Good afternoon, dear colleagues.

At the beginning of 2021, the Internet was blown up by numerous videos where people calling themselves specialists and consultants in the field of taxation solemnly announced that all taxes and fees were abolished in the Russian Federation! And at the same time, paragraph 5 of Art. was read out with enthusiasm and delight. 12 Tax Code of the Russian Federation:

“federal, regional and local taxes and fees are abolished by this Code.”

And, after reading this, they came to the conclusion that taxes in the Russian Federation have been abolished and there is no need to pay them. But none of them bothered to read the articles that were written earlier or look at the points that were written in Art. 12 of the Tax Code of the Russian Federation before clause 5 or after it. And none of them bothered to understand that what we are talking about here is that both federal and regional taxes and fees can be either established only by this Code, by amending the Tax Code of the Russian Federation, or abolished only by the Code. That is, neither the government, nor the president, nor the Constitutional Court, nor any other body can establish additional taxes or cancel them; they are established and repealed only by the laws of the Russian Federation after amendments are made to this Code. This caused a storm of misunderstandings.

I have also repeatedly noticed that in the comments under my articles and videos, someone writes that there is no need to pay taxes at all! Type RF is a joint stock company, or LLC, or other commercial organization. And that this is a commercial organization, registered in the USA, etc. Complete trash.

The news that blew up the Internet

And at the end of December 2021, there was a video, after which even my friends asked me to clarify whether the guy on the Internet was telling the truth... This friend read an article from the Tax Code of the Russian Federation, which says that from January 1, 2021, property taxes will be abolished. And that individuals may not pay taxes on property, land, and transport. All this must happen voluntarily.

This wonderful man, who calls himself a tax consultant, quoted Art. 45.1 Tax Code of the Russian Federation. It came into force on October 29, 2021. In fact, it just started working in 2021. And he quoted the following to us:

“The single tax payment of an individual is recognized as funds voluntarily transferred to the budget system of the Russian Federation to the appropriate account of the Federal Treasury by a taxpayer - an individual to fulfill the obligation to pay personal income tax in accordance with paragraph 6 of Article 228 of this Code, transport tax, land tax and (or) property tax for individuals.”

Quoting this, he says: “Well, look, now individuals may or may not pay transport tax, property tax and land tax. They must do this voluntarily." And it never occurred to anyone to clarify what a single tax payment is.

Penya

Penalties mean a certain accrued amount of money that the payer undertakes to pay in case of late payment of tax contributions (by the way, this also includes payments required when transporting various goods across the border of the Russian Federation).

Note! According to the law, a penalty must be paid in addition to the basic amount of tax, regardless of what other measures to ensure the fulfillment of obligations are used, or the liability provided for various types of violations of the law.

Article 75 of the Tax Code of the Russian Federation. Penya. File for download

Article 75 of the Tax Code of the Russian Federation. Penya

In what cases is a penalty not charged?

It is calculated for each day of delay, and the calculation is made from the next day after the last day of payment established by the authorities. However, for such arrears that a person has not paid due to the freezing of transactions on his bank accounts in accordance with a court decision or a fiscal authority, a penalty cannot be charged. The same applies to situations where the payer’s property is seized. Here, the penalty will not be charged until these circumstances cease.

However, a penalty will be charged if:

- you have submitted an application for an installment plan;

- you are seeking/have achieved an investment loan.

Features of the accrual procedure

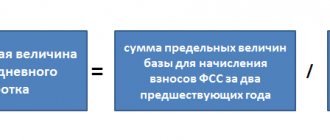

A penalty is charged as a percentage of the debt amount, and separately for each overdue day. The penalty percentage should be 1/300 of the Central Bank refinancing rate that is in effect at the time of accrual.

Penalty interest rate

You can pay the penalty either at one time along with the tax, or after full payment of all debts. In addition, penalties are actively used as a method of collecting customs taxes by collecting money from the payer’s accounts or his property. We also add that the provisions of Article 48 apply to individuals, and Article 46 of the Tax Code applies to individual entrepreneurs, organizations and tax agents.

Let's put an end to this issue

Does any of you in your right mind and sober memory think that our state will take it like this and exempt you from all taxes under paragraph 5 of Art. 12 of the Tax Code of the Russian Federation? Or will all Russian citizens be exempted from property tax and transport tax? In short, you understand... The Earth will sooner move off its axis, and the Sun will fly away to a neighboring galaxy, than any of you will wait for some state to exempt its citizens from taxes. Yes, now, let's run away!

This year I’ll tell you how taxes will increase next year. You don't pay enough! They will increase them for you. But to reduce? Why are you stunned?

How to correctly understand the statement that a single tax payment of an individual is recognized as funds voluntarily transferred to the budget system? What is it about? Each of us pays tax on an apartment, a house, land, a car, etc. And we have paid these taxes and continue to pay them. There is Art. 45 of the Tax Code of the Russian Federation, where everything is written, there is a whole chapter on property taxes and transport tax. Nothing changes in this regard. The tax authorities have sent paper notices that you must pay property taxes, and will continue to do so. If you have a personal account, you will be sent a notice of payment of property tax through it. And you will pay.

