For tax purposes, the Tax Code of the Russian Federation understands the concept of “income” as income received by a person both in cash and in kind. And although the monetary form of payment predominates, in practice there are often cases when an employee receives income from the employer in the form of goods, payment for services, travel, funding for training, etc. This type of income is also subject to taxation, personal income tax is withheld from it and is included in the calculation of insurance premiums. Find out more about how natural income is taxed in 2021.

Income in kind is subject to insurance contributions: mandatory payments

A comprehensive explanation of the term “income in kind” (not cash income) is contained in the Labor and Tax Code of the Russian Federation. So, as Art. 131 of the Labor Code of the Russian Federation, it is allowed to pay wages to working citizens not only in cash equivalent - in rubles (permissible in foreign currency), but also not in cash. In the latter case, the following conditions must be met:

- The presence of mutual consent of the parties (employer and employee) on the payment of wages in kind, fixed in the contract.

- The share of salary in non-monetary form should not exceed the established limit - 20% of monthly earnings.

Income in another form that does not contradict the law may be accrued without applying limits. Thus, to non-cash income, as evidenced by Art. 211 of the Tax Code of the Russian Federation, include:

- payment by an organization (or individual entrepreneur) for an employee for goods (specific services, work), including his training, rest, food, etc. in accordance with this article;

- payment in kind for work performed by the employee;

- goods received by the employee;

- works performed in his favor;

- services provided to an employee free of charge or with partial payment.

In fact, generally obligatory insurance contributions are withheld from all income in kind referred to in the relevant applicable legal acts. Withholding and payment of contributions to extra-budgetary funds is carried out in a general manner, i.e. through the employer (the policyholder).

Payout example

Let's look at a specific example of how the share of salary in kind is calculated. Open Joint Stock Company "North Pole" gave the company's employee D.I. Alekseev a share of the salary for December 2021 in kind. The condition for such payment was previously stated in the employment contract with Dmitry Alekseev.

The employee’s salary for December was accrued in the amount of 35,000 rubles. Alekseev wrote a statement according to which he was given a bread machine worth 3,000 rubles as part of his salary. The tax in this case was 458 rubles.

The price of the household appliance at which the company purchased it was 1,500 rubles. VAT amounted to 229 rubles. Accordingly, the amount of goods does not exceed twenty percent of the salary.

The wiring will look like this:

- D44 K70 - the employee was accrued a salary in the amount of 35,000;

- D70 K68 - tax in the amount of 4550 was withheld from it;

- D44 K69 - additional insurance premiums were charged in the amount of 7,700;

- D70 K90 subaccount “Revenue” - Alekseev was given goods as wages in the amount of 3,000 rubles;

- D90 subaccount “VAT” K68 - tax charged in the amount of 458 rubles;

- D90 subaccount “Cost of sales” K41 - the bread machine was written off at cost, the amount of which is 1,271 rubles (1,500 - 229);

- D70 K50 - the citizen received the balance of his salary in the amount of 27,450 rubles (35,000 - 4550 - 3000).

When calculating income tax, income must include the proceeds received from the sale of a bread machine of 2542 rubles (3000 - 458), expenses include the cost of goods 1271 rubles (1500 - 229).

When general mandatory contributions are withheld from income in kind

As is customary, the necessary taxes and fees are collected from the “salary” payments made by the employer to its employees. Thus, if income is “paid” within the framework of labor and civil law agreements, then, accordingly, mandatory contributions are withheld from it.

