Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

For each organization, it is important to maintain two legally established types of accounting. Each of them has its own goals and objectives. What is the difference between accounting and tax accounting?

First, the purposes of record keeping differ. Accounting provides information about the results of activities to the management of the organization and stakeholders. Tax accounting allows fiscal authorities to control the completeness of tax payment, the reliability of reporting and the implementation of legislation on taxes and fees.

Secondly, appropriate legislation has been developed for taxation purposes, in particular the Tax Code. Accounting statements are maintained in accordance with federal law, PBU and other documents. It is legislative regulation that is the main reason for the differences.

Permanent differences in accounting and tax accounting

Permanent differences arise from the portion of profits that is allocated only to accounting or only to taxable profits. That is, if your organization's actual and taxable income or expenses differ, then permanent differences arise. This is how permanent tax liabilities (PNO) or assets (PNA) appear. Due to the PNA, the income tax that you reflect in the reporting period will increase, and the PNA will reduce payments. Do not reflect PNO and PNA in the balance sheet, since they are recognized in the period when permanent differences arose.

However, PNO and PNA need to be shown in the financial results report, namely in line 2421. To account for them, accounts 68 and 99 are used.

PNA accrued: Dt 99 Kt 68 PNA accrued: Dt 68 Kt 99

Profit is always profit

So, income and expense transactions together provide the basis for calculating profit or, if problems arise in the business, loss. The object of accounting in NU and in accounting, as we see, is the same; the result of calculations is the financial result of the company’s work for the period.

Ultimately, tax accounting uses accounting documents and accounting registers to correctly determine the tax base; company analysts use the same data for financial analysis of business success for the reporting period, constructing other calculations based on profits, and determining more complex indicators.

The basic calculation formula remains unchanged: Profit = revenue – expenses.

From the above we can conclude that:

- in the vast majority of cases, both types of profit - tax and accounting - are calculated on the basis of the same data reflected in the primary accounting;

- As a result of calculations, in both cases a loss may be identified, in other words, tax and accounting profit may be negative.

Note ! Both types of profit are calculated without taking into account the so-called opportunity costs, in other words, lost benefits (profit) from the alternative use of financial investments. This indicator is not reflected in the primary accounting documents, therefore, it cannot be included in the calculation of real profit.

Temporary differences in accounting and tax accounting

If you attribute income and expenses that form actual profit and form the income tax base to different reporting periods, temporary differences appear. They have different effects on taxable income, so they are divided into two groups.

- If income is recognized earlier in tax accounting and later in accounting, deductible temporary differences appear. This leads to the emergence of a deferred tax asset (DTA).

- In the opposite situation, taxable temporary differences arise and a deferred tax liability (DTL) arises.

The formation of ONA or ONO leads to the fact that in subsequent reporting periods the amount of income tax will decrease or increase. In the balance sheet, SHE is taken into account in line 1180, ONO - in line 1420. SHE and IT are reflected in account 68, but there are also special accounts for them - 09 and 77, respectively.

Accrued IT: Dt 09 Kt 68 Accrued IT: Dt 68 Kt 77

In the financial results report, IT is reflected in line 2430, and IT is reflected in line 2450. Due to the complexity of the formation and reflection of permanent and temporary differences, regulatory authorities are trying to create a unified approach to generating profit. But for now, an accountant has to take into account all the intricacies of accounting and tax accounting systems.

Table

| Tax profit | Accounting profit |

| What do they have in common? | |

| May be the same size | |

| Does not involve taking into account opportunity costs - unlike economic profit | |

| Can be calculated based on the same documents | |

| What is the difference between them? | |

| Calculated for the purpose of determining the tax base of the enterprise according to the criteria of the Tax Code of the Russian Federation | Calculated in order to comply with accounting legislation or at the request of the investor |

| Determined only in those taxation systems in which tax is calculated taking into account income and expenses | Calculated under any tax system |

Deferred tax accounting

D99 subaccount “Conditional expense” D68 – accrued conditional income tax expense;

D68 K99 subaccount “Conditional expense” – conditional income for income tax is accrued;

D09 K68 – deferred tax assets are reflected;

D68 K09 – deferred tax assets were reduced;

D99 K09 – deferred tax assets are written off upon disposal of the asset;

D68 K77 – deferred tax liabilities are reflected;

D77 K68 – deferred tax liabilities were reduced;

D77 K99 – deferred tax liabilities are written off upon disposal of an asset (liability);

D68 K99 – permanent tax assets are reflected;

D99 K68 – permanent tax liabilities are reflected.

Examples of using the report

Video review of the development

Let's consider the work of the report using the example of one year of the organization's work

1st quarter

In the 1st quarter we see the following situation:

- adjustment declarations are used for analysis (k/1)

- in this quarter, the VAT rate of 0% was confirmed for the amount of 10,878,485 rubles (for income tax purposes, these sales were taken into account in previous quarters)

- For sales in the amount of 3,730,529 rubles, the 0% rate has not yet been confirmed

Result: there are no erroneous differences, all differences are “allowed”

2nd quarter

This quarter we see a similar situation with differences, but the indicators are already considered both quarterly and cumulatively - to facilitate reconciliation. Please note that indicators that are obtained by calculation are highlighted in gray (you will not find these figures in the declarations).

3rd quarter

In the 3rd quarter we see a difference of 33,700 rubles. If you analyze all the data, you can find the reason for the difference - the presence of non-operating income not subject to VAT.

