Note! tax regime has been abolished since 2021 . Payers of UTII need to choose another taxation option.

UTII is a preferential tax regime, which may turn out to be the most profitable option for the tax burden. Despite restrictions on the types of activities, retail trade and most services can be carried out on the imputed area, i.e. the most popular areas for small businesses. We'll tell you how to switch to UTII from 2021 and report it to the tax office.

Why declare a transition to UTII

UTII is one of the most used tax regimes in small businesses. This is explained by:

- One imputed tax replaces several other taxes - on profit, on the property of organizations, VAT, personal income tax (on the income of individual entrepreneurs);

- is paid in a fixed amount, regardless of the amount of income;

- quite simple to calculate;

- the amount of tax depends on the type of activity and, compared to the income received, can be very small;

- the tax can be reduced by the amount of insurance premiums paid;

- Tax accounting and reporting is not complicated. The tax return only needs to be filed once a quarter and is easy to prepare;

- you can switch to it at any time, and not only from the beginning of the year or newly registered;

- the ability to apply it simultaneously with other tax regimes.

Therefore, the transition to UTII has clear advantages and is very beneficial for small businesses.

Application of UTII

UTII is a special taxation regime in which the object is the amount of estimated imputed income. Until 2013, the use of UTII was considered mandatory for certain types of activities. Since the beginning of 2013, the exercise of the right to use preferential treatment has become voluntary (clause 1 of Article 346.28 of the Tax Code of the Russian Federation).

For more information about changes in tax legislation regarding UTII, see the material “UTI Taxation System: Pros and Cons of Imputation.”

How to switch to UTII, application procedure

To determine whether an organization or individual entrepreneur can switch to imputed tax, you need to make sure that a number of conditions are met.

Conditions of transition and application

First of all, the application of a tax in relation to a specific type of activity must be legislatively introduced by a decision of a representative body in the region and municipal area (urban district) where the work is to be done. The list of possible types of activities is established by clause 2 of Article 346.26 of the Tax Code of the Russian Federation, however, in specific regions not the entire list may be applied.

The list of activities includes:

- provision of household services (according to their classification determined by the Government of the Russian Federation;

- provision of veterinary services;

- provision of repair, maintenance and washing services for cars and motor vehicles;

- provision of parking spaces for cars and motor vehicles;

- provision of motor transport services for the transportation of passengers and cargo (no more than 20 vehicles);

- retail trade through shops and pavilions with a sales floor area of no more than 150 square meters;

- retail trade through stationary retail facilities without trading floors, as well as through non-stationary retail facilities;

- provision of catering services through facilities with a service area of no more than 150 square meters;

- provision of catering services through facilities without a customer service area;

- outdoor advertising using advertising structures;

- advertising using vehicle surfaces;

- temporary accommodation and accommodation services using a total area of premises of no more than 500 square meters;

- services for the transfer of temporary possession and (or) for use of retail space in stationary retail facilities without trading floors, non-stationary retail facilities, as well as public catering facilities without a customer service area;

- services for the transfer of temporary possession and (or) use of land plots for the placement of stationary and non-stationary retail facilities, as well as public catering facilities.

To switch to UTII, Article 346.26 of the Tax Code requires compliance with the following criteria:

a) the share in the authorized capital of a legal entity owned by another organization must not exceed 25%;

this restriction does not apply to:

- organizations established by public organizations of disabled people, if disabled employees in them have an average number of at least 50% and a wage fund of at least 25%;

- consumer cooperation organizations and societies established by consumer societies and their unions.

When and where to contact

The application of a single tax is voluntary. If a businessman decides to switch to paying it, he is not obliged to ask permission, he simply notifies the INFS of the decision.

The easiest way is to apply for UTII for individual entrepreneurs for 2021 upon registration; It is enough to send it to the Federal Tax Service at your place of residence if the entrepreneur:

- places advertisements in transport;

- transports people or goods;

- works in the field of peddling or distribution trade.

Timing of transition to imputation

In accordance with Art. 346.28 of the Tax Code of the Russian Federation, an application for registration must be submitted to the tax authority within 5 working days from the beginning of the application of UTII.

The date of registration will be the date indicated in the corresponding line in the application (according to Article 346.28 of the Tax Code of the Russian Federation).

After receiving the application, within 5 working days the tax authority will issue (send) to the taxpayer a notice of registration under UTII.

According to Article 346.29 of the Tax Code of the Russian Federation, if an organization or individual entrepreneur is registered with the tax authorities as payers of a single tax (as well as their deregistration from such registration) not from the first day of the calendar month, then the amount of imputed income for this month is calculated based on the actual number of days of activity this month.

Violation of the registration deadline

For violation by a taxpayer of the deadline for filing a single tax application, liability may be imposed under Article 116 of the Tax Code of the Russian Federation “Violation of the procedure for registration with the tax authority” - a fine of 10 to 40 thousand rubles.

