Salary

Denis Pokshan

Expert in taxes, accounting and personnel records

Current as of January 31, 2020

How is payment for employee treatment at the expense of the company taken into account in 2020? Are these amounts subject to personal income tax and insurance premiums? Does the current tax legislation allow such expenses to be included in the tax base for income tax and in the calculation of the single tax when applying the simplified taxation system? We will answer these and other questions about paying for an employee’s treatment at the expense of the company in the material.

Conditions for the benefit

Amounts paid by employers for the provision of medical services to their employees are not subject to personal income tax if they are transferred from funds remaining with the organization after paying income tax.

The source of payment is the first condition for exempting such income from personal income tax. In addition, to be exempt from personal income tax, it is necessary to comply with the conditions for paying expenses.

Let's return to the norm of the Tax Code of the Russian Federation. Although it may not be obvious, the deciding factor for the exemption is that the medical services must be paid for by the employer. The medical institution must receive company funds allocated specifically for medical services. The financiers also spoke about this in the letter dated December 3, 2018 No. 03-04-05/87037, which is referenced in the commented letter.

Taxation of health resort vouchers for employees under OSNO and simplified tax system

It is allowed to count expenses as expenses for income tax and the simplified tax system only if the specified conditions and requirements are met. Any other types of payment for sanatorium-resort treatment, recreation, tourism and health improvement for employees and members of their families are not taken into account for tax purposes.

All company expenses must be documented. The Federal Tax Service has the right to request documents for a desk audit. If the documentation is not provided, the tax authorities will impose a fine of 200 rubles for each document not provided. And most importantly, preferential taxation of expenses for sanatorium-resort treatment is recognized as unfounded, and an additional tax and fine of up to 40% of the unpaid amount will be assessed.

IMPORTANT!

Payment for sanatorium-resort treatment to an employee with a simplified tax system of 6% (income) cannot be taken into account as expenses. The 6% simplified tax system tax regime does not provide for a reduction in the amount of income by the amount of actual costs of an economic entity.

Compensation is a violation

The Tax Code of the Russian Federation does not provide for such a form of payment for medical services as compensation to an employee for expenses incurred for medical purposes. That is, the company must either transfer money to the medical institution in a non-cash manner, or give it to the employee from the cash register or transfer it to a card. And the employee must pay the medical institution with the money received. If this procedure is followed, there is no need to pay personal income tax. That is, if the listed conditions are met, amounts of payment for medical services for employees are exempt from personal income tax. Otherwise, such income is subject to personal income tax in accordance with the general procedure.

Insurance premiums

If the employer pays for the trip for the employee himself, then insurance premiums for sanatorium treatment will have to be calculated. Tariffs for calculation are general, that is, those that the organization applies to employee salaries. In relation to vouchers purchased for close relatives of subordinates, insurance coverage is not required.

The opinions of the courts on this matter differ from the position of the tax authorities. Judges recognize such company expenses as not subject to insurance premiums (Resolution of the Arbitration Court of the North-Western District dated June 20, 2017 No. F07-5516/2017, Determination of the Supreme Court of the Russian Federation dated November 3, 2017 No. 309-KG17-15716). Representatives of the judicial system justified their position with the provisions of the ineffective law No. 212-FZ. Tax officials, citing the fact that Law No. 212-FZ has lost force, consider the position to be unlawful (Letter No. BS-4-11 dated September 14, 2017 / [email protected] ). Therefore, you will have to pay insurance premiums. Or prove your position in court.

How to replace compensation

The Tax Code of the Russian Federation also provides for the exemption from personal income tax for income not exceeding 4,000 rubles per tax period in the form of amounts of material assistance to employees (clause 28 of Article 217 of the Tax Code of the Russian Federation). Financial assistance can be provided if the employee pays for his own treatment.

Financial assistance is exempt from taxation, regardless of the basis and sources of its payment.

But an amount exceeding 4,000 rubles is subject to personal income tax. And this is still better than withholding tax on the entire compensation amount. Insurance premiums will also have to be charged on the excess amount. Example.

Calculation of compensation for the cost of treatment in the form of financial assistance A company employee, having been discharged from the hospital, wrote an application to the accounting department with a request to reimburse him for the cost of treatment.

