Accounting for income in retail trading using the simplified tax system

Income accounting for retail companies is similar to income accounting for any other company using the simplified tax system. (click to expand)

- Tax accounting is carried out using the cash method. This means that all receipts for goods sold are included in income. Regardless of the method of payment - cash to the cash desk or non-cash to the organization's current account.

- The buyer can pay not only in cash. This may be payment in property, work, or services. In this case, a counter debt arises between the buyer and sellers. If the obligations of both parties have come due, such companies can offset mutual claims. The date of receipt of the simplified tax system income in this case will be the date of signing the netting act. When calculating property, it is necessary to remember that property must be reflected at market prices.

- When prepayments or advances are received, their full amount is also included in income under the simplified tax system on the date of receipt. This occurs regardless of whether the goods have been shipped to the buyer or not.

- A trading company may also have non-operating income. For example, from renting out temporarily vacant premises. Such income is also included in income under the simplified tax system.

Which tax object to choose for retail

Simplified taxation is characterized by the possibility of choosing the object of taxation. There are two of them:

- "Income". The standard rate for calculating tax is 6%, and regions have the right to reduce it. The object is more suitable for use in the service sector, when the expense component is not high, or in cases where expenses cannot be documented.

- "Income minus expenses." The tax rate is 15%, but regions can also lower it. The object is chosen by those business entities whose costs are at least 60–65% of their income.

In general, in trade, the purchase price of goods constitutes a significant part of the costs. Therefore, it is logical to assume that the object of taxation of the simplified tax system “income minus expenses” in retail trade will arouse the greatest interest. However, each seller will make his choice based on the specifics of his own work. And if difficulties arise with documenting expenses, for example, due to an unwillingness to understand all the nuances of tax legislation, then the seller can choose the “income” object.

Accounting for expenses when retailing using the simplified tax system

All company expenses must be:

- economically justified

- documented

- aimed at generating income

Conventionally, the company’s expenses for the simplified tax system can be divided into the following groups:

- expenses for the purchase of goods (excluding VAT)

- VAT presented by the supplier (if the supplier works on the general taxation system)

- expenses for purchasing goods

- costs of selling goods

An additional condition for companies operating on the simplified tax system is that goods purchased for resale must be paid for and sold to customers.

The accounting policy must define one of the methods for valuing purchased goods:

- FIFO method (first of all, expenses for the earliest goods purchased are taken into account)

- based on the average cost of purchased goods

- at the cost of a unit of goods.

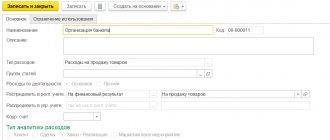

The procedure for determining expenses under the simplified tax system is described in Article 346.16 of the Tax Code (Tax Code of the Russian Federation). It is precisely based on the requirements of this article that the cost of the goods themselves and the VAT presented by the supplier on purchased goods must be reflected separately in the Book of Income and Expenses under the simplified tax system.

Retail trade: choosing the optimal tax system for individual entrepreneurs

Individual entrepreneur retail trade is the activity of selling goods for personal use. Buyers of products are individuals and representatives of enterprises who purchase material assets not for sale. Sales are carried out under a retail sales agreement, which is represented by a cash register receipt or other document replacing the form.

The taxpayer has the right to choose the form of accounting independently, subject to compliance with restrictive standards. When choosing the most profitable system, it is necessary to determine what conditions of taxation and additional expenses are present in each of the regimes.

The procedure for writing off goods in retail trade using the simplified tax system

With a large range of goods and a significant number of suppliers, special attention must be paid to tracking paid and sold goods. This can be done using, for example, the methodology recommended by the Ministry of Finance of the Russian Federation in Letter No. 03-11-04/2/94 dated April 28, 2006, or you can approve your own write-off rules by local regulations that do not contradict the provisions of the Tax Code of the Russian Federation.

Example 1. Write-off using the FIFO method

first purchased 20 bathroom sets at a price of 2,200.00 per set excluding VAT (1st batch), after 2 weeks another 10 sets were purchased at a price of 2,000.00 per set (2nd batch). Within a month, 25 sets were sold.

When using the FIFO method the following will be written off:

- all 20 sets of their first batch priced at 2,200.00 for a total of 44,000.00;

- 5 sets from the second batch at a price of 2,000.00 for a total of 10,000.00;

- total expenses will include 44,000.00 + 10,000.00 = 54,000.00

Example 2. Write-off of goods at average cost

Let's use the conditions of Example 1 regarding the quantity and amount of purchased goods. Let us add that at the beginning of the month there were 5 of the same sets in stock for a total amount of 9,500.00 (excluding VAT). 27 sets of varying prices were sold.

Let's determine the average cost of the set

- (9 500,00 + 2 200,00 * 20 + 2 000,00 * 10) / (5 + 20 + 10) = 2 100,00

- In total, expenses will include 27 * 2,100.00 = 56,700.00

Example 3. Write-off of goods at the cost of each unit

This method is suitable for selling a small range of goods (usually expensive ones, which can be taken into account at the cost of a unit of goods). For example, a set of built-in kitchen appliances was purchased at a price of 200,000.00. It was sold to the buyer for 300,000.00 200,000.00 will be written off as expenses

UTII: to be or not to be?

The application of the tax regime is regulated by the Tax Code of the Russian Federation (Chapter 26.3). According to Federal Law No. 97 (06/29/2012), the use of UTII will be available until the end of 2021. All attempts to revise the end date of the regime were unsuccessful. One way or another, all tax collectors will have to choose a new taxation system and face the difficulties of the transition.