However, not all non-cash income of individuals is subject to such deductions. Remunerations that are recognized as the object of taxation specifically for generally obligatory contributions are designated by the Tax Code of the Russian Federation.

| What does the subject of contribution include? |

(main cases under Article 420 of the Tax Code of the Russian Federation)

(according to Article 422 of the Tax Code of the Russian Federation)

remuneration under GPC agreements;

(under the author's order agreement);

remuneration under alienation agreements for the result of intellectual activity and other agreements specified in Art. 420 Tax Code of the Russian Federation

compensation payments provided for by law, and clause 2 of Art. 422 Tax Code of the Russian Federation;

one-time financial assistance to victims of emergency situations (natural disasters, etc.), as well as at the birth, adoption of a child (or establishment of guardianship) and in the event of the death of a family member;

profit received from the sale of personal property (if owned for more than 3 years);

value expression of uniforms, uniforms and benefits provided to employees;

financial assistance no more than 4,000 rubles. per employee for the billing period;

amounts of payments (contributions) for voluntary personal annual insurance, as well as medical services, etc. in accordance with the article of the Tax Code of the Russian Federation

So, most non-monetary income, with some exceptions, may be subject to mandatory contributions. At the same time, the basis for calculating fees (in relation to Art.

421 of the Tax Code of the Russian Federation), is defined as the value of such income, equivalent to the market average. Prices are determined in accordance with the provisions of Art. 105.3 Tax Code of the Russian Federation.

In other words, this is the cost of the product (service, work) on the date of payment, taking into account VAT and excise tax (for excisable goods).

It is noteworthy that the profit on which tax is not calculated is, in fact, non-taxable income in kind. As a rule, this is income received under a gift agreement (free use).

| Income of citizens not subject to general compulsory contributions |

| Salary according to the employment agreement; |

| State benefits, including unemployment and compulsory social insurance; |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Withholding of general mandatory contributions from gifts to employees

Gifts intended for employees can be different (monetary and non-monetary). It depends on the qualifications of this gift and how it is decorated and transferred to the recipient whether contributions need to be withheld from its value or not.

| Conditional classification of a gift | The procedure for its registration | Withholding of mandatory contributions |

| A gift not related to the work activity of the recipient |

(not compensation, does not depend on the employee’s work and length of service)

Transferred to the donee free of charge under a gift agreement

The corresponding taxes and contributions are withheld when the donor is an individual and the price of the gift is more than 3,000 rubles.

Gift - reward for work

(in relation to Article 191 of the Labor Code of the Russian Federation)

The necessary fees are collected from the value of the gift (equated to the amount of profit)

Withholding of mandatory contributions (compulsory pension insurance, compulsory medical insurance, compulsory social insurance) from gifts, where necessary, is carried out as follows. The amount of contributions (tax) is withheld from a cash gift when the money is given to the recipient employee from the cash register or transferred to his account (card).

If the gift is provided in kind, then contributions (taxes) are deducted from its value on the next payment day. This could be, for example, the day a salary is paid to the recipient employee. When no payments are expected in a particular billing period, fees from this gift are deducted at the end of the period, in the month following it.

Gifts for the employee and his children

Giving gifts is a common practice, and the gift can be either cash or material things. As a rule, gifts can be dedicated to some official holiday (New Year, anniversary of the organization) or to the birthday of the employee himself.

The main rule of donating property is gratuitousness.

The essence of the gift is that ownership of the transferred property is transferred, and this has nothing to do with the employee’s performance of work duties, incentives or compensation of expenses, and does not depend on the length of service and position held.

Source: https://oookiz.ru/buhgalteriya/naturalnyj-dohod-oblagaetsya-strahovymi-vznosami.html

Example 4

The amount of imputed income is 1000 thousand rubles, payroll is 300 thousand rubles. The total amount of contributions from the payroll will be equal to

VZ = 300 x 30% = 90 thousand rubles.

The “imputed” tax is equal to

UTII = 1000 x 15% = 150 thousand rubles.

Because 90 thousand rubles. - this is more than 50% of 150 thousand rubles, then contributions are partially deducted from the tax amount, in the amount of 75 thousand rubles.

Thus, the “remaining” fiscal burden on the payroll is 5% of its amount ((90 – 75) / 300).

As for the patent, under this special regime no deductions related to payroll are provided, and VAT is also not paid. Therefore, the fiscal burden on wages will be 30% plus “unfortunate” contributions.

