Loans between related parties are common transactions, which, however, does not exempt them from tax risks. The latter are due to the fact that such loans can be made for selfish purposes and serve to launder funds. Therefore, such transactions are accompanied by enhanced control.

Question: Does the lender need to determine income based on the market interest rate for the use of funds if an interest-free loan agreement is concluded between related parties using the simplified tax system? View answer

Loan agreement between related parties

Interdependent organizations are entities that meet a number of characteristics. They are specified in paragraph 2 of Article 105.1 of the Tax Code of the Russian Federation:

- One entity participates in the capital of the second by more than 25%.

- One entity owns more than 50% of another.

- The heads of the organizations are the same persons.

- The management teams of the companies include the same individuals.

Question: Does an LLC have the right to issue an interest-free loan to an individual entrepreneur if he is one of the founders and director? Is such a loan considered a transaction with related parties? Does an individual entrepreneur have income subject to personal income tax? View answer

Establishing interdependence can be carried out on other grounds if they have a significant impact on the terms of transactions between legal entities (clause 2 of Article 105.1 of the Tax Code of the Russian Federation).

What does a taxpayer need to know about transactions between related parties ?

Loan agreements between interdependent entities are divided into these types:

- Paid. The borrower returns to the lender not only the amount of debt, but also the interest on it.

- Free. Interest is not calculated.

Loans between interdependent legal entities can be classified as controlled transactions if the signs from subparagraphs 2-3 of Article 105.14 of the Tax Code of the Russian Federation are present.

What are interest-free loans between related parties ?

How to draw up a loan agreement between legal entities

The parties draw up a written agreement in free form on the terms that are convenient for them. An exception is if the conditions are contrary to the law. For example, the contract states that the borrower does not have the right to go to court - such a condition is invalid because it violates constitutional law.

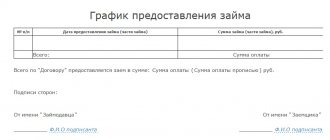

The contract specifies essential terms; without them, the court refuses to consider possible disputes. Essential conditions include information about:

- companies - names, addresses, details;

- the subject of the loan is money or property;

- term - when the borrower repays the debt;

- debt repayment procedure - how exactly the borrower pays the debt.

If you enter into an agreement at a notary’s office, the notary will help you draw it up correctly from the point of view of the law.

Interest loan

Transactions are partially regulated by letter of the Ministry of Finance No. 03-01-18/40737 dated July 15, 2015. It states that when forming interest on a loan between interdependent persons, it is not necessary to apply to the Tax Code of the Russian Federation. The percentage can be any amount.

When determining the tax base, the creditor's income from interest is taken into account as part of non-operating income on the basis of paragraph 6 of Article 250 of the Tax Code of the Russian Federation. The debtor includes paid interest in non-operating expenses on the basis of paragraph 1 of Article 265 of the Tax Code of the Russian Federation. Article 269 of the Tax Code of the Russian Federation states that the procedure for recognizing interest is determined by whether the transaction is recognized as controlled:

- The transaction is not recognized as controlled. Interest is taken into account in the amount calculated from the interest rate. The latter is taken from the contract.

- The transaction was recognized as controlled. Interest is taken into account based on the contractual rate within the limits prescribed in paragraph 1.2 of Article 269 of the Tax Code of the Russian Federation.

Let's consider the limits established by Article 269 of the Tax Code of the Russian Federation:

- Debt in rubles incurred from January 1, 2015 to December 31, 2015 – 0-180% of the Central Bank rate.

- Debt in rubles arising from January 1, 2021 – 75%-125% of the Central Bank rate.

- Debt in foreign currency - the rate is set on the basis of subparagraphs 2-6 of paragraph 1.2 of Article 269 of the Tax Code of the Russian Federation.

The key rate of the Central Bank from May 2, 2021 is 9.25% per annum.

