Often organizations purchase fixed assets that have already been used. However, a situation may arise when a fixed asset is acquired that has been fully depreciated from the previous owner. How, then, should this property be taken into account in order to avoid tax risks?

Organizations that purchased a used, fully depreciated fixed asset must reflect this acquisition in accounting and tax accounting. Read the article about how to avoid mistakes when calculating the initial cost of such property and avoid tax risks.

Documenting

The commission's decision to liquidate a fixed asset is formalized by an act on the write-off of a fixed asset item in form No. OS-4 (clause 78 of the Methodological Instructions). This form of the act can be used (from January 1, 2013 it is not mandatory) when deregistering all types of fixed assets, with the exception of vehicles. If you wish, you can independently develop and approve the form of the act for writing off the fixed assets. When liquidating vehicles, an act in form No. OS-4a is used.

The object being written off must be clearly identified, therefore the act indicates data characterizing the asset: the date the fixed asset was accepted for accounting, the year of manufacture or construction, time of commissioning, useful life, initial cost and the amount of accrued depreciation, revaluations, repairs. The act must indicate the inexpediency of further operation of the facility and the irrationality of its modernization. In addition, the act describes the condition of the main parts, parts, assemblies, structural elements and indicates the possibility of their further use, for example, for the repair of other objects.

The act is drawn up in two copies, signed by the members of the commission and approved by the head of the organization. One copy of the executed act for write-off of the asset remains with the financially responsible person. The second copy is transferred to the accounting department for registration of accounts. Based on this document, a mark indicating its disposal is placed in the inventory card of the item being written off. Inventory cards for retired fixed assets are stored separately for at least five years. The actual shelf life of such cards is determined by the head of the company (clause 80 of the Guidelines).

Note that the procedure for documenting the write-off of a fixed asset does not depend on the amount of accrued depreciation and applies even if the object is fully depreciated. Only when a vehicle is written off does the paperwork increase slightly. After all, a document confirming the deregistration of the car with the State Traffic Inspectorate is sent to the accounting department along with the report.

Partial liquidation of property

It is not possible to write off a fixed asset completely from the balance sheet. The method is often used for real estate for the purpose of modernization, redevelopment or other uses. If we are talking about structures and buildings, then the part unsuitable for use can be demolished while the main part remains in place.

It turns out that in fact the fixed asset remains in the assets of the enterprise, but its value changes. In this regard, there is a need to revaluate the property, as well as recalculate depreciation charges. The amounts of expenses and income from partial liquidation are reflected in account 91.

How to write off fixed assets from the balance sheet correctly? To do this, you need to subtract the original value from the current value, the amount of depreciation and get the balance, which is then reflected in account 91 of the accounting.

Income tax

Expenses for the liquidation of fixed assets taken out of service, including the amount of depreciation underaccrued in accordance with the established useful life, are taken into account as part of non-operating expenses. The basis is subparagraph 8 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation.

When a taxpayer uses the accrual method in tax accounting, expenses accepted for profit tax purposes are recognized as such in the reporting (tax) period to which they relate (Clause 1, Article 272 of the Tax Code of the Russian Federation). Since the cost of the object has been fully repaid, the expenses associated does not arise with the write-off of underaccrued depreciation. But the organization’s expenses incurred during the liquidation of depreciated fixed assets can be taken into account when calculating income tax. Moreover, not only costs incurred by the company itself are recognized, but also those associated with payment for the relevant services of third-party organizations. After all, a company cannot always dismantle and dispose of an object being liquidated on its own.

As already mentioned, the write-off of fixed assets is carried out on the basis of the order of the manager and the write-off act signed by the members of the commission. In this case, the act of decommissioning the object can be fully executed only after the completion of the liquidation work.

When dismantling a fixed asset, materials, assemblies and assemblies often remain that are suitable for further use or for disposal for scrap or scrap metal. The cost of such material assets is taken into account as part of non-operating income (clause 13 of Article 250 of the Tax Code of the Russian Federation). The exception is the cases provided for (clause 18, clause 1, article 251 of the Tax Code of the Russian Federation). The date of recognition of such income is the date of signing the act on liquidation of depreciable property (subclause 8, clause 4, article 271 of the Tax Code of the Russian Federation). At the same time, the act reflects information about material assets obtained during the dismantling and disassembly of the object. Let us recall that the amount of the specified non-operating income is calculated as the current market value of the materials received (clause 5 of Article 274 and clause 1 of Article 40 of the Tax Code of the Russian Federation).

The fact that income arises does not depend on whether the capitalized materials received as a result of the liquidation of the asset will be subsequently used in business activities or not (see letter of the Ministry of Finance of Russia dated May 19, 2008 No. 03-03-06/2/58).

