UTII is a preferential tax regime for small businesses. A single tax on imputed income is applied only to certain types of activities, however, many LLCs opt for it.

The popularity of UTII is explained by the relatively low tax burden. The fact is that the tax here is not on actually received income, but on imputed income, i.e. supposed. Often the imputed income is much lower than the real one, so payers of this regime receive tangible benefits.

To decide whether it is worth switching to UTII in your case, you need to know what amounts you will have to pay. And to do this, you need to understand the procedure for calculating tax, which is quite complicated.

Payers of UTII

The transition to paying a single tax is carried out by entrepreneurs voluntarily, subject to the following conditions:

- organizations and individual entrepreneurs registered as single tax payers with the tax authority within the prescribed period;

- the UTII taxation system has been introduced in the prescribed manner on the territory of the municipality where business activities are carried out;

- in the local regulatory legal act on UTII, among the types of business activities subject to this tax, the type of business activity being carried out is indicated.

The use of UTII exempts taxpayers from paying a number of taxes, in particular, organizations on UTII do not pay profit tax, VAT (except for “import”), and property tax. Individual entrepreneurs are exempt from paying personal income tax (on income received from activities subject to UTII), property tax for individuals (in relation to property used in activities subject to UTII), and VAT.

The list of types of activities in respect of which representative bodies have the right to decide on the introduction of UTII is indicated in paragraph 2 of Art. 346.26 Tax Code of the Russian Federation.

These include household and veterinary services, repair services, maintenance and washing of vehicles, retail trade, catering, distribution and (or) placement of outdoor advertising, etc.

This might also be useful:

- Pros and cons of the simplified tax system and UTII in comparison

- Changes in UTII for individual entrepreneurs in 2021

- UTII for individual entrepreneurs in 2021

- How much taxes does an individual entrepreneur pay in 2021?

- Fixed payments for individual entrepreneurs in 2021 for themselves

- What taxes does the individual entrepreneur pay?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Procedure for calculating UTII

The calculation of the single tax is simple and is carried out on the basis of the standard indicators established by the Tax Code of the Russian Federation.

The tax base for calculating the single tax is imputed, i.e. potential income of the taxpayer UTII. Thus, the tax is calculated on the basis of imputed and not actually received income.

The tax base is calculated as the product of the basic profitability for a certain type of business activity, calculated for the tax period, and the value of the physical indicator characterizing this type of activity (clause 2 of Article 346.29 of the Tax Code of the Russian Federation).

In this case, the basic profitability is adjusted (decreased or increased) by coefficients K1 and K2 (clause 4 of Article 346.29 of the Tax Code of the Russian Federation).

The formula for calculating the tax base is as follows:

NB = DB x K1 x K2 x (FP1 + FP2 + FP3),

where NB is the tax base;

BD – basic profitability established for a specific type of business activity;

K1 – deflator coefficient;

K2 – correction factor;

FP1, FP2, FP3 – values of the physical indicator established for each type of activity in the first, second and third months of the quarter, respectively.

Is it possible to see the income of an individual entrepreneur somewhere?

How to calculate UTII for individual entrepreneurs - tax calculation formula

There are several official documents that confirm the main income of entrepreneurs:

- tax return;

- income certificate.

Note! In most cases, confirmation of information is the right and responsibility of the tax service. After all, it is to the territorial offices of this body that all documents confirming such information are submitted.

The following sources of information are available to outsiders:

- sales receipts;

- invoices;

- contracts;

- bank statements and invoices.

Calculations

But this is only proof that the taxpayer performed a particular transaction and received revenue.

Note! Usually requests are made with the participation of representatives of the bailiff service.

They, in turn, may require additional verification of the entrepreneur’s income. He presents all official documents containing relevant information.

Physical indicators and basic UTII profitability

Next, let's take a closer look at the above indicators.