But now the state has decided to do well for itself. The state allowed individuals to take a wad of money and give it to the federal treasury. And this money will remain with the federal treasury until it runs out. The money may be enough to pay property taxes for the next five years. And this money sits for 5 years, and the state takes and pays your taxes every year.

That is, you decided that you need to put 400 thousand rubles towards property taxes for the next 5 years and took this money to the state. They are in the federal treasury account. The deadline for paying taxes has already arrived - in the fall, the state pulls 40 thousand rubles in taxes from your account and pays it off. All. You have 360 thousand left. Another year passes, the state still takes and pays off your property taxes. And so on, year after year. That is, a single tax payment is the money that you voluntarily gave to the federal treasury to pay your future taxes. And the state will take this money from there in order to pay your taxes for you:

“The offset of the amount of a single tax payment of an individual is carried out by the tax authority independently against the upcoming payments of the taxpayer - an individual for the taxes specified in paragraph 1 of this article, or against the payment of arrears on these taxes and (or) debts on the corresponding penalties payable in in accordance with Article 64 of this Code, interest.

The decision to offset the amount of a single tax payment of an individual is made by the tax authority at the place of residence of this individual (place of stay - if such a person does not have a place of residence on the territory of the Russian Federation), and if the taxpayer does not have a place of residence and place of stay in the territory of the Russian Federation of the Russian Federation - the tax authority at the location of one of the real estate objects owned by such person.”

Tax return

This is a written statement drawn up by the payer to indicate all of his income and expenses, list sources of profit, available benefits, the amount of tax and other important information related to taxation.

In 2021, a new declaration in form 3-NDFL will be used

Order dated November 25, 2015 No. ММВ-7-11/ [email protected] Text for downloading

Order

Typically, you must provide such a return separately for each of the taxes payable, unless otherwise required by law. The tax office does not have the right to demand anything other than compliance with the requirements for the payment procedure, so you should not indicate in the declaration something that is not directly related to the issue.

Tax return preparation software

Tax return online

Note! The declaration must be submitted within the deadlines specified in Article 229 of the Tax Code - that is, before April 30 of the year following the reporting year. In other words, for the 2015 reporting year, for example, the declaration must be submitted before the end of April 2016.

Article 229 of the Tax Code of the Russian Federation. Tax return

Transactions for the purpose of tax evasion

If the audit does not reveal intentional distortions in accounting and reporting, the inspectors will look for transactions (operations) the main purpose of which was non-payment (incomplete payment) and (or) offset (refund) of the tax amount.

The approach to identifying such transactions will be similar to that applied previously under Resolution No. The taxpayer must be ready to prove that the main purpose of the transaction was a specific reasonable economic (business) goal, and not tax savings (letter of the Federal Tax Service of the Russian Federation dated October 31, 2017 No. ED-4-9 / [ email protected] ).

For example, during a tax audit of Optimist LLC, it was revealed that the company entered into a number of consecutive transactions:

- leasing agreement for production equipment;

- a purchase and sale agreement under which the equipment used by Optimist LLC was sold to a third party, who in turn sold this property to the lessor, who leased the equipment back to Optimist LLC.

The tax authority established that the main purpose of the set of leasing and purchase and sale transactions concluded by Optimist LLC was to understate income tax and VAT by accounting for expenses and applying a VAT deduction on lease payments calculated on the basis of an overstatement compared to the market the price level of the equipment, despite the fact that the same equipment was sold to Optimist LLC under a purchase and sale agreement with a reduced price.

Changes in communication with the Federal Tax Service from 2021

Tax authorities will send you SMS

Tax officials will be allowed to send you SMS messages about unpaid taxes, debts on penalties, fines, and interest. The Federal Tax Service will send such messages to you by email or other means. It is unclear what exactly “others” are.

However, you must give your written consent to receive such messages. And the tax authorities will have a restriction: to send you “chain letters” no more than once a quarter.

The change in the Tax Code of the Russian Federation on sending SMS to taxpayers comes into force on April 1, 2021.

Federal Law of September 29, 2019 No. 325-FZ.

Decisions on interim measures will be made public

From April 1, 2021, decisions on interim measures will appear on the Internet.

Decisions on the adoption and cancellation of interim measures in the form of a ban on the alienation of property will be published on the website of the tax service. Indicating the property that is subject to the ban. The list of information that will be posted on the website will be approved by the tax service later.

Information about decisions will be published on the tax website within three days from the date the decision is made, but not before the decision to bring (refusal to bring) to justice comes into force.

The amendment to the Tax Code of the Russian Federation comes into force on April 1, 2021.

Federal Law of September 29, 2019 No. 325-FZ.

