Cancellation of UTII: what to do?

Many businessmen now use a single tax on imputed income (UTI). This significantly simplifies accounting and makes it possible to save on mandatory payments.

However, at the end of 2021, all “imputed” workers will have to think about switching to other operating modes. And for those whose business is related to trade, problems can begin much faster. Let's look at the upcoming changes and tell you what businessmen should do to reduce losses during the transition period.

What is UTII and why is it convenient for business?

The main difference between “imputation” and most other tax regimes is that with UTII, the amount of payments to the budget is not tied to the results of activities.

Imputed (i.e., predetermined) tax is calculated based on certain physical indicators. This may be the number of employees, the area of retail premises, etc.

Therefore, if a business develops and increases profits, then it is much more profitable to pay one fixed amount than constantly growing “current” taxes.

Mode for the self-employed - who is it suitable for?

Self-employment is no longer intended for entrepreneurs, but for freelancers. Since there are quite a lot of restrictions: annual income should not exceed 2.4 million rubles, it is prohibited to register employees under employment contracts, engage in resale and be an agent.

Among the advantages: self-employed people do not pay insurance premiums, do not submit reports, and checks are sent through the tax office’s mobile application. The tax rate is 4% on income from individuals and 6% on income from legal entities and individual entrepreneurs.

Restrictions for using UTII

Naturally, the use of such a beneficial regime for businessmen is associated with a number of restrictions.

- UTII can only be used for a certain list of activities (clause 3 of Article 346.29 of the Tax Code of the Russian Federation). We are talking about trade, catering and some types of services.

- If the “imputed” person is a legal entity, then the share of other organizations in the authorized capital should not exceed 25%.

- The number of employees should not be more than 100 people.

- Other physical indicators are also limited: the area of a store or cafe can be no more than 150 square meters. m, and the number of vehicles is no more than 20.

A specific list of activities for which UTII can be used is determined by regional authorities within the framework of the federal list.

Also, local legislators can do so entirely on their own territory. For example, in Moscow, UTII has not been valid since 2012.

Reasons for stopping the application of imputed tax

Termination of registration as a UTII payer is carried out in the presence of one of the grounds listed in paragraph 3 of Article 346.28 of the Tax Code of the Russian Federation:

- cessation of the designated activity or complete closure of the business;

- voluntary transition to another tax regime;

- non-compliance with the single tax limits - the average number of employees of 100 people or 25% of the participation share of another organization (other organizations) in the authorized capital of the LLC on UTII.

If the limits established by the Tax Code of the Russian Federation for the imputed system are violated, filing an application with the Federal Tax Service is mandatory. In its absence, the taxpayer will be fined 200 rubles.

To correctly deregister under UTII, use free instructions from ConsultantPlus experts.

When will UTII be cancelled?

“Imputation” appeared in Russian legislation about 20 years ago. Then it was regulated by a separate law No. 148-FZ of July 31, 1998. Then, with the introduction of the Tax Code of the Russian Federation, a special chapter 26.3 appeared in it, dedicated to UTII.

The purpose of the “imputation” when it was introduced was to collect at least some taxes from small businesses. However, in recent years, the efficiency of tax administration has increased significantly, and officials have drawn attention to the fact that the use of UTII significantly reduces budget revenues.

Discussions about this have been going on for a long time, and initially UTII was supposed to “disappear” in 2021. However, due to the crisis of 2014-2015. the termination of UTII was postponed for three years, i.e. until 01/01/2021 (law dated 06/02/2016 No. 178-FZ)

The deadline for canceling UTII is approaching, and it is unlikely that the state will “change its mind” this time either. The fact that the fiscal authorities are determined is evidenced by the general tightening of control over business: the introduction of online cash registers, product labeling, etc.

By the way, in connection with the labeling of goods, for many entrepreneurs UTII will actually be abolished from the beginning of 2020. On September 19, 2021, the State Duma adopted the Federal Law on the abolition of UTII and PSN for certain labeled goods (clauses 58, 59 of Article 2 of the Federal Law of September 29, 2019 N 325-FZ “On Amendments to Parts One and Two of the Tax Code of the Russian Federation” ).

The upcoming changes provide, among other things, for the removal from UTII of retail trade of certain goods subject to mandatory labeling from 01/01/2020.

Therefore, those who work with such goods need to think about changing the tax regime now.

To categories that “fall out” from UTII, in accordance with paragraph 58 of Art. 2 bills No. 720839-7 include:

- Medicines.

- Shoes.

- Clothing and accessories made from natural fur.

Which mode is more convenient to change UTII to?

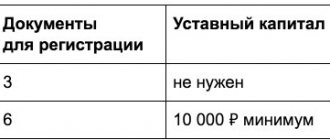

The tax regime closest to UTII is the patent system (PSN). But not everyone can simply switch from “imputation” to a patent:

- Only individual entrepreneurs have the right to use the patent system.

- Restrictions on the scale of business for PSN are much more stringent: the number of employees is no more than 15, and the area of a store or cafe is no more than 50 square meters. m.

- For a patent, there is a revenue limit of 60 million rubles. per year (clause 6 of article 346.45 of the Tax Code of the Russian Federation).

In addition, from 01/01/2020, when retailing the above-listed labeled goods, it will be impossible to use not only UTII, but also PSN.

Therefore, the transition to the PSN will not be suitable for legal entities, large entrepreneurs and many retailers. They will have to choose between the general tax system (OSNO) and the simplified tax system (STS).

At first glance, it seems that the choice is obvious. Even the very name of “simplified” hints that working in this format will be easier than with OSNO.

However, not all so simple…

If either at a loss, then under the simplified tax system you will still have to pay taxes. This will be 6% of revenue for the “Income” object or a minimum 1% tax for the “Revenue minus expenses” option.

And with OSNO, work without profit does not imply the payment of turnover taxes at all. Moreover, with this system, you can return VAT from the budget or transfer losses to reduce income tax in the future.

Although we should not forget that with OSNO you will in any case have to keep the most complex and detailed records.

But if your business is highly profitable, then, of course, it will be more profitable to work on a “simplified” basis. But even here the businessman faces a dilemma: he can pay (excluding benefits) 6% of income or 15% of the difference between income and expenses.

of taxation object here is primarily influenced by the share of costs in revenue: the greater it is, the more profitable the “Income minus expenses” object will be for the businessman. You also need to take into account the possibility of applying tax deductions associated with the payment of insurance premiums and trade taxes.

But if costs and revenue are approximately comparable, then it is worth reconsidering the option of using OSNO.