- home

- Reference

- Insurance premiums

Current legislation obliges legal entities, individual entrepreneurs and some other economic entities to pay insurance premiums allocated for the purposes of pension, medical and social insurance. They are accrued for each employee who works in an organization or on the basis of an employment or civil law contract.

However, payment of insurance premiums is accompanied by the mandatory submission of reporting documents, in particular SZV M, the procedure for which is determined by the regulatory authorities. It should be noted that provision of the report is the responsibility of the employer. If this does not happen, the enterprise is liable to pay a fine to the Pension Fund for late submission of SZV M.

What errors in the report lead to penalties?

SZV-M is the main reporting form submitted to the Pension Fund of the Russian Federation. The corresponding obligation is assigned to the following categories of insurance premium payers:

- legal entities;

- individual entrepreneurs;

- persons operating as privately practicing lawyers and notaries.

The SZV-M report form itself was approved by the Pension Fund of Russia at the end of 2016 and has not undergone any changes since then. At its core, SZV-M is a personalized report containing information about persons for whom an organization or individual entrepreneur pays contributions.

These include:

- employees with whom there is an employment relationship;

- citizens to whom the payer paid remuneration under a civil law contract.

This rule also applies to foreign citizens working in the Russian Federation. However, this does not apply to highly qualified specialists who have employment contracts for a certain period. This is due to the fact that this category of workers is not subject to compulsory pension insurance.

The SZV-M report includes the following information:

- information about the policyholder (name, legal form, contact details, registration number in the Pension Fund of Russia);

- information about the insured persons (full name, SNILS, INN).

The form must be certified by the signature of the manager.

For errors associated with non-compliance with the deadlines, procedure or form of reporting, the Pension Fund of the Russian Federation imposes monetary fines on the organization.

Let's name the most typical and frequently occurring errors associated with submitting this report to the Pension Fund:

- Submitting documents after the deadline . The law establishes that the SZV-M report must be submitted monthly. It does not matter whether the organization is active or not. It should be noted that submitting a report later than the due date and not submitting it at all from the point of view of the law are identical offenses.

- Errors in filling out the document . False information, lack of information and other inaccuracies in the document are considered as a failed report, for which financial sanctions are imposed.

- Incorrect report submission form. It has been established that organizations and individual entrepreneurs can submit documents to the Pension Fund both electronically and in printed form. However, submitting paper documentation is possible only if the number of insured persons at the enterprise is less than 25 people. If the number of employees is larger, then the submission of SZV-M is allowed only in the form of an electronic document, confirmed by the enhanced electronic signature of the manager.

Attention! It should be noted that, depending on the specific situation, an organization or individual entrepreneur has the opportunity to challenge the Pension Fund’s fine in court.

From the history of the issue: the purpose of SZV-M

As part of the anti-crisis measures taken by the Government for 2021, Art. 26.1. It established a new procedure for the payment of insurance pensions and the fixed part to it in relation to working pensioners (Part 2 of Article 3 of the Law “On the suspension of certain provisions of legislative acts” dated December 29, 2015 No. 385-FZ):

- the amounts of the insurance pension and its fixed payment are paid without taking into account indexation during the period of work of the pensioner;

- after he stops working, the ban on indexation of these amounts will be lifted.

For monthly monitoring of information about working pensioners, the Pension Fund of Russia introduced the SZV-M reporting form. It also allowed pensioners not to independently submit information about their employment to the Pension Fund; this responsibility is now assigned to the employer.

However, the pensioner still retains the right to submit to the Pension Fund a statement about the fact of his employment (termination). He can use it to speed up the process of starting to index his pension after dismissal.

Penalties for late submission

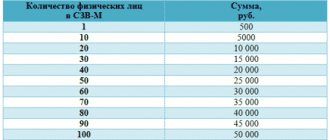

It has been established that the monetary sanction for late submission of the documentation in question is 500 rubles for each insured person.