Results

Interest on loans between LPs is considered income/expense for each party. At the same time, the theses formulated in Art. 269 of the Tax Code of the Russian Federation are applicable to both controlled and uncontrolled transactions. Income from interest-free loans is not included in the profit base.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Interest-free loan

Interest-free loans between interdependent legal entities serve for simple redistribution of funds within a group of companies. Such transactions are not prohibited by law. However, they also entail tax risks. The latter refers to the possible additional charge of income tax.

The lender's taxable income is established based on the amount of interest that could hypothetically be received in a similar transaction with an outside entity. That is, you need to turn to comparable transactions. The corresponding provision is contained in paragraph 1 of Article 105.3 of the Tax Code of the Russian Federation.

The interest-free transaction creates income for the lender, which will be subject to income tax. This means that interest will have to be paid in any case. For the debtor, receiving an interest-free loan does not generate income. The financial benefit received does not increase the tax base. The corresponding rule is contained in the letter of the Ministry of Finance No. 03-03-06/1/5149 dated February 9, 2015.

The following scheme is possible: one subject takes out a loan from a bank. Funds in the form of an interest-free loan are transferred to the dependent entity. In this case, tax representatives may recognize the resulting benefit as unjustified. However, if such a redistribution of funds does not contradict the Tax Code, it is possible to make an arbitration decision in favor of the subject. An example of this is the resolution of the AS SZO No. A56-60966/2014 dated July 1, 2015.

Tax control of transactions with interdependent and other persons in 2021

Transactions with such interdependent persons for the sale, acquisition of goods, (works, services), property rights are controlled if both parties are legal entities and the second party to the transaction is a person who does not pay income tax on the above grounds.

In 2021, a transaction for the sale or acquisition of goods (work, services), property rights is subject to control if it is concluded with an interdependent person - a tax resident of the Republic of Belarus, which does not calculate and pay income tax (exempt from income tax). For the purposes of transfer pricing control, such persons include:

Controllability of transactions

Typically, loans between interdependent legal entities are interest-free or issued at a symbolic interest rate. The purpose of such transactions is to replenish the debtor's working capital. Therefore, when making transactions, the question of controllability arises.

Letters of the Ministry of Finance No. 03-01-18/6-114 dated August 28, 2012 and No. 03-1-18/5-92 dated July 5, 2012 contain these arguments:

- The characteristics of controlled transactions are contained in Article 105.14 of the Tax Code of the Russian Federation. Transactions specified in subparagraphs 2 and 3 of paragraph 1 and subparagraphs 1-5 of paragraph 2 of the same article are considered controlled when the amount of income on them in a year exceeds the corresponding amount criterion.

- Clause 9 of Article 105.14 of the Tax Code of the Russian Federation states that the amount of income from transactions for the year is formed by adding the income from such transactions with one related party. In this case, the procedure for recognizing income contained in Chapter 25 of the Tax Code of the Russian Federation is taken into account.

The letter of the Ministry of Finance No. 03-01-18/4-67 dated May 23, 2012 states that when determining the amount of income to establish the controllability of a transaction, it is necessary to take into account income in the form of interest received under the loan agreement. Loan income (principal amount) is not taken into account in the calculations.

IMPORTANT! If a transaction is recognized as controlled, both income and expenses in the form of interest will be controlled.

Important changes in the taxation of controlled transactions from 2021

1) the parties to the transaction apply different corporate income tax rates (except for the rates provided for in paragraphs 2 - 4 of Article 284 of the Tax Code of the Russian Federation) to profit from the activities within which the specified transaction was concluded;

Until 2021, the general amount threshold for transactions between Russian related parties was set at 1 billion rubles per calendar year. Accordingly, if the amount of transactions, for example, for the purchase of goods by a trading house from an interdependent plant, exceeded this amount, then all such transactions were considered controlled.

Tax risks

As already mentioned, loans between interdependent entities entail tax risks. They will be different for the borrower and the lender.

Risks for the borrower

Transactions between related parties are subject to administration by the Federal Tax Service. The transaction is checked for compliance with market prices (based on letter of the Ministry of Finance No. 03-01-18/9-173 dated November 19, 2012). The type of loans in question must comply with the special requirements of the Tax Code of the Russian Federation. In particular, the assessment of income in case of gratuitous transfer is carried out on the basis of market prices established on the basis of 105.3 of the Tax Code of the Russian Federation.

