The concept of strict reporting forms

Strict reporting forms are paper documents that some organizations issue instead of sales and cash receipts to confirm the acceptance of money from the public. There are many types of forms, and examples include train tickets, theater tickets, shoe repair receipts, etc.

At the moment, the use of strict reporting forms (abbreviated as BSO) is possible when providing any services, even those not listed in OKUN.

Organizations using such documents must keep strict records of them, since BSOs are a form of reporting to the tax authorities.

Securing obligations and payments

The accounts of the second group take into account collateral for obligations and payments issued and received. Such security, according to paragraph 1 of Article 329 of the Civil Code of the Russian Federation, includes a pledge, deposit, surety, bank guarantee and others.

Here again the question arises: at what value should the collateral recorded off the balance sheet be taken into account? Let's say we are talking about collateral. In this case, what should be reflected on the balance sheet - the value of the pledged property or the amount of the obligation (payment) of the mortgagor? After all, these amounts will not necessarily be equal. It would be more logical to reflect the security at the value of the pledged property on the balance sheet. Since if the pledgor does not repay his obligation (payment), the pledgee will be able to compensate himself for losses in the amount of the pledged property. Let's give an example.

Example

CJSC Import-design sells a consignment of goods to Victoria LLC. The LLC secured payment for the goods by pawning a computer, the residual value of which is 15,000 rubles. This value was fixed in the collateral agreement. CJSC Import-design reflects the security on its balance sheet:

DEBIT 008 - 15,000 rub. - payment security has been received.

Victoria LLC did not pay for the goods by the due date. Thus, the computer became the property of the pledgee. Until Import-design CJSC sells the object received under the pledge agreement, the accountant of this company takes it into account as part of the inventory accepted for safekeeping.

The postings at Import-design CJSC will be as follows:

LOAN 008 — 15,000 rub. — payment security has been written off;

DEBIT 002 - 15,000 rub. — the object received under the pledge agreement is taken into account as part of the inventory items accepted for safekeeping.

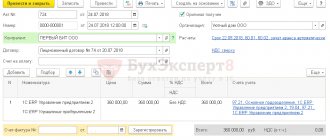

When the object received under the pledge agreement is sold, Import-design CJSC will reflect other income:

LOAN 002 — 15,000 rub. — an object received at disposal under a pledge agreement is sold;

DEBIT 51 CREDIT 91 - 15,000 rub. — income received from the sale of the property.

Off-balance sheet account 006

Off-balance sheet accounts are designed to account for various property that is in the company temporarily, in storage or on a rental basis, for example. A feature of accounting on these accounts is the absence of a double entry method, that is, there will be no correspondence in the Dt or Kt account. Analytical accounting is maintained in registers developed by the company independently and reflected in the accounting policies.

By the way, you can find out what’s new in the accounting policy for the next year here.

To account for strict reporting forms, the current chart of accounts provides for account 006. It is off-balance sheet, that is, its balance will not be affected in any way by the balance sheet currency, however, this account will not allow you to forget about some material assets in the company.

The debit of this account records the receipt of forms in the conditional valuation, and the credit indicates the expense. It is assumed that records are kept in the context of the name of each form and where they are stored. Thus, if your company has a separate division, then you will have 2 storage locations in this account. The company sets the conditional valuation (for example, 1 ruble) independently.

The requirements for maintaining off-balance sheet accounts are almost the same as for balance sheet accounts. You can find out about the inventory of such accounts in our article “Is it possible to carry out an inventory for an off-balance sheet account?”

You can read about off-balance sheet accounting in general here.

Let's look at accounting for strict reporting forms using an example.

Rules for accounting for funds in off-balance sheet accounts

According to Instruction No. 157n, the general accounting rules for off-balance sheet accounts are as follows:

- Off-balance sheet accounts record various assets belonging to the enterprise and other organizations.

- Both diplomas and checks or receipts can act as various BSOs.

- The accounting itself is maintained according to a simple scheme: control of debit receipts and credit expenses.

- There is no double entry for off-balance sheet accounts.

- To provide full information for the management account, you can open additional accounting lines.

- All recorded objects are annually inventoried at the same time as the objects on the balance sheet.

Carrying out inventory of off-balance sheet accounts must be carried out in accordance with methodological recommendations.

In this case, the movement of accounting property in these accounts should be reflected in section 3 of the Explanatory Note to the Balance Sheet of the institution “Information on the movement of non-financial assets of the institution” (form 0503768).

