Russian tax legislation contains such concepts as “residency”. For people who are becoming acquainted with these concepts for the first time, it may be difficult to understand official formulations, namely who is a resident and non-resident of the Russian Federation. In addition, the Tax Code of the Russian Federation answers questions about residency statuses in a very cumbersome manner.

Citizens often do not know which category they belong to if they regularly travel abroad for work or personal reasons. In the text we will talk about the features and differences between the two indicated statuses and explain what rights and obligations residents and non-residents of the Russian Federation have.

Who is a resident and non-resident of the Russian Federation?

Basic information about statuses

Many people confuse the definition of a citizen of a country and its resident. More precisely, people believe that these words are identical and are synonyms. This is an incorrect judgment. A person can be a Russian citizen and at the same time not be a resident, as in another combination - “stateless resident”. Let's take a closer look.

Article 207 of the tax code of the Russian Federation mentions that the status of “resident of the country” is available to people who live here for at least 183 days within twelve consecutive months. It is important to understand that these twelve months are not necessarily a calendar year, since the countdown can go from April of one year to April of the next, for example. Citizens traveling abroad for short periods of time will not lose their status. The maximum for continuous absence from the country is six months, and even then only for education or treatment. Also, offshore workers extracting hydrocarbons may be absent for six months.

Security officials, government officials and municipal government officials can leave Russia for up to a year without losing their resident status.

In these situations, citizens must be prepared to provide official documents confirming the purpose of their visits abroad and their duration. In the case of improving health, these will be special treatment (medical) visas in the foreign passport, contracts with foreign medical institutions. The situation is similar with obtaining an education - agreements with educational institutions and other supporting documents must be in hand. Moreover, both medical and educational organizations must have the appropriate licenses.

Article No. 11 of the Tax Code of the Russian Federation also states that resident status is obtained by:

- Citizens of the country who are registered at their place of permanent residence or location.

- Foreigners who have received a residence permit in Russia.

- Foreigners who have permission from an employee of the Ministry of Internal Affairs for continuous stay in the Russian Federation.

- Workers from other countries who have an employment contract for a period longer than 183 days.

It is logical that residential status cannot be achieved by individuals living in the country for less than the specified number of days or months that have passed between them. Regardless of the length of stay in the country (even if it exceeds 183 days), the status of “resident” cannot be obtained:

- refugees and foreigners who have received temporary asylum in the country;

- highly qualified foreign specialists invited to work/service.

The status of non-residents is characterized by a number of nuances:

- Persons who do not have resident status, but receive income in the country, are required to pay personal income tax.

- Even when paying income tax, non-residents cannot claim tax deductions: property, social, standard.

- Non-residents are required to submit a declaration to the Federal Tax Service when they receive profit in Russia.

- On each date of payment of such income, non-resident status is calculated and confirmed again.

Most often, citizens of the Russian Federation who rarely leave their homeland are its residents

Representatives

Having studied all the legislation and literature, the following subjects can be considered residents:

- Foreigners living in the Russian Federation with a residence permit.

- Individuals who have a permanent place of residence in the Russian Federation, including those temporarily staying outside the Russian Federation.

- Legal entities created in accordance with the canons of the Russian Federation, located in the Russian Federation.

- Organizations and enterprises that are not legal entities, established in accordance with the laws of the Russian Federation, located in the Russian Federation.

- Representative offices and branches of residents located outside the Russian Federation.

- Diplomatic and other official missions of the Russian Federation located outside the Russian Federation.

How to determine your status and calculate the number of days needed?

We have already figured out that nationality does not play any role in determining a person’s residence, since both citizens of the Russian Federation and foreigners can be both residents and non-residents. Only any continuous twelve-month period of time is taken into account, which can begin in one year and end in another. The final decision on whether a person has resident status is made at the end of the calendar year (from January to December).

The period of 183 days is calculated simply - all the days during which a person lived in the country during the above twelve months are added up. Days of entry into and exit from Russia are also counted.

Rights of representatives

The rights of residents of the Russian Federation are secured by Articles 14 and 24 of the Federal Law “On Currency Control and Currency Regulation”. These include:

- Opening without restrictions in authorized banks of accounts (deposits) in foreign currency.

- Legal entities have the right to make payments through their own accounts opened in banks outside the Russian Federation.

