When counting property during an inspection, an inventory list of inventory items is filled out. A sample is below on the page. The document is drawn up during a scheduled or extraordinary inventory.

Free INV-3 in excel

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

Before starting the inventory, the manager must issue an order to conduct an inspection in the INV-22 form and appoint a commission.

What it is

Everyone who works with the material and financial assets of an enterprise faces an audit. Upon admission, they are registered. Then, control is carried out at a certain frequency, during which the correspondence of all recorded and documented objects with the actual presence is established. After the work has been done, the following verdicts are established: excess or shortage.

The process is carried out by special people. They act strictly according to protocol, internal company regulations and recommendations of the Ministry of Finance. The following commercial objects must be analyzed:

- all warehouse premises - the main turnover of the activity is taken into account, equipment is numbered;

- workshops, factories - places where the production cycle is carried out, everything is taken into account, including raw materials and blanks, parts;

- trading floors, showcases;

- cash registers.

We looked at the classic content of inspection, which includes the manufacture and sale of products produced by a commercial enterprise. But at other points everything may happen differently, for example, restaurants, cafes, sports complexes or other places where services are provided. There are no products sold here or they are contained in small quantities, but there are other items in the estimate - dishes, sports equipment, etc.

Results

Monitoring the compliance of real information and information reflected in accounting data for current and non-current assets, as well as short-term and long-term liabilities, allows you to avoid errors in accounting and tax accounting.

The correct preparation of inventory records will help to perform this function. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Business Solutions

- shops clothing, shoes, groceries, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

Government institutions and pharmacies stand separately. For them, this process is more complicated, because any error in reporting or significant shortfall can be considered as negligence, abuse of authority, or even waste of the budget, which can result in not only dismissal and a fine, but also criminal prosecution and even imprisonment.

In the process of this activity, an inventory list is drawn up - this is paper designed to record inventory items, their quantity, and quality. Usually it is drawn up in two identical copies in the presence of the responsible employee and the commission members. All listed persons put their signatures upon completion of the inspection. As a result, one completed form is transferred to the accounting department for storage, and the second remains with the responsible person.

To carry out all the seemingly simple manipulations listed above, you must first obtain a signed decree on conducting an inventory in the INV-22 form. This reporting not only warns of the approaching inspection and authorizes it, but also acts as an important act that is provided as evidence. Therefore, it is kept by the accountant for 5 years.

Important changes

Starting from January 2021, all public sector institutions are required to fill out the updated form 0504087. Moreover, not only the formal form of the inventory list has changed, but also the rules for filling it out.

New graphs have been added:

- 8 — status of the accounting object;

- 9—target function of the asset;

- 10 - accounting account;

- 17 - the number of non-financial assets that do not meet the conditions for recognizing them as accounting objects, 18 - their amount.

The procedure for indicating information in these columns must be reflected in the accounting policies and regulations on the inventory of the institution.

The updated inventory format fully complies with federal standards.

Approved Form

Already in the process of counting values, they use (fill out) a special unified form - INV-3. It was approved by a decree of the State Statistics Committee of Russia back in 1998 and is used to this day without changes for any enterprise, commercial or municipal facility. It can be used as an example of filling out an inventory list.

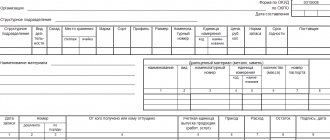

This is a three-page act, here is its blank and maximally abbreviated sample:

During the work, it is pre-filled; the following information is entered by hand:

- Name of the organization and type of activity.

- Order number, instruction, and date.

- Type of inventory items that are owned by the organization, received for processing.

After this comes the classic formula, according to which the responsible persons confirm and guarantee that all formalities have been met when writing off as expenses and that all evidence and receipts are available.

Then a large table is presented, which indicates each element of the inventory - its number, name, item code, cost, quantity and other tables at your discretion. The more inventory, the more extensive the listings will be. At the end of it follows the line “Total” - this is the amount, the assets of the organization.

After this there are signatures and calculations.

Form INV-3 is classic for all enterprises. It is created unified by the time the activity begins, when all values are put on the balance sheet in the accounting department. But something may change every month - new trading positions appear, others are completely written off and removed from the list. To confirm this and draw up new lists, written confirmation from the manager in the form of an order is required. Such measures are not justified verbally.

