STS is a simplified taxation system. Some companies have the right to apply it if they meet the conditions specified by law.

If the conditions giving the right to use the simplified tax system are violated, then the organization must send a message to the Federal Tax Service (submit to the local office) about the loss of the right to conduct business under the “simplified tax system” and the transition to the general taxation system - OSN, or OSNO.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

[email protected] dated November 2, 2012. It provides an example of a special form, as well as regulations for filling it out.

A notice of loss of the right to use the simplified tax system must contain:

- full name of the organization;

- tax period (code) with which work under the simplified tax system ended;

- the reasons why the company lost the right to “simplified taxation”, indicating links to the relevant articles of the Tax Code of the Russian Federation;

- Full name, signature of the taxpayer or person representing him, and date.

Submission deadlines - the message must be submitted to the Federal Tax Service within 15 days after the expiration of the tax period in which the conditions for applying the simplified taxation system to this organization were violated.

Main limits of the simplified tax system

The conditions under which a taxpayer has the opportunity to work on a simplified basis are set out in Art. Art. 346.12, 346.13 Tax Code of the Russian Federation. They are valid in the current tax period and will be relevant in the future, since the deflator coefficient for limits on the simplified tax system is frozen until 2021 (see Federal Law No. 243 dated 07/03/16).

The conditions are as follows:

- The company has no more than 100 employees.

- Cost of fixed assets (residual) up to 150 million rubles.

- The income limit for the tax (reporting) period is up to 150 million rubles.

- The share of participation in the fixed capital of the company of other legal entities should not exceed 25%.

- The company must not have branches.

- The company should not engage in certain types of activities (banking, insurance, pawnshops, mining of mineral resources, work of notaries, advocacy, etc. (Article 346.12, paragraph 3)).

On a note. To switch to the special regime from next year, you need to have revenue for 9 months of the current year of no more than 112.5 million rubles.

If at least one of the conditions is not met, the business entity loses the right to use the simplification.

The restrictions do not apply to the company's representative offices, only to its branches (the ban has been canceled since 2021). Restrictions on the share of participation do not apply to non-profit organizations, consumer cooperatives, and economic societies; a special procedure has been established for companies consisting of contributions from public organizations of disabled people.

Guidelines for completing Form 26.2-1

Let's look at how to fill out the form line by line. Let us point out the differences that are important to take into account when entering data about organizations and individual entrepreneurs.

Step 1. TIN and checkpoint

Enter the TIN in the line - the number is assigned when registering a company or individual entrepreneur. Entrepreneurs do not enter the checkpoint - the code for the reason for registration, since they simply do not receive it during registration. In this case, dashes are placed in the cells.

If the notification is submitted by an organization, the checkpoint must be included in the application for transition to the simplified tax system 2021 (the sample filling for an LLC shows how the “checkpoint” form window is filled out).

Step 2. Tax authority code

Each Federal Tax Service Inspectorate is assigned a code, which is indicated when submitting applications, reports, declarations and other papers. Firms and individual entrepreneurs submit forms to the inspectorate at the place of registration. If you don’t know the code, look it up on the Federal Tax Service website. An example is the code of the Interdistrict Inspectorate of the Federal Tax Service No. 16 for St. Petersburg.

Step 3. Taxpayer attribute code

At the bottom of the sheet is a list of numbers indicating the taxpayer’s characteristics:

- 1 is placed when submitting a notification by a newly created entity along with documents for registration;

- 2 - if a person is registered again after liquidation or closure;

- 3 - if an existing legal entity or individual entrepreneur switches to the simplified tax system from another regime.

Step 4. Company name or full name. IP

For individual entrepreneurs, the main identifier is the last name, first name and patronymic. Include them in the application for the transition to the simplified tax system from 2021; The sample filling for individual entrepreneurs shows that empty cells of the form are filled with dashes.

If you are the head of a company, then enter the full name of the organization. Fill in the remaining cells with dashes.

