For a long time, the unified agricultural tax regime was not considered a popular special tax regime, since not many entrepreneurs chose agricultural products as their path. However, in light of recent political events, including the imposition of Western sanctions, there have been significantly more agricultural producers. Therefore, legislators have somewhat revised the tax burden for those who will be on the Unified Agricultural Tax in 2021 and beyond.

What innovations await UAT payers? How will they pay property taxes, and in what cases will they not need to pay? How to calculate and take into account this tax? We will talk about all this in our article.

What is Unified Agricultural Tax

The unified agricultural tax was introduced in Russia in 2004.

Legislators believed that using a simple and understandable scheme would reduce the burden on agribusiness. The object of taxation of the Unified Agricultural Tax is the difference between income and expenses. The interest rate is 6%. The calculation formula is as follows: tax amount = (revenue – expenses) × tax rate.

Only those entrepreneurs who received 70% of their revenue from agricultural production can take advantage of the right to switch to the unified agricultural tax (Article 26.1 of the Tax Code of the Russian Federation).

Types of activities for which unified agricultural tax can be applied:

- Crop production as a branch of agriculture (forestry).

- Livestock products.

- Growing and growing fish.

- Fishing.

- Primary and industrial processing of agricultural products following production.

How is the tax rate and tax base determined?

Unified agricultural tax is calculated according to the established procedure, which is prescribed in Article 346.9 of the Tax Code of the Russian Federation. Typically, the rate for this tax is 6%, therefore, during the calculation, the size of the calculated tax base should be multiplied by 0.06 to obtain the original tax amount payable to the state budget.

In turn, the tax base is considered to be the monetary expression of the total amount of income, and a certain period, minus allowed expenses. In fact, the tax base is calculated using a simple method: all income is incrementally summed up at the end of the reporting period and allowed expenses are subtracted from this amount. The procedure is prescribed in the Tax Code.

If the income is greater than the amount of income received, then the payer’s activity is officially recognized as unprofitable and the company in this case receives the right to reduce its tax base in proportion to the losses incurred for the previous year. It must be taken into account that the size of the reduction should not be more than 30% of the total amount. If this figure exceeds the 30% barrier, then the remaining amount can be distributed over future periods in parts. The most important limitation in this case is that the amount can be distributed evenly only over ten years and no more.

How to switch to Unified Agricultural Tax

The single agricultural tax can be applied immediately after registering an individual entrepreneur. You can also switch to it from another system.

If you register an individual entrepreneur, then within 30 days you must submit a tax notice (Article 346.3. Tax Code of the Russian Federation). If you are already operating and decide to change the tax system, then you can start using the Unified Agricultural Tax only from next year (Article 346.3 of the Tax Code of the Russian Federation), you must inform the tax office about this before December 31. This means that in order to switch to the Unified Agricultural Tax in 2021, you need to submit a document before the end of 2018.

The form for notifying the transition to the unified agricultural tax was approved by order of the Federal Tax Service of Russia dated January 28, 2013 MMV-7-3/41.

To switch to the unified agricultural tax in 2021, you need to send a notification to the tax office before the end of 2021.

Algorithm for calculating property tax

As already mentioned, individual entrepreneurs pay this tax based on the tax notice sent. They do not need to calculate the tax themselves, unlike organizations that must regularly calculate property taxes and submit a tax return. This is done in the following sequence.

- Check for accounting objects which fixed assets are included in the taxable base.

- Check whether the organization has regional rights to benefits for this tax.

- Find out the basis for tax calculation: the average annual or cadastral value of the property, the residual value of the movable property.

- Select the required formula for calculating tax:

- for average annual cost: SR-G.ST. x ST. / 4, where SR-G.-ST. is the average annual cost of fixed assets, and Art. – the current rate in the given region;

- for cadastral value - K. ST x St / 4, where K. ST. – cadastral value of the fixed asset.

- Based on the tax rates in force in a given region, calculate the tax amount.

- Make advance payments quarterly.

A report on advance payments must be submitted once a quarter, and at the end of the accounting year a property tax declaration must be submitted.

NOTE! From 2021, new forms for submitting information are in effect, approved by Order of the Federal Tax Service No. ММВ-7-21 / [email protected] dated March 31, 2017.

How to report

The main reporting document for individual entrepreneurs on the Unified Agricultural Tax is the tax return. Order of the Federal Tax Service of Russia dated 02/01/2016 No. ММВ-7-3/51 “On amendments to the annexes to the order of the Federal Tax Service of Russia dated 07/28/2014 No. ММВ-7-3/384” regulates the latest edition of the form and procedure for filling it out.

