Fines for violating rules for storing archival documents will increase

The State Duma adopted in the second reading bill No. 759112-7 with amendments to the Code of Administrative Offenses of the Russian Federation on tightening sanctions for improper storage of archival documentation. The author of the initiative was the State Council of the Republic of Tatarstan. Fines will increase for officials and legal entities.

Now the norms of Article 13.20 of the Code of Administrative Offenses of the Russian Federation provide for administrative liability for violation of the rules:

- storage;

- acquisition;

- accounting;

- use of archival documents.

The punishment for such a violation is a warning or a fine for officials in the amount of 300 to 500 rubles. Organizations are not held liable for this.

Legislators propose maintaining a warning for officials for the first violation, and increasing the amount of the fine:

- for officials - from 3,000 to 5,000 rubles;

- for legal entities - from 5,000 to 10,000 rubles.

The new norms will come into effect 10 days after the official publication of the amendments to the Code of Administrative Offenses adopted and signed by the president, that is, still this year.

Normative base

The procedure for compiling files and storing documents generated in the process of activity is determined by archival legislation:

- Labor Code of the Russian Federation, articles 230, 230.1.

- Law “On Archiving in the Russian Federation” No. 125-FZ of October 22, 2004, which obliges the preservation of certain documentation for the period of time established in regulations.

- “Basic Rules for the Operation of Organizational Archives”, approved by the decision of the Board of Rosarkhiv dated 02/06/2002 (are of a methodological and informational nature).

- Order of the Federal Archive No. 236 dated December 20, 2019, which approved the list of standard archival documents indicating the storage time (List), which defines the obligations for all organizations for various types of documentation, including accounting, tax and personnel.

But do not forget that the listed regulations are advisory in nature, the specific storage periods for documents and the list of cases for 2021 are determined by the internal documents of the organization.

IMPORTANT!

02/18/2020 Order of the Ministry of Culture No. 558 dated 08/25/2010 became invalid. Instead, a list appeared, approved by Order of the Federal Archive No. 236 of December 20, 2019. Please take these changes into account in the LNA.

What to do if the deadline has not expired, but the document is damaged or damaged

Personnel records that are lost or damaged are subject to restoration:

- it complies with the law;

- protects the interests of employees;

- exempts managers from liability under the Code of Administrative Offences.

Lost originals are restored in several stages:

- a loss report is drawn up indicating the reasons (negligence, emergency, mass loss or damage);

- creating or ordering a duplicate;

- content restoration;

- collecting employee signatures.

For example, the shelf life of personnel orders is 75 years. Lost or damaged orders are subject to mandatory restoration. Duplicates are transferred to the archive indicating the details of the EPC act.

Storage rules

The employee responsible for maintaining personnel records and storing information is appointed by order of the head of the organization, his functional responsibilities are fixed in the job description.

Personnel information is compiled into files and transferred for storage to the organization’s archive or (in case of liquidation and in some other cases) to the state archive.

Formation of cases should be understood as grouping executed documents into cases (folders) in accordance with the nomenclature of cases.

Below is the order of case formation:

- To avoid the need for additional decoding, the following details must be indicated on the cover of the case:

- name of the organization (in full);

- name of the structural unit (in full);

- case number (in accordance with the nomenclature);

- case title;

- retention periods for the file and numbers of articles according to the list (if necessary).

- The following are filed in the file:

- only completed and executed documents;

- one original, except in a few cases;

- published in the same calendar year.

- Inside the file, the papers are filed in order by numbers and dates; if the volume exceeds 250 sheets or volume (4 cm), division into volumes is required. In large organizations, a large number of orders are issued, and as a rule, they are filed in different files depending on the duration of storage. Thus, the storage period for vacation orders is 5 years, and orders for hiring or dismissing employees are already 75, which is why they are assigned to different folders.

How many years are cash records kept?

5 years after the reporting year - this is the required storage period for cash documents in the organization (based on the above standards). Based on this, it is possible to establish a minimum five-year storage period for PKO and RKO, cash books, accounting book No. KO-5, and other documents documenting cash transactions.

The exception is payroll. Such documents should be stored for at least 75 years if there are no personal accounts (clause 412 of Order No. 558 of the Ministry of Culture of the Russian Federation). Otherwise, the standard shelf life is 5 years.

If documents are used as evidence in legal proceedings, they cannot be destroyed until a final court decision is made.

Shelf life

In state and municipal organizations, documentation is completed in the prescribed manner for transfer to the archive. But in commercial things it’s not so simple. The organization's LNA will help answer the question of how the storage periods for personal data and other information and documents are determined. They are compiled on the basis of existing regulations and established office practices.