- Legal entities can make settlements with non-resident individuals without using accounts in real money of the Russian Federation under contracts for the individual purchase and sale of products, as well as when providing these individuals with hotel, transport and other services provided to the population on the lands of the Russian Federation.

- Legal entities can settle accounts with non-resident citizens without using accounts in foreign cash currency and Russian Federation money for servicing aircraft of overseas states at airports, foreign ships in sea and river ports, as well as when non-residents pay airport, air navigation and port dues on the lands of the Russian Federation.

- Also, legal entities can make, without using accounts in accredited banks, settlements in foreign cash currency and Russian Federation money with non-residents for servicing the aircraft of such legal entities in air hubs of foreign countries, ships of such legal entities in overseas sea and river ports, and other transport of such legal entities while they are on the lands other countries, as well as when such legal entities pay airport, air navigation, port duties and other immutable fees on the lands of foreign countries related to the operation of such legal entities.

- Legal entities can make payments in foreign currency and the currency of the Russian Federation without the use of bank accounts with resident individuals staying outside the Russian Federation, as well as branches, residences and other divisions of legal entities created in accordance with the canons of the Russian Federation, and non-resident individuals under contracts for the transportation of travelers, as well as settlements in foreign currency and money of the Russian Federation with resident (non-resident) individuals located outside the lands of the Russian Federation under agreements for the transportation of goods transported by individuals for family, private, household and other needs not related to the execution of business activities.

- Consular offices, diplomatic missions of the Russian Federation and other official representative offices of the Russian Federation located outside the Russian Federation, as well as permanent representative offices of the Russian Federation at intergovernmental or interstate organizations can make payments in real currency with employees of representative offices without using bank accounts.

- Resident legal entities of the Russian Federation can, without the use of bank accounts, make payments in foreign cash currency with non-resident individuals staying outside the Russian Federation to pay salaries to employees of consular offices, diplomatic missions of the Russian Federation and other official representative offices of the Russian Federation located outside the borders of the Russian Federation, as well as permanent missions of the Russian Federation at intergovernmental and interstate organizations, for the payment of wages to employees of the representative office of a resident legal entity located outside the lands of the Russian Federation, for the payment or reimbursement of costs associated with the sending of employees to the lands of the country where institutions, representative offices and organizations are located and beyond its borders, with the exception of the zone of the Russian Federation.

- Making payments through personal bank accounts in any foreign currency with (if necessary) a conversion transaction at the rate agreed upon with an accredited bank, regardless of the foreign currency in which the account was opened.

- The right to familiarize yourself with inspection reports performed by agents and currency audit authorities.

- The right to appeal actions (inaction) and decisions of agents and currency control authorities in the manner prescribed by law.

- The right to compensation for actual damage caused by criminal actions (inactions) of agents and currency control authorities, in the manner prescribed by law.

Taxation of residents and non-residents under personal income tax

According to the law, a single personal income tax rate is provided for all individuals in the state. For residents it is thirteen percent of earnings, for non-residents it is thirty percent. This is a very significant difference both in percentage and in the numbers obtained. Moreover, standard types of benefits are provided for tax residents of the country who are officially employed by Russian companies. For example, parents who have one or two heirs receive 1 thousand 400 rubles for each, and 3 thousand rubles for the third child and subsequent ones. The amount of calculated personal income tax is reduced by these amounts. Non-residents, despite the tax percentage being 2.3 times higher, are deprived of these concessions. Let's look at examples.

| Example No. 1 | Example No. 2 |

| Ivan Konstantinovich Sonin is a resident of Russia and earns monthly 25 thousand rubles, from which he pays 3 thousand 250 rubles in income tax. And Sergey Petrovich Varfolomeev is not a resident of the country, but works at the same enterprise and earns the same 25 thousand rubles, but already pays 7 thousand 500 rubles in personal income tax on it. The monthly difference in the tax amount for a resident and a non-resident is 4 thousand 250 rubles, for a year - 51 thousand rubles, which is very significant. | Marina Ivanovna Tropina earns 50 thousand monthly, raises two young children and has the status of a resident of the country. After the standard “children’s deduction” (1 thousand 400 rubles for the first child and the same for the second), Tropin’s taxable salary is 47 thousand 200 rubles, and the monthly tax amount is 6 thousand 136 rubles. Her colleague Irina Stepanovna Kuznetsova, without resident status, but also with two children, will pay personal income tax in the amount of 15 thousand rubles at a 30 percent rate and without tax benefits. |

