The UTII interest rate 2021 is 15%: this is established at the federal level. But regional authorities are given the right to change it, taking into account the type of activity of the individual entrepreneur or organization.

The norms of the Tax Code of the Russian Federation provide for the possibility of using a single tax on imputed income by legal entities and individual entrepreneurs. In this case, the tax base is not the actual income of the taxpayer, but the imputed or basic income. Such business profitability is calculated based on physical indicators and basic profitability, adjusted for the deflator coefficient K1 and the local coefficient K2. This value is then multiplied by the interest rate to determine the tax due. Moreover, when applying UTII, how much percentage the rate will be is determined by the regions themselves.

Features of UTII

Documentation

Application for UTII (LLC)

Application for UTII (IP)

Deregistration under UTII (LLC)

Deregistration according to UTII (IP)

Declaration on UTII

LLC taxes The imputed tax replaces the payment of:

- income tax;

- VAT, in addition to what is paid when importing into the territory of the Russian Federation;

- property tax, with some exceptions.

Prepare a UTII declaration for only 149 rubles

We draw the attention of all LLCs to UTII - organizations can pay taxes only by non-cash transfer. This is a requirement of Art. 45 of the Tax Code of the Russian Federation, according to which the organization’s obligation to pay tax is considered fulfilled only after presentation of a payment order to the bank. The Ministry of Finance prohibits paying LLC taxes in cash.

Individual entrepreneur taxes For individual entrepreneurs, the imputed tax replaces the payment of:

- personal income tax;

- VAT, in addition to what is paid when importing into the territory of the Russian Federation;

- tax on property used in business activities, for which you need to apply for an exemption from payment to the tax office at the location of such real estate.

The essence of the single tax on imputed income is clear from its name. The word “imputed” is used quite rarely in colloquial language, unless you remember such clericalisms as “impute guilt” or “impute duty.” The meaning of the word “impute” is to count or estimate as something. In this case, the state believes that the UTII payer, engaged in the type of activity permitted for this regime, must receive a certain income from it. In this case, income is assessed not in monetary terms, but in physical indicators.

For example, three workers in the service sector will bring more income than one, and a store with an area of 30 square meters. m should be more profitable than an area of 20 square meters. m. In st. 346.27 of the Tax Code of the Russian Federation provides a more understandable interpretation of imputed income as potentially possible, taking into account the conditions affecting the receipt of this income.

What conditions are meant? First of all, this is a physical indicator to which the basic profitability is tied. A physical indicator can be the number of employees, units of transport, or the area of the sales floor. Basic profitability is a conditional monthly profitability per unit of physical indicator, calculated in rubles.

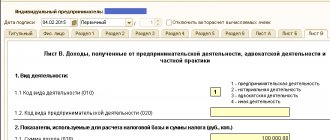

Here are simple examples of calculating the tax base for an imputed tax (we take the data from the table in Article 346.29 of the Tax Code of the Russian Federation):

- The basic monthly income for the provision of household services per employee (including the individual entrepreneur himself) is 7,500 rubles. If there are three employees, then the basic profitability will be 7500*3 = 22500 rubles.

- The basic income per month for catering services, if there is a service hall, is 1000 rubles. The physical indicator here is a square meter. Basic profitability of an object with an area of 20 sq. m will be 20,000 rubles, and on an area of 30 sq. m, respectively - 30,000 rubles.

- The basic profitability for motor transport services for the transportation of goods will be 6,000 rubles per vehicle. We calculate: three cars should give an income of 6,000 * 3 = 18,000 rubles, and five cars - 30,000 rubles.

Is this approach objective for calculating real income? No. If you want objectivity, then choose the simplified taxation system or the general taxation system. In this case, we are interested in the profitability of the imputed tax, i.e. reduction of tax burden.

Please note that the basic yield is the tax base for calculating the imputed tax, but it still needs to be adjusted by two special coefficients.

Object of taxation and tax base for UTII

Article 346.29 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) defines the object of taxation for UTII:

"1. The object of taxation for the application of a single tax is the imputed income of the taxpayer.”

According to Article 346.27 of the Tax Code of the Russian Federation:

“ imputed income is the potential income of a single tax payer, calculated taking into account a set of conditions that directly affect the receipt of said income, and used to calculate the amount of a single tax at the established rate.”

In accordance with paragraph 2 of Article 346.29 of the Tax Code of the Russian Federation, the tax base for calculating the amount of a single tax is the amount of imputed income. The amount of imputed income is calculated as the product of the basic profitability for a certain type of business activity, calculated for the tax period, and the value of the physical indicator characterizing this type of activity.