Insurance premiums for employees in 2021

Individual entrepreneurs and organizations that are employers are required to transfer monthly insurance contributions for pension, medical and social insurance to the Federal Tax Service of the Russian Federation

. Contributions for injuries are still paid to the Social Insurance Fund.

Note

: from 2021, the procedure for paying and reporting on insurance premiums has changed, this is due to the transfer of control over insurance premiums to the Federal Tax Service of the Russian Federation and the entry into force of the new Chapter 34 of the Tax Code of the Russian Federation “Insurance Premiums”.

From payments to individuals under civil law contracts, it is necessary to transfer contributions only to pension and health insurance (contributions for accidents are not transferred in any case, and contributions for temporary disability are transferred only if such a clause is specified in the contract).

Payments to employees who are legally exempt from paying insurance premiums are listed in Art. 422 of the Tax Code of the Russian Federation.

note

that individual entrepreneurs, in addition to paying insurance premiums for employees, must additionally transfer insurance premiums to individual entrepreneurs “for themselves.”

Free tax consultation

Insurance premium rates for employees in 2021

In 2021, insurance premiums must be paid at the following rates:

- For pension insurance (PPI) – 22%

. - For health insurance (CHI) – 5,1%

. - For social insurance (OSS) - 2.9%

(excluding

accident

).

At the same time, some individual entrepreneurs and organizations have the right to apply reduced tariffs

(see table below).

In 2021, the limits for calculating contributions have changed:

- for OPS – 1,292,000

.

(in case of excess, contributions are paid at a reduced rate - 10%

); - for OSS – 912,000

rubles. (if exceeded, contributions are no longer paid); - for compulsory medical insurance – the limit has been abolished.

note

that in 2021 there are no benefits on insurance premiums for most individual entrepreneurs and organizations that were applied before 2021.

In particular, the cancellation affected individual entrepreneurs on a patent, as well as representatives of SMEs working in the social and industrial spheres and using the simplified tax system. Reduced tariffs were left only for NGOs and charitable organizations.

More details on insurance premium rates can be found in the table below.

General rates for insurance premiums in 2021

Payer category OPS OMS OSS Total

| Organizations and individual entrepreneurs on OSN, simplified tax system, UTII, PSN and Unified Agricultural Tax, with the exception of beneficiaries | 22% | 5,1% | 2,9% | 30% |

| If the limit of 912,000 rubles | 22% | 5,1% | — | 27,1% |

| If the limit of 1,292,000 rubles | 10% | 5,1% | — | 15,1% |

Reduced rates for insurance premiums in 2021

Payer category PFR FFOMS FSS Total

| NPOs on the simplified tax system, conducting activities in the field of social services. services, science, education, healthcare, sports, culture and art | 20% | — | — | 20% |

| Charitable organizations on the simplified tax system | ||||

| Participants of the free economic zone in Crimea and Sevastopol | 6% | 0,1% | 1,5% | 7,6% |

| Organizations and individual entrepreneurs engaged in technical innovation and tourism and recreational activities in special economic zones | 20% | 5,1% | 2,9% | 28% |

| Business companies and partnerships operating in the field of IT technologies and meeting the conditions of paragraphs 1 and 2 of Art. 427 Tax Code of the Russian Federation | ||||

| Organizations that have received the status of a participant in the Skolkovo project | 14% | — | — | 14% |

| Organizations and individual entrepreneurs making payments to crew members of ships registered in the Russian International Register of Ships | — | — | — | 0% |

| Organizations in the field of IT (provided that the income from this activity at the end of 9 months is at least 90%, and the number of employees is at least 7 people | 8% | 4% | 2% | 14% |

Note

: benefit recipients, in case of exceeding the limits of 1,292,000 and 912,000 rubles. There is no need to make social and pension insurance contributions.