He paid 7,000 rubles from his own funds on the clinic’s account. The company decided to reimburse the employee for this amount, but only in the form of financial assistance. To do this, the employee was asked to rewrite the application for reimbursement of medical expenses with a request for financial assistance. The company pays contributions for insurance against industrial accidents and occupational diseases at a rate of 3.1%, and mandatory insurance contributions at a general rate of 30%. The accountant will make entries: Debit 91-2 Credit 70

- 7000 rub.

– financial assistance has been accrued to the employee; Debit 91-2 Credit 69-1-2

– 93 rub.

((RUB 7,000 – RUB 4,000) × 3.1%) – contributions for insurance against accidents and occupational diseases are assessed for an amount of financial assistance exceeding 4,000 rubles; Debit 91-2 Credit 69-1-1

– 900 rub.

((7000 rubles – 4000 rubles) × 30%) – insurance premiums are charged for the amount of financial assistance exceeding 4000 rubles; Debit 70 Credit 68, subaccount Personal income tax payments

– 390 rubles.

((RUB 7,000 – RUB 4,000) × 13%) – personal income tax is withheld from the amount of financial assistance exceeding RUB 4,000; Debit 70 Credit 51

– 6610 rub. (7000 – 390) – financial assistance is transferred to the employee.

Reimbursement for employee expenses for medical services: taxation features

An employee of an LLC (general taxation system) was provided with medical diagnostic services by a medical institution. The employee has an agreement with a medical institution, a receipt, a check. The LLC did not enter into an agreement with the medical institution. Can an LLC reimburse an employee for these expenses (a collective or employment agreement does not contain such a condition)? What taxes and insurance premiums must be paid on such compensation?

Having considered the issue, we came to the following conclusion:

Organizational expenses for treatment (medical services) made in favor of employees are not taken into account for profit tax purposes.

An employee’s income resulting from the payment of compensation to him for amounts spent on treatment, remaining at the disposal of the organization after paying income tax, is not subject to personal income tax.

Payment for treatment and medical care of employees must be included by the employer in the base for insurance premiums and contributions from NS and PP.

Rationale for the conclusion:

Personal income tax

According to paragraph 1 of Art. 210 of the Tax Code of the Russian Federation, when determining the tax base for personal income tax (NDFL), all income of the taxpayer received by him both in cash and in kind, or the right to dispose of which he has acquired, as well as income in the form of material benefits, are taken into account. determined in accordance with Art. 212 of the Tax Code of the Russian Federation.

Based on paragraphs. 1 item 2 art. 211 of the Tax Code of the Russian Federation, income received by a taxpayer in kind, in particular, includes payment (in whole or in part) for it by organizations or individual entrepreneurs for goods (work, services) or property rights, including services provided in the interests of the taxpayer on a free basis ( in the situation under consideration - medical services).

At the same time Art. 217 of the Tax Code of the Russian Federation establishes a list of income that is not subject to taxation (exempt from taxation). So, in accordance with paragraph 10 of Art. 217 of the Tax Code of the Russian Federation are not subject to personal income tax on amounts paid by employers for the provision of medical services to their employees, their spouses, parents, children (including adopted children), wards under the age of 18, as well as their former employees who resigned due to retirement due to disability or old age, and remaining at the disposal of employers after payment of corporate income tax. Such income is exempt from personal income tax, including in the case of issuing cash intended for these purposes directly to the taxpayer (members of his family, parents, legal representatives) or crediting funds intended for these purposes to taxpayers’ bank accounts.

Thus, one of the main conditions for the exemption of such income from taxation is that payment for treatment and medical care must be made from the funds remaining after paying income tax (letter of the Ministry of Finance of Russia dated August 13, 2012 N 03-04-06/6- 237, dated 07/02/2012 N 03-04-06/6-1911, dated 04/16/2012 N 03-04-06/6-115, dated 03/31/2011 N 03-03-06/1/196, dated 21.03. 2011 N 03-04-06/9-47, dated 03/05/2005 N 03-03-01-04/1/100).

Corporate income tax

According to paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, for the purposes of Chapter 25 of the Tax Code of the Russian Federation, the taxpayer reduces the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of the Tax Code of the Russian Federation).

Expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation, losses) incurred (incurred) by the taxpayer.

