Every year there are significant changes in legislation regarding the accounting of income and revenue of enterprises. According to recent changes in legislation, the concept of revenue now refers to the gross receipts of economic benefits in the normal course of business of an enterprise, leading directly to an increase in capital. In addition, deposit accounts from investors or other persons should also be included in revenue. This definition, in connection with the new changes, corresponds to the definition of income, and all documents on this concept are enshrined in PBU 9/99 in the section “Income of the organization.”

PBU 9/99 establishes rules for the formation in accounting of a complete list of information on the income of a commercial organization (except for credit and insurance companies), which is a full-fledged legal entity in accordance with the rules of the legislation of the Russian Federation. For non-profit organizations, in accordance with this PBU, only income from entrepreneurial and other types of earnings of the enterprise is recognized.

Understanding PBU 9/99 is perhaps even more difficult than understanding how to create a business plan, but we will still try to do it.

How is the concept of income formed in accordance with PBU 9/99?

Depending on the definition of this concept, the reflection of income in accounting reports, as well as their further taxation, largely depends. According to PBU, an organization’s income is defined as an increase in economic benefits as a result of the gradual receipt of assets (property and cash) and the systematic repayment of all liabilities leading to a decrease in the organization’s capital. However, income cannot be understood as the contributions of participants who form the organization’s fund thanks to the property of the owners.

For accounting purposes, the organization’s income does not recognize all kinds of receipts from legal entities and individuals not related to the enterprise. Thus, the report does not take into account:

1) The amount of value added taxes, various types of excise taxes, sales taxes, export duties and other types of similar mandatory payments; 2) The amount of commission on contracts, agency and similar contracts in favor of the committee; 3) The amount received in the preliminary stages of payment for products, works, goods and services; 4) The amount of the advance payment for products, goods, services, etc.; 5) The amount of the deposit received and the value of only the property that is pledged, if the agreement provides for the transfer of all types of pledged property for the use of the pledgee; 6) The amount received from borrowers when repaying loans or borrowings provided to borrowers.

Thus, when preparing accounting records, not all types of income are taken into account when planning reports. Moreover, revenue under the new legislation can be calculated using different methods.

Accounting for non-operating income and expenses in accounting and tax accounting

To display information about other income and expenses, account 91 is intended, to which the corresponding sub-accounts are opened: 1 - for accounting for income and 2 - for accounting for expenses of the enterprise (Order of the Ministry of Finance dated October 31, 2000 No. 94n). Accounting for transactions on other income and expenses is carried out in the above-mentioned sub-accounts cumulatively throughout the year, at the end of which they are closed to sub-account 91.9 “Balance of other income/expenses” by internal transactions.

At the end of each month, the difference between the final balance of subaccounts 91.1 and 91.2 final turnover is written off from subaccount 91.9 to account 99 “Profit/loss”. That is, account 91 does not have a balance at the end of the month.

For correspondence of accounts and al ٜ go ٜ ri ٜ tm accounting of other to ٜ ho ٜ to ٜ in and expenses , see article ٜ at ٜ ye “Accounting for other income and expenses (nuances)”.

Analytical accounting is organized for each type of income and expense with the ability to display the financial result for each operation.

Tax accounting of non-operating income (expenses) has its own characteristics and differences from accounting.

For details, see the material “How to take into account non-operating income when calculating income tax?”

We predict financial results

If you want to calculate revenue from services provided, then it should be determined depending on the predictability of the financial results of transactions:

1. By the method of recognizing revenue as it is developed and ready: if the results of a transaction can be reliably assessed (the amounts of revenue and costs are reliably planned, and the degree of completion of transactions is reliably determined, in addition, there is a likelihood of obtaining additional economic benefits), then the amount of revenue is determined taking into account all stages of development and completion of transactions by reporting dates.

2. Recognition of the amount of revenue to the extent of reducing all costs by reimbursing them to the creditor: when the results of the transaction cannot be calculated in any way, and revenue is recognized based on the amount of reimbursable expenses.