Until the end of 2021, regime change is possible voluntarily or forcibly. In the first case, the new regime will be used from January 2021. A voluntary change of the tax system is possible only from the new calendar year.

A forced transition from UTII to the simplified tax system is carried out upon loss of the right to apply the tax regime. In this case, the calendar year rule indicated above does not apply. The transition is carried out from the quarter in which the grounds for loss of the right to apply imputation arose. Forced migration to the simplified tax system occurs when the permissible share of participation of other organizations in the authorized capital is exceeded (relevant for legal entities) and the average number of employees increases (100+ people).

An important point: the automatic transition in case of loss of the right to use imputation is carried out on OSNO. To apply the simplified tax system, you must submit a corresponding application to the tax office.

When migrating, taxes are calculated and paid in the manner prescribed by the Tax Code of the Russian Federation for newly registered individual entrepreneurs and organizations.

Accounting for VAT on purchased goods under the simplified tax system

VAT is accounted for separately, the write-off conditions are the same as for the goods themselves - the goods must be paid for and sold. If not all goods are sold, but only part of them, VAT is written off as expenses, calculated in proportion to the cost of the goods written off for sale.

Expenses for the purchase of goods under the simplified tax system

Expenses associated with the purchase of goods can be written off immediately upon payment. Such expenses are the costs of delivering goods from the supplier, the costs of storing them and maintaining them in good condition. On the other hand, such expenses can also be taken into account as part of material expenses. Then it will be possible to take them into account as expenses are paid off as debts are paid to suppliers.

Costs of selling goods under the simplified tax system

Such expenses include the costs of delivering goods to customers, costs of pre-sale preparation, packaging and other similar costs. Such expenses can be taken into account immediately after they are paid. With regard to transport costs for delivering goods to customers, the position of regulatory authorities is not clear.

The Ministry of Finance believes that the cost of goods passes to the buyer at the time of sale, the cost of subsequent delivery (delivery of someone else's property, according to the Ministry of Finance) can be taken into account in expenses only if the cost of such delivery is included in the sale price of the goods, or delivery costs are separately reimbursed by the buyer.

Typical accounting entries when selling goods at retail at sales prices

Typical wiring is shown in Table 1: (click to expand)

| No. | Contents of operation | Debit account | Credit account |

| 1 | Goods received | D 41 | D 60 |

| 2 | Trade margin reflected | D 41 | K 42 |

| 3 | Payment to supplier reflected | D 60 | K 51 |

| 4 | Revenue from goods sold at retail | D 50 | K 90.01 |

| 5 | The sales value of goods sold is written off | D 90.02 | K 41 |

| 6 | REPLACEMENT reflects the trade margin on the goods sold | D 90.02 | K 42 |

| 7 | The financial result from retail sales has been determined | D 90.09 | K 99 |

Is it possible to do without CCT?

The use of the simplified tax system does not relieve the retailer from using cash register systems. A complete list of cases when it is allowed to conduct cash payments without cash register equipment is established by Art. 2 of the Law “On the use of cash register equipment when making cash payments and (or) payments using payment cards” dated May 22, 2003 No. 54-FZ.

To find out whether you need to use an online cash register, take the test posted on the website of the Federal Tax Service of Russia.

Is it possible for an organization using the simplified tax system to use strict reporting forms instead of a cash register? The answer to this question was given by I.V. Prosekova, 2nd class adviser to the State Civil Service of the Russian Federation. Get trial access to K+ and find out the official’s opinion.

Notice of commencement of activity

The obligation to report the start of work is established by law dated December 26, 2008 No. 294-FZ for certain types of activities, including trade. This requirement applies only to retailers and wholesalers operating under the following OKVED codes:

- 47.11 — Retail trade primarily in food products, including drinks, and tobacco products in non-specialized stores

- 47.19 — Other retail trade in non-specialized stores

- 47.21 — Retail trade of fruits and vegetables in specialized stores

- 47.22 — Retail trade of meat and meat products in specialized stores

- 47.23 — Retail trade in fish, crustaceans and molluscs in specialized stores

- 47.24 — Retail trade in bread and bakery products and confectionery in specialized stores

- 47.29 — Retail trade of other food products in specialized stores

- 47.75 — Retail trade of cosmetics and personal hygiene products in specialized stores

- 47.8 — Retail trade in non-stationary retail facilities and markets

- 46.32 — Wholesale trade of meat and meat products

- 46.33 — Wholesale trade in dairy products, eggs and edible oils and fats

- 46.36.4 — Wholesale trade in bakery products

- 46.38 — Wholesale trade of other food products, including fish, crustaceans and molluscs

- 46.38.21 — Wholesale trade in homogenized food products, baby and diet food

- 46.39.1 Non-specialized wholesale trade in frozen food products

- 46.45.1 Wholesale trade of perfumes and cosmetics, except soap

- 46.49.42 Wholesale trade in games and toys

- 46.73.4 Wholesale trade in paints and varnishes

- 46.75.1 Wholesale trade of fertilizers and agrochemical products

Please note: if you simply indicated these OKVED codes during registration, but do not yet plan to work using them, then you do not need to submit a notification.

The procedure for submitting a notification is established by Decree of the Government of the Russian Federation of July 16, 2009 No. 584. Before starting actual work, to submit two copies of the notification to the territorial division of Rospotrebnadzor - in person, by registered mail with a notification and a list of attachments, or an electronic document signed with an electronic signature.

In the event of a change in the legal address of the seller (place of residence of the individual entrepreneur), as well as a change in the place of actual trading activity, it will be necessary to notify the Rospotrebnadzor office where the notification was previously submitted within 10 days. An application to change information about a retail facility is submitted in any form.