Additional rates for insurance premiums in 2021

Payer category PFR FFOMS FSS Total

| Payers specified in paragraphs. 1 clause 1 art. 419 of Law No. 400-FZ in relation to payments to individuals named in paragraph 1 of paragraph 1 of Art. 30 of this law | 9% | — | — | 9% |

| Payers specified in paragraphs. 1 clause 1 art. 419 of Law No. 400-FZ in relation to payments to individuals named in paragraphs 2-18 of paragraph 1 of Art. 30 of this law | 6% | — | — | 6% |

Note

: additional contributions are paid regardless of the limits of 1,292,000 and 912,000. At the same time, companies that have assessed working conditions can pay additional payments.

contributions to pension insurance at special rates (clause 3 of Article 428 of the Tax Code of the Russian Federation).

Procedure and terms for payment of insurance premiums

Note! The deadlines for paying taxes and filing reports for some individual entrepreneurs and organizations have been postponed due to the coronavirus epidemic. Read the article for details.

Insurance contributions to the Federal Tax Service and Social Insurance Fund must be transferred monthly no later than the 15th

next month. If the last day coincides with a weekend or holiday, the final due date for payment of contributions is postponed to the next working day.

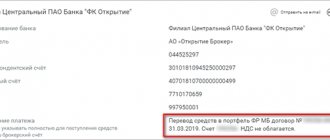

In 2021, all payments for pension insurance must be made in one payment order using KBK 182 1 02 02010 06 1010 160

. You can find out the remaining payment details of the Federal Tax Service necessary for payment using this service.

In 2021, the budget classification code for the transfer of insurance premiums for health insurance 182 1 02 02101 08 1013 160

. You can find out the remaining payment details of the Federal Tax Service necessary for payment using this service.

Transfer of insurance premiums is carried out in two types

compulsory social insurance:

- in case of temporary disability and in connection with maternity in the Federal Tax Service of the Russian Federation;

- from accidents at work and occupational diseases in the Social Insurance Fund.

The amount of insurance premiums for temporary disability is 2,9%

from salary, but may vary depending on the benefit applied (see table above).

Accident insurance premiums range from 0,2

up to

8.5%

depending on which professional risk class your main type of activity belongs to.

In 2021, the budget classification codes for transferring social insurance contributions have not changed:

- KBK 182 1 0210 160.

(in case of temporary disability); - KBK 393 1 0200 160.

(from industrial accidents).

You can find out the remaining payment details by contacting the territorial office of the Social Insurance Fund and the tax office at your place of registration.

Note

: insurance premiums must be paid and reported in rubles and kopecks.

Reporting on insurance premiums

The sliders below list all the reporting that needs to be submitted for insurance premiums in 2021:

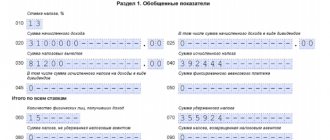

Starting from 2021, insurance premiums must be submitted to the Federal Tax Service every quarter. The calculation is submitted no later than the 30th day of the month of the next quarter. Thus, in 2021 it must be passed:

- for 2021 – no later than January 30, 2021;

- for the 1st quarter of 2021 – no later than April 30, 2021;

- for the first half of 2021 – no later than July 30, 2021;

- for 9 months of 2021 – no later than October 30, 2021;

- for 2021 – no later than February 1, 2021.

Every month you need to submit a report to the Pension Fund in the SZV-M form, which contains information about working pensioners. The deadline for submitting the report is no later than the 15th of the next month.

Also, starting from January 1, 2021, new reporting was introduced in the SZV-STAZH form, which reflects information about the insurance length of insured workers. This report must be submitted to the Pension Fund every year, no later than March 1 of the following year.

Every quarter, you must submit a calculation to the Social Insurance Fund in form 4-FSS. Starting from January 1, 2021, in the calculation of 4-FSS it is necessary to reflect only information on injuries

and

occupational diseases

.

In 2021, the deadline for submitting reports to the Social Insurance Fund depends on its form:

- In electronic form – no later than the 25th

day of the month following the reporting quarter. - On paper – no later than the 20th

day of the month following the reporting quarter.