Article 255 of the Tax Code of the Russian Federation establishes that the taxpayer’s expenses for wages include any accruals to employees in cash and (or) in kind, incentive accruals and allowances, compensation accruals related to working hours or working conditions, bonuses and one-time incentive accruals, expenses, related to the maintenance of these workers, provided for by the norms of the legislation of the Russian Federation, labor agreements (contracts) and (or) collective agreements.

At the same time, the list of expenses established by Art. 255 of the Tax Code of the Russian Federation, is open, because on the basis of clause 25 of Art. 255 of the Tax Code of the Russian Federation, any payments to employees that are specified in an employment or collective agreement can be taken into account under this article, with the exception of those expenses that are prohibited from being taken into account when taxing profits, Art. 270 Tax Code of the Russian Federation.

However, even if any payments are provided for by a collective agreement or employment contract, such payments do not reduce the tax base for income tax if they relate to the expenses listed in paragraph 23 and paragraph 29 of Art. 270 Tax Code of the Russian Federation.

So, on the basis of clause 23 of Art. 270 of the Tax Code of the Russian Federation, when determining the tax base for income tax, expenses in the form of amounts of material assistance to employees are not taken into account. According to the definition of the Supreme Arbitration Court of the Russian Federation dated August 20, 2010 N VAS-4350/10, under material assistance falling under clause 23 of Art. 270 of the Tax Code of the Russian Federation, payment is understood to be:

- not related to the recipient’s performance of a labor function;

- aimed at satisfying social needs caused by the emergence of a difficult life situation or the occurrence of a certain event (for example, harm due to a natural disaster or other emergency, illness of a family member, birth or adoption of a child, serious illness, etc.).

According to paragraph 29 of Art. 270 of the Tax Code of the Russian Federation, expenses not taken into account for income tax purposes include expenses for payment for vouchers for treatment or recreation, excursions or travel, classes in sports sections, clubs or clubs, visits to cultural, entertainment or physical education (sports) events, subscriptions, not related to subscriptions to regulatory, technical and other literature used for production purposes, and to payment for goods for personal consumption of employees, as well as other similar expenses made in favor of employees.

If the organization’s expenses in the form of reimbursement of the employee’s expenses when providing him with paid medical services are of a social nature and are made for the benefit of the employee, they are not taken into account for profit tax purposes, regardless of whether they are provided for in an employment or collective agreement (see, for example, letters from the Department of Tax Administration for Moscow dated 02/04/2003 N 28-11/6901, Ministry of Finance of Russia dated 08/24/2012 N 03-03-06/4/87, dated 02/16/2012 N 03-03-06/4/8, dated 02/22/2011 N 03-03-06/4/12, dated December 23, 2004 N 03-03-01-04/1/185, resolution of the Federal Antimonopoly Service of the East Siberian District dated January 19, 2010 N A19-15653/08).

Insurance premiums

Insurance contributions to the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund of the Russian Federation are levied, in particular, on payments and other remunerations accrued in favor of individuals within the framework of labor relations and civil contracts, the subject of which is the performance of work, the provision of services (Part 1 of Article 7 of the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” (hereinafter referred to as Law N 212-FZ)).

In this situation, your organization’s obligation to reimburse the employee for the costs of diagnostic medical services is not specified in the employment contract. Nevertheless, such a payment can be considered made within the framework of the employment relationship (after all, it will be made to the employee in connection with the work in your organization).

The basis for calculating insurance premiums for organizations is the amount of payments and other remunerations provided for in Part 1 of Art. 7 of Law N 212-FZ, accrued by payers of insurance premiums for the billing period in favor of individuals, with the exception of the amounts specified in Art. 9 of Law No. 212-FZ (Part 1 of Article 8 of Law No. 212-FZ).

Article 9 of Law N 212-FZ does not include reimbursement of employee expenses for paid medical services as amounts not subject to insurance premiums. Consequently, the payment in question is recognized as subject to insurance premiums, even if these expenses are not included in the calculation of income tax (letter of the Ministry of Health and Social Development of Russia dated March 16, 2010 N 589-19).

A similar approach, in our opinion, should be applied when deciding whether it is necessary to charge contributions for compulsory social insurance against accidents and industrial diseases (hereinafter referred to as contributions from NS and PP) from the payments under consideration. In other words, the amount of reimbursement to an employee for the costs of medical diagnostic services is subject to contributions from the NS and PZ (clauses 1, 2, Article 20.1, Article 20.2 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents”) cases at work and occupational diseases" (hereinafter referred to as Law N 125-FZ)).

