Benefits and compensation

Denis Pokshan

Expert in taxes, accounting and personnel records

Current as of October 27, 2018

From January 1, 2021, the minimum wage has been increased to 11,280 rubles. In this regard, there have been changes in the calculation of some “children’s” benefits. How to calculate “children’s” benefits from January 1, 2021? What is the amount of benefits from January 1, 2021? Has the minimum amount of child care benefit changed? How much will the Social Insurance Fund reimburse for “children’s” benefits? What are the amounts of new child benefits for the first and second child in different regions of Russia and who is entitled to such benefits? You will find answers to these and other questions related to children's benefits, as well as a table with new sizes in this article.

Types of child benefits

“Children’s” benefits usually include payments related to the birth of children. The list of such payments is contained in Federal Law No. 81-FZ of May 19, 1995 “On State Benefits for Citizens with Children” (hereinafter referred to as Law No. 81-FZ). Most often, employers have to deal with the calculation and payment of the following types of “children’s” benefits:

- benefits for registration in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly allowance for child care up to 1.5 years;

- maternity benefit.

The listed types of benefits are paid by the employer to its employees. In this case, with the social benefits paid, you can reduce insurance contributions to the Social Insurance Fund or receive the necessary compensation from the fund.

It is worth noting that in some regions there is a pilot project in which benefits are paid not by employers, but directly from the Social Insurance Fund. The territorial bodies of the Social Insurance Fund in the “pilot” regions themselves calculate and pay “children’s” benefits. Since January 1, 2019, there have been more .

Also see “ Sickness benefit amount from 2021: new amount “.

Nuances

All types of government support can be obtained through the State Services portal and in multifunctional centers (MFC):

- Submission deadline. Documents and an application must be submitted within a period not exceeding 6 months from the date of birth of the baby;

- Number of documents. The volume of the package of documents depends on the category of the applicant;

- Where to apply. Employed parents submit documents to the accounting department of the employing organization. Uninsured categories of citizens contact the social protection departments at their place of registration or residence.

Contents of the document

The form of the document is not established by law and does not have a standard form, so the document is drawn up in any form. Organizations often develop the application format themselves. As a rule, it indicates:

- applicant details;

- type of benefit;

- addresses by registration and actual residence;

- bank details for transferring money.

The application must be submitted to the social protection department or your organization no later than 6 months from the date of birth of the child. Otherwise, the right to receive assistance is lost.

Recommendation! If you apply for a subsidy to social security, the application should be written in two copies (make a copy): one remains with the department employee, and the date of receipt of the document is stamped on the applicant’s copy. This will provide the necessary control over the period for granting benefits and will help get rid of a possible controversial situation.

Indexation of child benefits in 2019

There has been no indexation of “children’s” benefits since January 1, 2021. After all, child benefits are indexed annually from February 1. The indexation coefficient is approved by the Government of the Russian Federation (Federal Law dated December 19, 2016 No. 444-FZ.) Indexation concerns the following benefits paid by the employer:

- a one-time benefit for women who registered in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance.

From January 1 to February 1, 2021, “children’s” benefits should be paid in the same amounts as in 2021. Here are the amounts of “children’s” benefits in the table until February 1, 2021.

| Type of benefit | Until February 1, 2021 |

| At the birth (adoption) of a child | RUR 16,759.09 |

| For registration in the early stages of pregnancy | RUB 628.47 |

| Minimum care for a second or younger child up to one and a half years old | 6284.65 rub. |

However, from February 1, 2021, the indexation coefficient for child benefits is 1.043.

Taking into account the new coefficient, from February 1, 2021, “children’s” benefits should be paid in indexed amounts, which are shown in the table below.

| Type of benefit | From February 1, 2021 |

| At the birth (adoption) of a child | RUB 17,479.73 (16,759.09 x 1.043) |

| For registration in the early stages of pregnancy | RUB 655.49 (628.47 x 1.043) |

| Minimum care for a second or younger child up to one and a half years old | 6554.89 rub. (6284.65 x 1.043) |

In districts and localities where regional wage coefficients have been established, “children’s” benefits (both in January 2021 and from February 1, 2021) will be higher, since they need to be additionally increased by the amount of the increasing coefficient (Article 5 of Law No. 81-FZ). Next, we will comment on the conditions and procedure for indexing benefits from February 1, 2021.

