From July 1, 2021, the bulk of Russian trade and service enterprises will switch to online cash registers without fail. For non-use of innovative KMM, a fine will be charged. But some businesses fall under exceptions to this strict rule, and among them are a number of business entities on UTII. Among them are both individual entrepreneurs and legal entities on the “imputation”.

Are you switching to an online checkout? We will select a cash register for.

Leave a request and receive a consultation within 5 minutes.

From what date and for which individual entrepreneurs is the cash register required?

Let’s say right away that there will be no cancellation of CCP for UTII in 2021. Moreover, you shouldn’t expect it next year either.

According to the law, CCP for individual entrepreneurs on UTII is mandatory in all cases from July 1, 2021. There are no exceptions.

As a result, only 2 categories of entrepreneurs can postpone the use of cash registers for UTII in 2021:

- who provide services, with the exception of catering (part 7.1 of article 7 of the Law of July 3, 2016 No. 290-FZ);

- who sell goods at retail or provide catering services in the absence of personnel with whom employment contracts have been concluded (clause 2, 4, part 7.1, article 7 of Law No. 290-FZ).

This is a kind of deferment for CCP for UTII. And as you can see, it is not for everyone.

And vice versa: CCP for UTII has become mandatory from July 1, 2021, if the individual entrepreneur has retail trade or catering and also has a staff of hired workers.

The use of cash register for individual entrepreneurs on UTII from 2021 is mandatory if he trades in retail or provides catering services without employees under employment contracts, but has concluded at least one contract.

In this case, it is no longer possible to talk about CCP for individual entrepreneurs on UTII without employees. He must register his CCP within 30 calendar days from the date of his conclusion of the employment contract (Part 7.3 of Article 7 of Law No. 290-FZ).

What is UTII

UTII, or the so-called “imputation”, is a tax for certain types of business activities and correlates well with the simplified taxation system (STS).

A special feature of UTII is that its amount is calculated not from real income, but from imputed income. That is, the figure is calculated by tax officials based on the estimated amount of income.

The transition to a single tax from the beginning of 2013 is voluntary. Article 346.26 (clause 2) of the Tax Code spells out in detail all the cases when imputation and possible restrictions can be applied. For example, if there are more than 100 employees, this type of tax is not applicable.

And in different regions, authorities can establish their own framework for the use of UTII by entrepreneurs in accordance with the existing realities and nuances of the products produced and procured and the local climate.

Right to deduction

It is important that the use of cash registers for UTII gives the right to a deduction for the purchased cash register. The maximum amount is no more than 18,000 rubles. Such a reduction in imputed tax is permissible in addition to insurance premiums made by individual entrepreneurs and payment of sick leave benefits for the first 3 days.

The 50% limit on reduction does not need to be observed (letter of the Ministry of Finance dated April 20, 2018 No. 03-11-11/26722).

Also see “Reducing UTII for insurance premiums in 2021 for individual entrepreneurs.”

Who can not use CCT?

- traders of bottled drinks from tanks: kvass, milk, etc.

- traders in markets, mobile stalls, fairs, etc.

- ticket sellers

- sellers of postage stamps, newspapers, etc.

- securities traders

- persons engaged in peddling trade

- watch, shoe or electronics repairers, key makers

- nurses, nannies

- people providing services for plowing gardens, etc.

- porters at train stations and airports

- people renting houses

Calculation of tax taking into account the purchased cash register

Now let’s give an example of calculating UTII taking into account the deduction of cash registers.

EXAMPLE

IP Shirokova bought and registered an online cash register in the 1st quarter of 2021. The cost of the CCP was 18,000 rubles. The amount of calculated UTII for the first quarter of 2021 was 7,000 rubles. The amount of insurance contributions made was 3,000 rubles. In this situation, the entrepreneur Shirokova can reduce the calculated amount of tax (7,000 rubles) by insurance premiums (3,000 rubles) and the cost of purchasing a cash register in the amount of 4,000 rubles.

The individual entrepreneur has the right to take into account the balance of 14,000 rubles when reducing the amount of calculated tax in subsequent tax periods within the deadline (see above, as well as letter of the Federal Tax Service dated April 19, 2018 No. SD-4-3/7542).

Also see “Tax deduction for individual entrepreneurs’ cash register on UTII”.

How to choose a cash register for an online store

If an online store, in addition to ESP, accepts money through a courier, then you need to use a cash register, which prints a paper check and sends an electronic copy of it to the tax office and to the buyer (upon request before settlement). There are various checkout models that are suitable for couriers. We will briefly describe in what situation which cash register should be chosen.

Cash desks for non-stationary trade with an assortment of up to 10 thousand products

This solution is suitable if the product catalog is small and you are ready to fill and edit it manually. There are two options for transferring items to the cash register, which are worth remembering when choosing a cash register.

