The tax office has the right to demand documents or information from the company, and the company may refuse or ask for a deferment. From June 2021, there is a single notification form for this. You can send it from Extern.

In what cases can such a response be sent?

The unified notification form was approved by order of the Federal Tax Service dated April 24, 2019 No. ММВ-7-2/ [email protected] The document became effective on June 9, 2021.

A company may use this form in the following cases:

- if he wants to submit documents later and asks for a deferment;

- if he reports that he cannot provide documents for any reason, for example because they are with the auditor, the police or lost;

- if you need to report that the documents have already been sent to the tax office earlier.

The form can be submitted on paper or electronically. This must be done within one working day following the day of receipt of the request to submit documents (clause 6, article 6.1, clause 3, article 93 of the Tax Code of the Russian Federation). This way you will warn the inspector and avoid fines. After all, for every document that is not submitted on time in response to a demand, you face a fine of 200 rubles (Clause 1 of Article 126 of the Tax Code of the Russian Federation).

Which is correct: “non-provision” or “non-provision”

Verbal nouns have two spelling options with the particle “not”. In speech, as a rule, there are more variants of continuous spelling.

The noun “providing” is written together with the negative particle “not” according to the established rule:

if there is no opposition in the sentence, “not” is written together with the noun.

In this case, the particle turns into a prefix.

The noun “providing” with a negative particle or prefix “not” is used mainly in the official business style of speech.

Continuous spelling with the prefix non-

Continuous writing usually predominates. In the absence of opposition, a certain synonym is selected that can replace the necessary word

, such as: concealment, non-presentation.

“Failure to provide documents with objections within ten days is grounds for bringing the order into effect.”

“Failure to provide papers will affect the result.”

“Failure to provide information to the tax authorities is a violation of the law.”

A similar rule applies when using words with similar spellings:

“Failure to notify a change in the situation may have unpleasant consequences.”

“Failure to receive funds into the account for a certain period of time will serve as a reason for refusing further cooperation.”

Example sentences

For clarity, consider a few examples:

- Failure to provide documents upon request on time will result in sanctions and unwanted suspicion. It is necessary to quickly prepare them for tomorrow.

- The worst thing is the failure to provide evidence of the suspect’s innocence.

- Failure to provide all required documents will delay the assignment and payment of benefits.

- The reason for postponing the deadline for consideration of the application was the failure to provide all supporting documents.

- Failure to provide information about the change of residence of borrowers to the bank is a pressing issue that should be worked on.

In all of the above examples, the noun “failure” is used as a refusal.

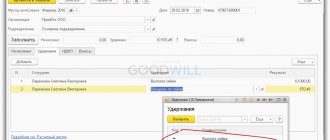

How to submit a form via Extern

On the request page, click “Respond to request” and select “Notify that documents cannot be provided.”

Fill out the notification form. Select the reason why documents cannot be submitted and provide the required information.

Example sentences

Examples of using separate writing with opposition:

- In fact, it was not the provision of documents, but an offer to find them in the archive on our own.

- This is not a guarantee, but a simple deception of the buyer.

- Here we see not the provision of material assistance, but vice versa. This activity strongly resembles fraud.

- In this unpleasant situation, the citizen is not required to be provided with living space, but to be excluded from the queue for housing.

- Not the provision of a job, but another request from the employer to wait - that’s all that was in the received message. This news ruined plans and clouded thoughts.

From the above examples it is clear that the meaning of a noun with the particle “not” means the ability to give something to someone. However, due to certain circumstances this does not happen.

Rule for separate writing

If there is a opposition, an objection, it seems possible to insert some word after the prefix

(“not provided” = “was not provided”), then the term is written separately.

The particle “not” is written separately with all verbs and short participles:

“You did not provide a certificate” - “The certificate was not provided by you.”

“They did not recognize the state” - “The state is not recognized by them.”

“He did not present a certificate” - “They did not present a certificate.”

“The goods were not delivered on time” - “The goods were not delivered on time.”

non-provision or failure to provide

In Russian there are both spellings, the application depends on the context.

So what is the article for oncoming traffic - 126 or 129.1?

Let's do a little experiment. Let’s imagine that you have received a request to provide documentation for a counterparty that is undergoing an on-site inspection.

For information about what documents can be requested as part of “meetings,” read the article “Tax authorities can request any documents from a counterparty .

In total, 500 documents were requested - 250 invoices and delivery notes. You sent them to the inspectors at the wrong time. How much will you be fined? For 5,000, 10,000, or maybe even 100,000 rubles?

Agree, there is something to think about. After all, the difference in size is colossal. Moreover, the last amount (a fine of 100,000 rubles and even more) is completely real: as we were able to verify, 100,000 rubles. - this is only 500 “late” documents for 200 rubles. And if documents are checked as part of an on-site audit over several years, a large number of requested papers is a common practice. So let's figure it out.

According to paragraph 4 of Art. 93 “Request for documents during a tax audit”, an audited person who refuses to send the requested documentation to the Federal Tax Service during a tax audit or who sent it to the tax authorities later than the deadline established by the Tax Code of the Russian Federation is considered a violator who will have to answer under Art. 126 of the Tax Code of the Russian Federation.