The same section should contain information regarding the value of property at the beginning and end of the year, as well as those received and disposed of during the reporting period.

In 2021, the right to use BSO as checks and coupons remained with individual entrepreneurs and companies, who have the right not to use cash register equipment (CCT) until July 1, 2019.

Example of BSO accounting on account 006

Most often, BSOs are purchased independently by the company and are issued to employees. Accounting for the costs of purchasing such forms is carried out in cost accounts at the cost of their acquisition according to the documents. The BSO themselves are accounted for in account 006.

Example

works with the population in cash. According to current regulations, when receiving funds, the company issues receipts, which are BSO. A batch of BSO purchased on April 3 was purchased for 25 kopecks. per piece excluding VAT, 2000 pieces - according to the invoice. Receipts were immediately issued to stores for customer service. The accountant will show the following entries in accounting:

- Dt 10 “Materials” Kt 60 “Settlements with suppliers” - forms (receipts for the provision of services) have been capitalized at the cost of the invoice - 500 rubles. (0.25 rub. × 2000 pcs.);

- Dt 20 “Main production” Kt 10 “Materials” - receipts issued for work are written off - 500 rubles.

Simultaneously with this posting, others appear to control the use of forms (in terms of storage locations):

- Dt 006 “Store No. 1” - some of the forms were transferred under the act: 250 rubles. — 1000 pieces;

- Dt 006 “Store No. 2” - some of the forms were transferred under the act: 250 rubles. — 1000 pieces;

- Kt 006 “Store No. 1” - 50 forms were written off from the storage location (according to the store report from April 3 to April 10): 12.5 rubles. (50 × 0.25 rub.);

- Kt 006 “Store No. 2” - written off from the storage location based on the report of 200 forms: 50 rubles. (200 × 0.25 rub.).

Strict reporting forms (work books and loose sheets for them, receipts for road transport, etc.) are recorded in off-balance sheet account 006 Strict reporting forms.

[p.346] Accounting for the movement of coupons is kept on the off-balance sheet account 006 Strict reporting forms, in a special book on the types of petroleum products at their nominal value. [p.167] Account 006 Strict reporting forms [p.129]

Account 006 Strict reporting forms is intended to summarize information about the availability and movement of strict reporting forms stored and issued for reporting - receipt books, forms of certificates, diplomas, various subscriptions, coupons, tickets, forms of shipping documents, etc. [p.129]

Strict reporting forms are accounted for in account 006 Strict reporting forms in the conditional valuation. [p.129]

Analytical accounting for account 006 Strict reporting forms is maintained for each type of strict reporting forms and their storage locations. [p.129]

ACCOUNT 006 STRICT ACCOUNTING FORMS [p.147]

Before they are sold, the company's shares are accounted for at par value on the balance sheet in account 006 Strict reporting forms. After full payment by shareholders, the shares are written off the balance sheet. When shares are sold at a price higher than their par value, the difference is credited to subaccount 872 Share premium. If the market value of a share is below par value, then the negative difference is debited to subaccount 872 Share premium. The company can carry out various operations with its own shares - buy them back from shareholders (i.e. buy them on the secondary stock market), exchange ordinary shares for preferred ones, exchange shares for bonds, pledge shares, etc. [p.13]

The cash desk of an enterprise can store not only cash, but also securities, monetary documents, which are strict reporting forms. These include vouchers to holiday homes and sanatoriums purchased using funds from a special purpose fund, postage stamps, state duty stamps, uniform and travel tickets (tram, trolleybus, bus). Securities are accounted for in account 56 Cash documents in journal order No. 3. Receipt and issue of securities are carried out according to incoming and outgoing cash orders, followed by the cashier drawing up a report on the movement of securities. Strict reporting forms (work books and loose sheets for them, receipts for road transport, etc.) are recorded in off-balance sheet account 006 Strict reporting forms. [p.63]

AN ACT FOR WRITTING OFF USED STRICT REPORTING FORMS is used to formalize the write-off of used strict reporting forms. The act is drawn up by a commission appointed by the head of the organization. The act indicates the number of book forms used, indicating the series and numbers of the forms. The act is filled out in one copy. After approval by the head of the organization, it is transferred to the accounting department to reflect in the accounting records the write-off transactions on off-balance sheet account 006 “Strict reporting forms”. [p.14]