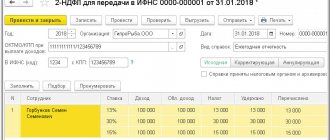

If during the reporting period a non-resident of Russia acquired resident status, the 30 percent personal income tax calculated by him will be offset. That is, from the beginning of the calendar year, income tax will be recalculated at a 13 percent rate, and the excess money will be taken into account against the next payments. If the surplus “does not fit in” at the end of the year, the employee can receive the overpayment in person by submitting to the Federal Tax Service the 3-NDFL declaration and a statement about the withheld tax fee in the excess amount.

To confirm your status, the Federal Tax Service will not ask for a large package of documents

How to confirm residency status?

To have a favorable income tax rate or to qualify for tax breaks, you need to be confident in your own status as a resident of the Russian Federation. This status must not only correspond to the required number of days of stay in the country, but also meet the criteria specific to a resident.

First of all, a resident must be an organized and law-abiding employee who regularly pays income taxes to the treasury. In case of official employment, the resident status is confirmed by a 2-NDFL certificate from the accounting department, which indicates the status of the citizen and his tax rate. Therefore, working citizens should not worry about confirming their residence.

If the payer is not a citizen of the country, or receives income independently, or is related to other categories of residents of Russia, he will have to confirm his resident status, so to speak, manually. To do this, you should go to the Federal Tax Service with a corresponding application. Although the document does not have a clear structure and format approved by law, it must reflect the following:

- details of the applicant (full name, place of residence, residential address);

- year for which proof of residence is required;

- copy of TIN;

- documents attached to the application (for example, tax deduction certificates or a photocopy of the international passport);

- contact details (phone number).

In addition to these documents, you will need to attach a photocopy of the contract with the employer confirming the person’s employment in a company operating in the country, a table where the days of continuous stay in Russia are calculated (we remind you, no less than 183 days). Documents confirming this fact may be extracts from the labor log, employee time sheets, or a certificate from the workplace certified by the human resources department.

A specific list of papers by which the period of stay of a citizen in the country and outside it is established is not officially approved by law. Therefore, you can use any documents: passport and international passport, diplomatic documents, migration card, employee ID cards, etc. The only document that can confirm resident status under the law is a tax certificate. Specialists may consider an application for status confirmation within forty days.

Video - Personal income tax on non-resident income

Determining the period of stay in the Russian Federation

The length of stay of individuals in Russia (more or less than 183 days) is calculated from the moment of entry into the country until the day of departure, inclusive. If a person travels abroad, the period will be interrupted. But, only if it is not a short-term foreign trip of up to 6 months for the purpose of training or due to illness to undergo a course of therapy.

According to current legislation, at the moment there is no specific list of documents that would help determine the length of a person’s stay in the Russian Federation. Therefore, this period is determined by studying the marks that border guards place at the border upon entry and exit. They are found in documents such as a migration card or international passport.

Let's sum it up

Persons who permanently reside in Russia, work officially, obediently pay taxes and travel abroad only on vacation do not have to worry about the safety of their residency status. Doubts may arise among people who actively move from country to country and spend a significant amount of time away from home. To maintain a favorable tax rate and the opportunity to take advantage of tax benefits, they should carefully count the number of days they lived in Russia. We have already found out that there should be more than 183.

When it turns out that maintaining or obtaining residency status requires you to stay in the country a little longer than you would like, it may make sense to do so. If the days spent in the country fall significantly short of the required number, there is nothing left to do except come to terms with the situation of a non-resident.

Can a non-resident individual transfer money to the account of a legal entity?

By law, cash can be credited to an organization’s current account only from another organization. This means that the person who deposits money through the cash register must be an executive of the company. In this case, he will have sufficient rights to carry out the operation. If a non-resident is an authorized representative of an organization, then he also has the right to transfer funds through the cash desk of a banking institution to the organization’s current account.

Speaking about settlement transactions with third parties, legal entities can carry them out in accordance with the law of the Russian Federation in non-cash or cash form. But, Article 14 of Federal Law No. 173 states that payments between legal entities, non-residents and residents can only be made in non-cash form.