If we turn to paragraph 6 of Art. 93.1 of the Tax Code of the Russian Federation “Request for documents (information) about a taxpayer, payer of fees, payer of insurance premiums and tax agent or information about specific transactions”, we will see the following wording: refusal of a person to send to the Federal Tax Service the papers requested during a tax audit or sending them in violation terms is qualified as a violation, entailing the imposition of sanctions under Art. 126 of the Tax Code of the Russian Federation. Illegal failure to report (or report in violation of the deadline) the required information is also considered a violation, for which you will have to answer under Art. 129.1 Tax Code of the Russian Federation.

Analyzing the wording of these articles, we can make an unambiguous conclusion that the request for documentation within the framework of Art. 93 of the Tax Code of the Russian Federation applies only to cases when it is requested from the taxpayer who is directly being audited. The wording of Art. 93.1 of the Tax Code of the Russian Federation indicates situations when papers are requested not from the person being checked, but from someone who has any information about the person being checked or a specific transaction. And these are precisely counter checks.

It follows that for failure to provide information for oncoming traffic, you will be fined under Art. 129.1 of the Tax Code of the Russian Federation in the amount of 5,000 to 20,000 rubles, and for documents - under Art. 126 of the Tax Code of the Russian Federation, but at what point? We read the article and it becomes clear that liability in case of oncoming collisions can only arise under clause 2 (this is a 10,000 ruble fine), but not under clause 1, since clause 2 of this article talks about requests for data about the payer . As for paragraph 1 of Art. 126 of the Tax Code of the Russian Federation, it is applicable if the documents were requested directly from the person being inspected. So the fine, calculated on the basis of 200 rubles. for a document, in the event of oncoming traffic, of course, this cannot happen.

For the opinion of the main tax department, see our material “The Federal Tax Service explained how they are fined for failure to submit documents on oncoming traffic.”

Read about how “counter meetings” are carried out in the article “Features of conducting a counter tax audit” .

What is this anyway? Why do they need this? Can't they cope without me?

Counter check

– this is one of the standard tax control measures, which is carried out in order to compare documents and information provided by the audited person and his partners in order to identify any discrepancies, signs of unrealistic transactions, the use of unreasonable prices, etc. When conducting it, the tax authority is guided by Art. 93.1 of the Tax Code of the Russian Federation, as well as sub. 4 clause 1 of Article 31 of the Tax Code of the Russian Federation and pursues only one goal - to find inconsistencies and charge additional taxes.

A “meeting” is held with your counterparty if he is undergoing an on-site or desk inspection

or if inspectors suspect it is an unscrupulous taxpayer or a “dummy company”. Having analyzed the documents of all participants in the transaction, it is easier for fiscal officials to uncover violations, so they “request documents from counterparties and other persons.”

It is necessary to understand that as part of such a check, Federal Tax Service employees are authorized to request from you not only documents, but also information. Moreover, this can be done both from a direct counterparty and from any person who has documents (information) regarding the taxpayer being audited.

But the powers of inspectors are far from unlimited.

, you are required to provide not everything that Federal Tax Service employees require or recommend that you provide. Let's take a closer look and figure out how not to harm either yourself or your business partner when answering questions from tax officials. The material is based on regulations, recent judicial practice and explanations of officials.

Is it possible not to provide correspondence with a counterparty?

Yes, you can.

You are not required to submit business correspondence during a counter-inspection of a counterparty on the basis that the tax office has the right to request from the company only those documents that are related to the calculation and payment of taxes (clause 1 of Article 31 of the Tax Code of the Russian Federation), and business correspondence does not apply to them ( Articles 313, 314 of the Tax Code of the Russian Federation).

is especially dangerous to submit business correspondence if it could harm your organization

or counterparty. At the same time, it is better to store an archive of letters in case of an on-site inspection already in your organization.

Meaning of the word "provide"

This cognate verb has the following lexical meaning:

- put at someone's disposal or use;

- give the opportunity to manage something.

As we can see, its lexical meaning is narrower than that of the same-root paronym.

Conjugation of the verb "to provide"

- provide information;

- give information;

- provide facts;

- provide leave;

- provide a loan;

- provide premises;

- provide housing;

- provide political asylum;

- provide space;

- provide choice;

- provide patronage;

- give freedom

Russian

| Paronyms: non-representation. |

Morphological and syntactic properties

| case | units h. | pl. h. |

| Them. | failure to provide | failure to provide |

| R. | failure to provide | failure to provide |

| D. | failure to provide | failure to provide |

| IN. | failure to provide | failure to provide |

| TV | failure to provide | failure to provide |

| Etc. | failure to provide | failure to provide |

Noun, inanimate, neuter, 2nd declension (declension type 7a according to the classification of A. A. Zaliznyak).

non-provision or failure to provide

What does judicial practice say?

Judicial practice, in fact, confirms that holding a taxpayer liable is unlawful if there is no evidence that he has the required documents.

In other words, the tax office must prove that the taxpayer should have had the requested documents and could have provided them within the prescribed period. Here are examples:

- Resolution of the AS ZSO dated January 26, 2018 N F04-6104/2017 in case N A70-16258/2016;

- Resolution of the AS SZO dated 06/08/2016 N F07-3996/2016 in case N A66-13779/2014;

- resolution of the AS TsO dated May 26, 2016 N F10-1470/2016 in case N A09-7104/2015;

- Resolution of the AS SZO dated 08/04/2015 N F07-3810/2015 in case N A56-15896/2014.

Article 126 of the Tax Code of the Russian Federation implies liability in the form of a fine for failure to provide the tax authority with only those documents that it has. And accordingly, it does not imply liability in the form of a fine for failure to provide the tax authority with documents that the taxpayer actually does not have.