Risks for the lender

If, as part of a loan, property is transferred to a dependent entity for gratuitous use, the payer makes the decision to pay VAT as for the sale of services independently. However, he needs to take into account that refusal to charge VAT on the market value entails significant tax risks.

IMPORTANT! Accrued VAT is not taken into account for profit tax purposes on the basis of paragraph 19 of Article 270 of the Tax Code of the Russian Federation.

In what cases do tax risks arise?

Tax risks arise in two cases:

- The loan falls under the characteristics of controlled transactions established by subparagraph 1 of paragraph 2 of Article 105.14 of the Tax Code of the Russian Federation (availability of a certain amount and interdependence of participants).

- The loan was provided on non-market terms (no interest or a symbolic amount).

Legal entities must take into account that most transactions between interdependent entities are controlled.

Rules for accounting for interest-bearing loan expenses

Interest on the loan is taken into account as part of income tax expenses according to special rules.

If the actual rate is within the range of established limit values (clauses 1.1-1.2 of Article 269 of the Tax Code of the Russian Federation), the taxpayer takes into account as expenses the entire amount of interest calculated at this rate. The size of such values depends on the currency in which the debt obligation is issued. The intervals are:

- for a debt obligation in rubles - from 0 to 180 percent (for the period from January 1 to December 31, 2015), from 75 to 125 percent (starting from January 1, 2021) of the key rate of the Central Bank of the Russian Federation (if the place of registration, place of residence, or the place of tax residence of all parties is the Russian Federation);

- for a debt obligation in rubles for other transactions between related parties - from 75 to 180 percent of the refinancing rate of the Central Bank of the Russian Federation (for the period from January 1 to December 31, 2015), from 75 to 125 percent - (starting from January 1, 2021);

- for a debt obligation in euros, from the European Interbank Offered Rate (EURIBOR) in euros increased by 4 percentage points to the EURIBOR rate in euros increased by 7 percentage points;

- for Chinese Yuan debt, from the Chinese Yuan Shanghai Interbank Offered Rate (SHIBOR) increased by 4 percentage points to the Chinese Yuan SHIBOR increased by 7 percentage points;

- for a debt obligation in pounds sterling, from the LIBOR rate in pounds sterling increased by 4 percentage points to the LIBOR rate in pounds sterling increased by 7 percentage points;

- for a debt obligation in Swiss francs or Japanese yen, from the LIBOR rate in the relevant currency increased by 2 percentage points to the LIBOR rate in the relevant currency increased by 5 percentage points;

- for debt obligations in other currencies - from the LIBOR rate in US dollars, increased by 4 percentage points, to the LIBOR rate in US dollars, increased by 7 percentage points.

If the rate on an obligation is fixed for the entire period of its validity, then the rate that was in effect on the date of raising funds is used to calculate the interval. The date of raising funds is the moment of actual transfer of the loan amount to the borrower (Article 307, Article 807, paragraph 2 of Article 433 of the Civil Code of the Russian Federation).

In other cases, the rate in effect on the date interest expense is recognized is applied.

In accounting, interest on debt obligations is reflected as part of other expenses. In tax accounting, interest accrued on any borrowed funds is included in non-operating expenses (clause 2, clause 1, article 265 of the Tax Code of the Russian Federation).

Additional Information

On January 1, 2021, some changes to tax legislation came into force. In particular, interest-free loans between Russian interdependent entities are not subject to control. The relevant provisions are contained in subparagraph 7, paragraph 4 of Article 105.14 of the Tax Code of the Russian Federation, in letter of the Ministry of Finance No. 03-03-RZ/16846 dated March 23, 2017. The Federal Tax Service letter No. ED-4-13/6968 dated April 13, 2021 states that the loan is not subject to tax control if the place of registration of the legal entity is Russia. The date of conclusion of the contract is not taken into account.