Accounting for sales share forms is maintained on off-balance sheet account 006 “Strict reporting forms” at par value, their types and storage locations. [p.22]

BILL - a security certifying the unconditional monetary obligation of the drawer to pay, upon maturity, a certain amount of money to the owner of the bill (bill holder). Promissory notes and bills of exchange are issued. Accounting for bill forms is carried out on off-balance sheet account 006 “Strict reporting forms” at face value. These forms are written off from the off-balance sheet account simultaneously with entries for the sale of securities. [p.52]

OFF-BALANCE ACCOUNTS - accounts intended for accounting for assets that do not belong to the enterprise, but are in its use or disposal (deposit property accounts 001 “Leased fixed assets”, 002 “Inventory assets accepted for safekeeping”), and also to control individual transactions that are not reflected in the system of balance sheet accounts (control account 006 “Strict reporting forms”) and to obtain data on the implementation of business contracts, orders and other administrative documents (accounts of conditional rights and obligations 003 “Materials accepted in processing", 005 "Equipment accepted for installation", etc.). [p.113]

In canteens, meals may be provided on subscription basis. Subscriptions are strict reporting forms. The stock of subscriptions is stored at the cash desk and is the responsibility of the cashier, who maintains the subscription book (non-standard form). Accounting for subscriptions is kept on off-balance sheet account 006 “Strict reporting forms”. Used subscription coupons are stored for the period established for storing cash documents. The daily cost of meals sold under subscriptions must be indicated on the cafeteria menu. [p.346]

Usually payment for A. is made in advance. Inventory of assets held at the enterprise's cash desk is carried out at least once a month. The procedure for storing and using A. is established by the enterprise. A. accounting is maintained in the manner established for strict reporting forms. Off-balance sheet account 006 Strict reporting forms is intended for this. Received A. are recorded on the debit of the account without correspondence with other accounts. Analytical accounting for account 006 Strict reporting forms are maintained for each type of asset, nominal value and storage location. [p.3]

STRICT ACCOUNTABILITY FORMS - document forms that are subject to accounting and issued to employees for registration of business transactions. Accounting for strict reporting forms is carried out in off-balance sheet account 006 Strict reporting forms. The list of documents related to strict reporting forms is in order [p.72]

Checks are strict reporting forms and are accounted for in the off-balance sheet account 006 Strict reporting forms. Crediting of checks is reflected in the debit of account 006 Strict reporting forms. Checks are written off from the credit of account 006 Strict reporting forms as they are used. [p.82]

Account 006 - Strict reporting forms is used to summarize information on the availability and movement of strict reporting forms stored and issued for reporting - receipt books, forms of work books, certificates, diplomas, various subscriptions, coupons, tickets, forms of shipping documents, etc. etc., vouchers received at the branch of the Social Insurance Fund of the Russian Federation. Strict reporting forms are accounted for in account 006 Strict reporting forms in conditional valuation (for example, 5 rubles). [p.423]

To account for options and warrants, cash accounting accounts and off-balance sheet accounts 006 Strict reporting forms, 008 Security for obligations and payments received and 009 Security for obligations and payments issued are used. To account for options and warrants by the nature of their use, subaccounts of the corresponding names are opened in accounts 008 and 009. [p.46]

To reflect payment expenses in accounting accounts, it seems possible to use account 26 General business expenses. Also, bill forms must be accounted for on the debit side of off-balance sheet account 006 Strict reporting forms. Accounting is carried out on a conditional basis. When registering a bill of exchange as a debt obligation and transferring it to the bill holder, the bill of exchange form must be written off from accounting, reflecting the transaction on the credit of account 006 Strict reporting forms. [p.46]

Special stamps must be reflected in accounting accounts as tangible assets at the actual cost of their production and acquisition, with simultaneous accounting at their nominal value in off-balance sheet account 006 Strict reporting forms. Write-off of special stamps from account 006 must be carried out on the basis of the relevant accounting documents. The actual cost of special stamps, listed in the accounting records in a separate subaccount of account 10 Materials, is written off when they are issued and simultaneously written off from the off-balance sheet account. If there is a shortage of special stamps, the actual costs of the missing stamps are written off in accordance with the established procedure in accordance with clause 3 of Art. 12 of the Federal Law of November 21, 1996 No. 129-FZ On Accounting. [p.232]