Step 5. The number in the line “switches to simplified mode” and the date of transition

Specify one of three values. Each number is deciphered below:

- 1 - for those who switch to the simplified tax system from other taxation regimes from the beginning of the calendar year. Don't forget to enter the year of transition;

- 2 - for those who register for the first time as an individual entrepreneur or legal entity;

- 3 - for those who stopped using UTII and switched to the simplified tax system not from the beginning of the year. Does not apply to all UTII payers. To switch from UTII to simplified taxation in the middle of the year, you need reasons. For example, stop activities that were subject to UTII and start running a different business.

Step 6. Object of taxation and year of notification

Enter the value corresponding to the selected taxation object:

- The simplified tax system “Income” is taxed at a rate of 6% - expenses cannot be deducted from the tax base. Regions have the right to lower interest rates starting from 2021. If you chose this type of object, put 1;

- The simplified tax system “Income minus expenses” has a rate of 15%, which regions have the right to reduce to 5%. Expenses incurred are deducted from income. If the choice is “Income minus expenses”, put 2.

Be sure to indicate the year in which you are submitting the notice.

Step 7. Income for 9 months

Enter the amount of income for 9 months of 2021; for an organization it cannot exceed 112,500,000 rubles for the right to apply the simplified system in the future period. This restriction does not apply to individual entrepreneurs.

Step 8. Residual value of fixed assets

The residual value of the organization's fixed assets as of October 1, 2019 cannot exceed 150,000,000 rubles. There are no restrictions for individual entrepreneurs.

Step 9. Full name company manager or representative

In the final part, indicate your full name. the head of the company or his representative, who has the right to sign papers by proxy. Don't forget to indicate by number who signs the form:

- 1 - the leader himself;

- 2 - trusted representative.

The entrepreneur does not need to write his last name in this line; put dashes.

Voluntary loss of the right to the simplified tax system

Despite the benefits of this tax regime, sometimes it becomes necessary to part with it voluntarily. To make the transition to another regime, you need to notify the Federal Tax Service of your refusal to work on the simplified tax system by filling out the form. 26.2-3 and transferring it to the tax office before 15.01 of the year in which the transition from OSNO is planned. This is stated in Art. 346.13, clause 6 of the Tax Code of the Russian Federation.

You can voluntarily switch not only to OSNO, but also to UTII, if the type of activity of the company provides such an opportunity (Tax Code of the Russian Federation, Article 346.26-2). Notification of the transition to imputation must be submitted within 5 days (working days) from the beginning of the year.

You cannot voluntarily switch from a simplified regime to another BUT regime before the end of the tax period; changing the tax regime is possible only from the beginning of the year.

Step-by-step filling instructions

The recommended form was introduced by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] “On approval of document forms for the application of the simplified taxation system.” Newly created companies and individual entrepreneurs submit a notification using the same form, only they attach documents for registration to it. Newly created enterprises have the right to inform the Federal Tax Service about the application of the simplified tax system within 30 days from the time they register.

Preservation of the right to the simplified tax system and legislative risks

Most companies do not want to part with the simplified tax system, trying to circumvent the established limits in one way or another. The main problem is exceeding the revenue limit for the period, after which the company is automatically deprived of the right to the simplified tax regime.

Typically, a number of “tricks” are used with a high risk of tax sanctions for the company:

- The conclusion of two contracts (purchase and sale and loan), and the first involves shipment, and the second - actual payment. Under the loan agreement, the funds are then returned, and payment for the shipped goods is made in the new period and is not included in the calculation of the income limit. This method contains considerable risk, since the Federal Tax Service in court can prove the fact of manipulation by analyzing bank data.

- Some companies, in order to lower the limit, make various kinds of refunds to customers in the current period in order to receive them again in the next period, by agreement with counterparties.

- By agreement with the counterparty, money is accepted after the expiration of the deadlines for which the limit is considered, for example, payment for goods from the previous year is received in the new year.

