Salary in kind

In order for the payment of wages in kind to be legal, this must be stipulated in the collective or labor agreement with the employee. If there is no such condition in the contract, it can be introduced either by drawing up an additional agreement to the contract, or by approving the contract in a new edition. Another condition for issuing wages in this form is an application from the employee. The application must indicate that the employee requests that part of the salary be given to him in kind. Only if these two conditions are met will the issuance of wages not in cash equivalent be recognized as legal (

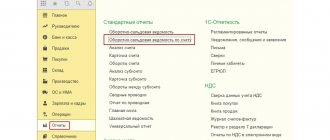

Settings in the program

- Create an accrual type for accruing income in kind with a purpose Payment in kind:

In the formula we use the indicator Income in kind - a predefined indicator, by default its accuracy is 0 (integer). To be able to enter the amount accurate to kopecks, you need to specify this in the indicator settings (Settings - Payroll indicators - Income in kind). - Create another accrual “with a minus” to reduce the amount to be issued.

- Basic settings:

- Tax and contribution settings:

- Create a template for entering the amount of natural income (Settings – Initial data entry templates):

How can an employee write a statement?

An employee can draw up an application, for example, for only one payment, or for a certain period of time: a quarter, a year. At the same time, the employee retains the right to early refusal to pay wages in this form if the period specified in the application exceeds 1 month.

The wording in the application may be as follows: “Based on Article 131 of the Labor Code of the Russian Federation and clause 4.1 of the collective agreement, I ask you to pay me 20% of the accrued wages for January 2021 in kind - in goods of Continent LLC, namely, a microwave oven, the cost 5,500 rubles.”

If an employee pays alimony, then they must be withheld from this type of salary payments. The procedure for withholding alimony will be the same as for withholding from wages paid in cash (

The legislative framework

| Legislative act | Content |

| Article 131 of the Labor Code of the Russian Federation | "Forms of remuneration" |

| International Labor Organization Convention No. 95 of July 1, 1949 | "Regarding wage protection" |

| Letter of the Ministry of Finance of the Russian Federation No. 03-03-05/59 dated March 24, 2010 | “On the procedure for accounting for income tax purposes for wages in kind in excess of 20%” |

| Letter of the Ministry of Finance No. 03-03-06/2/109 dated 08/27/2008 | “On compensation to employees for rent” |

Registration of salary payment

To calculate salaries, one of the forms is used: statement T-51 or statement T-49. A statement such as T-53 will not be suitable for paying wages in this form, as it is not intended for this. An organization can develop a form independently, or use Form 415-APK, developed for agricultural complexes. In order for a company to use it, it must be provided for in the company's accounting policies. If the accounting policy does not provide for such a form, then appropriate changes will need to be made by order of the manager. If necessary, Form 415-APK can be adapted to the company's requirements.

Payment in 2021

The procedure for paying wages with a natural product is as follows:

- Make sure that this method is specified in the employment contract.

- Check what percentage of the salary the natural part fits into.

- Compare its value with the market value.

- The employee must personally write an application to receive part of the salary in kind.

- Receive a salary in kind. Usually it is issued using form 415-APK.

- Upon receipt, ensure the proper quality of the product and its suitability for use. If one or the other is not satisfactory, the employee can refuse it.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. Submit your question using the form (below) and one of our lawyers will call you back to provide a free consultation.

What can be given to an employee?

Property that can be issued as salary must meet one of the following conditions: be useful or suitable for use for the employee’s personal purposes.

The following may be issued in this capacity:

- Goods or finished products;

- Materials or OS;

- Raw materials, etc.

An important condition for issuing wages in this form is the cost of the goods. If the employer inflates its price compared to the market price, such payment will be regarded as unreasonable. Market value is defined as the average market price established in the region of the employer.

There are also categories of valuables that are prohibited from being given as salary:

- Alcohol;

- Substances of a narcotic, toxic or poisonous nature;

- IOUs;

- Coupons;

- Ammunition or weapons.

How much can a salary in kind be?

It is impossible to give the entire salary to an employee in goods or other valuables. Payment in kind should not exceed 20% of the accrued salary. If, nevertheless, there is a need to give the employee more than 20% of the salary in kind, then this must be formalized as a sale. Thus, the documents will reflect that the employee was paid his salary in full, after which he purchased some property from his employer for cash.

Important! It is impossible to exceed the limit of 20% for the payment of wages in kind, as this may be of interest to the inspection authorities.