Benefit for registration in early pregnancy

This benefit is supposed to be paid once (that is, in a lump sum). Women who:

- registered in medical institutions before 12 weeks of pregnancy;

- have the right to maternity benefits (Article 9 of Law No. 81-FZ).

This benefit will be paid in a new amount from February 1, 2021 - 655.49 rubles. rubles However, a controversial situation is possible.

Let's give an example.

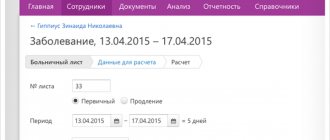

The employee goes on maternity leave from February 4, 2019. On January 25, 2021, the woman submitted to the accounting department a certificate from the antenatal clinic stating that in 2021 she registered in the early stages of pregnancy (up to 12 weeks). How much benefits should I pay for early registration?

The benefit for registration in the early stages of pregnancy should be paid in addition to the maternity benefit (Article 9 of Law No. 81-FZ). Therefore, the benefit for registration in the early stages of pregnancy must be transferred in the amount that is established on the start date of maternity leave.

In our case, the woman went on maternity leave on February 4, 2021. Therefore, the registration allowance should be paid in the amount of 655.49 rubles (including indexation by a factor of 1.043). If the start of maternity leave was in January 2021, then the benefit would be in a smaller amount - 628.47 rubles.

Special payments for children of military personnel

For children of military personnel called up for service, in addition to all the payments described above, special payments are also valid, the right to which arises regardless of the fact of receiving other benefits. These are the payments that can be received by:

- The wife of a conscript is pregnant for at least 180 days. The payment is a one-time payment. Its basic value is 14,000 rubles, which for 2021 (taking into account indexation) corresponds to a value of 28,511.40 rubles. (from 02/01/2020 to 01/31/2021).

- The mother of a conscript's child or the person who replaced her, in the form of monthly payments for the period from the birth of the child until he reaches the age of three years, coinciding with the period of the father's conscription service. The basic amount of such a monthly amount is 6,000 rubles, and for 2021 (taking into account indexation) it is 12,219.17 rubles. (from 02/01/2020 to 01/31/2021).

The right to such payments does not arise in relation to children of cadets of military educational organizations.

One-time benefit for the birth of a child from February 1, 2021

One of the parents has the right to a lump sum benefit upon the birth of a child. If two or more children were born, then the benefit is paid for each of them (Article 11 of Law No. 81-FZ).

The employer must pay the benefit within six months after the birth of the child if the employee has submitted the documents necessary to assign the benefit (Article 17.2 of Law No. 81-FZ). Due to the indexation of benefits from February 1, 2021, an ambiguous situation may arise when assigning.

The child was born in 2021, and the woman came to the accounting department in February 2019 to receive a one-time benefit for the birth of a child. How much benefits should I pay?

The amount of a lump sum benefit for the birth of a child should be calculated on the date of birth, and not on the date of application for benefits (FSS letter dated January 17, 2006 No. 02-18/07-337). In our case, the child was born in 2018, so the benefit amount will be 16,759.09. (excluding indexation by a factor of 1.043). Pay a one-time benefit for the birth of a child in the indexed amount (RUB 17,479.73) if the child is born from February 1, 2019.

Receipt procedure

The appointment of a PRR is of a declarative nature and requires the mandatory submission of an appropriate application with a package of necessary documents, determined by the category of parents.

Range of benefit recipients

A prerequisite for receipt is the very fact of the birth of the child.

The applicant may be one of the parents. Read also: How to apply for alimony

Funding sources define three categories of recipients:

- At the expense of the Social Insurance Fund - employed persons;

- At the expense of federal subsidies - full-time students, unemployed and unemployed, pensioners;

- At the expense of the federal budget - contract military personnel, employees of the Ministry of Internal Affairs, customs officers, firefighters.

Who can receive benefits?

According to federal law, the right to a one-time subsidy upon the birth of a newborn has one of the parents or a person replacing him (guardian, adoptive parent or foster parent).

What documents are needed to process the payment?

The specific list of documents depends on the category of the applicant. General required documents include:

- passport;

- application for payment of benefits for the birth of a child indicating personal data;

- certificate from the registry office about the birth of the baby (F 24);

Certificate form F24 - a certificate of non-receipt of a one-time PRP from work (service) or the social security department at the place of registration of the husband (if the father is applying for payment, a similar certificate from the mother is needed).