What to do if a controlled loan transaction has been completed

Let's assume that a loan obligation has arisen among interdependent companies. Then their transaction is considered controlled, which entails the obligation to notify the tax authority (Article 105.16 of the Tax Code of the Russian Federation):

- The document is drawn up in a form approved by the Federal Tax Service of the Russian Federation (starting from 2019, the form is used by order dated 05/07/2018 No. ММВ-7-13 / [email protected] , until 2021 - the form is used by order dated 07/27/2012 No. ММВ-7-13 / [email protected] ).

- The period for informing government agencies is until May 20 of the year following the reporting year.

- The addressee is the fiscal authority at the location of the payer, for the largest payers - the inspection at the place of their registration. Within 10 days, the territorial body sends the received information to the Federal Tax Service of Russia (clauses 2, 5 of Article 105.16 of the Tax Code of the Russian Federation).

For failure to provide information or for providing incorrect data, the taxpayer may be fined 5,000 rubles. (Article 129.4 of the Tax Code of the Russian Federation), therefore, before sending the document, you should check the data included in it with the counterparties to the transaction.

Interest-bearing loan between legal entities

According to tax officials, interest on a loan agreement (if its validity period covers two or more reporting periods) is taken into account in income evenly at the end of the month of the corresponding reporting period, and this does not depend on the timing and actual payment determined by the agreement.

If the lending company receives a fee in the form of interest for providing a loan, this amount will be included in non-operating income, which means that income tax will need to be paid on it (the interest rate existing in the company’s region is applied).

Accounting entries for interest-free loans

Postings for an interest-free loan depend on the other party to the transaction. An employee received an interest-free loan - accounting entries are made using account 73. If this is a third-party individual, then account 76. If a transaction on an interest-free loan is made between legal entities, then account 76 is also used. In entries for an interest-free loan issued to another organization, account 58 should not be used maybe, since a loan with a rate of 0 is not a financial investment. The table below lists possible accounting options for interest-free loan transactions between legal entities, as well as with individuals.

| Description | Dt | CT |

| Accounting with the lender | ||

| An interest-free loan was issued | 73.1, 76 | 51, 50 |

| Loan amount repaid | 51, 50 | 73.1, 76 |

| Personal income tax is withheld from the employee’s material benefit | 70 | 68 subaccount “NDFL” |

| PNO accrued if the transaction is recognized as controlled | 99 | 68 subaccount “Income tax” |

| Accounting with the borrower | ||

| Received an interest-free loan | 51, 50 | 66, 67 |

| Loan amount repaid | 66, 67 | 51, 50 |

Useful information for entrepreneurs and accountants

The legislator believes that transactions in such organizations are concluded on preferential terms in comparison with the same transactions between independent organizations. Therefore, the Federal Tax Service believes that the borrower is obliged to pay additional tax on the amount of interest saved on the loan.

Changes in accordance with 401-FZ dated November 30, 2016 affected the concept of controlled transactions. According to this law, loan transactions between interdependent persons registered in Russia are not controlled.

Therefore, the tax authority cannot control the conduct and cost of such a transaction. Also, by this law, the lender gets rid of the risk of claims from the Federal Tax Service regarding additional accrual of income based on their average interest rate on the market.

Until 2021, there were attempts at such actions by the Federal Tax Service; not a single case was won in court. The court sided with the lender. The law clearly states that there are no claims against the lender if they provide a gratuitous loan. Now lenders will be freed from tax demands.

If the loan was issued to a foreign interdependent company, or the company issued a loan to a Russian legal entity, then the transaction is considered controlled. In this case, there is a possibility that the Federal Tax Service will charge additional tax on the saved interest to the borrowing organization.

Judicial practice on these disputes contains a large number of cases. Basically, all claims against the actions of the Federal Tax Service in relation to lenders are based on the opinion of the tax service that additional taxes must be assessed on controlled transactions between related parties. The position of the courts in this regard is clear: lenders do not receive income in the form of material benefits, and therefore do not have to pay tax.