Subsequently, when using the material assets in question in business activities, the company will be able to take into account their value as part of material expenses in an amount equal to the amount of tax calculated on the income specified in paragraph 13 of Article 250 of the Tax Code of the Russian Federation (taken into account when recording these assets). This is stated in paragraph 2 of Article 254 of the Tax Code of the Russian Federation2.

The correct procedure for writing off fixed assets - postings, example and documentation

» » » » 08/22/2021 The property of an enterprise, in particular fixed assets (hereinafter referred to as fixed assets), can be written off from the company’s records for various reasons. It happens that they simply become unusable, or the manager decides to sell them or donate them. In this article, we will look in detail at how the procedure for writing off fixed assets occurs, what documents are needed for this, and what entries the accounting employee will make to write off the residual value of the fixed asset.

The article describes typical situations.

To solve your problem - or call for free: - Moscow - - St. Petersburg - - Other regions - It's fast and free! The procedure for decommissioning an OS contains many nuances.

They need to be studied in advance, before the process starts.

Knowing the correct procedure and what entries need to be made by the accounting department, the company will be able to carry out the procedure correctly, which will help avoid problems with regulatory authorities (in particular with the tax office). The main reasons for deregistration of fixed assets:

- exchange;

- theft of an object identified during inventory.

- damage due to an emergency;

- breakdown - ;

- ;

- sale ();

- wear - ;

Deterioration of an object can be physical or moral.

Write-offs are carried out by the company only in certain situations.

The first implies breakdowns or failure, in the second case they talk about the obsolescence of the model. In both situations, further use of the fixed asset for its intended purpose is considered inappropriate. Important! no write-off is made. A simple one is drawn up here. The company's fixed assets still remain on the balance sheet.

Regardless of the reasons, the procedure for writing off an asset from the balance sheet of an enterprise will be identical in all cases. The procedure itself begins with approval by the manager. For this purpose, a corresponding order is issued for the enterprise.

The commission consists of at least three people.

The members of the commission are middle managers: Ch. engineer, gl. mechanic, gl. accountant, etc. Specialists should be from different fields, this will help to consider the impossibility of further using the OS from different points of view.

The Commission carries out a number of actions:

- identification of those responsible (in case of theft or breakdown);

- decor ;

- drawing up a defective statement;

- thorough inspection of the OS;

- assessment of the possibility of restoring the previous parameters of the object;

- decor ;

- formation of an act on write-off of OS and.

- determining the cause;

Only after the commission has completed its assigned tasks does the manager decide whether to write off the fixed asset or not. If the decision is positive, a special order is issued. It must be signed by all members of the commission, the head of the company and other interested parties.

After publication, the accountant makes the necessary entries, and the property is written off.

If there are parts in the OS that can be used in the future in other property, it is also necessary to capitalize the parts.

An algorithm that will help you write off a fixed asset that has become unusable - documents, postings, example

» » » » 08/22/2021 is not always associated with the end of its useful life. The reason for deregistration of a non-current asset may be a breakdown, malfunction, or defect that does not allow further operation of the equipment with the required output.

Assets that have become unusable can be removed from the balance sheet. In this case, the organization must follow a certain algorithm: draw up the necessary documentation, reflect postings, dismantle, dispose of unnecessary fixed assets, and capitalize the remaining usable parts. The article describes typical situations.

To solve your problem - or call for free: - Moscow - - St. Petersburg - - Other regions - It's fast and free! If an organization decides to write off a fixed asset that has not yet been depreciated (that is, has a non-zero residual value), then the reason for this is the inexpediency of further use of the asset.

If the OS has become unusable, it is better to remove it from the balance sheet and replace it with a more modern, productive, and fast one. As a rule, the reason for premature write-off before the end of its useful life is:

- Moral obsolescence – when a model does not meet modern requirements.

- A breakdown is one that cannot be corrected, or can be corrected at significant costs that are not economically feasible.

- Reduced productivity due to wear and tear.

In all of these cases, equipment or other fixed assets that have become unusable should be written off. Below is a step-by-step instruction that will tell you how to proceed in order to correctly write off an under-depreciated fixed asset that has become unusable.

Step-by-step write-off algorithm: Step 1. Create a commission. This group of persons is formed by order of the manager for the purpose of inspecting fixed assets to identify objects that have fallen into disrepair and are subject to write-off. Step 2. Inventory and inspection of the OS.

During the inspection, the commission assesses the condition of existing assets, determines the degree of wear and tear, damage and makes a decision on the advisability of further use or write-off. In carrying out their duties, the members of the commission are:

- ;

- about the condition of the object and the need for write-off;

- .