Form UTII-2 for individual entrepreneurs in 2021, refusal of the UTII regime

For an individual entrepreneur, the same rules for switching to the UTII regime apply as for legal entities. Forms UTII-1 and UTII-2 differ from each other only in the title page, everything else is the same. The main difference is in filling out the title page: instead of the name of the organization, fill in your full name. individual entrepreneur, and instead of the OGRN, the OGRNIP (main state registration number of the individual entrepreneur) is indicated.

A sample of UTII-2 is shown in the figure below.

Refusal from the UTII regime by a legal entity and individual entrepreneur occurs after submitting a special application within five days - from the moment of transition to another regime, from the day of deregistration with the Federal Tax Service as a “imputed”, from the last day of the month of the quarter in which it was the condition for the lawful use of UTII has been violated (before 04/05/2017, before 07/05/2017, before 10/05/2017, before 01/05/2021, etc.).

According to paragraph 7 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 157 dated March 5, 2013, suspension of sales of goods and provision of services without the process of deregistration with the tax inspectorate does not exempt taxpayers from taxation of UTII.

Conclusion: the deadlines for filing an application for registration as a UTII payer and deregistration in fact coincide - either from the date of transition to a new regime, or from the day of complete cessation of business activity.

Important point: To switch to the UTII regime, an individual entrepreneur or legal entity must be engaged in certain types of activities and meet the profitability limit on the number of employees. The transition to the UTII regime occurs after submitting the appropriate application.

Application form for UTII

Application forms for the transition to UTII for organizations and individual entrepreneurs are different.

For organizations - this is form No. UTII-1, for individual entrepreneurs - form No. UTII-2, each consists of two pages.

Both forms were approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-6 / [email protected] dated December 11, 2012.

Application forms for tax registration under UTII can be downloaded from the following links:

on registration of an organization as a taxpayer of a single tax on imputed income for certain types of activities.

on registration of an individual entrepreneur as a taxpayer of a single tax on imputed income for certain types of activities.

These same statements are in PDF format, if this option is more convenient for someone to fill out:

- according to the UTII-1 form for organizations ().

- according to the UTII-2 form for individual entrepreneurs ().

What it is

The basic principles and nuances of using this system are reflected in Chapter 26.3 of the Tax Code of the Russian Federation. UTII is a special tax regime in which the Federal Tax Service sets a certain level of expected profit from selected types of activities.

The transition to UTII allows an entrepreneur to be exempt from paying other types of taxes and fees. With the selected UTII taxation system, an individual entrepreneur is exempt from personal income tax and personal property tax.

Moreover, businessmen do not pay VAT on transactions that are recognized as objects of taxation in accordance with Chapter 21 of the Tax Code of the Russian Federation. An exception is VAT, payable in accordance with the Tax Code of the Russian Federation when importing goods into the territory of the Russian Federation.

Thus, UTII replaces three types of taxes at once - personal income tax, VAT and personal property tax. On January 1, 2013, 94-FZ of June 25, 2012 came into force, which somewhat changed the principles of application of UTII.

The regime became voluntary. Taxpayers using UTII have the right to choose whether to carry out activities using UTII or switch to another system.

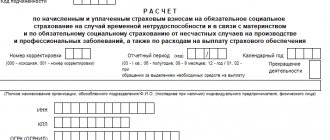

Sample of filling out an application for UTII

Let's consider filling out samples for organizations and individual entrepreneurs.

For organizations

When filling out an application on the UTII-1 form for an organization, you need to enter the following data:

a) on the first page

- TIN and checkpoint of the organization;

- code of the tax authority to which the application is submitted;

- select and enter in the field a number indicating that the organization is Russian or foreign;

- full name of the organization;

- OGRN of the organization;

- start date of activities under UTII;

- depending on the person signing the application, enter the number “1” or “2” in the field;

- Full name, tax identification number and telephone number of the head or representative of the organization;

- power of attorney data if the application is signed by a representative;

- date of signing the application.

When signing an application by a representative, a power of attorney is attached as an attachment.

b) on the second page

- activity type code (given in Appendix No. 5 to the Procedure for filling out the UTII declaration, approved by order of the Ministry of Finance and the Federal Tax Service of the Russian Federation No. ММВ-7-3 / [email protected] dated 07/04/2014);

- address of the place of business (postal code, code and name of the region, district, city, town, street, house, office/apartment);

- applicant's signature.

On this page it is possible to indicate details of three different places (or types) of activity. If there are more than three, you should fill out the required number of such pages.

The second and subsequent pages are also appendices to the first page. The number of applications must be indicated on the first page of the application.

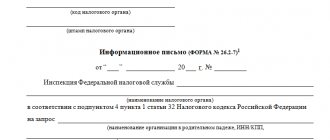

Presentation to third parties

Sometimes documents on the application of preferential treatment may be required by third parties, for example, during legal proceedings or to work with counterparties. Most often, the taxpayer is written: “I ask you to issue a scanned copy of the notice of application of UTII...”. What document should he prepare? The one issued by the Federal Tax Service. There is no special form that will confirm work under preferential treatment. Or the company can offer the interested person the latest tax return with a mark from the Federal Tax Service on its acceptance. The last option is to provide a copy of the statement of intent to pay a single tax, where it will be clear that it was accepted by an employee of the Federal Tax Service.