However, these methods of concealing actual revenue are subject to careful consideration by fiscal authorities, and often in courts. Judicial practice is not reassuring for companies: a significant part of decisions are made in favor of the Federal Tax Service, with all the ensuing sanctions. An example is the decision in case A26-7732/2014 dated 09/03/15, considered in the SZO arbitration. The court recognizes such manipulations as concealment of proceeds.

A company that does not want to lose the simplified tax system because it has a branch can register a new structural unit as a representative office. Of all the ways to maintain a simplified regime, this is one of the safest, since it is recognized by the courts as legal (see Post of the FAS SZO No. A05-9537/2010 dated 11-04-11, FAS SKO No. A32-4638/2010 dated 11-08-10, etc.).

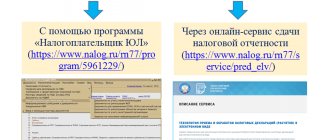

Deadlines for submitting a notice of transition to a simplified taxation system in 2021

Important! If an operating organization or individual entrepreneur wants to switch to a simplified taxation system (STS), then this must be done in advance.

If a company wants to start using a simplified taxation system in 2021, then it must submit a notification to the tax office by December 31, 2020. If we are talking about a newly created company or individual entrepreneur, then they can switch to a simplified taxation system immediately. In this case, the notice can be submitted either immediately with the registration documents or within 30 days after registration. If the deadline for submitting the notification is violated, the next opportunity will arise only after a year.

Consequences of losing the right to the simplified tax system

Having lost for one reason or another the right to apply the simplified tax assessment regime and making the transition to the general system, the taxpayer is obliged to solve a number of problems:

- Restoration of a detailed control unit using primary documentation. When working on the simplified taxation system, as a rule, in-depth analytics are not required.

- Organization of accounting for income tax, value added tax, and property tax. Calculations are made according to the same rules as for new organizations or individual entrepreneurs using OSNO.

On a note. Do not forget to submit a simplified tax return before the 25th day of the month following the moment of loss of the right to the simplified tax system (Article 346.23-2 of the Tax Code of the Russian Federation).

When switching to a common system, you need to take into account the difference in approaches: the cash method and the accrual method.

It is necessary to calculate:

- accounts receivable;

- accounts payable that were not repaid before the transition;

- residual value of property assets.

It is necessary to remember:

- Revenue not paid during the simplification is included in income when applying the general system in the first month (Tax Code of the Russian Federation, Article 346.25, clause 2 (1), letter of the Federal Tax Service No. SD-4-3/6, 09-01-18 ).

- Advances received before the start of the application of the general system are included in the calculation of tax on the simplified tax system, regardless of the moment of shipment of goods, and expenses on shipped goods reduce income tax (Tax Code of the Russian Federation, Article 251-1(1), letter No. 03-11-06 /2/8 Ministry of Finance dated 01/28/09). Expenses also include all unpaid debts for services, wages and contributions (Article 346.25 of the Code, a number of letters from the Ministry of Finance, for example, dated 05/03/17).

- MC paid for and purchased during the simplification, used as a product, can be sold already on the general system. They can be taken into account at the time of calculating income tax (determination of the Supreme Council No. 306-KG15-289 dated 06-03-15 and letters from the Ministry of Finance).

- When calculating VAT, it is necessary to take into account only those transactions for which payment took place after the start of the application of the general system. For example, an advance for products received before the transition is not included in the calculations for this tax.

Main

- Loss of the right to the simplified tax system, voluntary or forced, leads to a significant number of problematic issues that arise both in tax and accounting.

- A voluntary transition to another NU system is possible only at the end of the year, at the beginning of the next period.

- When switching to UTII, accounting will be significantly simplified, and the general system, on the contrary, involves its detailing.

- During the transition period, it is necessary to organize the accounting system for income taxes, property taxes, and VAT, and to expand the analytical component of accounting.

- Attempts to circumvent the conditions for using the simplified tax system by concealing income and other risky actions may lead to litigation and decisions not in favor of the taxpayer.

Mid-year option

If an organization “got out of bounds” and was forced to switch from the simplified tax system to the special tax system in the middle of the year, for example, in the third quarter, then it immediately turns out to be a payer of VAT and income tax. In this regard, collisions often arise.