- ;

Step 3. Issuing an order. Based on the decision of the commission members to write off an under-depreciated object that has fallen into disrepair, it is published.

The order indicates the reason for removal from the balance sheet, the type of property, the timing of the write-off, and the persons responsible for the process.

Step 4. Drawing up a write-off act.

Can be used (for a single object), (for road transport), (for groups of similar objects). Step 5. Reflection of transactions in accounting. To make double entries for write-off operations on assets that have become unusable, a documentary justification is required.

This is the act of write-off. Step 6. Disposal of fixed assets.

Dismantling, partial or complete destruction may be carried out. Step 7

Accounting

Costs associated with the sale, disposal and other write-off of fixed assets and other assets other than cash (except foreign currency), goods, products are classified as other expenses (clause 11 of PBU 10/99).

The procedure for recognizing income and expenses associated with the write-off of fixed assets in accounting is similar to the procedure used for taxation of profits. In accordance with paragraph 31 of PBU 6/01, income and expenses from this operation are reflected in the reporting period to which they relate.

The cost of materials received during disassembly and dismantling of liquidated fixed assets is reflected in other income (clause 7 of PBU 9/99). The amount of other income for accounting purposes is determined in the same way as for tax purposes - based on the current market value of capital assets (clause 9 of PBU 5/01).

Free transfer

The organization is free to dispose of property at its own discretion. The main thing is that the actions taken comply with established legislative acts. When donating property, how to write off fixed assets from the balance sheet? Postings begin with the same steps: deducting the original cost and accumulated depreciation. The residual value is then written off to Other Expenses. The account also collects other costs for the gratuitous transfer of the object. VAT is also calculated based on the current market value of the property.

What is the difference between accounting for an act of donation and a sale? In the first case, income cannot be generated in any way, only costs. When implemented, the company has a chance to receive income and make a profit, or at least cover expenses. The financial result (loss) from the donation of assets is written off by posting Dt 99 Kt 91.9.

Example 1

Favorit LLC has several depreciated fixed assets on its balance sheet. Moreover, the initial cost of these objects is completely written off both in accounting and tax accounting. To clarify their technical condition and determine their possible use, a special commission was created by order of the director. The commission examined the condition of assets with zero residual value and determined that the moral and physical condition of one of the inspected objects was such that it should be liquidated. The company carried out partial liquidation on its own in June 2009. In addition, for the final dismantling and disposal of this object, Favorit LLC used the services of a third-party company. The work was carried out in two stages, which was confirmed by acts dated 06/30/2009 and 07/31/2009.

When dismantling the fixed asset, parts remained that could be used to repair the production equipment of Favorit LLC. These material assets were capitalized in the warehouse in July 2009 at a market value of 40,000 rubles. and used in August 2009.

The initial cost of the written-off fixed asset is RUB 800,000. The company's costs for dismantling the fixed asset amounted to 35,000 rubles, in addition, the cost of the work of the company hired to dispose of the write-off asset was 180,000 rubles. (excluding VAT), as well as the cost of each stage of work - 90,000 rubles. (excluding VAT).

The act in form No. OS-4 was drawn up and signed after the completion of all work on the liquidation of the facility, that is, in July 2009. According to him, this fixed asset was written off from the register.

In tax accounting, the organization takes into account the expenses for the services of a third-party company involved in the dismantling of a liquidated object on the basis of certificates of work performed in June and July 2009 for 90,000 rubles. respectively. Costs for partial disassembly of the object, carried out on our own, in the amount of 35,000 rubles. Favorit LLC recognized it on the basis of the write-off act, that is, in July 2009.

In July, the organization reflected non-operating income in the amount of 40,000 rubles. in the form of the cost of capitalized parts. When using them in business activities in August 2009, the company included 8,000 rubles in expenses. (RUB 40,000 × 20%).

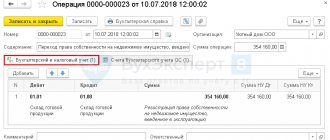

In accounting, the cost of parts received during the liquidation of a fixed asset and subsequently used in production is recognized as expenses in full. According to paragraph 7 of PBU 18/02, it is necessary to reflect a permanent tax liability in the amount of 6,400 rubles in accounting. [(RUB 40,000 – RUB 8,000) × 20%]. The listed operations are reflected in the following entries:

in June 2009:

- debit 01 subaccount “disposal of fixed assets” credit 01 subaccount “fixed assets in operation” 800,000 rub. — the initial cost of the liquidated fixed asset is written off

- debit 02 credit 01 subaccount “disposal of fixed assets” 800,000 rub. — depreciation accrued on the liquidated object is written off

