How to process salary payment

In order to calculate salaries, the accountant uses the T-51 or T-49 statement. A separate statement is drawn up for issuance. The T-53 statement is not intended for issuing wages other than cash, so it will be difficult to use it for this type of payment. To simplify the work, you can use the statement form intended for agricultural complexes No. 415-APK, but in order to use it, this should be specified in the accounting policy of the organization (unless, of course, the company is engaged in non-agricultural activities).

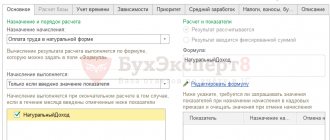

Tax base for personal income tax on income received in kind.

The procedure for determining the tax base for income in kind is regulated by the provisions of Article 211 of the Tax Code of the Russian Federation.

According to clause 1 of Article 211 of the Tax Code of the Russian Federation, when a taxpayer receives income from organizations and individual entrepreneurs in kind in the form of:

- goods,

- works,

- services,

- other property,

the tax base is defined as their value calculated on the basis of their market prices.

At the same time, prices are determined in a manner similar to that provided for in Article 105.3 of the Tax Code of the Russian Federation.

Based on clause 1 of Article 105.3 of the Tax Code of the Russian Federation, market prices are considered to be those prices for goods (work, services) that are used in transactions between parties that are not interdependent.