The values of basic profitability and physical indicator are determined for each specific type of business activity and approved by the norms of Article 346.29 of the Tax Code of the Russian Federation.

| Types of business activities | Physical indicators | Basic income per month (rubles) |

| 1 | 2 | 3 |

| Provision of household services | Number of employees, including individual entrepreneurs | 7 500 |

| Provision of veterinary services | Number of employees, including individual entrepreneurs | 7 500 |

| Providing repair, maintenance and washing services for motor vehicles | Number of employees, including individual entrepreneurs | 12 000 |

| Provision of services for the provision of temporary possession (for use) of parking spaces for motor vehicles, as well as for the storage of motor vehicles in paid parking lots | Total parking area (in square meters) | 50 |

| Provision of motor transport services for the transportation of goods | Number of vehicles used to transport goods | 6 000 |

| Provision of motor transport services for the transportation of passengers | Number of seats | 1 500 |

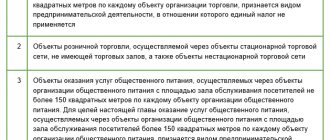

| Retail trade carried out through stationary retail chain facilities with trading floors | Sales area (in square meters) | 1 800 |

| Retail trade carried out through facilities of a stationary retail chain that do not have sales floors, as well as through facilities of a non-stationary retail chain, the area of the retail space in which does not exceed 5 square meters | Number of retail places | 9 000 |

| Retail trade carried out through stationary retail chain facilities that do not have trading floors, as well as through non-stationary retail chain facilities with a retail space exceeding 5 square meters | Area of retail space (in square meters) | 1 800 |

| Delivery and distribution retail trade | Number of employees, including individual entrepreneurs | 4 500 |

| Sales of goods using vending machines | Number of vending machines | 4 500 |

| Provision of public catering services through a public catering facility with a customer service hall | Area of the visitor service hall (in square meters) | 1 000 |

| Provision of public catering services through a public catering facility that does not have a customer service hall | Number of employees, including individual entrepreneurs | 4 500 |

| Distribution of outdoor advertising using advertising structures (except for advertising structures with automatic image changes and electronic displays) | Area intended for printing (in square meters) | 3 000 |

| Distribution of outdoor advertising using advertising structures with automatic image changes | Exposure surface area (in square meters) | 4 000 |

| Distribution of outdoor advertising using electronic signs | Light emitting surface area (in square meters) | 5 000 |

| Advertising using external and internal surfaces of vehicles | Number of vehicles used for advertising | 10 000 |

| Provision of temporary accommodation and accommodation services | Total area of premises for temporary accommodation and living (in square meters) | 1 000 |

| Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each they do not exceed 5 square meters | Number of trading places, non-stationary retail chain facilities, and public catering facilities transferred for temporary possession and (or) use | 6 000 |

| Provision of services for the transfer for temporary possession and (or) use of retail spaces located in facilities of a stationary retail chain that do not have trading floors, facilities of a non-stationary retail chain, as well as public catering facilities that do not have customer service halls, if the area of each exceeds 5 square meters | Area of a retail space, a non-stationary retail chain facility, or a public catering facility transferred for temporary possession and (or) use (in square meters) | 1 200 |

| Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot does not exceed 10 square meters | Number of land plots transferred for temporary possession and (or) use | 10 000 |

| Provision of services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail chain facilities, as well as public catering facilities, if the area of the land plot exceeds 10 square meters | Area of land transferred for temporary possession and (or) use (in square meters) | 1 000 |

Correction factors K1 and K2

Coefficients K1 and K2 allow you to adjust the basic profitability taking into account the influence of various external conditions (factors) on the amount of income received.

K1 is a deflator coefficient established by federal legislation for the calendar year. It is determined annually by the Ministry of Economic Development of Russia and published no later than November 20 of the year in which deflator coefficients are established. Its value corresponds to the indexation of consumer prices for various categories of goods and services.

UTII Coefficient K1 for 2021 is 1.915

K2 – adjustment coefficient of basic profitability, established by local legislation and taking into account the totality of features of doing business (list of goods, services, other features).

Calculation formula and payment of UTII

The single tax is calculated based on the results of the tax period using the following formula:

UTII = (Tax base * Tax rate) – Insurance Contributions.

The UTII rate is the same for all types of activities and all territories – 15%.