- debit 91-2 credit 69, 70 35,000 rub. — dismantling work done on our own is taken into account

- debit 91-2 credit 60 90,000 rub. — the first stage of dismantling and disposal work performed by the contractor was taken into account

in July 2009:

- debit 91-2 credit 60 90,000 rub. — the second stage of dismantling and disposal work performed by the contractor was taken into account

- debit 10 credit 91-1 40,000 rub. — parts received during dismantling of the fixed asset were capitalized

in August 2009:

- debit 20 credit 10 40,000 rub. — the cost of parts obtained as a result of dismantling the fixed asset is written off to production

- debit 99 credit 68 subaccount “income tax calculations” 6400 rub. — permanent tax liability is taken into account

How to write off fixed assets from the balance sheet under the simplified tax system?

The simplified tax regime largely distinguishes accounting from generally accepted standards. Regulates the procedure for writing off property from the balance sheet of small businesses - the Tax Code of the Russian Federation (Article 346.16). According to the Code, upon disposal of fixed assets, the use of which in the future is not possible, their value is not included in the tax base in full. The amount remaining on the balance sheet upon liquidation of non-current assets is not taken into account for tax purposes.

If the disposal of fixed assets occurs earlier than the due date, it is necessary to recalculate the tax base. In case of write-off due to moral or physical wear and tear, small businesses do not comply with this point.

Sale of fixed assets

The fact that a fixed asset is fully depreciated does not mean that this asset cannot be used in the organization's activities. After all, the suitability of an object for operation is determined by its technical and economic indicators. And if these indicators do not meet the requirements of one enterprise, they may suit another. Therefore, there is a chance to sell outdated equipment. In this case, the fixed asset item is also subject to deregistration (clause 76 of the Methodological Instructions).

Documenting

The sale of a fixed asset (its disposal for other reasons) is documented with the relevant primary accounting documents (clause 7 of the Methodological Instructions).

Thus, to reflect the disposal of an asset, a transfer and acceptance certificate is used in form No. OS-1, and if a building or structure is disposed of - (clause 81 of the Methodological Instructions). The document is drawn up in at least two copies, one for each party. The usual requirements for drawing up the act are: all fields must be filled out and the document must be signed by members of the commission. Section 1 of the act, which is filled out based on the data of the transferring party, indicates information about the disposed object, including the amount of depreciation accrued from the beginning of operation.

The transfer by an organization of an object of fixed assets into the ownership of other persons is formalized by an act of acceptance and transfer of fixed assets in form No. OS-1 [comment: Sale of fixed assets] Operations for the receipt of fixed assets in the organization, their internal movement and disposal relate to operations for the movement of fixed assets [ /a comment]/

Section 2 of the act in form No. OS-1 is filled out only by the purchasing organization in one copy (that is, the seller does not fill it out).

The act must reflect information characterizing the object being sold, and also include a note from the accounting department that the disposal of the asset is recorded on the inventory card. The entry is made on the date of approval of the act by the heads of the companies of the seller and the buyer and is certified by the signature of the chief accountant of the seller’s organization. Based on this act, the seller’s accounting records the write-off of the fixed asset.

An inventory card for the sold fixed asset is attached to the transfer and acceptance certificate. A note about the seizure of the inventory card for a retired object is made in a document opened at the location of the object.

How to determine the service life of a depreciated object

It must be remembered that the use of SPI minus the service life of the fixed asset by the previous owner is the right, but not the obligation of the taxpayer (clause 7 of Article 258 of the Tax Code of the Russian Federation).

For such a fixed asset, the buyer has the right to establish SPI as for a new object, if the company benefits from this more. But in this case, depreciation deductions can lead to the formation of a tax loss and, as a result, questions from inspectors. The new accounting law obliged the company to approve all used forms of primary documents with the manager and attach them to the accounting policy (Part 4, Article 9 of Federal Law No. 402-FZ of December 6, 2011 (hereinafter referred to as Law No. 402-FZ)). In this regard, it is unlikely that the primary document, which the buyer can use as evidence of the period of use of the property by the previous owner, can be approved by two taxpayers at the same time. Most likely, the form will be from the seller, and in such cases the buyer should provide in the accounting policy for the possibility of using someone else’s form (this, by the way, also applies to other operations, for example in the case of analogues of the TORG-12 form, which are compiled by the company’s suppliers using their own forms) . At the same time, using the data of the previous owner on the actual service life through a primary document confirming the transfer of a fixed asset (analogous to form No. OS-1) is the most proven, but not the only method. Thus, data on the actual service life can be taken from the technical accompanying documentation, such data can be indicated in the contract. Finally, data on the service life can be contained in the fixed asset itself in electronic form.