Products in the cloud

The electronic catalog of goods is stored in a personal account, which is provided by the manufacturer of the cash register and software. When generating a receipt, the cash register accesses the cloud catalog and adds the item to the receipt from it; this process can take about a minute. If there are about ten items on a receipt, it will take the courier about 10 minutes to serve the buyer.

Products in the cash register memory

The product catalog can be downloaded to the checkout from the cloud, from Excel or other spreadsheet format. When selling, the cash register does not contact the cloud; it takes goods from the built-in memory, which means receipt generation is faster. If you do not maintain the item in the goods accounting service, then the product catalog is not updated according to the data from the cash register. Accordingly, inventory balances in it are not automatically recalculated.

Cash desks for non-stationary trade with an assortment of up to 30 thousand products

Such cash registers are more powerful than the previous group of cash registers and have a more capacious memory. Some have a touch screen and a 2D scanner.

The cash register receives items from the goods accounting service via the Internet and remembers it. When generating a check, the cash register does not contact the cloud for each item, which significantly speeds up customer service. The goods accounting service receives sales data from the online cash register and recalculates the balances.

It is important that data from the cash register is transferred to the service without delays or losses. Thus, the goods accounting web service “Kontur.Market” has its own cash register module, so the exchange of data between the cash register and the service occurs instantly - the courier made a sale through the cash register, and the director, having opened the service in his office, sees current statistics on goods and revenue.

A complete set for online cash register: for the price of a cash register you will receive a cash register, OFD and the Kontur.Market product accounting system Send a request

How to reflect CCP in the declaration

Oddly enough, there is no new form of declaration for UTII with CCP as of mid-2018, although its draft has long been ready. Therefore, it is difficult to reflect the cash deduction in it.

At the same time, the Federal Tax Service in letter dated 02.20.2018 No. SD-4-3/3375 strongly recommends that in order to reduce UTII, along with this report, submit an explanatory note to the tax office with the obligatory indication of the following details for each cash register in respect of which you are reducing the tax :

- CCP model name;

- serial number of the KKT model;

- CCP registration number assigned by the tax office;

- date of registration of the cash register with the tax office;

- the amount of expenses for purchasing a copy of the cash register, which reduces UTII (no more than 18,000 rubles);

- the total amount of expenses for the purchase of a cash register, which reduces the tax payable for the tax period.

For more information about this, see “Explanatory note to the UTII declaration for obtaining a deduction for the purchase of a cash register.”

If an individual entrepreneur bought a cash register for UTII, but indicated the amount of tax in the declaration without reducing it by deduction and paid it, he can then submit an amendment. After checking it, the Federal Tax Service will return or count the overpayment against upcoming payments (clause 3 of the Federal Tax Service letter dated February 21, 2018 No. SD-3-3/1122, Article 78 of the Tax Code of the Russian Federation).

Thus, from 2021, CCP on UTII has become mandatory for most individual entrepreneurs, and from July 1, 2021 - for all businessmen on imputation.

Read also

26.07.2018

How to use online cash registers when combining OSN, simplified tax system and UTII

As mentioned above, working on UTII can be combined with other taxation systems. Activities that correspond to the “imputation” are carried out according to it, and the rest are carried out according to a general or simplified system, which cannot be combined with each other.

The subject of taxation is not obliged to work under UTII (even if he has the right to do so) - he can work under the simplified tax system or the OSN. In this case, the online cash register had to be installed on July 1, 2021.

Although paying a fixed fee can be extremely unprofitable when the retail outlet’s turnover is small or seasonal. Actual profit is significantly lower than the tax assigned to it.

There are options when it is impossible to apply a more favorable simplified tax system, and then you have to work according to general taxation:

- the amount of revenue from trade and other activities exceeds the scope of application of the “simplified”;

- the fixed assets of an organization or individual entrepreneur are higher than those for which the simplified tax system can be used;

- a significant part of the authorized capital (more than 25%) is in the possession of other legal entities, whose taxes are paid unknown where and unknown to whom.

When combining tax regimes, polar situations may arise:

- An entrepreneur, starting to work for UTII, recruits a staff of more than 100 employees and loses the right to this type of taxation.

- Trading was initially carried out according to the simplified tax system or even the OSN (due to ignorance or for some other reasons), the conditions of his business allow him to switch to “imputation”.

How to confirm the fact of payment when exempt from cash register

So, we found out that in most cases a cash register is needed for UTII. In this case, a cash receipt is issued to the buyer or client to confirm payment. What should those individual entrepreneurs without employees who received a deferment from the CCP do? What document should they issue?