Sample certificate of non-receipt of a one-time benefit

The additional package includes the following documents:

- for the unemployed - an extract from the work book or other document confirming the last place of employment or study;

- for divorced applicants - a certificate from the housing organization confirming the cohabitation of the applicant with the newborn, a certificate of divorce;

- for non-workers - a certificate of non-assignment of support by social protection authorities at the place of registration.

Advice! The package of documents includes a certificate of non-receipt of benefits by the other parent. In the event of a tense relationship (especially in the case of divorce), if the young father suddenly refuses to provide such a certificate, the woman can solve the problem on her own by contacting her husband’s employer with an official letter containing a request for the document.

Procedural Features

The following parents are excluded from the category of PRP recipients:

- deprived of rights;

- those who moved for permanent residence to another state;

- whose children are transferred to state support.

The payment is not accrued to a non-working parent if the second one is employed (serves), to the father of a child born out of wedlock, to a parent after a divorce if the child remained with the other parent.

Monthly childcare benefit for children up to 1.5 years old from February 1, 2021

Also see “ Child Care Benefit 2021 “.

Minimum amount of care allowance

The minimum amount of benefits for caring for the first child up to one and a half years old depends on the minimum wage (Part 1.1, Article 14 of the Federal Law of December 29, 2006 No. 255-FZ). Since from January 1, 2021, the minimum wage is 11,280 rubles, the minimum amount of benefits for caring for the first child is 4,512 rubles. (RUB 11,280 x 40%). For more information about this, see “ Table with new amounts of child care benefits in 2019. ”

The “minimum wage” for caring for the second and subsequent children has not changed since January 1, 2019. It remained 6284.65 rubles even after January 1, 2021.

From February 1, 2021, the benefit indexation coefficient was approved in the amount of 1.043. Therefore, from February 1, the allowance for the second and subsequent children is 6554.89 rubles. (6284.65 x 1.043).

Maximum amount of care allowance

In 2019, the maximum amount of child care benefits for children up to 1.5 years is not limited. However, the amount of average daily earnings from which the benefit is calculated is limited.

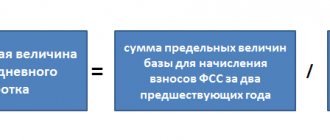

The amount of average daily earnings for calculating benefits cannot exceed the sum of the maximum values of the base for calculating insurance premiums for the two years preceding the year of parental leave, divided by 730 (Part 3.3 of Article 14 of the Federal Law of December 29, 2006 No. 255- Federal Law). Therefore, in order to determine the maximum amount of average daily earnings, the following formula is used:

Maximum average daily earnings = Sum of the maximum values of the base for calculating insurance contributions to the Social Insurance Fund for the two previous years / 730

It turns out that if an employee’s vacation begins in 2021, it is necessary to take into account the values of the maximum values of the base for calculating contributions to the Social Insurance Fund for 2021 and 2021. They are:

- in 2021 – RUB 755,000;

- in 2021 – RUB 815,000.

Therefore, in 2021, the maximum average earnings for calculating care leave will be RUB 2,150.69. ((RUB 755,000 + RUB 815,000) ÷ 730 days).

Next, we need to multiply the average daily earnings by the average monthly number of calendar days equal to 30.4 (Part 5.1, Article 14 of Law No. 255-FZ). Total: in 2021, the maximum average monthly earnings for calculating benefits will be 65,380.82 rubles. (RUB 2,150.69 × 30.4).

The amount of the monthly childcare benefit for a child up to 1.5 years old is generally equal to 40% of the average monthly earnings (Part 1, Article 15 of Law No. 81-FZ). Therefore, in 2021, the maximum amount of monthly benefit per child is RUB 26,152.33. (RUB 65,380.82 × 40%). This is the amount that must be reimbursed from the Social Insurance Fund.

Maternity benefit in 2019

The table below shows the minimum and maximum amounts of maternity benefits. They are valid from January 1, 2021. They were not affected by the February indexation.

| Maternity benefit (M&B) | Amount, rubles |

| For working women (general calculation procedure) | Average daily earnings for all days of vacation according to BiR (140, 156 or 194 days) |

| Minimum payment for employed women |

|

| Maximum benefit for working women |

|

Read also

28.10.2018