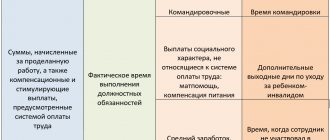

UTII taxpayers have the right to reduce the amount of tax calculated for the tax period by the amounts of payments (contributions) and benefits that were paid in favor of employees employed in those areas of the taxpayer’s activity for which a single tax is paid (Article 346.32 of the Tax Code of the Russian Federation).

If there are employees, it is possible to reduce the UTII tax on insurance premiums paid, but not more than 50 percent of the calculated tax amount.

Individual entrepreneurs working without employees (do not make payments or other remuneration to individuals) can reduce the amount of the single tax by the entire amount of fixed insurance contributions paid to the Pension Fund and Compulsory Medical Insurance in the reporting period (without applying the 50% limit). The resulting tax amount payable in this case cannot be less than 0.

The tax period for UTII is a quarter (Article 346.30 of the Tax Code of the Russian Federation).

This means that it is necessary to calculate and pay tax to the budget at the place of registration with the tax authority as a UTII taxpayer at the end of each quarter no later than the 25th day of the first month of the next tax period.

In the payment order for the transfer of tax, you must indicate the budget classification code (BCC).

Results

By observing the conditions specified in the article for reducing the tax on the amount of insurance premiums, taxpayers on UTII have the opportunity to reduce the tax burden.

Our online calculator will help you correctly calculate UTII.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation of November 15, 2017 N 1378

- Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”

- Federal Law of December 31, 2017 N 484-FZ “On insurance tariffs for compulsory social insurance against accidents at work and occupational diseases for 2021 and for the planning period of 2021 and 2021”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Examples of calculations of the single tax on imputed income

Below are tax calculations for different types of activities.

An example of calculating UTII for the transportation of goods

The organization operates to provide motor transport services for the transportation of goods by 3 vehicles.

| Business activity code | 05 |

| Basic income per month (RUB) | 6000 |

| The value of the physical indicator (number of vehicles used to transport goods) | 3 |

| K1 coefficient for 2021 | 1,868 |

| K2 coefficient | 1,0 |

| Paid insurance premiums for employees | 27 000 |

Tax base for the month = DB*FP*K1*K2= 6,000 rubles. x 3 mash. x 1,868 x 1= 33,624 rub.

Tax base for the quarter = RUB 33,624. x 3 months = 100,872 rub.

UTII for the quarter = 100,872*15% = 15,131 rubles.

The amount of insurance premiums paid in the reporting period for employees engaged in business activities for which a single tax is paid amounted to 27,000 rubles. Thus, the calculated single tax can be reduced by insurance premiums paid, but not less than 50% of the total tax amount.

The amount of contributions by which UTII can be reduced for the quarter was 7,565 rubles. (RUB 15,131 x 50% < RUB 27,000).

Thus, the amount of UTII payable for the quarter will be 7,565 rubles. (RUB 15,131 – RUB 7,565).

If an organization registered as a UTII payer on the 10th day of the second month of the quarter, then the tax base for the quarter will be calculated as follows:

- 1 month of the quarter – 0 rub.;

- 2nd month of the quarter – 23,537 rubles. (RUB 6,000 x 3 cars x 1,868 x 1/30 days x 21 days);

- 3rd month of the quarter – RUB 33,624. (RUB 6,000 x 3 cars x 1,868 x 1/31 days x 31 days).

Business income is revenue or profit

How to calculate income over 300,000 individual entrepreneurs on UTII and simplified tax system - what tax is paid

Example. The store received 60 thousand rubles in a month. through the sale of products. A common mistake is when the entire number is considered the profit of the individual entrepreneur. To determine profit, you need to subtract the main expense items from income.

About income based on a patent

Here are just a few of the acceptable items that are deducted:

- interest on a loan for commercial equipment;

- transport services and communications, stationery, cash register services;

- employees' salaries;

- taxes;

- rental of retail premises;

- purchase price of goods. They are important for those who are interested in how to calculate the income of an individual entrepreneur.

Note! Income is the funds received by the entrepreneur, which he can spend in the future at his own discretion. Profit is the balance of money minus expenses. You can analyze the activities of an enterprise to determine both income and profit and predict them for the future.