Note!

From 2021, policyholders with an average number of employees

of more than 10 people

Source: https://www.malyi-biznes.ru/nalogi-za-rabotnikov/vznosy/

Income in kind insurance premiums

A comprehensive explanation of the term “income in kind” (not cash income) is contained in the Labor and Tax Code of the Russian Federation. So, as Art. 131 of the Labor Code of the Russian Federation, it is allowed to pay wages to working citizens not only in cash equivalent - in rubles (permissible in foreign currency), but also not in cash. In the latter case, the following conditions must be met:

- The presence of mutual consent of the parties (employer and employee) on the payment of wages in kind, fixed in the contract.

- The share of salary in non-monetary form should not exceed the established limit - 20% of monthly earnings.

Income in another form that does not contradict the law may be accrued without applying limits. Thus, to non-cash income, as evidenced by Art. 211 of the Tax Code of the Russian Federation, include:

- payment by an organization (or individual entrepreneur) for an employee for goods (specific services, work), including his training, rest, food, etc. in accordance with this article;

- payment in kind for work performed by the employee;

- goods received by the employee;

- works performed in his favor;

- services provided to an employee free of charge or with partial payment.

In fact, generally obligatory insurance contributions are withheld from all income in kind referred to in the relevant applicable legal acts. Withholding and payment of contributions to extra-budgetary funds is carried out in a general manner, i.e. through the employer (the policyholder).

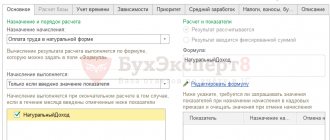

Documenting

To calculate wages in kind, use payroll in form No. T-51 or payroll in form No. T-49. To issue salaries, prepare a separate statement. The payroll in form No. T-53 is intended for issuing wages in cash. Therefore, it is quite difficult to use it to process payments in kind.

For convenience, you can use the unified form No. 415-APK, approved by order of the Ministry of Agriculture of Russia dated May 16, 2003 No. 750. This is a statement of payment in kind provided for organizations of the agro-industrial complex. It is a supporting document for writing off in the organization’s accounting the value of the property transferred as salary.

Tax officials explain the procedure for taxing income of an individual from a tax agent

A comprehensive explanation of the term “income in kind” (not cash income) is contained in the Labor and Tax Code of the Russian Federation. So, as Art. 131 of the Labor Code of the Russian Federation, it is allowed to pay wages to working citizens not only in cash equivalent - in rubles (permissible in foreign currency), but also not in cash. In the latter case, the following conditions must be met:

- The presence of mutual consent of the parties (employer and employee) on the payment of wages in kind, fixed in the contract.

- The share of salary in non-monetary form should not exceed the established limit - 20% of monthly earnings.

Income in another form that does not contradict the law may be accrued without applying limits. Thus, to non-cash income, as evidenced by Art. 211 of the Tax Code of the Russian Federation, include:

- payment by an organization (or individual entrepreneur) for an employee for goods (specific services, work), including his training, rest, food, etc. in accordance with this article;

- payment in kind for work performed by the employee;

- goods received by the employee;

- works performed in his favor;

- services provided to an employee free of charge or with partial payment.

In fact, generally obligatory insurance contributions are withheld from all income in kind referred to in the relevant applicable legal acts. Withholding and payment of contributions to extra-budgetary funds is carried out in a general manner, i.e. through the employer (the policyholder).

Example 1. Non-monetary income of a sewing studio employee

L. T. Sidorenko works as a seamstress in the Beloshveyka atelier. Over the past September 2021, the employer made payments to her partially in non-monetary form. The possibility of remuneration in kind is stipulated in the employment agreement concluded by L. T. Sidorenko with the director of the Beloshveyka atelier.

So, L. T. Sidorenko was given 5 T-shirts and 5 shirts towards September earnings. In value terms, this non-cash income amounted to 20% of the employee’s actual salary for September 2021.