11 The Arbitration Court considered a case where the tax authority assessed additional tax on the lender on lost profits in the form of interest on an interest-free loan. The transaction was not controlled, but the MRIFNS of Russia for the Samara region believed that Art. 105.3 of the Tax Code of the Russian Federation provides the right to control pricing for any transactions concluded between interdependent persons. The tax office considered that instead of providing a loan, the lender could have deposited the money in the bank and made a profit. The market price for interest by the tax authority was calculated based on information from the Interfax agency, according to which the interest rate ranged from 12 to 13% per annum. The tax was additionally charged from abstract income if the company had placed money on deposit.

The court did not accept the Federal Tax Service's arguments. The interdistrict body of the Federal Tax Service does not have the right to use the mechanism for monitoring transactions and determining the market price for transactions that do not fall under control. The court based its findings on the following reasons:

1. Arbitrary interpretation of tax legislation and the exercise of rights not specified in the law by tax authorities is not permissible, as this leads to arbitrariness in carrying out control activities.

2. It is not allowed to deprive taxpayers of security guarantees provided for by law.

3. Taxation of abstract income is not allowed.

The court did not establish that the lender received any material benefit from providing the borrower with an interest-free loan. Transactions that are not subject to control should not be subject to inspection by tax authorities in terms of pricing. The Ninth Arbitration Court came to a similar decision in Resolution No. 09AP-35789/2015 dated September 30, 2015.

Arbitration practice

Interest-free loans between legal entities are one of the easiest ways to redistribute cash flows within a group of companies.

However, as arbitration practice shows, issuing interest-free loans is fraught with additional charges of income tax (for organizations) and personal income tax (for individual entrepreneurs). Let's analyze what tax risks arise when carrying out such transactions? According to current legislation, a loan agreement can be either compensated, i.e. providing for the payment of interest for the use of borrowed funds, and gratuitous, when the borrower’s fulfillment of the obligation is limited only to the repayment of the debt (clause 1 of Article 809 of the Civil Code of the Russian Federation). The corresponding condition is agreed upon in the contract.

TAX MONITORING

Registration of the contract

A correctly drawn up loan agreement allows you to avoid undesirable consequences both from the inspection authorities and from the parties to the transaction. The agreement is strictly in writing and can be signed with a digital electronic signature.

The agreement is concluded by the director of the company or an authorized representative in the presence of a notarized power of attorney. If the company's charter provides for obtaining permission to grant a loan from the founder, it must be attached to the remaining documents.

The loan agreement is the real deal. This means that the presence of signatures of the parties does not yet impose financial obligations. The transaction is considered completed after the direct transfer of money to the borrower.

The structure of the contract is standard:

- Subject (amount, type of loan - in this case gratuitous, repayment terms);

- Rights and obligations of the parties;

- Additional conditions (possibility of extension, payment methods, etc.);

- Requisites.

If the borrower is an individual entrepreneur or individual

The situation is different if one of the borrowers is an individual or individual entrepreneur. Clause 1 of Art. 210 of the Tax Code of the Russian Federation provides that when calculating the tax base, all income of the taxpayer received by him, both in cash and in kind, or the right to dispose of which he has acquired, as well as income in the form of material benefits, determined in accordance with Art. 212 of the Tax Code of the Russian Federation, according to paragraphs. 1 and 2 of which such income is the material benefit received from savings on interest for the taxpayer’s use of borrowed (credit) funds provided by organizations or individual entrepreneurs. In the case of acquiring income in the form of a material benefit, the date of its actual receipt is the day the taxpayer pays interest on borrowed funds (clause 3, clause 1, Article 223 of the Tax Code of the Russian Federation), and in a situation with an interest-free loan, this is the date of its repayment (Definition of the Supreme Court RF dated April 16, 2015 No. 301-KG15-2401).

In other words, if the borrower under an interest-free loan agreement is an individual entrepreneur, then for the period of use of gratuitous funds personal income tax is calculated at a rate of 35% (clause 2 of Article 224 of the Tax Code of the Russian Federation).