Reflection in accounting

In the document Reflection of salaries in accounting, a negative amount that reduces “salary” income will be highlighted in a separate line according to the Type of transaction - Accrued :

To ensure that in the accounting database after synchronization the amount accrued to the employee on the credit of account 70 does not decrease, you need to adjust the Type of operation in stock with negative income to Income in kind :

After synchronization, a posting for a negative amount will NOT be generated in the accounting database, which is true:

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Separate statements for the payment of bonuses to dismissed and working employees Options for solving the problem To solve the problem, you can use two...

- What payments do judges consider social and allow them not to impose contributions? Based on the results of the audit, the FSS assessed additional contributions to the company for injuries, having calculated...

- Law No. 323-FZ provided more personal income tax benefits to those affected by natural disasters and terrorist attacks. Law dated September 29, 2019 No. 323-FZ amended Art. 217…

- How can additional insurance premiums be calculated for the amount of the bonus calculated after dismissal of an employee from a position with hazardous working conditions? ...

Personal income tax and insurance premiums

Like wages paid in cash, wages in kind are subject to personal income tax and insurance contributions. In order to calculate the amount of personal income tax, you will need to determine the value of the value issued. The price is determined by agreement between the employee and the employer, based on the market price, including VAT. Personal income tax is calculated as 13% of this amount, and wages paid in kind are included in the employee’s total income, which is subject to reduction by standard deductions. Insurance premiums are charged on all wages, including that part that is paid in kind.

Important! Insurance premiums must be charged on the value of property issued to an employee as salary in kind. Personal income tax is also withheld from this amount.

Pay in kind

If you don't have enough money for your salary

Expertise of the article: M.A. Zolotykh, Legal Consulting Service GARANT, legal consultant

We are accustomed to the fact that wages in kind are used, as a rule, by enterprises producing agricultural products.

However, in conditions of economic instability, this form of payment of wages can also be used by organizations in other industries in case of a lack of funds. Read about the features of this form of remuneration in “Current Accounting”.

Payment in kind is when an employee receives as wages the products of his own company, goods purchased for sale, or other inventory items on the balance sheet. If there is enough money to pay salaries, companies rarely resort to this method (Does the founder want to help the company with money? Read about how to do this correctly in “Actual Accounting” No. 3, 2009). There are 2 reasons for this: the emergence of an additional tax burden and restrictions from labor legislation. In this case, it is meant that payment of wages in kind can be considered justified only if certain conditions are met (1). In order to fulfill them, it is necessary: - to fix the possibility of paying wages in kind in an employment or collective agreement; — receive a written application from the employee for payment of part of the salary in non-monetary form; — set the price for these products at the level of market prices for similar goods in a given period of time; - do not issue wages in the form of promissory notes, coupons, receipts, as well as in the form of alcoholic beverages, narcotic, toxic and other items that are subject to prohibitions or restrictions on their free circulation.

In addition, the "in kind" salary must be normal or desirable in the particular industry, be for home use, and be no more than 20 percent of the gross monthly salary. If a company exceeds this limit, administrative measures may be applied to it (2). (By the way, with regard to “in-kind” bonuses for achieving production results, it is necessary to comply with all the same general requirements that the Labor Code imposes on the payment of wages in kind.) Note that wages in kind can be either systematic or one-time. Therefore, if a company has decided to pay wages in kind, then it can record the possibility of such payment in a separate document that supplements the regulations on the wage system or other local regulations. This option is less labor-intensive than drawing up additional agreements to employment contracts.

Tax accounting... Salaries are subject to personal income tax regardless of the form in which they are received (3). Therefore, from the “in kind” salary, as well as from the money paid, it is necessary to withhold personal income tax, accrue unified social tax (4), contributions for compulsory pension insurance (5) and for insurance against industrial accidents and occupational diseases (6) . The date of receipt of income in the form of wages (including in kind) is recognized as the last calendar day of the month for which income was accrued (7). However, in the order of forming the tax base for personal income tax (When to withhold personal income tax at a rate of 30 percent, we wrote in “Actual Accounting” No. 7, 2008) in the case of remuneration in kind, there are peculiarities (8). It is established as the cost of products (property) issued to the employee, calculated from its market price, which should be determined in accordance with Article 40 of the Tax Code. At the same time, the cost of these products (property) includes the corresponding amount of VAT and excise taxes (9). The specified principle for determining the price of goods says that (10) that for tax purposes the price specified by the parties to the transaction is accepted. Until proven otherwise, it is assumed that the price quoted corresponds to the market price.