This position on the taxation of the payments under consideration with insurance premiums and contributions from NS and PP is also shared by specialists from official bodies (see, for example, letter of the Federal Social Insurance Fund of the Russian Federation dated November 17, 2011 N 14-03-11/08-13985, paragraph 1 of the letter of the Ministry of Health and Social Development of Russia dated 06.08 .2010 N 2538-19).

We recommend that you additionally familiarize yourself with the following materials:

— Encyclopedia of solutions. Personal income tax on payments by employers for treatment and medical care of their employees;

— Encyclopedia of solutions. Accounting for employer payments for medical services for employees and members of their families.

Answer prepared by: Expert of the Legal Consulting Service GARANT Olga Volkova

Tax deduction for treatment

You can take advantage of the social tax deduction for treatment and get part of your expenses back in the following cases.

- You can receive a tax deduction when paying for medical services if you paid for services for your own treatment or treatment of immediate relatives (spouses, parents, children under 18 years old) provided by medical institutions in Russia; paid services are included in a special list of medical services for which a deduction is provided (the list of services is defined in Decree of the Government of the Russian Federation dated March 19, 2001 No. 201); the treatment was carried out in a medical institution licensed to carry out medical activities, or by individual entrepreneurs carrying out medical activities.

- You can receive a tax deduction when paying for medicines if you paid at your own expense for medicines for yourself or your immediate family (spouse, parents, children under 18 years of age) prescribed by your doctor; paid for medications are included in a special list of medications for which deductions are provided (this list of medications is defined in Decree of the Government of the Russian Federation dated March 19, 2001 No. 201).

- You can receive a tax deduction when paying for voluntary health insurance if you have paid insurance premiums under a voluntary health insurance agreement or insurance for immediate relatives (spouse, parents, children under 18 years of age); the insurance contract only provides for payment for treatment services; the insurance organization with which the voluntary insurance agreement has been concluded has a license to conduct the corresponding type of activity.

The Ministry of Finance of Russia noted that for sanatorium-resort treatment, the specified tax deduction can be provided to the taxpayer for part of the cost of the voucher, which corresponds to the costs of medical services included in its price, as well as for the amount of payment for medical services not included in the cost of the voucher, if payment at the expense of the taxpayer.

The taxpayer has the right to return up to 13 percent of the cost of paid treatment, but not more than 15,600 rubles. This is due to the restriction on the maximum deduction amount of 120,000 rubles (120,000 rubles × 13% = 15,600 rubles).

Expert “NA” S.M. Lvovsky

What can be included in costs

The composition of costs that are included in the tax benefit is limited. But in addition to treatment, additional services can be included in the package.

Expenses taken into account for tax purposes:

- Treatment and wellness services.

- Accommodation, food, recreation.

- Travel to and from the place of health improvement, recreation or tourism.

- Excursion programs and services.

IMPORTANT!

All types of expenses must be clearly specified in the contract with the tour operator. Otherwise, it will not be possible to offset the costs. For example, if an employee purchased excursions on his own, then no one is obliged to compensate him for these amounts.

Can an employer force an employee to take a test?

As Yulia Kholodionova explains, if an employee is not included in the list of persons and does not work in areas for which testing is mandatory due to the possibility of infecting other citizens, then such requirements are illegal.

If you suddenly received a salary less than usual and realized that the missing amount was deducted from your earnings for conducting a test, or you are not allowed to work at all without being given time off, then you have every right to resolve the current conflict situation by contacting the Labor Inspectorate or the Prosecutor's Office or court.

Please note that even the presence of confirmed cases of coronavirus infection on the employer’s premises is not grounds for forcing other employees to take the test, with the exception of some of the cases described above.

How is payment processed?

As a rule, the employee first makes a written request, attaching to the application copies of documents confirming the need for treatment expenses. The legislation does not contain a strict list of them; these may include:

- extract from the medical history;

- prescription from the attending physician;

- bills for medical services;

- receipts for the purchase of medicines, etc.

After receiving the documents, the manager reviews the request, after which he either refuses to assign financial assistance or gives an order for its execution. An order is issued and sent to the accounting department. Next, the accounting department makes a payment in the amount specified in the order.

If desired, the manager can decide to allocate funds on his own initiative - without the employee’s application, however, in this case it will be difficult to confirm that the payment is targeted.