On the Federal Tax Service website we found the following answer: “It should be noted that from 07/01/2019 to 07/01/2021 for individual entrepreneurs who do not have employees (with whom employment contracts have been concluded), when selling goods of their own production, as well as performing work and providing services, the legislation of the Russian Federation The Federation on the use of cash register systems has been granted the right not to use cash register equipment when making payments for such goods, works, and services. In other words, such individual entrepreneurs may not use cash register systems during the specified period and issue BSOs that meet the requirements of Decree of the Government of the Russian Federation dated May 6, 2008 No. 359.”

However, this answer does not describe cases when payment for services is made to the bank account of an individual entrepreneur or online. After all, in this case there is no personal contact with the client and it is impossible to give him a paper BSO. In addition, the advice to issue BSO when selling goods of your own production seems strange, because the strict reporting form is intended only for payment for services. We recommend that our users in such situations contact their Federal Tax Service for clarification.

Responsibility for violation of the law on cash register equipment

For individual entrepreneurs on UTII, sanctions for non-compliance with the requirements for cash mechanisms are indicated in Art. 14.5 of the Code of Administrative Violations of the Russian Federation.

If payments by an individual entrepreneur are made without using a cash register, the fine will be from 25% to 50% of the amount of settlements carried out “by the cash register”. The minimum amount of such a penalty is not less than 10 thousand rubles. Legal entities in a similar situation will be charged from 75% to 100% of payments made “bypass the cash register” (but not less than 30 thousand rubles).

Installation of a cash register model that is not included in the official register, lack of registration with the Federal Tax Service, as well as failure (or delay) to submit documents and information on cash registers to the tax service entails a warning or an administrative fine:

- from one and a half to three thousand rubles - for individual entrepreneurs;

- from five to ten thousand rubles - for legal entities.

Codes and database

The calculation is carried out using the data provided by the table of basic UTII yield for 2021. DB is a conditional income based on the physical indicator. These two parameters are established by law.

The table of basic UTII yield for 2021 displays constant constants, adjusted by K1 and K2.

Let's display it along with the business codes for the declaration:

All codes and meanings are displayed in the tax code and in by-laws.

They must be strictly observed, since in case of an error, the Federal Tax Service will not accept declarations and other documents.

back to menu ↑

When can you work on UTII without a cash register?

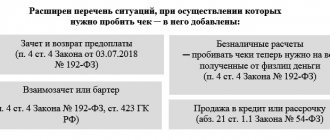

However, the Law “On Cash Registers” provides for a number of situations when cash registers may not be used at all. Moreover, these relaxations do not depend on the tax regime of individual entrepreneurs or organizations.

These exceptions are listed in Article 2 of Law 05/22/2003 N 54-FZ and do not apply to popular types of activities:

- peddling trade from hands or hand carts, except for goods that require certain conditions of storage and sale or are subject to mandatory labeling;

- sale of newspapers and magazines, as well as related products at newsstands;

- trade in kiosks of ice cream, as well as soft drinks, milk and bottled drinking water;

- trade in kvass, milk, vegetable oil, live fish, kerosene from tank trucks;

- seasonal trade in waddling vegetables;

- trade at retail markets, fairs, exhibition complexes, if the trading place does not ensure the safety of goods (with the exception of goods listed in Government Order No. 698-r dated April 14, 2021);

- sales of folk art products by their manufacturers;

- some household services (plowing gardens, repairing and painting shoes, caring for children, the sick, the elderly and disabled, sawing firewood, portering services).

Who else can work without a cash register? If your buyer (client) is a legal entity or individual entrepreneur, then when making payments with him you can not issue a cash receipt, but only on the condition that the payment is transferred from one current account to another. And when paying in cash or by card, a cash register is needed even when making payments with such partners.

The problem is that the types of activities on UTII are focused mainly on individual consumers. That is, within the framework of retail, you cannot sell anything to a buyer who is a legal entity or individual entrepreneur, because such sales already relate to wholesale trade. The same applies to most services on UTII, because household services are provided to the population, not to business.

You can use the opportunity to make a payment through a current account without a cash register only for transportation, advertising, service stations, rental of retail space and land plots for retail facilities.

Why are cash registers needed from July 1, 2021?

Online cash registers are needed not only by the tax office. They will protect the rights of buyers and help businesses with goods.

Previously, not all stores gave customers a receipt for payment or issued a receipt that was not legally binding. New cash registers print fiscal receipts, which can be used to protect rights in court. If the buyer loses the receipt, he can print out an electronic version, which is stored on the website of the fiscal data operator.

Online cash registers keep track of goods, count revenue, payments in cash and by bank card. With new technology, a business owner can control processes from anywhere in the world and replenish goods on time.