The most common situation is when an organization entered into an agreement with a clearly stated price, for example, for the supply of goods in the quarter when the simplified tax system was in effect, and the contract was executed - the goods were delivered - was in another quarter, when taxes were actually calculated according to the simplified tax system.

In this case, the procedure for accounting for debit and credit is regulated by Article 346.25, paragraph 2 of the Tax Code, and consists of the following:

- Income from any revenue received for the provision of services, sale of goods, real estate rights, etc. during the period of validity of the “simplified tax”, which were not paid BEFORE the date of transition to the OSN, are recognized as income, and they are subject to income tax on an accrual basis.

- Any expenses of the organization that were planned under concluded agreements and other immutable obligations during the “simplified tax” period, but had not yet been paid at the time of the transition to the OSN, are recognized as expenses, unless Chapter No. 25 of the Tax Code implies otherwise. Expenses can only include those specified in Article 346.16 of the Tax Code.

In any case, when switching from the simplified tax system to the OSNO, income tax is applied using the accrual method, since the law provides only this option.

The following rules apply regarding VAT. If at the time of the transition from the simplified tax system to the OSNO (at the same time an obligation to pay VAT is formed) the organization had any contract for the supply of goods or performance of work that has not yet been executed, the organization has the right to change the price of the contract without changing the total amount , i.e. simply by allocating VAT from there by reducing your own profits. It is not possible to impose additional VAT on the price of an already concluded contract.

Conditions for the transition to a simplified taxation system in 2020

The simplified taxation system is beneficial for business, but in order to start using it, a number of conditions must be met . General conditions under which you can switch to a simplified taxation system (STS).

| Conditions for transition to a simplified taxation system | Note |

| Income has limits |

|

| The residual value of fixed assets (FPE) also has limitations | The residual value of depreciable fixed assets should not exceed 150 million rubles |

| The average number of employees has limitations | It cannot exceed 100 people. The list includes: · employees working under employment contracts; · freelance workers; · part-time workers; · employees working under civil contracts |

| Lack of branches | Organizations cannot apply the simplified taxation system if they have branches. At the same time, the legislation allows organizations to have representative offices |

| Production Sharing Agreement Banned | It is not allowed to be party to production sharing agreements |

| Unified Agricultural Tax (Unified Agricultural Tax) cannot be used together with the simplified taxation system (STS) | Organizations and individual entrepreneurs that apply the Unified Agricultural Tax (UAT) cannot apply the simplified taxation system (STS) |

| The share of other organizations in the authorized capital of the organization must be less than 25% | There are exceptions to this rule. The following can switch to a simplified taxation system: · organizations whose capital consists 100% of contributions from organizations of disabled people, while 50% of the number of employees should be disabled people, and their share in the wage fund (payroll) should not be less than 25%; · all non-profit organizations; · organizations that were created by scientific and educational institutions and that implement the results of intellectual activity in life |

Samples of filling out a notice of transition to a simplified taxation system in 2021

| Who will apply the simplified tax system | What fields to fill out |

| An organization that operates and wants to switch to a simplified taxation system (STS) | For such organizations, you must fill in the following fields: · selected object of taxation; · residual value of fixed assets; · amount of income for 9 months of the year the notification was submitted |

| Individual entrepreneurs who are already operating and want to switch to a simplified taxation system (STS) | In this case, the notification must indicate only the selected taxable object. For an individual entrepreneur, when switching to a simplified taxation system, the amount of his income and the value of his assets do not matter |

| An organization that has just registered | Newly created organizations and individual entrepreneurs need to indicate only the object of taxation that they want to apply, being on a simplified taxation system. As already mentioned, there are only two objects: · income; income minus expenses If the notification is submitted simultaneously with a package of documents for registration of a legal entity or for registration of an individual entrepreneur, then in the section “Taxpayer Identification” the number “1” is entered. If the notification is planned to be submitted later, then the number “2” must be indicated in this section. |

| Individual entrepreneurs who have just registered |