Reimbursement for food expenses: will there be personal income tax and insurance premiums?

Moreover, existing arbitration practice suggests that judges in many cases recognize an organization and its employees as interdependent persons.

Please also note that there is no material gain in this situation. After all, the employing company transfers products to the employee as payment for wages in accordance with an employment contract, and not a civil law contract.

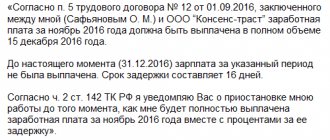

In this case, the withheld amount of tax cannot exceed 50 percent of the amount of payments due to the employee. If the period during which tax can be withheld exceeds 12 months, then the organization must report this to the tax office at its place of registration and indicate the amount of tax debt.

When wages are paid in kind, there is a compulsory transfer of ownership of the goods. And along with it, the concept of sales of goods arises, the proceeds from which should be subject to income tax and VAT in the generally established manner (VAT benefits are provided only to agricultural producers.

READ MORE: Mortgage from Sberbank with an initial contribution of maternity capital Advisor

On the other hand, the cost of this product is not paid, as usual, but is repaid by closing part of the salary arrears.

The Tax Code allows the entire amount of wages accrued in accordance with the company's wage system, regardless of its form, to be taken into account as expenses when calculating income tax.

This generates income and expenses associated with the transfer of products to pay off wage arrears.

As for value added tax, a special rule directly indicates the obligation to charge it when paying for labor in kind.

It says that the tax base in this case is determined based on market prices (without including VAT).

Consequently, companies can calculate this tax based on the price of products that they set to pay off wage arrears (excluding VAT).

However, there is also an opposite point of view. It is based on the fact that legal relations regarding the payment of wages to employees in kind are regulated not by tax law, but by labor law. Accordingly, the payment of wages in kind cannot be recognized as a sale, and the company is not obliged to pay income tax and VAT to the budget.

What property can be given out

Attention: payment of wages in kind may be considered unjustified if employees are given goods at a cost that obviously exceeds the market price (clause 54 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2). In this case, the market price is the value of the goods that prevailed at the time of payment of wages in the region where the organization is located.

It is prohibited to issue the following as salary payment:

- narcotic, toxic, poisonous and harmful substances;

Such restrictions are established by part 3 of article 131 of the Labor Code of the Russian Federation.

Insurance contributions for employees to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund in 2021

LLCs and individual entrepreneurs are required to pay monthly insurance premiums for employees under an employment and civil law contract. Contribution rates change every year. In the article we will talk about the innovations of 2020 and the tariffs of insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund and the Federal Compulsory Compulsory Medical Insurance Fund.

Employers transfer monthly insurance contributions from payments accrued to employees. If they are drawn up under an employment contract, then these are deductions:

- for pension insurance;

- for health insurance;

- for insurance in case of temporary disability or maternity (VNIM);

- for insurance against accidents or occupational diseases.

Employees registered under a GPC agreement also need to be paid, but in this case only transfers to medical and pension insurance are required. You don’t need to pay contributions for VNiM, but you pay for accident insurance only if this condition is provided for in the contract.

In this article we will look at insurance premiums, which are under the jurisdiction of the Federal Tax Service and are regulated by Chapter 34 of the Tax Code of the Russian Federation. This is everything listed above, except for contributions to “accident” insurance.

What payments are subject to insurance premiums?

Contributions for compulsory insurance are subject to most payments under GPC and labor contracts. At the same time, Art. 422 of the Tax Code of the Russian Federation provides for payments from which contributions do not need to be transferred:

- unemployment benefits and other government benefits;

- various compensation payments: compensation for harm to health, payment for rent of an apartment, reimbursement of expenses for lunches, funding for advanced training, etc.;

- financial assistance paid at a time in the event of the birth of a child, a natural disaster, or the death of a family member;

- income, other than wages for work, received by members of communities of small indigenous peoples;

- contributions to funded pension within 12,000 rubles per employee;

- financial assistance up to 4,000 rubles;

- reimbursement of costs for repaying loans and borrowings for the purchase or construction of housing for employees;

- and other types of compensation payments.