Such approaches to revenue recognition for accounting for a certain period of time make it possible to reflect in the financial statements the amount of income that will actually be received in the near future. Thus, the amount of receivables is now not taken into account, which may or may not be real upon collection.

In the sections of the rules “organizational income - PBU 9/99”, for the first time in accounting, specific conditions are formulated for the recognition of income from ordinary activities of the enterprise. This type of income (revenue) is recognized when preparing accounting records only if the following conditions and criteria are met:

a) the enterprise has full rights to receive this type of revenue, which arises from specific contracts or is otherwise confirmed in an appropriate manner; b) the amount of revenue can be accurately determined; c) during the calculation process there is confidence that as a result of specific transactions there will be an increase in the entire list of economic benefits of this organization. Confirmation of this factor may be a situation where the organization received assets as payment, or there is no uncertainty regarding the possibility of receiving this asset; d) ownership rights (possession, use and disposal) of products or goods have passed from the organization to a specific buyer, or the work has been accepted at one time by the customer (i.e. the service has been provided to the client).

Results

Accounting for non-operating income is carried out in account 91.1 “Other income”, expenses - 91.2 “Other expenses”.

Tax legislation provides for certain conditions for determining non-operating income and expenses that differ from accounting ones. The consequence of these differences is the emergence of tax obligations and the need to maintain additional tax registers. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Other supply

7. Operating income is:

- receipts associated with the provision for a fee for temporary use (temporary possession and use) of the organization’s assets;

- receipts related to the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property;

- proceeds related to participation in the authorized capitals of other organizations (including interest and other income on securities);

- profit received by the organization as a result of joint activities (under a simple partnership agreement);

- proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods;

- interest received for the provision of an organization's funds for use, as well as interest for the bank's use of funds held in the organization's account with this bank.

8. Non-operating income is:

- fines, penalties, penalties for violation of contract terms;

- assets received free of charge, including under a gift agreement;

- proceeds to compensate for losses caused to the organization;

- profit of previous years identified in the reporting year;

- amounts of accounts payable and depositors for which the statute of limitations has expired;

- exchange differences;

- the amount of revaluation of assets (except for non-current assets);

- other non-operating income.

9. Extraordinary income is considered to be income arising as a consequence of extraordinary circumstances of economic activity (natural disaster, fire, accident, nationalization, etc.): insurance compensation, the cost of material assets remaining from the write-off of assets unsuitable for restoration and further use, etc. .P.

10. For accounting purposes, the amount of other income is determined in the following order: 10.1. The amount of proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods, as well as the amount of interest received for providing the organization’s funds for use, and income from participation in the authorized capitals of other organizations (when is not the subject of the organization’s activities) is determined in a manner similar to that provided for in paragraph 6 of these Regulations. 10.2. Fines, penalties, penalties for violations of contract terms, as well as compensation for losses caused to the organization are accepted for accounting in amounts awarded by the court or recognized by the debtor. 10.3. Assets received free of charge are accepted for accounting at market value. The market value of assets received free of charge is determined by the organization on the basis of prices in force on the date of their acceptance for accounting for this or a similar type of asset. Data on prices valid on the date of acceptance for accounting must be confirmed by documents or through an examination. 10.4. Accounts payable for which the statute of limitations has expired are included in the organization's income in the amount in which this debt was reflected in the organization's accounting records. 10.5. The amounts of revaluation of assets are determined in accordance with the rules established for the revaluation of assets. 10.6. Other income is accepted for accounting in actual amounts.

11. Other receipts are subject to credit to the organization’s profit and loss account, except in cases where the accounting rules establish a different procedure.

What income is not realized?

When the definition states that the defined concept includes all indicators except those listed, then the necessary factors can be calculated by the method of elimination. It can be said that all types of income not mentioned in Art. 249 of the Tax Code of the Russian Federation. In turn, in Art. 250 of the Tax Code of the Russian Federation states that all income of an organization is recognized as non-operating, except :

- amounts received as a result of sales;

- tax-free financial income (they are specifically stipulated in Article 251 of the Tax Code of the Russian Federation).