Required details

On the title page it is necessary to indicate the name of the legal entity and its divisions in full or short form in accordance with the constituent documentation. Next, all available details must be filled in: OKUD, OKPO, OKVED, start and completion date of the property inventory.

In the middle part, next to the name of the document, its numbering and date of formation are indicated. It must coincide with the date of completion of the inventory list. Below is the type of inventory items subject to inventory and the rights under which they are at the disposal of the business entity (owned or received for processing).

In the tabular part, columns 1 to 7 and 10 to 13 are required to be filled in. In columns 8 and 9, data is entered if the inventory and materials inventory number has an inventory and passport number. The final indicators are presented in digital and verbal versions.

The procedure for filling out an inventory form with an example

The page is completed in two steps. First, the header and all items of the goods are entered, and then, during the assessment of the quantity and condition of the items, availability is indicated. Afterwards, the signatures of the financially responsible person (MRP) and a member of the commission are affixed.

Let's start with the header. Not all fields that are presented there are required. For example, the type of activity, also known as the OKONKH code, is indicated as the main detail, although in a number of other documents it is omitted. And the “Type of operation” column is often empty, since not all organizations officially use the code system. You can also not write anything in the “structural unit” line. Please note that in places where there is nothing to indicate, there is no need to put dashes or other signs of missing data; it is enough to leave it blank.

The hat was the first step. Here you should also indicate all the information about the document on the basis of which a scheduled or extraordinary inspection is carried out. This can be ordered by the manager. Most often the paper looks like this:

Thus, already at the preliminary stage the following are known:

- the date of the;

- initials and positions of commission members;

- what exactly is subject to inventory.

Therefore, this information, as well as the order number, can be entered in advance into the INV-3 report.

The second step is confirmation that the valuables and funds entrusted to its storage were either capitalized (and confirmations and checks are provided for this) or written off - this fact is also verified. You must be prepared to provide explanatory reasons for the write-off. For example, expired products or goods damaged during transportation. The MOL puts its signature under the relevant paragraph even before the start of the entire procedure.

Business Solutions

- the shops

clothes, shoes, products, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

Step #3: go to the table. It includes the main point of conducting a reconciliation, since it contains a detailed list of everything that is included in the goods and materials of the enterprise. This can be: raw materials, parts and blanks, finished products, all commodity units, as well as furniture, equipment and other inventory that has a cost and is on the balance sheet.

On average, any firm has many positions. And accounting is almost impossible without a computer program - manually it will take many hours. Offers the best for commercial properties, warehouses. This is software for conducting inventory of equipment and tools, materials, fixed assets using barcodes. Thus, all the first 9 columns immediately contain information about the product unit, their quantity, cost, and serial number. You only need to enter “Actual availability”. The marks are made by the commission, accompanied by the responsible employee. There can be no data falsification. It is forbidden to fill out the statement, focusing only on the words and assurances of the MOL; everything must be accurately checked, viewed, verified and recorded.

After the listing, a summary is made. For ease of calculation, the final conclusions are drawn page by page. And then they are put together. The number of pages depends on how voluminous the item is.

Step No. 4: all members of the verification commission put their signatures as a sign that they confirm the information received. The financially responsible employee does the same. Who can be part of the inspectors:

- administrators;

- accountant;

- people in leadership positions;

- specialists from the neighboring workshop, etc.

The main thing is that the list of persons is approved in advance by order.

How to fill it out correctly

There are several recommendations and requirements for how to correctly fill out an inventory of inventory items:

- It is prohibited to make changes without the presence of the MOL;

- the committee must always contain the same persons who were announced by the order;

- information is recorded only after actual detection of the actual presence of inventory items (not from the words of anyone).

All results are recorded on paper. In this case, both presence and deficiency are recorded. Based on this, acts will be drawn up that confirm the excess or shortage. If this is detected, then an internal investigation should be carried out or everything should be written off in the “Expenses” column of accounting. Orders should also be signed for all this.

In addition, it is necessary to indicate:

- the cost of a commodity unit - this determines, for example, what amount will be deducted from the employee responsible for this;

- product code - this makes it easier to carry out all procedures according to the article;

- condition, quality.

The latter is important because a number of products are defective or broken. They are usually sold at a deep discount, often to the detriment of the company, and sometimes this is the basis for a write-off. Thus, even damaged items must be recorded on the list.

If there are free columns in the form (in the table), then they are crossed out across the entire width of the space with the letter Z, this is necessary so as not to enter anything unnecessary there.