Maximum base for insurance premiums

Contributions for the Pension Fund and the Social Insurance Fund do not always need to be paid from the entire amount of the employee’s income. For the calculation of contributions, a limit is established, above which contributions are not paid or the rate for them is reduced. This base is indexed annually based on the growth of average wages.

Contributions to the Pension Fund . From January 1, 2021, the maximum amount of an employee’s total income from which contributions must be transferred in full to the Pension Fund will be 1,292,000 rubles.

For each employee, the employer must track the amount of all accruals from January 1 on an increasing basis. As soon as it exceeds the limit, the contribution rate for compulsory pension insurance is reduced from 22% to 10%. And if the company operates at preferential rates, no fees are paid.

Contributions to the Social Insurance Fund . The maximum base for VNiM has also been indexed since January 1, 2021. It has increased to 912,000 rubles. After reaching the limit value, contributions for this type of insurance are not required.

Contributions for compulsory medical insurance and injuries . Not limited, as in previous years. Therefore, all income received by employees is subject to contributions.

Insurance premium rate for 2020

Back in the summer of 2021, it became known what insurance premium rates would be set in 2021.

If an organization or entrepreneur is not entitled to benefits on contributions, they pay them at standard rates. As before, the total contribution amount is 30% of the employee's income.

- The rate of insurance contributions to the Pension Fund is 22%. This rate is applied until the income limit of 1,292,000 rubles is reached. Then the rate drops to 10%.

- The rate for contributions to compulsory medical insurance is 5.1% It does not depend on the amount of income and is paid constantly.

- The insurance premium rate for VNiM is 2.9%. The exception is foreign employees who temporarily stay in the Russian Federation - they are subject to a 1.8% rate. The rate applies until the income limit of 912,000 rubles is exceeded, after which contributions are not paid.

General rates of insurance premiums in 2021 in the form of a table.

Direction of contributions Base limit, rubles Rate for 2021, %

| Pension Fund | Within 1,292,000 | 22 |

| Over 1,292,000 | 10 | |

| FSS | Within 912,000 | 2.9 (1.8 for foreign employees with temporary residence status) |

| Over 912,000 | Not paid | |

| FFOMS | Not limited | 5,1 |

Preferential rates in 2021

This year there are even fewer firms and entrepreneurs who can pay contributions at reduced rates. Three categories did not receive an extension of benefits:

- Individual entrepreneurs and organizations that have entered into agreements on the performance of tourism and recreational work, which pay income to employees within the framework of special economic zones allocated by the Government of the Russian Federation.

- Individual entrepreneurs and organizations that have entered into agreements for the implementation of technical innovation work, which pay income to employees within special economic zones.

- Economic partnerships and societies that introduce and use the fruits of intellectual labor, if the right to them belongs to their participants or founders.

These policyholders will switch to general tariffs in 2021. See the table for who is eligible for reduced rates.

Who is entitled to benefits Tariff rate, % OPS VNiM compulsory medical insurance

| Organizations on the simplified tax system that are engaged in charitable activities | 20 | 0 | 0 |

| NPOs on the simplified tax system in the field of education, social services for citizens, science, culture and art, healthcare | 20 | 0 | 0 |

| Skolkovo organizations | 14 | 0 | 0 |

| Organizations developing and selling animation, audio or video products | 8 | 2 | 4 |

| Participants of the FEZ of Crimea and Sevastopol | 6 | 1,5 | 0,1 |

| Residents of zones with rapid development of the socio-economic sphere | 6 | 1,5 | 0,1 |

| Residents of the free port of Vladivostok | 6 | 1,5 | 0,1 |

| Residents of the SEZ in the Kaliningrad region | 6 | 1,5 | 0,1 |