Note that if an interest-free loan agreement is concluded between spouses who have the status of individual entrepreneurs, then income in the form of material benefits from saving on interest does not arise. In this case, the presence of the legal status of taxpayers - individual entrepreneurs does not exclude the application of the joint property regime between spouses, which is primary and applies to all income received during the marriage. Money transferred by way of loan from the common joint property of both spouses to their common joint property cannot actually be borrowed.

Thus, the funds received by an individual entrepreneur from his spouse under a loan agreement are their common property, therefore these funds cannot be considered income for personal income tax purposes (resolution of the Fourth Arbitration Court of Appeal dated April 2, 2015 No. A78-7533/2014 ).

Irina Starodubtseva - auditor-expert,

FINANCIAL NEWSPAPER No. 01, January 14, 2021

EXAMPLE

Under the loan agreement, the organization raised funds at 15% per annum to replenish working capital (loan amount - 60 million rubles). These funds were sent to another organization under an interest-free loan agreement for the subsequent purchase of cars.

Based on these circumstances, the tax inspectorate concluded that expenses in the form of interest under a credit agreement and a loan agreement are economically unjustified, since the funds received under these agreements were transferred to a related party under unreal transactions (executed only on paper, without real business purpose and of a purely formal nature). At the same time, own collected funds are withdrawn from circulation by issuing interest-free loans to the founder or other interdependent organizations. During the audit, it was also established that all interdependent persons provide each other with interest-free loans, while receiving credit funds from banks. The tax office excluded the amount of accrued interest on loan agreements directed to interdependent companies from the expenses taken into account when calculating income tax. Having disagreed with the decision of the tax inspectorate, the organization went to court. As the judges indicated in the resolution of the Arbitration Court of the North-Western District dated July 1, 2015 No. A56-60966/2014, the redistribution of funds within a group of companies in itself does not contradict the requirements of the Tax Code of the Russian Federation. The court assessed the tax inspectorate’s arguments based on the position set out in the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53 “On the assessment by arbitration courts of the validity of the taxpayer receiving a tax benefit.”

A tax benefit cannot be recognized as justified if it was received by the taxpayer outside of connection with the implementation of real business or other economic activity.

The validity of obtaining a tax benefit cannot be made dependent on the methods of attracting capital to carry out economic activities or on the efficiency of using capital.

TAX LAWYER CONSULTATION

The tax authorities did not prove that the main goal pursued by the company was to generate income solely or primarily through tax benefits (reduction of taxable profit due to non-operating expenses) in the absence of intention to carry out real economic activity.

Despite the fact that the legal dispute was resolved in favor of the taxpayer (due to insufficient evidence on the part of the tax authorities), under similar circumstances court cases cannot be ruled out, the outcome of which is difficult to predict. The subject of consideration by some arbitration courts were cases related to the procedure for determining the material benefit of the lender when issuing interest-free loans to interdependent persons.

For the purposes of tax control, all transactions concluded by business entities are divided into transactions between interdependent persons and transactions between persons who are not interdependent (clause 1 of Article 105.3 of the Tax Code of the Russian Federation).

At the same time, as follows from the set of norms of the Tax Code of the Russian Federation, transactions between related parties can be divided into two groups:

- controlled, recognized as such subject to the provisions of Art. 105.14 Tax Code of the Russian Federation;

- other transactions between related parties (uncontrolled).

Clause 3 of Art. 105.3 of the Tax Code of the Russian Federation provides that the price of goods (work, services) applied by the parties to the transaction for tax purposes is recognized as market price, unless the federal executive body authorized for control and supervision in the field of taxes and fees has proven otherwise, or if the taxpayer has not made independently adjusting tax amounts in accordance with clause 6 of Art. 105.3 Tax Code of the Russian Federation.