To determine the amount of the penalty, it is necessary to multiply this amount by the number of persons who should have been indicated in the report. For example, if an organization employs 20 people, then 500 * 20 = 10,000. Thus, you will have to pay 10 thousand rubles.

It should be noted that for enterprises with hundreds or thousands of employees, the amount of the penalty can be quite significant.

Results

You should be careful when filling out and meeting deadlines for submitting the form in question. The fine for the SZV-M report in companies with a large number of employees can result in significant amounts. After all, it is calculated by the number of insured individuals, information about which, in the opinion of the Pension Fund of Russia, should be included in the form in the reporting period.

Sources:

- Tax Code of the Russian Federation

- Law “On Personalized Accounting” dated April 1, 1996 No. 27-FZ

- Law “On Compulsory Pension Insurance” dated December 15, 2001 No. 167-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to challenge illegal penalties

Based on the identified violation, Pension Fund employees draw up an act to hold the organization accountable, after which a demand for payment of a fine is issued, which is sent to the policyholder. The latter has the right to submit written objections to the decision to prosecute. If their consideration is unsatisfactory, representatives of the policyholder may go to court to resolve the issue of reducing the amount of sanctions or canceling them completely.

Reference! A pension fund can also initiate litigation. This is due to the fact that forced collection of funds from the accounts of insurance premium payers is possible only on the basis of a court decision.

Is it possible to reduce the amount of the fine?

If the Pension Fund of Russia has issued you a fine for inaccuracies in the report, and you do not agree with it, there may be three possible solutions:

- Cancellation of fine;

- Reduced fine;

- Payment of the fine in full.

The law does not provide for the possibility of reducing or canceling the fine. If the fund has issued it to you, you can either agree with it or challenge the fine in court. The latter already decides the legitimacy of representatives of the state structure.

Please note that in order to prove your case, you will need to provide supporting evidence. If you don’t have them, then you will have nothing to say in court.

During the short existence of the SZV-M program, judicial practice has already accumulated on resolving issues between insurance funds and representatives of organizations. It is worth noting that most of the decisions were put forward in favor of companies, not the Pension Fund.

It is important to understand that mistakes are more often made in large companies that employ several dozen people. In small companies, this risk is reduced to almost zero, and therefore the fines here can be minimal.

If the company is small and a fine of 500 rubles has been assessed, then the owner of the enterprise often has no desire to sue the fund. But in large companies, fines can amount to millions, and therefore there are many more cases of court decisions among them.

How to pay in 2021

To pay the pension fund fine for errors related to the procedure for submitting the SZV-M form, the organization needs to issue a payment order.

Funds are paid according to the details of the Pension Fund branch to which the organization or individual entrepreneur usually submits documents and pays insurance premiums. Accordingly, if there is a demand, the details of the department that submitted it are used.

As a general rule, the requirement must be satisfied within 15 days , however, it itself may indicate other deadlines for fulfilling the relevant obligation.

The details of the PFR branch are usually indicated in the requirement itself. If there is no such information in it, then you can find the details on the official website of the Pension Fund.

When filling out a payment order, special attention should be paid to choosing the correct budget classification code (BCC). So, for delays or errors in the SZV-M the following BCC is entered:

39211607090066000140.

The purpose of the payment shall indicate the circumstances put forward as justification for the Pension Fund's request.

Non-standard situations that arise when filling out the SZV-M form

Let's look into situations that are non-standard for such cases, which are why policyholders have most of the questions.

The main principle when deciding whether to include information about individuals in the SZV-M is the following:

- individuals work in an organization under employment contracts or GPC agreements, author's orders, publishing license agreements and other agreements listed in the form itself;

- the validity of such contracts falls on the reporting period (separately or in aggregate: concluded, continue to operate, terminated in such a period);

- payments under contracts in favor of individuals may potentially be subject to insurance contributions to the Pension Fund (Clause 1, Article 7 of the Law “On Compulsory Pension Insurance” dated December 15, 2001 No. 167-FZ; Clause 2.2 of Article 11 of the Law “On Personalized Accounting” dated 04/01/1996 No. 27-FZ).