Setting up other income not subject to VAT

There is a special setting in the VAT and Profit reconciliation report that allows you to specify a list of non-operating expenses that should not be subject to VAT and that must be included in the “allowed” differences.

If an item of other income is added to this list, then the detail “Not subject to VAT” is filled in (it can also be set in the directory itself).

This allows you to build SALT for the 91st account, grouped by VAT taxability. By default, this list is filled with unambiguously “allowed” differences. The user can independently supplement the list. In this case, we will add the article “Insurance compensation (MTPL)” to the exceptions.

As a result, we will receive a report in which there are no unresolved differences

4th quarter

In the 4th quarter we see that a whole range of “allowed” differences have been taken into account:

- unconfirmed export 0%

- returns of goods to the supplier

- returns of goods from customers

- non-operating income not subject to VAT

And still we get an unresolved difference. In this case, it means the presence of an accounting error in the VAT or Profit return. Additional data analysis (outside the scope of this report) is required to identify the error. But our primary recommendation is to update the closing of months, the formation of a sales book and refill tax returns.

The report “Analysis of the state of tax accounting” is your assistant

As mentioned above, a report “Analysis of the state of tax accounting” has been developed (menu “Tax accounting - Analysis of the state of tax accounting”), designed to facilitate the comparison of tax and accounting data when using standard configurations.

First you need to select a reporting period. After this, decide which indicators you will analyze and go to the appropriate tab of the dialog box. Let's say you decide to analyze the expenses of the reporting period. Due to the fact that discrepancies between tax and accounting data are quite likely, we will set the “Comment on the difference” flag (then in the future, if a difference arises between tax and accounting data, a short comment will appear in the report, explaining the most likely objective reasons for the discrepancy in data; for the last two bookmarks are not provided for comments). After clicking the “Perform analysis” button, the result of the comparison with the comment will appear (see Fig. 1).

Rice. 1

Next, a logical question is: “How were the figures in the report obtained?” (especially those where there are discrepancies in data). To get a decryption, just double-click on the cell with the name of the indicator that you want to decrypt (take, for example, indirect costs according to accounting data). The transcript will be shown directly in the report (see Fig. 2).

Rice. 2

Double-clicking the table cell with the name of the indicator again will have the opposite effect - only the final figure will be visible, as shown in the previous figure.

Explanation can also be given for objects of analytical accounting. For example, a breakdown of non-current assets by object when analyzing the corresponding indicator (the cost of non-current assets) looks as shown in Fig. 3.

Rice. 3

Explanations are not provided for those indicators that are immediately shown in detail in the report. For example, a comparison of the amounts of accrued depreciation of fixed assets is shown by object (see Fig. 4).

Rice. 4

You can generate a report for any period, but it is recommended to compare data monthly.

RIGHT OF THE TAX AUTHORITY TO SEEK CLARIFICATIONS.

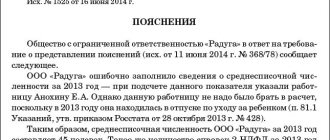

Before considering the substance of the issue about the discrepancy between the amounts of income indicated in the declaration under the simplified tax system and the financial statements for 2021, we will answer the question of whether the tax authority has the right to request any clarification in the analyzed case. In accordance with Art. 88 of the Tax Code of the Russian Federation, upon receipt of a declaration for a “simplified” tax, the tax authority conducts a desk audit of it. If a desk tax audit reveals errors in the tax return or contradictions between the information contained in the submitted documents, or discrepancies are identified between the information provided by the taxpayer and the information contained in the documents available to the tax authority and received by it during tax control, then the tax authority has the right to request clarification regarding this fact. In the case under consideration, a discrepancy was identified between the “simplified” tax return and the organization’s financial statements, which is the basis for requesting clarification from the taxpayer. The tax authority notifies the taxpayer of the discovery of an error or discrepancy and requires the taxpayer to provide the necessary explanations or make corrections to the tax return.

Note:

The deadline for fulfilling this requirement is five working days from the date of receipt of the request. Can the taxpayer, along with explanations, additionally submit other documents confirming his position? Yes, he has the right to additionally submit to the tax authority extracts from tax or accounting registers and other documents confirming the accuracy of the data included in the tax return. The tax authority representative is obliged to review all documents submitted by the taxpayer. And if after this consideration or in the case where the taxpayer does not provide explanations, the tax inspector establishes that an offense has been committed, he will draw up an inspection report in the manner prescribed by Art. 100 of the Tax Code of the Russian Federation. From the above rules it follows that the current tax legislation grants the tax authorities the right to request from the “simplified” person explanations regarding the submitted declaration under the simplified tax system if errors or inconsistencies are identified between the declaration data and other documents available to the tax authorities (for example, the annual accounting reporting). We recommend that you provide explanations within the prescribed period (five working days), otherwise a violation report will be drawn up based on the data that the tax authority has. And this may not be the end of the matter: if the discrepancies are large-scale, then the tax authorities can initiate an on-site tax audit. In addition to requesting clarification, the tax authority has the right to call the taxpayer to give explanations if it considers that the taxpayer’s direct appearance at the tax authority is required (clause 4 p. 1 Article 31 of the Tax Code of the Russian Federation). To do this, the taxpayer will be sent a notice of summons from the taxpayer (payer of the fee, tax agent).