Only if the loan agreement is a controlled transaction, the lender must show virtual income in the amount of interest not received on the interest-free loan (letters of the Ministry of Finance of Russia dated October 2, 2013 No. 03-01-18/40821, dated August 13, 2013 No. 03 -01-18/32745, dated 07/18/12 No. 03-01-18/5-97, dated 02/24/12 No. 03-01-18/1-15). In this regard, the tax authorities conclude that any income that could be received by one of the related parties under such transactions should be taken into account for tax purposes by this person. In other words, in controlled transactions for the provision of an interest-free loan, the lender’s income is determined based on the amount of interest that would be received by the lender in the event of a transaction between persons who are not interdependent, in commercial and (or) financial conditions comparable to the analyzed transaction, i.e. in a comparable transaction.

The interdependence of the parties to a transaction as a factor influencing the procedure for taxation of the results of this transaction can be established by the tax authority only as a result of carrying out individual tax control activities outside the framework of an on-site or desk tax audit (paragraph 3 of clause 1 of Article 105.17 of the Tax Code of the Russian Federation).

It should be noted that the current judicial practice on this issue is ambiguous. In a number of cases, courts point out that failure to obtain a positive financial result in the form of interest under a loan agreement is beyond the control and assessment of the tax authority, and concluding transactions with interest-free loans does not lead to either an increase or a decrease in the tax base for income tax none of the parties to the agreement, and therefore the corresponding transactions should not be recognized as controlled (clause 13 of article 105.3, clause 11 of article 105.14 of the Tax Code of the Russian Federation).

Moreover, one of the courts noted that transactions between interdependent organizations that are payers of income tax are considered controlled if the amount of income from such transactions in a calendar year exceeds the value of the amount limit specified in paragraphs. 1 item 2 art. 105.14 of the Tax Code of the Russian Federation (since 2014 - 1 billion rubles).

In other words, the court refuted the arguments presented in the letter of the Federal Tax Service of Russia dated September 16, 2014 No. ED-4-2 / [email protected] , in part that verification of price compliance in uncontrolled transactions can be carried out between interdependent persons.

As a result, the court decided that the rules and requirements that came into force on January 1, 2012, which are set out in section V.1 of the Tax Code of the Russian Federation, do not make it possible to clearly establish the possibility of their application to the analyzed situation, namely with regard to the possibility of taxation of material benefits from the provision of interest-free loans. At the same time, Chapter 25 of the Tax Code of the Russian Federation does not consider the material benefit from savings on interest for the use of borrowed funds as taxable income. According to the court, the current legislation on taxes and fees lacks clarity on the issue of the possibility of taxation of material benefits received through the provision of interest-free loans by an interdependent party, therefore all irremovable doubts and ambiguities in acts of legislation on taxes and fees must be interpreted in favor of the taxpayer (decision of the Court of Justice of Yamalo -Nenets Autonomous Okrug dated April 20, 2015, No. A81-165/2015).

However, in one of the court cases, the tax authorities managed to win the dispute (resolution of the Administrative Court of the North Caucasus District dated April 1, 2015 No. A53-28342/2013). The judges agreed with the tax authorities on the issue of unreasonably inflating expenses, obtaining unjustified tax benefits through the creation of a scheme by interdependent persons to unreasonably inflate expenses.

Some judges, without denying the possibility of the lender receiving income when issuing interest-free loans to interdependent persons, do not agree with the opinion of the tax authorities regarding the formation of information on market rates.

In one of the cases, the court considered that a bank deposit agreement is not comparable to a loan agreement, since the tax authority did not take into account the essential condition that under a bank deposit agreement one of the parties to the transaction is always the credit organization (bank), for which this type of activity is the main one (decision of the Stavropol Territory AS of August 5, 2015, No. A63-2718/2015).

LAWYER SERVICES IN COURT

In another court case, it was pointed out that when comparing the terms of these agreements, among other things, the following should be taken into account:

- credit history and solvency, respectively, of the loan recipient, the person whose obligations are secured by a guarantee or a bank guarantee;

- the nature and market value of security for the fulfillment of the obligation;

- the period for which the loan or credit is provided;

- currency that is the subject of a loan or credit agreement;

- procedure for determining the interest rate (fixed or floating);

- other conditions that affect the amount of the interest rate (remuneration) under the relevant agreement (resolution of the Fourteenth Arbitration Court of Appeal dated October 15, 2015 No. A05-4564/2015).