The chart of accounts for the accounting of financial and economic activities of enterprises and the Instructions for its application, approved by Order of the USSR Ministry of Finance of November 1, 1991 No. 56, to summarize information on the availability and movement of strict reporting forms stored and issued for reporting, account 006 Strict reporting forms is intended reporting Strict reporting forms are accounted for on account 006 in a conditional valuation (if enterprises are centrally provided with the specified forms (at present this is practically not used)) or at the purchase price (if the enterprise purchases the forms independently). [p.58]

Strict reporting forms are document forms that are subject to accounting and issued for reporting to certain employees for registration of business transactions. Accounting is carried out using off-balance sheet account No. 006 Strict reporting forms. Receipts are recorded in the debit of this account, and expenditures of forms are recorded in credit. Analytical accounting is carried out separately for each type of B. s. O. and places of their storage. Application of B. s. O. promotes the protection of socialist property. [p.14]

Own shares produced by the organization's printing house (or by order from a third-party printing house), according to a special inventory, are accounted for off-balance sheet account 006 Strict reporting forms at par value and are written off as they are redeemed. [p.341]

Strict reporting forms are accounted for in the off-balance sheet account 006 Strict reporting forms, and their cost is included in overhead expenses (if there are significant one-time expenses, they can be included in future expenses). [p.343]

Strict reporting forms (powers of attorney, waybills, receipt books, forms of vouchers (courses) to holiday homes, health and sports centers, night sanatoriums and similar institutions owned by the organization, and other similar forms), as a rule, are produced according to separate orders of functional services in the organization's printing house. Operational accounting of the number of forms printed, handed over to the consumer and used by the consumer is carried out according to their serial numbers and recorded in natural units on the off-balance sheet account 006. Strict reporting forms. [p.362]

Vouchers (courses) to their own tourist centers, sports and recreational camps, holiday homes and similar institutions, which are on the balance sheet of the organization and financed from its own funds, are accounted for in the off-balance sheet account 006 Strict reporting forms (by their types, purpose, numbers, cost) the cost established by the administration of the organization in agreement with the trade union is used to increase the funds of targeted financing intended to finance the activities of the specified social institutions of the organization d-tsch. 73-2, set of accounts. 96 (on a separate subaccount), you can also d-t account. 50, set count. 96, bypassing the count. 73-2, for the cost of issued vouchers (courses). At the same time, an accounting entry is made on credit to off-balance sheet account 006. [p.383]

Inventory of property off balance sheet

In some cases, companies are required to conduct an inventory of property and liabilities. For example, when preparing annual financial statements. This is stated in Article 11 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” and paragraph 27 of the Regulations on Accounting and Financial Reporting in the Russian Federation (approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n). This requirement also applies to property included in the balance sheet.

When making an inventory of “off-balance sheet” property, separate matching statements must be drawn up. This is stated in paragraph 4.1 of the Methodological Guidelines for Inventorying Property and Financial Liabilities (approved by Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49).

Based on the results of the inventory, inventory lists (acts) are signed by all members of the commission and the financially responsible person. During the inspection, the commission can identify both surpluses of “off-balance sheet” property and shortages.

Let’s say that the inventory results reveal a shortage of goods accepted for commission. Then the company will have to compensate the owner of this property for this deficiency. Since, when the commission period expires, the owner of the missing objects will demand compensation for losses. The company that has identified a shortage reflects the amount of losses as part of other expenses.

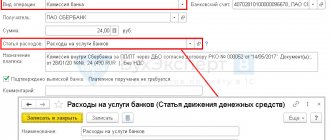

This is reflected in the accounting records:

CREDIT 004 - the shortage of goods accepted for commission was written off on the basis of an inventory report;

DEBIT 91 CREDIT 76 - the amount of losses that must be paid to the organization that owns the missing objects is included in other expenses.

Excess “off-balance sheet” goods can be taken onto the balance sheet as part of other income. Let's say that a surplus of goods accepted for commission is discovered. Then the wiring will be like this:

DEBIT 41 CREDIT 91 - excess goods accepted on commission are accepted into the enterprise’s goods.

Off-balance sheet accounting data in reporting

The company may include off-balance sheet accounting data in its financial statements, namely in the notes to the balance sheet and income statement. There, in particular, they indicate the cost of fixed assets received for rent, as well as the amount of security received and issued (Appendix No. 3 to the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n). In the explanations to the balance sheet, you can reflect “off-balance sheet” property, which is maintained both in monetary and in conditional or quantitative valuation.

Editorial board of the magazine "Glavbukh"