What to do to receive payment

The law clearly states how sanatorium-resort treatment at work is paid for. In order for an employee to receive it at the expense of the company, the employer must enter into a formal agreement with a travel agent (or tour operator).

Compensation for sanatorium-resort treatment by the employer in 2021 is not provided for by law. That is, you cannot buy a ticket yourself and go to the employer for compensation.

| Employer's actions | Allowed or not allowed by law |

| Conclude an agreement with a travel agent (tour operator) for sanatorium treatment of an employee. | Can. These costs are legally written off as expenses. |

| Compensate the employee for the costs of a trip that he independently issued for himself or his relatives. | It is forbidden. The law does not provide tax breaks for such situations. |

| Allocate money to the employee to independently purchase a trip for himself or his family. | It is forbidden. The law does not provide tax breaks for such situations. |

Who can receive financial assistance

The possibility of allocating funds to employees to purchase medications or pay for medical services may be provided for in a collective agreement or other local document of the organization. More often, the payment is assigned by order of the head of the company.

Not only currently employed people, but also former employees can receive financial assistance from their employer for treatment. Funds may also be needed for treatment of the employee’s family members. The decision about who should be helped and in what amount is made by the company's management, based on the current financial condition.

Issue dated September 16, 2021

Syromitsky Alexey Valerievich (03/30/2012 at 08:28:35)

Good afternoon The topic of paying the amount due to an employee who was injured while performing his work duties requires a special approach to the matter. It is not clear why the employer is removed from his duties, because the amounts paid by him to reimburse expenses are compensated from the Social Insurance Fund. If your injury is recognized as an industrial injury, the commission draws up Act N-1, and a labor inspector is required to be included in the commission. The commission determines the degree of guilt of the victim based on witness testimony, studying the nature of the injury, examination results and details of the incident. If, for example, you violated safety regulations, your chances of receiving treatment compensation from your employer are greatly reduced. Everything must be recorded and recorded. To obtain the compensation you are entitled to, you may need to prove a cause-and-effect relationship between your work-related actions and the harm that occurred to your body. To prove this connection, you will need a doctor's report. If the injury is severe and requires surgery, ask your doctor to also confirm that the surgery is related to the work-related injury. Otherwise, your employer may refuse to pay you for all of your medical expenses. In general, in all acts, protocols, conclusions it should be clear that the employer is completely to blame, then you will not have to prove anything. In accordance with Law No. 125-FZ, in the event of harm to the life and health of an employee during the performance of his work duties, he is compensated for the harm caused (Article 220 of the Labor Code of the Russian Federation). The victim is paid lost earnings and rehabilitation expenses (Article 184 of the Labor Code of the Russian Federation). The legislation provides for the following types of insurance coverage (Article 8 of Law No. 125-FZ): - temporary disability benefits due to an industrial accident; — one-time insurance payment; — monthly insurance payment; — payment of additional expenses associated with the medical, social and professional rehabilitation of the insured (including payment for vacation in addition to the annual basic one for the entire period of treatment and travel to the place of treatment and back). In addition to mandatory payments, the company has the right to provide other compensation or payments in a larger volume, if this is specified in the agreement. If the organization has signed this agreement, then it is obliged to pay increased security to employees. Additional compensation and payments can be provided for in the collective agreement. One-time and monthly insurance payments are paid directly by the FSS of the Russian Federation. The amount of these insurance payments is determined in accordance with the degree of loss of professional ability to work based on the maximum amount established by Law N 292-FZ (Article 10 and paragraph 1 of Article 11 of Law N 125-FZ). In 2010, the maximum size of a one-time insurance payment is 64,400 rubles. (Clause 1, Article 7 of Law No. 292-FZ). List of documents required to assign such insurance payments: - report on an industrial accident (court decision, if the fact of an industrial accident is established in court); — a medical report on the extent of the victim’s loss of professional ability and his need for medical, social and professional rehabilitation; — certificate of earnings (income) of the victim; — a certificate about the period of payment to the victim of temporary disability benefits in connection with an industrial accident; — employment contract, etc. Payment of additional expenses. Rehabilitation of the victim is carried out entirely at the expense of the Social Insurance Fund of the Russian Federation (the insurer). — for treatment of the insured immediately after an accident; — purchase of medicines, medical products and personal care; — provision of technical and transport means in the presence of appropriate medical indications; — vocational training (retraining), etc. Compensation for moral damage. Compensation to the injured employee for moral damage caused in connection with an industrial accident is carried out by the employer. The amount of compensation is determined by the court!!! (Clause 2 of Article 1101 of the Civil Code of the Russian Federation).