The declaration must be submitted no later than March 31 of the year following the reporting year. For entrepreneurs without employees, it is necessary to keep a book of income and expenses (KUDiR). The fact is that the tax period of the Unified Agricultural Tax is a year, and the reporting period is a half-year. Therefore, just like with the simplified tax system, you need to make an advance payment. But unlike the “simplified” payment, the advance must be made once. And you will take the data for calculation in KUDiR.

An entrepreneur with a staff will have to submit more documents.

To the Federal Tax Service (tax office):

- Information on the average number of employees.

- Declarations in form 2-NDFL and 6-NDFL.

In the FSS (Social Insurance Fund) and the Pension Fund (PFR):

- RSV-1 – quarterly.

- ADV-6-5, SZV-6-4, ADV-6-2 (personalized accounting) - quarterly.

- 4-FSS – quarterly.

- At the end of the year, confirm the main type of activity with the Social Insurance Fund - until April 15 of the year following the reporting one.

Transport tax – not for special agricultural transport

The objects of transport tax are cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed) ships and other water and air vehicles registered in accordance with the established procedure in accordance with the legislation of the Russian Federation.

Various agricultural machinery is also subject to registration, which is why initially it is also subject to transport tax. But some types of special agricultural machinery, being registered to agricultural producers, by virtue of paragraphs. 5 p. 2 art. 358 of the Tax Code of the Russian Federation are not recognized as subject to transport tax if they are used in agricultural work for the production of agricultural products.

This standard directly includes tractors, self-propelled combines of all brands, and special vehicles (milk tankers, livestock trucks, special vehicles for transporting poultry, machines for transporting and applying mineral fertilizers, veterinary care, and maintenance) as such special equipment.

How to pay

The advance payment for entrepreneurs applying the single agricultural tax system is calculated as follows:

- We determine the tax base from the beginning of the year to the end of the six months.

- The final tax is determined in the same way, but we take into account income and expenses from the beginning to the end of the year. We take into account the advance payment.

- We pay no later than 25 days after the end of the semester. Annual tax – until March 31. This can be done on the Federal Tax Service online service.

Advance payment = (income - expenses) × tax rate. Final tax = (income – expenses – advance payment) × tax rate.

Taxation of peasant farming: special regimes and reporting

- home

- Legal Resources

- Collections of materials

- Transport tax under the Unified Agricultural Tax

A selection of the most important documents on request Transport tax under the Unified Agricultural Tax (legal acts, forms, articles, expert consultations and much more). Regulatory acts: Transport tax under the Unified Agricultural Tax "Methodological recommendations for the development of accounting policies in agricultural organizations" (approved by the Ministry of Agriculture of the Russian Federation on May 16, 2005) 110. Calculation and payment of transport tax by agricultural organizations is carried out in accordance with the provisions of Chapter 28 "Transport Tax" of part two of the Tax Code Code of the Russian Federation.

Changes in 2021

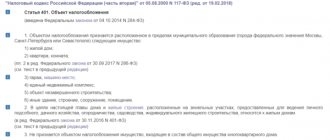

Until 2021, companies that pay the Unified Agricultural Tax were completely exempt from corporate property tax. Individual entrepreneurs on the Unified Agricultural Tax were exempt from property tax for individuals in relation to objects used in business activities. All this is regulated by clause 3 of Article 346.1 of the Tax Code of the Russian Federation.

In January 2021, the situation changed. Organizations and individual entrepreneurs will not pay property tax only on objects used in the production of agricultural products, primary and subsequent industrial processing and sale of these products, as well as in the provision of services by agricultural producers. All other property of Unified Agricultural Tax payers will be taxed.

What property is taxed?

The Tax Code outlined the scope of application of taxable property, but did not specify which of its objects are meant, did not divide it according to qualification criteria, by types of use in agricultural activities, etc. Therefore, discrepancies are possible regarding the determination of the tax base, which may cause conflicts with tax service. What to do to avoid them?

Since the law is new, the amendments came into force relatively recently, a system for its functioning has not yet been developed, and there are no precedents for the disputes that have arisen. To avoid ambiguous situations, we recommend that before dividing taxable and exempt property, you consult your territorial INFS.

IMPORTANT! It is advisable to ask tax officials for written explanations: this will save you from possible problems in the future and will become an argument in your favor in any disputes.

As a general rule, the property tax base includes all movable and immovable (accounted for at cadastral value) objects, except for land and vehicles: there are separate taxes for them (land and transport).

Dividing objects cannot be taxed

In this phrase, a comma can be before or after the word “impossible” - the expected tax base depends on this.

The criterion for distributing the property base into taxable and non-taxable is separate accounting.

IMPORTANT INFORMATION! Features of separate accounting of taxable and non-taxable property must be reflected in the internal accounting policy of the organization.