Separate units

Situation: what documents need to be submitted to the tax office if an organization creates a separate division at the place of business on UTII? The organization is not engaged in the transportation of passengers and cargo, distribution (distribution) trade and does not place advertising on transport.

The answer to this question depends on where the organization creates a separate division and where it is registered with the tax authorities as a payer of UTII.

According to the general rules, the organization is obliged to register with the tax inspectorates at the location of each separate division. Moreover, such an obligation does not depend on whether she is listed in these inspections for other reasons. This procedure follows from the provisions of paragraph 2 of paragraph 1, paragraph 1 of paragraph 4 of Article 83 of the Tax Code of the Russian Federation and is confirmed by letter of the Ministry of Finance of Russia dated August 16, 2012 No. 03-11-06/3/60.

To register an organization at the location of its separate division (except for branches and representative offices), you need to submit a message. Compile it according to form No. S-09-3-1, approved by order of the Federal Tax Service of Russia dated June 9, 2011 No. MMV-7-6/362. In this case, no documents confirming the creation of a separate division need to be submitted.

The tax inspectorate will register the branch or representative office at its location independently based on the information from the Unified State Register of Legal Entities. This procedure is provided for in paragraph 1 of paragraph 4 of Article 83, paragraph 2 of paragraph 2 of Article 84 of the Tax Code of the Russian Federation.

If, by the time the separate division is created, the organization is already registered in the municipality as a UTII payer, then it is not required to re-register for taxation in this capacity (letter of the Ministry of Finance of Russia dated August 16, 2012 No. 03-11-06/3/60). It is enough to send only a message in form No. S-09-3-1 to the tax office at the location of the separate division.

You can submit a message about the creation of a separate division to the tax office in one of three ways. The first is through a representative of the organization. The second way is by mail (registered mail). And the third - through telecommunication channels. Such rules are established by paragraph 7 of Article 23 of the Tax Code of the Russian Federation.

All possible options for registering separate units when using UTII are listed in the table.

An example of registering an organization as a UTII payer

An organization opens a separate division in the municipality in which it is already registered for tax purposes on a different basis.

The organization is engaged in wholesale trade (general taxation system) in the city of Pushkino, Moscow region and is registered with this municipal entity for tax purposes at the location of the head office. In May 2015, the organization opened a new retail outlet (a separate division) in Pushkino. The head office of the organization and its separate division operate in the territory under the jurisdiction of one inspection. In this regard, the organization submitted to this tax office an application in the form of UTII-1 and a message in form No. S-09-3-1 about the creation of a separate division.

Situation: does a separate division arise if the activities for which the use of UTII is allowed (provision of household services to the population) are carried out on behalf of the organization by employees working under civil law contracts?

Answer: no, it does not occur.

As a general rule, a separate division is formed only where stationary workplaces are equipped, geographically remote from the location of the organization, for a period of more than one month (Article 11 of the Tax Code of the Russian Federation). And it is mandatory to equip such places only for those with whom the organization has entered into employment contracts (paragraph 4, part 1, article 21 of the Labor Code of the Russian Federation). Labor legislation does not apply to those working under civil contracts (for example, under contract or paid services) (Article 11 of the Labor Code of the Russian Federation). That is why the place where employees work under a civil contract is not a separate unit.

However, if an organization decides to apply UTII for household services, then it will have to register for taxation at the place where such activities are carried out. The procedure for applying UTII does not depend on who performs work or provides services on behalf of the organization: full-time employees or those with whom civil contracts have been concluded. In this situation, the contractor itself under contracts concluded with customers is the organization itself as a legal entity. Therefore, if an organization provides household services in a municipality where UTII is applicable for such activities, then it needs to register as a payer of this tax on a general basis. This must be done within five working days from the date of commencement of activities (clause 3 of Article 346.28 of the Tax Code of the Russian Federation). This moment can be considered the day when the first contract for the provision of services (performance of work) was concluded. If an organization provides personal services in the territory of different municipalities (including through mobile teams of its employees), then it needs to register for tax purposes in each of these entities.

This follows from the provisions of Article 346.28 of the Tax Code of the Russian Federation.

Where to register

To apply UTII, an organization needs to register (register with tax authorities) in each municipality in whose territory it conducts activities subject to this tax.

There are exceptions to this rule. Thus, organizations are required to register for taxation with only one inspectorate at their location if they are engaged in:

- transportation of passengers and cargo;

- delivery (distribution) trade;

- placement of advertising on vehicles.

This procedure is provided for in paragraph 2 of Article 346.28 of the Tax Code of the Russian Federation.

For example, an organization is registered in a municipality, where UTII does not apply to the above types of activities. But the opportunity to switch to UTII for such areas of business is in the territory of another municipality, where the organization actually operates. However, at such a place of business (including through a separate division), the organization will not be registered as a UTII payer, since this regime is not provided for at the place of registration. In this case, at the place where the organization actually carries out its activities, it will have to pay taxes either according to the general taxation system or under a simplified tax system. Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated October 30, 2009 No. 03-11-06/3/262.