INDUSTRY TAX FEES AND PAYMENTS

Fees for the use of wildlife objects

Objects of taxation are objects of the animal world (i.e. the animals themselves) in accordance with the established list - when they are removed from their habitat. Payers: citizens, individual entrepreneurs and legal entities receiving, in accordance with the established procedure, a license (permit) to use wildlife objects on the territory of the Russian Federation. According to Art. 333.3 of the Tax Code of the Russian Federation, fee rates are established for each animal object separately.

Fees for the use of aquatic biological resources

Objects of taxation are objects of aquatic biological resources in accordance with the established list, the removal of which from their habitat is carried out on the basis of a permit for the extraction (catch) of aquatic biological resources, including objects subject to removal from their habitat as permitted bycatch. Payers: individuals, individual entrepreneurs and organizations receiving, in accordance with the established procedure, permission to extract (catch) aquatic biological resources in internal waters, in the territorial sea, on the continental shelf of the Russian Federation and in the exclusive economic zone of the Russian Federation, as well as in the Azov, Caspian, Barents Seas seas and in the area of the Spitsbergen archipelago. Fee rates are set in rubles per 1 ton of permitted catch, depending on the basin in which fishing of aquatic biological resources is permitted.

Regular payments for subsoil use

A set of mandatory payments paid by subsoil users when obtaining exclusive rights to perform certain types of work as one of the mandatory conditions for obtaining and exercising the right to use subsoil: - One-time payments are paid upon the occurrence of certain events specified in the License (link to licenses). — The fee for participation in the competition (auction) is paid upon registration of the application. — Regular payments for the use of subsoil are paid by subsoil users during the period of validity of the License (link), regardless of the actual performance of work. For more details, see the Law of the Russian Federation “On Subsoil” dated February 21, 1992 No. 2395-1

Additional tax control: the presentation of results will change

Legislators have more clearly defined the procedure that tax authorities must follow when documenting the results of additional control measures.

There are also changes for taxpayers who want to object to these results. Both before and after the introduction of the commented amendments, additional control measures will be assigned by decision of the head of the Federal Tax Service or his deputy. Such activities may include requesting documents, questioning a witness, and conducting an examination. The specific event, as well as the timing of its implementation, must be indicated in the decision.

But previously the Tax Code did not say exactly how inspectors should formalize the results of additional control. Now there is clarity. Tax officers must draw up a document called an “addition to the tax audit report.” This document must reflect the following data: the beginning and end of additional activities, a description of the activities themselves and the evidence obtained through them. Tax authorities are required to draw up this document within 15 working days from the date of completion of additional activities.

Then, within 5 working days, employees of the Federal Tax Service are obliged to transfer to the taxpayer an addition to the tax audit report and materials received during additional measures. As soon as the person being inspected receives them, the countdown of 15 working days begins for the submission of written objections (according to the previous edition of the Tax Code of the Russian Federation, objections could be filed within 10 working days from the date of expiration of the deadline for additional measures). These amendments are set out in the new edition of clause 6.1 and in the new clause 6.2 of Article 101 of the Tax Code of the Russian Federation. They must be applied to decisions on inspections completed after the commented Law No. 302-FZ came into force, that is, after September 3, 2021.

Determine the likelihood of an on-site tax audit and receive recommendations on the tax burden

Is it possible to evade paying taxes?

There are many clever techniques by which you can evade taxes. Let's take a brief look at the most common methods.

How to legally evade taxes

The most popular method is rightfully considered to be the use of shell companies, which provide organizations with significant tax benefits. Such enterprises are created with the aim of obtaining deductions for some taxes or fictitious expenses, or, alternatively, to increase the added value of products and reduce the total tax burden.

Another option is that the entire product is passed through a series of such shell companies, as a result of which its value increases, and the fictitious companies immediately disappear along with their tax obligations. If you carefully read the practice of the Supreme Arbitration Court, you can conclude: in most cases, the management of a one-day company that has denied liability is completely released from it (provided that due diligence was exercised); which means that the responsibility will fall on the end consumer.

As a result, we emphasize that any tax fraud is almost always a violation of current laws. People who use the methods described above or other methods must understand what the consequences of such actions may be.

Be aware of liability for fraud and tax evasion

Opinion of the Ministry of Finance of the Russian Federation and the Federal Tax Service

Information about the abolition of taxes has spread so much that the Ministry of Finance and the Federal Tax Service were forced to issue a number of letters refuting this information:

Letter of the Ministry of Finance dated August 10, 2018 No. 03-02-08/56662

Letter of the Ministry of Finance dated 09/07/2018 No. 03-02-08/64037

Letter of the Federal Tax Service dated August 30, 2018 No. BS-3-11/ [email protected]

Letter of the Federal Tax Service of Russia dated September 14, 2018 No. BS-3-21/ [email protected]

The content of these documents boils down to the same thing: paragraph 5 of Article 12 of the Tax Code of the Russian Federation has only one meaning - any tax can be abolished only by making appropriate changes to the code

. Each person is still required to pay taxes and fees established by current legislation.