Thus, the cash equivalent of a “in-kind” salary is taken as the cost of production at which the company transfers it to its employees. But only in this case you need to remember that it should not deviate from the price at which the organization sells its goods under normal conditions by more than 20 percent in one direction or another. Otherwise, inspectors can check the correctness of prices and recalculate taxes. Moreover, existing arbitration practice suggests that judges in many cases recognize an organization and its employees as interdependent persons. Please also note that there is no material gain in this situation. After all, the employing company transfers products to the employee as payment for wages in accordance with an employment contract, and not a civil law contract (11).

In this case, the withheld amount of tax cannot exceed 50 percent of the amount of payments due to the employee (12). If the period during which the tax can be withheld exceeds 12 months, then the organization must report this to the tax office at the place of its registration and indicate the amount of tax debt (13). When wages are paid in kind, there is a compulsory transfer of ownership of the goods. And along with it, the concept of the sale of goods arises, the proceeds from which must be subject to income tax and VAT in the generally established manner (VAT benefits are provided only to agricultural producers (14). On the other hand, the cost of this product is not paid, as usual, but is repaid by closing part of the salary arrears. The Tax Code allows the entire amount of wages accrued in accordance with the company's wage system, regardless of its form, to be taken into account in expenses when calculating income tax (15). Thus, income and expenses associated with the transfer of products are generated to pay off wage arrears.

As for value added tax, the obligation to charge it when paying for labor in kind is directly indicated by a special norm (16). It says that the tax base in this case is determined based on market prices (without including VAT). Consequently, companies can calculate this tax based on the price of products that they set to pay off wage arrears (excluding VAT). However, there is also an opposite point of view. It is based on the fact that legal relations regarding the payment of wages to employees in kind are regulated not by tax law, but by labor law. Accordingly, the payment of wages in kind cannot be recognized as a sale, and the company is not obliged to pay income tax and VAT to the budget. Arbitration practice on this issue is currently inconsistent. The judges draw conclusions both for the assessment of taxes when paying wages in kind (17) and against (18).

...and accounting Expenses for remuneration of employees in accounting are expenses for ordinary activities (19). They are accrued and reflected in accounting in the generally accepted manner, regardless of the form of subsequent payment of wages. In order to pay off wage arrears with your own products, you need to reflect its sales.

Example

Payments are made in the company 2 times a month - on the 1st and 15th. The salary accrued for January 2009 amounted to 700,000 rubles. Due to the lack of funds on February 1, the salary for January was paid partially with products of own production. (The possibility of remuneration in kind is provided for by the collective agreement; products are transferred to employees at the organization’s selling prices.) The selling price of products transferred to employees is 118,000 rubles. (including VAT - 18,000 rubles), which does not exceed 20% of the monthly salary accrued. Its cost is 80,000 rubles. The tax base for personal income tax for January is determined based on the accrued amount of earnings - 700,000 rubles. The tax amount will be: 700,000 rubles. x 13% = 91,000 rub. A single social tax, contributions to mandatory health insurance and compulsory accident insurance should be charged from the same amount. (In order to simplify the example, entries related to the reflection of contributions for accident insurance and standard tax deductions (20) for personal income tax are not given. The calculation of the amount of unified social tax and contributions to mandatory pension insurance was made using the maximum rates of 26% and 14%.) In January The following entries were made in the accounting: DEBIT 20 (26, 44) CREDIT 70 – 700,000 rub. — wages accrued; DEBIT 20 (26, 44) CREDIT 69 – 182,000 rub. (RUB 700,000 × 26%) - UST is accrued in the part credited to the federal budget (FB), FSS, FFOMS and TFOMS; DEBIT 69 subaccount “Unified Social Tax, credited to the FB” CREDIT 69 subaccount “Cumulative part of the labor pension” subaccount “Insurance part of the labor pension” - 98,000 rubles. (RUB 700,000 × 14%) - the unified social tax was reduced by the amount of accrued insurance premiums for compulsory health insurance. On February 1 (the date of transfer of products to employees and at the same time the date of issuance of cash payment of the remaining part of wages), the accountant made the following entries: DEBIT 76 CREDIT 90-1 - 118,000 rubles. — revenue from the transfer of products to pay for labor is accrued; DEBIT 90-3 CREDIT 68 subaccount “VAT calculations” – 18,000 rubles. – VAT is reflected on the proceeds from the transfer of products to pay for labor; DEBIT 90-2 CREDIT 43 – 80,000 rub. — the cost of products transferred as payment for labor is written off; DEBIT 70 CREDIT 68 “Calculations for personal income tax” – 91,000 rubles. (RUB 700,000 × 13%) - personal income tax withheld; DEBIT 70 CREDIT 50 – 491,000 rub. (700,000 – 118,000 – 91,000) - part of the salary for January was paid in cash; DEBIT 70 CREDIT 76 – 118,000 rub. - debts have been offset.