But what to do if, in fact, part of the property is used simultaneously for agricultural and other business activities? In such cases, it is usually difficult to carry out separate accounting of fixed assets. An auxiliary method for determining the taxable share will come to the rescue, based on the result of business activity, namely, revenue from sales (provision of services, work). You should compare revenue from agricultural activities with revenue from other activities carried out using this OS. The residual value of such property is determined in proportion to the share of income from other, non-agricultural activities in the total revenue of the organization.

The objects unconditionally subject to property tax under the new legislation will include:

- administrative buildings of the company;

- office rooms;

- residential and hotel stock;

- workers' dormitories;

- canteens, etc.

FOR YOUR INFORMATION! The tax is paid not only by the owner of these objects, but also by the entrepreneur or company on the Unified Agricultural Tax that leased or chartered them.

Changes in 2021

Organizations and individual entrepreneurs who pay the Unified Agricultural Tax will be recognized as VAT payers from January 2021. Clause 8 of Article 346.1 of the Tax Code of the Russian Federation will cease to apply. Unified agricultural tax payers will make deductions and restore value added tax like everyone else. From the same time, subclause 8 of clause 2 of Article 346.5 of the Tax Code of the Russian Federation, which states that “input” VAT applies to expenses, will cease to apply.

Organizations and individual entrepreneurs who pay the Unified Agricultural Tax will be recognized as VAT payers from January 2021.

But in 2021, those who pay the Unified Agricultural Tax will receive the right to be exempt from VAT under Article 145 of the Tax Code of the Russian Federation. True, there are some caveats here. An individual entrepreneur or organization must declare its right to work without VAT in the same year in which it submitted an application for the desire to pay the Unified Agricultural Tax. There is an alternative condition: in the previous tax period, income from activities related to agriculture (excluding the single tax) should not exceed the established limit: 100 million rubles for 2021, 90 million rubles for 2019, 80 million rubles for 2021 year, etc.

Reduction of the single tax under the simplified tax system and UTII by the amount of insurance premiums

Before the law under commentary came into force, the Tax Code of the Russian Federation did not clearly state whether individual entrepreneurs on the “imputation” who did not hire employees could reduce the single tax by the entire amount of contributions “for themselves” without a 50 percent limitation. There was also no clarity regarding entrepreneurs using the simplified system with the object “income”, who do not have a single employee on their staff. True, officials in their comments traditionally stated that the restriction for these categories of taxpayers does not apply (see, for example, letters of the Ministry of Finance of Russia dated 04/08/13 No. 03-11-11/139 and dated 04/05/13 No. 03-11-10/ 17).

Starting from November 27, 2021 (the date of entry into force of the corresponding norm of Law No. 335-FZ), paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation, paragraph 2.1 of Article 346.32 of the Tax Code of the Russian Federation are set out in a new edition. Now it clearly states that the 50 percent limit does not apply to entrepreneurs without employees. Moreover, this innovation applies to legal relations that arose from January 1, 2021 (Clause 9, Article 9 of Law No. 335-FZ).

Calculate contributions “for yourself”, tax according to the simplified tax system, fill out payments in the web service Fill out for free

Who benefits from it?

Agricultural producers (individual entrepreneurs and LLCs) have been reluctant to use unified agricultural tax in the last few years. Let's figure out why this happens.

Firstly, the Unified Agricultural Tax exempts people from paying value added tax. But, according to statistics, most of the contractors of farms are large companies that use OSNO. Transactions between VAT payers and non-payers become inconvenient due to complex reporting and the inability to make a VAT refund.

Secondly, the VAT rate on agricultural products is now only 10%. And this tax can be reimbursed at a general rate of 18%. For example, a farmer sells wheat with VAT of 10% and buys a tractor with VAT of 18%. The benefits of using OSNO in this case are obvious.

Thirdly, the property tax is very low, and since 2013 another benefit has been in effect - a zero rate on movable property. Therefore, the benefits of using OSNO in some cases outweigh its disadvantages.

Of course, it’s up to you to decide whether to use the Unified Agricultural Tax or stay on OSNO, but don’t forget to take into account the specifics of your business. The simplicity of the Unified Agricultural Tax may seem like a great bonus to you, but you should take into account the taxation system of your partners. Take a responsible approach to your business, and your business will go uphill.

How can an agricultural producer confirm his right to a transport tax benefit?

A business entity may be exempt from paying tax on the types of transport listed in paragraphs. 5 p. 2 art. 358 of the Tax Code of the Russian Federation, subject to confirmation:

- agricultural producer status;

- intended purpose of transport (used in the production of agricultural products);

- vehicle registration in accordance with the established procedure.

The specifics of obtaining the right to a tax benefit are described below.

Confirmation of agricultural producer status

In accordance with tax legislation, only agricultural producers can be exempt from paying taxes on special agricultural vehicles (tractors, combines, milk tankers, etc.).

