the manner and within the “time limits” established by the Bank of Russia (Article 89 208-FZ). In the law on joint-stock companies there is still an indication of the place; in fact, it works poorly. Therefore, a bill on amendments with the following text is ready: “The place of storage of documents must be determined in the charter or internal documents of the company.”

How and where to store documents

While the document is being used by employees, it can be at the workplace of the responsible person. To store papers that are not needed for current work, it is necessary to allocate a separate room. It needs to be installed with convenient racks for storing folders and fireproof cabinets for long-term storage or those documents that contain confidential information. The cabinets, like the archive itself, are locked with a key, which is kept by the person in charge. This is necessary not only for the safety of the papers themselves, but also to suppress attempts to make any changes to them.

Documentation must be submitted to the archives in processed form. It is necessary to create folders from documents of the same type, staple them, make an inventory and number them. After depositing it in the archive, it is unacceptable to unravel the files and take out sheets from there. You can only use the entire folder without violating its integrity.

Personnel documents are usually located in the personnel department premises. Therefore, you need to install a fireproof safe in it to store personal files and work records.

Starting in 2021, a gradual transition to electronic work books . But, most likely, many employees will prefer to keep their usual paper books. Therefore, personnel officers will still need to deal with their storage.

There are often cases when a company does not have premises for storing papers or has a lot of documentation. In such a situation, you can use the services of an external archive. These specialized organizations not only offer storage space, but also carry out all the necessary activities - from filing documents to their destruction.

The cost of services depends on the volume of documents and the additional work that will need to be done with them. The minimum tariff for storing documents starts from 2,000 rubles per month.

Document storage procedure

The organization must ensure safe storage conditions for accounting and tax records and their protection from changes (Article 29 of Law No. 402-FZ).

Organizations and citizens have the right to create archives for the purpose of storing archival documents generated in the process of their activities (Article 13 of Law No. 125-FZ).

To organize the archive, a separate room must be allocated, equipped with special shelves (racks) or closed cabinets. If there are windows in the archive room, they should be curtained or blinds installed, otherwise it will not be possible to protect documents from exposure to light, and therefore they may fade. It is advisable to equip the windows of the first or basement floor with metal bars; in addition, it is better to install a metal door in the archive. Such measures will help to avoid unauthorized entry into the archive premises.

According to the Basic Rules for the Operation of Archives of Organizations, approved by the decision of the Board of Rosarkhiv dated 02/06/2002, inventories of files are compiled in the archive:

- permanent storage;

- temporary (over 10 years) storage;

- by personnel;

- as well as acts on the allocation for destruction of files that are not subject to storage.

Cases with expired storage periods according to the List are included in the act of allocation for destruction and are subject to destruction.

The processed primary documents of the current month are compiled in chronological order and accompanied by an inventory for the archive. Cash orders, advance reports, bank statements with related documents must be collected in chronological order and bound. Certain types of documents may be stored unbound, but filed in folders to prevent loss or misuse.

Storage of primary documents, accounting and tax accounting documents can be carried out in electronic form, unless otherwise provided by regulatory legal acts of the Russian Federation. At the same time, their storage on computer storage media should be carried out in accordance with the Federal Law “On Electronic Signatures” dated 04/06/2011 N 63-FZ using an electronic digital signature equivalent to a handwritten signature in a document on a paper medium.

The safety of primary documents, accounting and tax reporting, their execution and transfer to the archive is ensured by the chief accountant. The issuance of documents from the accounting department and from the archives of the organization to employees or other persons, as a rule, is not allowed, and in some cases can only be done by order of the chief accountant.

Seizure of documents can only be carried out by the bodies of inquiry, preliminary investigation, prosecutor's office and courts on the basis of a decision of these bodies in accordance with the current criminal procedural legislation. The seizure is documented in a protocol, a copy of which is handed over to an official of the organization against receipt. With the permission and in the presence of representatives of the authorities making the seizure, the accountant can make copies of the seized documents indicating the grounds and date of their seizure.

The procedure for storing personnel documentation is regulated by separate provisions of labor legislation in relation to various types of documentation. So, for example, in Art. 87 of the Labor Code of the Russian Federation establishes the employer’s obligation to ensure the safety of the employee’s personal data. Employee personal data is information required by the employer in connection with employment relations and relating to a specific employee. Personal data includes information contained in a personal file.

The procedure for storing personal data of employees is established by the employer in compliance with the requirements of the Labor Code of the Russian Federation and other federal laws. The employer must control the storage and use of personal data, as well as ensure its protection from misuse or loss.

Separate requirements apply to the storage of work record forms. Forms of the work book and its insert, as strict reporting forms, must be stored in safes, metal cabinets or special rooms to ensure their safety.

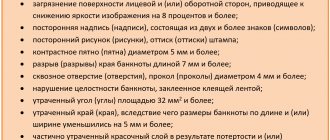

What happens if you violate the order of working with documents?

Some businessmen believe that it is not necessary to strictly adhere to the storage periods for documents, because this is an “internal matter” of the company. But they are wrong.

In the absence of documents that confirm the accuracy of the determination of the tax base, the tax inspectorate has the right to charge mandatory payments using the calculation method (clause 7, clause 1, article 31 of the Tax Code of the Russian Federation). And most likely, this calculation will not be in favor of the businessman. After all, provide documents for VAT deductions, confirmation of income tax expenses, etc. will no longer be possible. As a result, you will have to pay additional taxes to the budget, as well as penalties and fines.

In addition to tax sanctions, businessmen will need to pay a fine for the lack of documents. If the information necessary for tax control is not provided, the fine will be 200 rubles for each form (Article 126 of the Tax Code of the Russian Federation). The responsible person will pay from 300 to 500 rubles (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

If the lack of documents led to an underestimation of the tax base, then the fine will be equal to 20% of the amount of unpaid tax, but not less than 40 thousand rubles. (Article 120 of the Tax Code of the Russian Federation). In addition, a fine in the amount of 5 to 10 thousand rubles will be imposed on the responsible official. (Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

The lack of necessary personnel documents will also cost a businessman a lot. For a legal entity, the fine will be from 30 to 50 thousand rubles. An official or individual entrepreneur will have to pay from 1 to 5 thousand rubles. (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

How to destroy old documents

Once the storage period for documents expires, they can be destroyed. The decision to destroy is made by a commission consisting of company employees. The chairman of the commission can be either the manager or the employee who is responsible for document flow in the organization. The commission compiles a list of all documents with an expired storage period as of January 1 of the current year.

After the list is approved by the manager, the documents can be destroyed. An act of destruction should be drawn up and signed by the members of the commission.

But large companies often use the services of special organizations, since it is often impossible to dispose of a large volume of documentation on their own. The executing organization also provides the owner of the securities with a certificate of their destruction.