*1) .. art. 131 Labor Code of the Russian Federation; paragraph 54 Post. Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2 *2) ... Art. 5.27 Code of Administrative Offenses of the Russian Federation *3) ... clause 1. Article 210 of the Tax Code of the Russian Federation *4) ... clause 1 art. 236 Tax Code of the Russian Federation; letter of the Ministry of Finance of Russia dated 02/03/2009 No. 03-04-06-02/7 *5) ... clause 2 of Art. 10 of the Federal Law of December 15, 2001 No. 167-FZ *6) ... clause 3 of the rules, approved. fast. Government of the Russian Federation dated March 2, 2000 No. 184 *7) ... clause 2 of Art. 223 Tax Code of the Russian Federation *8) ... art. 211 of the Tax Code of the Russian Federation *9) ... clause 1 of Art. 211 Tax Code of the Russian Federation *10) ... Art. 40 Tax Code of the Russian Federation *11) ... sub. 2 p. 1 art. 212 of the Tax Code of the Russian Federation *12) ... clause 4 of Art. 226 of the Tax Code of the Russian Federation *13) ... clause 5 of Art. 226 Tax Code of the Russian Federation *14) ... sub. 20 clause 3 art. 149 Tax Code of the Russian Federation *15) ... Art. 255 of the Tax Code of the Russian Federation *16) ... clause 2 of Art. 154 Tax Code of the Russian Federation *17) ... Post. FAS PO dated 02/05/2008 No. A65-15782/07-SA2-41, FAS UO dated 06/28/2006 No. F09-5541/06-S2 *18) ... Post. FAS PO dated 01.03.2007 No. A65-15982/2006 *19) ... paragraphs. 5, 8 PBU 10/99, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n *20) ... Art. 218 Tax Code of the Russian Federation

Land plots by position As history says, in the primitive communal state there were 3 forms of remuneration. The most common payment was in food (which came in the form of a tax in kind from community members). Basically, it was paid to unproductive labor workers - the military, police, civil servants, priests, etc. But, in addition, to peasants and artisans who, due to the existing universal labor conscription, worked several days a year at an irrigation facility or at a state agricultural enterprise . Another category of government employees, such as military personnel, received their salaries partly in the form of food and partly in the form of money. But there were also those who received their salaries exclusively in money. These included foreign trade workers. In those days, money to pay wages came to the state in the form of a cash tax from artisans and partly peasants, from trade (especially foreign trade), which, as a rule, was a state monopoly, and from the sale of part of the products of state farms. However, some government employees received their salaries not in the form of money or natural products, but in a unique form of use of land. In general, all community members received land plots in a primitive communal society, and equally. But the persons in question also received additional plots. Moreover, the size of this additional area was determined based on the employee’s position. To cultivate such plots of land, workers were hired, and the product received from this farm was used to support themselves and their families. Having left this position for any reason, the person was deprived of the right to use the land plot “ex officio”. But he still had at his disposal the piece of land that he received, like all other ordinary members of the community. The land plots that the state allocated to officials were not subject to transfer for community use. It was an indivisible state land fund, which was constantly replenished from conquered or purchased lands.

Source: “Actual Accounting” magazine

Accounting for salaries in kind

Let's consider the main transactions depending on the property issued to the employee as salary:

| Business operation | Postings | |

| Debit | Credit | |

| The employee is given goods (finished products) | ||

| Goods were issued as payment for wages | 70 | 90 (sub-account “Revenue”) |

| The cost of the goods is written off | 90 (sub-account “Cost of sales”) | 43(41) |

| The employee is given materials (OS) | ||

| OS issued as salary | 70 | 91 (sub-account “Other income”) |

| The cost of the OS has been written off | 91 (subaccount “Other expenses”) | 01(08, 10, 21) |

| Depreciation written off on fixed assets | 02 | 01 |

Example of payment of salary in kind

Petrova O.P. I wrote a statement to the head of Kontinent LLC, in which I asked for a microwave oven worth 5,500 rubles, VAT – 838.98 rubles, as payment for my salary for January 2021. The conditions for such payment are fixed in the employment contract. For January 2021, Petrova received a salary of 40,000 rubles. The cost of the microwave oven at which the organization purchased it is 2,700 rubles, including VAT of 411.86 rubles. The cost of a microwave oven does not exceed the 20% limit for issuing wages in kind, so it can be issued to an employee.