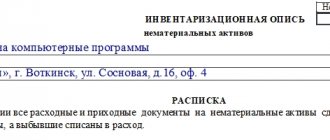

As mentioned earlier, a form in the INV-3 form is taken. But if the corporation has non-financial assets, then they should be entered in form 0504087. A clean sample looks like this:

In fact, it contains the same fields as those presented above, but the cost of accounting units is not taken into account.

Where is it used?

Appendix 3 to Order of the Ministry of Finance dated March 30, 2015 No. 52n contains accounting registers. The form we are considering is present in this list. Its main purpose is to identify discrepancies in non-financial assets. This is carried out by the responsible person by comparing accounting data with actual results. From the inventory you can track:

- the estimated value of the non-financial asset;

- its target function;

- its actual quantity;

- object status;

- compliance with the conditions for recognizing an object as an asset.

Based on the data in this document, one can draw a conclusion about the organizational and technical readiness of the enterprise and the depreciation of assets (if any).

Inventory details

This is the name of the very tables that make up the bulk of the act. The important thing is that for one type of value there must be a special form. Thus, if raw materials, goods and furniture are to be accounted for, three reports should be prepared and completed.

All columns are numbered, there are thirteen in total. One of them, No. 9, is filled out optionally, that is, optionally. Let's look at an example:

Here we see that this column remains blank. The fact is that registration of technical devices or jewelry is more complicated, since they have a passport. It is in such cases that the line is needed. Also pay attention to columns 10, 11 and 12, 13. These are the ones that often diverge, since actual availability may be more or less than stated in accounting. If this is confirmed, then you should fill out form INV-19: matching statement based on inventory results.

How to fill out the second and third sheets

Since there are methodological recommendations for them, we will not dwell in detail on the design of these tables. Let's consider only the difficult moments.

The estimated value of the object should be determined in accordance with Section II of the Instructions for the Application of the Unified Chart of Accounts (Appendix 2 to Order of the Ministry of Finance dated December 1, 2010 No. 157n). Paragraph 25 is devoted to the estimated value of non-financial assets. According to the market price method, it is determined as the sales price of a similar object on the accounting date.

The objective function of an asset is the way it is brought into circulation in order to make a profit (for example, commissioning or retrofitting). If this is not possible, describe the procedure for its disposal (for example, write-off or transfer to another organization).

Entering information into paper on fixed assets (Fixed Assets)

This process is carried out at least once every three years. In this case, the INV-1 form is used, which in content is practically indistinguishable from the one presented above. Its design follows the above order. Here the following columns will be indicated:

- real estate;

- cars and other vehicles, including agricultural machines;

- equipment and electrical engineering;

- household equipment;

- adult draft animals;

- special tools and other means that are essential to ensure the activities of the enterprise.

When is inventory taken?

Typically, the process is preventive, carried out according to a predetermined schedule and does not represent anything special or unexpected for the staff. So checks can be carried out every month - reconciliation of the cash register and goods, and for fixed assets - once every 3 years. But there are also unscheduled recalculations; they are shown in the following cases:

- the management person changes, the company is transferred for use to another owner or tenant;

- an annual report is prepared;

- there is a change of financially responsible persons - the old one must sign the act of delivery of valuables, and the new one must sign the act of receipt;

- during an official investigation for theft or abuse of authority;

- a situation that is caused by force majeure - flood, fire, that is, when it is necessary to calculate losses;

- during reorganization or liquidation of the entire company.

Responsibility for compilation

All persons who take part in the process of recounting values are responsible. Therefore, each member of the commission who signs is responsible for the documented results. Also, the responsibilities are not removed from the person who was initially responsible for the inventory items. Usually this is a seller, storekeeper, manager. If mistakes are made, the listed people may be fined with the indication of causing material damage to the enterprise. If one of the commission members does not come for the inspection, its results can actually be considered invalid.

Documentation of inspection results

Naturally, the fact of verification must be documented.

For these purposes, orders, acts, accounting journals, inventories, and collating documents are drawn up. All documents prepared during the inventory process must have at least two copies. There are many standardized forms used for specific situations. They should indicate the following information:

- Company name;

- Title of the document;

- description of objects subject to inventory;

- indication of measurement units, cost and quantity;

- inspectors, their positions and signatures with transcripts.

The legislation does not prohibit adding any new items to the unified form, or changing existing ones. However, you need to remember that the listed points must be left unchanged.