ConsultantPlus experts analyzed the storage periods for personnel documents in an organization where all employees are remote. Use these instructions for free.

Example:

Federal Law No. 152-FZ of July 27, 2006 (as amended on April 24, 2020) “On Personal Data” limits the period of processing (including storage) of personal data to the achievement of the purpose of their processing. After the task for which they were requested has been completed, the PD must be destroyed. The specific period is determined by law or by the organization’s specialists, if such standards are not established.

It is necessary to take into account the special role of the expert commission when establishing the period during which it is necessary to store files in the personnel service. In Scheme 1 we will see the tasks solved by the above-mentioned body.

The regulations on the work of such a commission, as a rule, are developed on the basis of the Order of the Federal Archive No. 2 of January 19, 1995 “On approval of the approximate regulations on the permanent expert commission of an institution, organization, enterprise.”

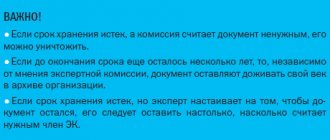

When setting time, marks of this type are sometimes used:

- according to the protocol (EC), if there is none, an order is used on the period of storage of documents in the organization, which fixes the decision on the need to store documents or destroy them;

- “until the need passes” or “until replacement with new ones”, i.e. The time is set by the organization independently (at least 1 year).

The storage period for documents according to the nomenclature of cases begins on January 1 of the next calendar year. Cases with expired shelf life are prepared for destruction.

IMPORTANT!

Reducing the storage periods stated in lists or regulations is unacceptable. If two regulations set different retention periods for the same type of information, the choice is made in favor of the longer one.

For clarity, here are approximate lists of documents with storage periods:

| Table of storage periods for personnel documents in an organization in 2020 | ||

| Permanent | ||

| Statement on the protection of personal data | Clause 8, part 1, art. 86 Labor Code of the Russian Federation | |

| Regulations on remuneration (bonuses and material incentives) | Art. 21 Labor Code of the Russian Federation | |

| Regulations on certification | ||

| Regulations on the training system | Art. 196 Labor Code of the Russian Federation, art. 197 Labor Code of the Russian Federation | |

| Orders on main activities | ||

| Long-term | ||

| Orders on admission, transfer, dismissal, leave without pay | Art. , 72.1, , part 1 art. 80, clause 6, part 1, art. 81 Labor Code of the Russian Federation | 75 |

| Personal cards of employees (T-2) | Resolution of the State Statistics Committee No. 1 of 01/05/2004 | 75 |

| Journals, books of registration of orders for admission, transfer, dismissal | 75 | |

| Time sheets | Part 3 art. 91 Labor Code of the Russian Federation |

|

| Employment contracts, agreements thereto | Art. 16, art. 56, art. 57, art. 67 Labor Code of the Russian Federation | 75 |

| Limited | ||

| Minutes of meetings, resolutions of certification and qualification commissions | 10 | |

| Orders on granting regular and educational leaves | Art. 114, 115, 116, 117, 118, 119, 173 Labor Code of the Russian Federation | 5 |

| Calculations, analyses, certificates on the revision and application of production standards, prices, tariff schedules and rates, improvement of various forms of remuneration | Art. 135, 144, 147 Labor Code of the Russian Federation | 5 |

| Applications, information, correspondence about the need for workers, reduction (release) of workers | 5 | |

| Correspondence about the establishment and payment of personal rates, salaries, allowances | 5 | |

| Orders on personnel (professional development, bonuses and incentives for employees, maternity leave or without pay, etc.) | Art. 6 list of Rosarkhiv dated 10/06/2000 | 75 |

| Orders on business trips, on duty | 5 | |

| Orders of disciplinary action | 3 | |

| Books, magazines, leave cards, issuance of certificates of wages, length of service, place of work | 5 | |

| Time logs | 1 | |

| Vacation schedules | Art. 123 Labor Code of the Russian Federation | 3 |

| Internal labor regulations | Part 4 art. 189 Labor Code of the Russian Federation | 1 |

| List of professions with hazardous working conditions | Art. 221 Labor Code of the Russian Federation | DZN (before replacement with new ones) |

| Storage period for incoming and outgoing correspondence | 5 | |

| Table of storage periods for contracts in an organization in 2020 | ||

| Name | List item | Shelf life |

| Civil contracts on the performance of work, provision of services by individuals, acceptance certificates of work performed, services provided | 301 | 50/75 years |

| Documents (calculations, conclusions, certificates, correspondence) for agreements, agreements, contracts | 5 years | |