Calculations prepared by tax authorities on the basis of "SPARK", as well as the information used by the "SPARK" system, do not meet the requirements of the Tax Code of the Russian Federation and are also not accepted by the courts (resolution of the Ninth Arbitration Court of Appeal dated September 30, 2015 No. A40-204810/2014) .

The courts are unanimous that interdependence can have legal significance for tax control purposes only if it is established that such interdependence is used by the parties to the transaction as an opportunity to carry out concerted dishonest actions aimed at illegally understating tax payments.

Thus, at present, there is no judicial practice with unambiguous conclusions regarding the additional assessment of income tax on virtual income for transactions of issuing interest-free loans between interdependent legal entities. In addition, even if the courts agree with the need to calculate virtual income from the lender, the methodology for calculating such income is unclear.

Let's consider such an issue as the possibility of recovering losses from the director of an organization for a transaction with an interest-free loan. Thus, in one of the organizations, the director, without obtaining the consent of the founders, transferred an interest-free loan to an interdependent company from the organization’s account to the card account of the company director. The result of this operation was a trial, as a result of which the court ordered the director to return the amount of the interest-free loan. When making their decision, the judges referred to clause 1 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 62 “On some issues of compensation for losses by persons included in the bodies of a legal entity,” which explained that the sole executive body is obliged to act in the interests of the legal entity persons in good faith and reasonably, and in the event of a violation of this obligation, the director, at the request of the legal entity and (or) its founders (participants), must compensate for losses caused to the legal entity by such a violation (Resolution of the AS of the Ural District dated September 22, 2015 No. F09-6778/ 15).

Conditions

When concluding an agreement, it is better for the borrower to carefully check its contents for the presence of mandatory conditions and to avoid misunderstandings in the future. You need to pay attention to the following points:

- The interest-free clause of the contract must be indicated on a separate line.

- If an organization provides a loan in the form of equipment, tools, things, then their availability must be checked against the list attached to the contract.

- Condition for early repayment of the borrowed amount. There are rarely disagreements on this point, since the creditor does not receive a profit and is therefore interested in the speedy repayment of the debt. The lender's permission for early repayment is not required in accordance with the law.

- Purposes of the loan. If the loan is targeted, then you need to check what needs the money can be spent on and spend the money in accordance with its purpose. Otherwise, the lender has grounds to demand that the loan be repaid ahead of schedule.

- Penalties for late repayment and non-compliance with loan terms. The borrower should pay attention to this point.

In relation to things, items that have individual characteristics cannot be transferred as part of a gratuitous loan. In case of damage or breakage, the borrower will not have the opportunity to return the exact same item. This applies to art, vehicles and other similar things.

There are no legal restrictions on the loan amount.

Legal entities can apply for a loan for any amount by bank transfer. The limit is set on the provision of funds in cash; the loan amount should not exceed 100,000 rubles.

Online magazine for accountants

The legal concept of interdependent persons in tax legislation is contained in paragraph 1 of Article 20 of the Tax Code of the Russian Federation. And so, interdependent persons for tax purposes are individuals and/or companies, the relationship between which may affect:

Any accountant and lawyer should know how to carry out netting between interdependent parties, so as not to later run into accusations of receiving an unjustified tax benefit. Judicial practice shows that tax authorities for the most part win in such disputes (for example, resolution of the Arbitration Court of the North-Western District dated May 26, 2019 No. F07-4431/2019 in case No. A42-23/2019).

How to avoid mistakes?

When drawing up a loan agreement, it is important to check all the points so as not to fall under tax sanctions.

Current legislation does not prohibit the conclusion of contracts of this type; however, the conditions under which the loan is provided must be specified in detail. You need to check the text of the agreement especially carefully when arranging a loan between interdependent parties in cases where the transaction is controlled. In transactions of this kind, the recipient of the loan becomes obligated to pay tax on the amount of interest saved.