Thus, for the purposes of filling out the form, the following does not matter (letters from the Pension Fund of the Russian Federation dated May 6, 2016 No. 08-22/6356, dated July 27, 2016 No. LCH-08-19/10581):

- the fact that there were no payments to an individual in the reporting period if there were such accruals to him;

- an employee being on sick leave, on maternity leave or in similar situations;

- the employee is on vacation (including vacation at his own expense in the absence of activity in the organization);

- the presence in the organization of only a manager (who is the sole founder), with whom neither an employment contract nor GPC agreements have been concluded.

Such features of concluding contracts with an individual, such as part-time work / combining professions, also do not matter.

Is it possible to avoid a fine if you forgot to include one of your employees in the SZV-M? Get free trial access to the ConsultantPlus system and find out how courts at various levels resolved this issue.

Read what mistakes accountants make when filling out SZV-M in the material “The most common mistakes in SZV-M”.

The only people not included in the form are foreign citizens - highly qualified specialists temporarily staying in the Russian Federation who are not insured in the compulsory pension insurance system (Article 7 of Law No. 167-FZ of December 15, 2001).

IMPORTANT! From the above it follows: a report in the SZV-M form cannot be zero (with an empty table).

Read about one of the non-standard situations that arise when submitting reports in the article “Should I submit SZV-M to the manager - the sole founder?” .

What circumstances may be considered mitigating?

For large companies with hundreds of employees, the size of the financial penalty for failure to submit the SZV-M form can be quite significant. But even if the employer is at fault, it remains possible to reduce the amount of the penalty. To do this, you need to prove to the judges that the offense is associated with mitigating circumstances.

In the practice of arbitration cases, there are a sufficient number of examples when the penalty imposed by Pension Fund inspectors was subsequently reduced to a symbolic amount. Eg:

- The most “popular” mitigating reason is a short delay in reporting. Short time means a delay of no more than 16 days.

- The same justification may be that the reporting failure was committed for the first time.

- A mitigating reason may also be the absence of debts on contributions and other unforeseen circumstances (the employee responsible for the uniform got sick, etc.).

Among other things, the following can be considered a valid reason for preventing a report from being submitted on time:

- Power outage at the company.

- Program replacement or failure.

If these circumstances exist, you can not only reduce the size of the fine, but even cancel it completely.

Below is a table with examples of court orders that take into account mitigating circumstances.

Is zero reporting required?

The document displays the number of employees with whom employment agreements were concluded (contractors, including). This means that even if an individual entrepreneur or enterprise does not operate (has suspended it), then a report must be submitted, and this is a mandatory requirement. Otherwise, payment of a fine is inevitable.

Typical errors in the C3B-M form

What can they be fined for?

The legislation does not make a distinction between late submission and failure to submit reports. Therefore, for missing deadlines, the same punishment is assumed as for ignoring requirements. It is also an offense if a document contains errors or lacks information about employees and the employer. Penalized:

Questions about passing the C3V-M

- absence of full name or inaccuracies in them,

- incorrectly specified TIN or SNILS.

It must be remembered that after the Pension Fund of the Russian Federation submits a demand for the collection of a fine for failure to provide SZM 2021, the company or individual entrepreneur who was at fault has 10 days to comply. During the same period, you can appeal this decision.

How to avoid a fine and not pay money?

This is possible if penalties were imposed without proper grounds. So, for example, if the employees of the pension fund made mistakes, and the reports were submitted on time and filled out correctly. This can be done if Pension Fund employees entered the details incorrectly or made some other mistake.

A claim is filed. The applications used are:

- copy of the S3V-M report,

- Pension Fund's demand for a fine,

- receipt of payment of state duty,

- bank payment order.

Important! This refers to a payment slip that indicates that the money has been paid in full.