| Founding agreements of a company, business partnership | Constantly | |

| State and municipal contracts for the purchase of goods, works, services to meet state and municipal needs | 224 | 5 years EPC after expiration of the contract, termination of obligations under the contract |

| Treaties, agreements, contracts not specified in individual articles of the List, documents (acts, protocols of disagreements) to them | 5 years EPC after expiration of the contract, after termination of obligations under the contract | |

| Table of storage periods for accounting documents in an organization in 2021 | ||

| Name | List item | Shelf life |

| Annual reports | 269 | Constantly |

| Quarterly reports | 269 | 5 years. In the absence of annual reports, they are stored permanently |

| Monthly reports | 269 | 1 year provided that the company prepares quarterly and annual reporting. If not, then store it permanently. |

| Audit reports | 287 | 5 years

|

| Accounting policy documents | 268 | 5 years. The countdown begins on the first day of validity of the new |

Any primary, in particular:

| 278 | 5 years. The countdown begins from the end of the reporting year |

Accounting registers, including:

| 277 | 5 years, if an audit was carried out |

| Information on accounts receivable and payable | 267 | 5 years from the moment the debt is repaid |

| Information about shortages, embezzlement, thefts | 277 | 10 years

|

| Statements for the issuance of salaries, benefits, financial assistance and other payments | 295 | At least 6 years. In the absence of personal accounts:

|

What documents are cash registers?

In 2021, cash transactions are accompanied by the preparation of the following documents:

- PKO (receipt cash order) is a document that is issued when cash is received at the cash desk. It is possible to draw up one cash order per day if the receipt of cash is issued by a cash receipt (if there is a cash register) or a strict reporting form (SSR).

- RKO (expenditure cash order) is a document that is issued when DS is spent from the cash register. The cashier, after identifying the recipient of the cash using the passport or other identification document presented by him, issues money according to the cash register signed by the chief accountant. The manager signs the RKO only if the organization does not have a chief accountant (accountant) on staff. Cash book is a document that reflects all receipts and expenses of the DS. At the end of the shift, the cashier needs to create a cash book, display the balance of the cash balance and recalculate it. This document is not filled out only if there was no vehicle movement during the day.

- Cash book is a document that reflects all receipts and expenses of the DS. At the end of the shift, the cashier needs to create a cash book, display the balance of the cash balance and recalculate it. This document is not filled out only if there was no vehicle movement during the day.

- The accounting book is a document that is formed only when there are several cashiers at the enterprise, and serves to reflect the transfer of cash from the senior cashier to the junior. The data in the book is reflected during the shift and certified by the signatures of both parties.

- Payroll and payroll - they are compiled to make payments to employees (wages, stipends, etc.).

All of the above documents can be maintained both on paper and electronic media.

IMPORTANT! Strictly speaking, from this list only cash receipts and debit orders are considered cash documents (clause 4.1 of the Bank of Russia Directive No. 3210-U dated March 11, 2014). The rest of the above documents do not apply to cash documents, although they are used when processing cash transactions.

Individual entrepreneurs who keep records of income and expenses or physical indicators characterizing a certain type of business activity may not draw up cash documents and a cash book (clauses 4.1, 4.6 of the Bank of Russia instructions dated March 11, 2014 No. 3210-U).

Read about the need to maintain cash discipline in the article “Is your cash discipline in order?” .

Administrative responsibility

In Art. 13.20, 13.25, 19.5, 19.6, 19.7 of the Code of Administrative Offenses of the Russian Federation provide for various administrative and civil liability, which awaits if the storage periods for documents on personnel and others are not observed: from warning and imposition of a fine to disqualification.

Cases of administrative offenses in the field of archival legislation are considered in civil proceedings. For the most part, control is aimed at identifying existing violations. Inspectors are guided by the Storage Organization Rules developed by the Ministry of Culture in 2007. Despite the fact that the normative act is somewhat outdated, a new one has not been developed.

Currently, minimum fines are used in accordance with Art. 13.20 of the Code of Administrative Offenses of the Russian Federation, but you shouldn’t be happy about it, since they apply mainly to state and municipal archives. But in relation to commercial organizations, Art. 13.25 of the Code of Administrative Offenses of the Russian Federation, which provides for much higher fines - up to 300,000 rubles.

Results

When organizing an archive in a company, you should remember that the storage periods for one document serving in different capacities can be established by different legal acts and therefore vary. In this case, the period should be calculated to the maximum. Until its expiration, the document must be kept in the company's archives and cannot be destroyed.

Sources:

- Law “On Accounting” dated December 6, 2011 No. 402-FZ

- Order of Rosarkhiv dated December 20, 2019 No. 236

- Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.