The conditions under which a business entity is assigned the status of an agricultural producer are established by Art. 1 of Law No. 193-FZ of December 8, 1995:

| Agricultural producer status | Manufacturer of agricultural products | 2 | November 28, 2021 Exemption of agricultural transport from transport tax editor of the magazine "Accountant of Crimea: accounting in agriculture" Since 2015, organizations of the Republic of Crimea and Sevastopol, on an equal basis with other regions of the Russian Federation, pay transport tax. The procedure for its calculation and payment is established by the laws of the Republic of Crimea dated November 19, 2014 No. 8-ZRK/2014 and the city of Sevastopol dated November 14, 2014 No. 75-ZS. These regulations do not provide any benefits for agricultural enterprises, but they are available at the federal level - directly in the Tax Code of the Russian Federation. However, what we will talk about next is not formally called a benefit. But in fact it is, because excluding a vehicle from taxation is, in fact, fundamentally no different from providing a benefit. |

Check the documents for the equipment

However, as can be seen from the Letter of the Ministry of Finance of Russia dated December 10, 2013 No. 03-05-06-04/54111, the classification of a specific vehicle as such a special equipment must be documented. The department explained how to do this.

Financiers pointed out that in accordance with the Decree of the State Standard of Russia dated 04/01/1998 No. 19 “On improving the certification of motor vehicles and trailers”, the document valid in the Russian Federation for registration and admission of vehicles for operation is the vehicle passport (PTS) . Among other things, it confirms the type approval of the vehicle.

In other words, the type of vehicle specified in the PTS must correspond to the information from the vehicle type approval (certificate of conformity).

By Order of the Ministry of Internal Affairs of Russia No. 496, the Ministry of Industry and Energy of Russia No. 192, the Ministry of Economic Development of Russia No. 134 dated June 23, 2005, the Regulations on vehicle passports and vehicle chassis passports (hereinafter referred to as the Regulations) were approved. Clause 28 of the Regulations states that in line 4 “Vehicle category (A, B, C, D, trailer)” of the PTS, the category that corresponds to the classification of vehicles is indicated.

These categories are established by the International Convention on Road Traffic [1]. Appendix 3 to the Regulations contains a comparative table of categories of vehicles according to the classification of the Inland Transport Committee of the United Nations Economic Commission for Europe and according to the classification of the Convention on Road Traffic.

In accordance with the Decision of the Board of the Eurasian Economic Commission dated September 22, 2015 No. 122, the preparation of vehicle passports (vehicle chassis passports) in the form and in accordance with the rules established by the legislation of the Russian Federation is allowed until July 1, 2017.

From this date, a single form of vehicle passport (vehicle chassis passport) and passport of self-propelled vehicle and other types of equipment will be introduced everywhere in the EAEU. Moreover, for new vehicles these documents will be issued in electronic form (electronic passport). Replacement of previously issued PTS and passports for self-propelled vehicles and other types of equipment will be made upon application by the owner of the vehicle (self-propelled vehicle and other type of equipment).

The Ministry of Finance drew attention to the fact that the indication of any category of vehicle in the PTS (A, B, C, D, trailer) does not indicate what type of vehicle it is, for example, a passenger car or a truck, that is, it is impossible to determine the ownership of the equipment in this way to special.

The financiers concluded that if the totality of this information does not indicate that the vehicle used for agricultural work is classified as special, then the provisions of paragraphs. 5 p. 2 art. 358 of the Tax Code of the Russian Federation does not apply to it.

Combining the Unified Agricultural Tax with other tax regimes

Organizations can combine Unified Agricultural Tax with UTII, and individual entrepreneurs with both UTII and PSN, but they will need to keep separate records of income and expenses. When combining regimes, the total income for determining the share from the sale of agricultural products of at least 70% will be calculated for all regimes. In addition, it will not be possible to use UTII for the sale of agricultural products through your own stores and catering outlets. Unified agricultural taxation is not combined with the simplified taxation system and OSNO modes.

Thus, we can conclude that the Unified Agricultural Tax is a gentle special regime, and if an agricultural producer (or fishing organization) can meet all the specified requirements, then the tax burden for them will be minimal.

Loss of the right or refusal to apply the unified agricultural tax

If at the end of the year it turns out that the requirements for the application of this regime have been violated (for example, the share of income from the sale of agricultural products or fishing catch is at least 70% of the total income), then the Unified Agricultural Tax payer must report this in Form No. 26.1-2. In this case, the tax for the past year will be recalculated based on the requirements of OSNO, and the arrears will have to be paid in January of the new year.

You can also refuse to apply this preferential treatment on a voluntary basis; this is reported in Form No. 26.1-3. This can be done only at the end of the tax period, that is, the calendar year, in the period from January 1 to January 15.

Finally, the fact that the Unified Agricultural Tax payer has ceased the activities of the agricultural producer must be reported within 15 days from the date of termination of such activities in Form No. 26.1-7.