Which test should employees take? Smear or blood test for antibodies?

Let's figure it out: a smear (PCR test - polymerase chain reaction) and donating blood from a vein for antibodies (ELISA - enzyme-linked immunosorbent test for blood) are different tests. If in the first case we are talking about taking a test for coronavirus, then in the second - for antibodies, the presence of which implies the theoretical impossibility of re-infection.

“The first test is taken when the first signs of the disease appear, and it must be taken at certain intervals, and results take up to seven days. If there is a positive test result, it is necessary to take a second test, and if it is also positive, the employee will have to self-isolate for two weeks.

Citizens who have been in contact with coronavirus patients are required to take one test. And those who have a positive result need to be tested for the virus two more times, otherwise the attending physician “will not close the hospital,” Kholodionova clarified.

After receiving the third test, negative, based on a medical report, the employee is considered healthy, and only after that can he go to donate blood for antibodies. It is important to know that this analysis is done at the request of the patient, and the employer has no right to force it! There are cases when organizations issue special orders regarding mandatory blood donation for antibodies. This requirement of a local nature is outside the legal framework and is not subject to enforcement as it worsens the situation of workers in comparison with the current norms of labor legislation.

Documents for refund

In order for the employer to transfer compensation for the completed medical examination, you need to submit an application to him. The application is drawn up in any order and contains the following information:

- Full name of the manager to whose address it is submitted;

- name of the employing company;

- Full name of the applicant employee and his position;

- document title : “Application”;

- essence of the request : to pay compensation for the costs of a medical examination;

- amount of compensation;

- date of application;

- applicant's signature with transcript.

A sample application for payment of compensation for the applicant undergoing a medical examination can be downloaded here.

The following must be attached to the return application:

- previously received referral for examination;

- original payment document (sales or cash receipt), indicating payment for medical services;

- conclusion of the medical commission (or medical book and certificate in form 086);

- work book (usually it is already kept by the employer).

The company's secretariat, human resources department or accounting department may be responsible for receiving and processing such applications.

Who is eligible to apply for a ticket?

The law stipulates the circle of persons entitled to apply for a voucher:

- directly an employee of the enterprise;

- his spouse;

- employee's parents;

- his children (natural and adopted) are not older than 18 years old or not older than 24 years old if they are studying full-time in educational organizations;

- persons under 18 years of age who are under the care of an employee;

- former wards of an employee (after termination of guardianship, trusteeship) under the age of 24, if they are studying full-time in educational organizations.

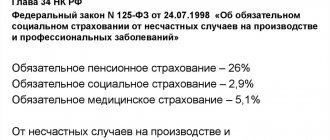

Contributions to state extra-budgetary funds

According to Part 1 of Art. 7 of the Federal Law of July 24, 2009 N 212-FZ, the object of taxation of insurance contributions to the Pension Fund of the Russian Federation, the Federal Social Insurance Fund of the Russian Federation, the Federal Compulsory Compulsory Medical Insurance Fund and the Federal Compulsory Compulsory Medical Insurance Fund are payments and other remunerations accrued in favor of individuals:

- within the framework of labor relations and civil contracts, the subject of which is the performance of work, the provision of services (with the exception of remunerations paid to self-employed persons - entrepreneurs, lawyers, notaries);

- under copyright contracts, contracts on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art.

For organizations that pay insurance contributions, the object of taxation of contributions is also recognized as payments accrued in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance.

When an organization compensates for part of an employee’s treatment, it makes a payment in favor of the employee, essentially providing him with financial assistance.

As a general rule (p.

Can a test be required for employment?

Article 65 of the Labor Code of the Russian Federation contains a clear list of documents and certificates that are required when applying for a job. In addition to the standard passport, work book, tax identification number and some others, you may be asked to provide a certificate of health, but there is definitely no clause about a document confirming the absence of COVID-19 or the presence of antibodies to the virus.

In theory, such confirmation may be required for workers in education, medicine, public catering and transport, and some others. However, here there is no direct requirement to provide a certificate of absence of COVID-19. Be healthy!