Publication of reports

The publicity of financial statements is provided for in Chapter 10 of PBU 4/99 “Accounting statements of an organization” (clause 42 – ). Since the reporting of an enterprise must be open to various users (investors, creditors, partners), legislators have established the obligation to publish reporting for public joint stock companies, insurance companies, enterprises involved in the placement of securities, as well as legal entities preparing consolidated reporting.

Companies are required to submit a copy of their annual reporting to each founder, state statistics department and regulatory authorities within the established time frame. If necessary, the reports are published together with the final part of the auditor’s report before June 1 of the year following the reporting year.

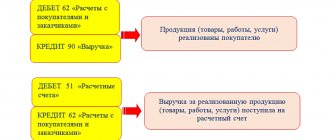

Income from ordinary activities

5. Income from ordinary activities is revenue from the sale of products and goods, receipts associated with the performance of work, provision of services (hereinafter referred to as revenue). In organizations whose subject of activity is the provision for a fee for temporary use (temporary possession and use) of their assets under a lease agreement, revenue is considered to be receipts the receipt of which is associated with this activity (rent). In organizations whose subject of activity is the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property, revenue is considered to be receipts the receipt of which is associated with this activity (license payments (including royalties) for the use of intellectual property). In organizations whose subject of activity is participation in the authorized capital of other organizations, revenue is considered to be receipts of which are associated with this activity. Income received by an organization from provision for a fee for temporary use (temporary possession and use) of its assets, rights arising from patents for inventions, industrial designs and other types of intellectual property, and from participation in the authorized capital of other organizations, when this is not the subject of activities of the organization are classified as operating income.

6. Revenue is accepted for accounting in an amount calculated in monetary terms equal to the amount of receipt of cash and other property and (or) the amount of accounts receivable (taking into account the provisions of paragraph 3 of these Regulations). If the amount of receipt covers only part of the revenue, then the revenue accepted for accounting is determined as the sum of receipt and receivables (in the part not covered by receipt). 6.1. The amount of receipts and (or) receivables is determined based on the price established by the agreement between the organization and the buyer (customer) or user of the organization’s assets. If the price is not provided for in the contract and cannot be established based on the terms of the contract, then to determine the amount of receipts and (or) receivables, the price at which, in comparable circumstances, the organization usually determines revenue in relation to similar products (goods, works, services) is accepted. or providing for temporary use (temporary possession and use) of similar assets. 6.2. When selling products and goods, performing work, providing services on the terms of a commercial loan provided in the form of deferred and installment payment, the proceeds are accepted for accounting in the full amount of receivables. 6.3. The amount of receipts and (or) receivables under contracts providing for the fulfillment of obligations (payment) not in cash is accepted for accounting at the cost of goods (valuables) received or to be received by the organization. The cost of goods (valuables) received or to be received by an organization is established based on the price at which, in comparable circumstances, the organization usually determines the cost of similar goods (valuables). If it is impossible to determine the value of goods (valuables) received by the organization, the amount of receipts and (or) receivables is determined by the value of the products (goods) transferred or to be transferred by the organization. The cost of products (goods) transferred or to be transferred by an organization is established based on the price at which, in comparable circumstances, the organization usually determines revenue in relation to similar products (goods). 6.4. In the event of a change in the obligation under the contract, the initial amount of receipts and (or) receivables is adjusted based on the value of the asset to be received by the organization. The value of an asset to be received by an organization is determined based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets. 6.5. The amount of receipts and (or) receivables is determined taking into account all discounts (mark-ups) provided to the organization in accordance with the agreement. 6.6. The amount of receipt is also determined taking into account (increases or decreases) the amount difference that arises in cases where payment is made in rubles in an amount equivalent to the amount in foreign currency (conventional monetary units). The amount difference is understood as the difference between the ruble valuation of an asset actually received as revenue, expressed in foreign currency (conventional monetary units), calculated at the official or other agreed rate on the date of acceptance for accounting, and the ruble valuation of this asset, calculated at the official or other the agreed exchange rate on the date of recognition of revenue in accounting. 6.7. When provisions for doubtful debts are formed in accordance with the accounting rules, the amount of revenue does not change.