Let's look at what the wiring will be like:

D44 K70 – salary accrued to Petrova O.P. – 40,000 rubles;

D70 K68 – personal income tax withheld from salary – 5,200 rubles;

D44 K69 – insurance premiums charged – 8,000 rubles;

D70 K90 (sub-account “Revenue”) - goods were issued as wages - 5,500 rubles;

D90 (sub-account “VAT”) K68 – VAT is charged on the goods – 838.98 rubles;

D90 subaccount (“Cost of sales”) K41 – microwave oven written off at cost – 2,288.14 rubles (2,700 – 411.86);

D70 K50 - the balance of the salary was paid 29,300 rubles (40,000 - 5,200 - 5,500).

When calculating income tax, Continent LLC must take into account the income received from the sale of a microwave oven - 4,661.02 rubles (5,500 - 838.98), and expenses will include the cost of the microwave - 2,288.14 (2,700 - 411.86).

simplified tax system

The accrued salary (regardless of the form of payment) is taken into account in expenses when calculating the single tax (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Situation: is the payment of wages in kind (goods, finished products, other property of the organization) subject to a single tax under simplification?

According to general standards, it is. But there are examples of court decisions that indicate the opposite.

The transfer of ownership of property is recognized as a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation). Consequently, if an organization issues wages in kind, then it actually sells its property. This operation is subject to income tax (Clause 1 of Article 249 of the Tax Code of the Russian Federation, Resolution of the Federal Antimonopoly Service of the Volga Region dated March 1, 2007 No. A65-15982/2006). Thus, if you follow this position, the organization must reflect the value of the transferred property in taxable income (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). In addition, if an organization applies a simplification of the difference between income and expenses, expenses can also be increased by the value of the transferred property (clause 2 of Article 346.16, clause 1 of Article 252 of the Tax Code of the Russian Federation).

However, the payment of wages to employees in kind is subject to regulation by labor law, not civil law. Therefore, such an operation cannot be recognized as a sale (see, for example, resolutions of the Federal Antimonopoly Service of the Ural District dated September 25, 2012 No. Ф09-8684/12, dated February 18, 2011 No. Ф09-11558/10-С2 and the West Siberian District dated January 18, 2006 No. F04-9650/2005(18711-A27-14)). Despite the fact that such arbitration practice is associated with organizations under the general regime, one can be guided by its conclusions under the simplified regime. Therefore, there is no need to pay a single tax during simplification.

In addition, labor costs themselves are one of the elements that form the total cost of production. The organization is obliged to charge a single tax on the cost of these products upon their sale. Charging taxes not only on the total cost of production, but also on its individual elements would mean double taxation of the same object. Therefore, if the value of property issued as wages is taken into account as part of labor costs, there is no need to charge a single tax on it when simplified.

However, if the organization is guided by this point of view, it may have to defend its position in court.

Situation: is it possible to take into account the payment of utilities for an employee when calculating the single tax? The organization pays a single tax on the difference between income and expenses.

Yes, it is possible if the organization is required by law to pay the employee’s utilities.

Simplified organizations take into account expenses in the manner prescribed for income tax payers (subclause 6, clause 1, clause 2, article 346.16 of the Tax Code of the Russian Federation). Payment of utilities for an employee can be taken into account in labor costs (clause 4 of Article 255, subclause 6 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation). In this case, expenses must be documented (clause 1 of article 252, clause 2 of article 346.16 of the Tax Code of the Russian Federation). However, this possibility is provided only for cases where the obligation to pay utility bills for an employee is provided for by the legislation of the Russian Federation. These can be both federal and regional legislative acts for all areas of activity, and acts related to a specific industry. For example, Part 2 of Article 21 of Law No. 81-FZ of June 20, 1996 provides for the obligation of coal industry organizations to provide employees with free ration coal for heating according to the standards approved by the Government of the Russian Federation.

If the obligation to pay an employee the cost of utility services is not provided for by law, such expenses cannot be taken into account when calculating the single tax. The fact is that in the list of labor costs given in Article 255 of the Tax Code of the Russian Federation, such costs are not directly named. Based on paragraph 25 of Article 255 of the Tax Code of the Russian Federation, which allows other types of expenses incurred in favor of an employee to be included in costs, it is also impossible to take into account payment for utilities. This is explained by the fact that such payment is not related to the employee’s performance of job duties, and therefore is not economically justified (clause 1 of Article 252, clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated April 15, 2013 No. 03-11-11/146.