In order not to fall under the laws imposing a fine, you must fill out the reports correctly, without a single mistake, and submit them within the time limits specified by law. It is indicated that this must be done later than the 15th day of the month following the reporting period. But sometimes this coincides with weekends and holidays that need to be taken into account.

Schedule for submitting a report on workers who need to be insured in 2021

Those who submitted reports in the SVZ-M form before:

- 02/15/2018 for January,

- 03/15/2018 for February,

- 04/16/2018 for March,

- 05/15/2018 for April,

- 06/15/2018 for May,

- 07/16/2018 for June,

- 08/15/2018 for July,

- 09/17/2018 for August,

- 10/15/2018 for September,

- 11/15/2018 for October,

- 12/17/2018 for November.

When the new year begins, December reports can be submitted before January 15, 2019, and not pay a fine.

Schedule for reporting in 2021.

We pay the fine

If you still have to pay a fine, then check the details for transferring funds to the insurance fund. To understand where to pay the amount, contact the fund at the place of registration of the company.

The form with the details must contain the following information:

- Full name of the fund;

- TIN and checkpoint of the state structure;

- Name of the bank in which the current account operates;

- 20 account digits;

- BIC, OKTMO, cor./account;

- KBK (the fine is transferred according to a numerical value, the same for all regions);

- Purpose of the transfer (indicate the month for which the reports with errors were submitted, the year, as well as the number of the form in the fund database).

The accrual and payment of the fine must be shown on the company's balance sheet.

Postings for SZV-M fines will look like this.

| D-t | Kit | Amount, rub. | Operation |

| 99.01 | 69.02.07 | 3000 | The fine was taken into account |

| 69.02.07 | 51 | 3000 | The fine has been paid |

Is it possible to reduce the sanctions?

Unfortunately, the legislation does not provide for mitigating circumstances for violators to reduce the amount of the fine or its maximum limit. Therefore, failure to submit reports on insured persons inevitably leads to additional costs for companies. But in practice things are different.

Organizations and individual entrepreneurs have the right to apply to the court:

- Recognize the Pension Fund's decision on the fine as partially invalid.

- Ask to reduce the amount of the sanction.

Reason – the violation occurred for the first time or the duration of the delay was insignificant. The document should indicate a link to paragraph 5 of the motivational part of the resolution of the Constitutional Court of the Russian Federation No. 2-P dated January 19, 2021. There are cases when the claim is satisfied and the costs are reduced by half.

For large organizations with a large number of employees, the fine from the Pension Fund of the Russian Federation can cost a decent amount. Responsible persons can use an electronic diary, a reminder program, or make a note in the accountant’s calendar. All this will help you avoid violations and pass the SZV-M. Including on time.

Also see “SZV-M for June 2021: due date and sample filling.”

Read also

23.06.2017

Are there any penalties for completing the form?

There are three types of SZV-M reporting:

- Outgoing (primary form, which is submitted before the 15th);

- Canceled (if there were gross errors in the initial report and the fund did not accept it, then you draw up a cancellation form);

- Additional (if there were minor errors in the previous report, they can be corrected with the mark “additional”).

If you saw an error in the submitted report in a timely manner, you can have time to correct it before the 15th. This way you can avoid a fine. If the error is not noticed and the report is submitted, then a fine will follow for each employee. Therefore, try to send the form as early as possible. This will only insure yourself.

If an error is noticed by a regulatory authority, you may be given 2 weeks to correct it. During this time, no fine will be charged. And if you don’t meet the deadline within 14 days, then you won’t be able to avoid a fine.

Administrative fine for the manager

In addition to the fine for the company, the Code of Administrative Offenses provides for administrative liability for officials - from 300 to 500 rubles. Here the courts are in no hurry to help the manager. Even if the company managed to defend itself and was not fined, the directors will most likely be fined.

See also “Penalties for supplementary SZV-M must be paid to the director.”

But the situation with entrepreneurs has recently changed. If an individual entrepreneur acts as both an insurer for hired personnel and an official, he cannot be issued 2 fines. We told you the details.