An enterprise can account for goods and materials at accounting prices, using account 15.

Accounting prices are established by the enterprise independently (these may be actual prices of the supplier, prices of assets of the previous period). The chosen method for determining accounting prices must be enshrined in the accounting policy.

Account 15 is called “Procurement and acquisition of material assets”

The debit of this account reflects the actual cost of goods and materials, transportation costs, consulting expenses (from the credit of accounts 60,76,70,69). And on the loan, accounting prices with the correspondence of account 10. And on account 10, materials are accounted for at accounting prices.

On account 15 the following operations can be taken into account:

- -Purchase of goods

- -Purchase of materials

- -Purchase of equipment requiring installation.

- -Purchase of animals for breeding and fattening.

At the end of the month, the difference between the debit and credit turnover on account 15 is written off to account 16.

Inventory structure

In order to guarantee the uninterrupted production process and satisfy managerial needs, companies form certain reserves, to control which the position outlined in today’s topic is used.

The latter refers to assets used as raw materials or materials during the production of goods for sale, as well as to meet the management needs of enterprises.

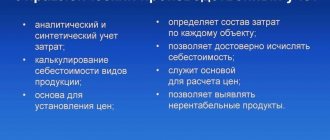

As for the tasks pursued from the point of view of inventory accounting, the following should be highlighted:

- control over the safety of inventory items in warehouses, as well as during their processing;

- ensuring the adequacy and timeliness of document flow for the movement of inventory items, determining and indicating the costs associated with their production, assessing the actual cost of used inventory items and their balances in warehouses, as well as on balance sheet items;

- constant monitoring of compliance with established inventory standards, as well as detection of surplus and unused inventory and their sale;

- ensuring the timeliness and completeness of settlements with contractors for supplied materials, as well as control over inventory items in transit.

Taking into account the role performed by certain PMZ in the production cycle, they should be divided into groups such as:

- base and raw materials;

- auxiliary raw materials;

- purchased semi-finished products;

- generated waste and fuel materials;

- components, containers and materials for its manufacture;

- household supplies and equipment.

As for the applied unit of measurement of PMZ, here, in addition to the nomenclature number, a batch, a homogeneous composition, etc. can be accepted.

Composition of inventories

Business entities periodically need materials that can be involved in the main production or used for auxiliary needs of the enterprise, including management.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

To account for inventories, organizations use accounting account 10. Depending on the characteristics of the inventory, capitalization is carried out to different sub-accounts.

Table. Classification of materials

| Capitalization account | Name | Where is it used? |

| 10 ― 1 | Raw materials | Raw materials are accumulated and then used in the main production |

| 10 ― 2 | Purchased semi-finished products and components | Used when assembling main parts |

| 10 ― 3 | fuels and lubricants | The receipt and consumption of fuels and lubricants (gasoline, diesel fuel), which go to the needs of the enterprise, are taken into account |

| 10 ― 5 | Spare parts | Materials used for further repair of machines and production equipment |

| 10 ― 6 | Other materials | MHZ involved in management and other activities, including the office |

| 10 ― 9 | Inventory | Tools, household supplies and other means of labor are taken into account |

| 10 ― 10 | Workwear and equipment in warehouse | Used uniforms, workwear in stock |

| 10 ― 11 | Working clothes and equipment in use | Uniforms and workwear used when performing production functions |

Features of inventory accounting

As practice shows, a company’s inventory can arrive at its warehouse as a result of their purchase, gratuitous receipt, or as a contribution to its authorized capital. Account 10 is used to keep records of this category of goods.

Thus, the cost of inventory items at the time of their delivery to the warehouse can be taken into account using the following methods:

- at the cost of goods and materials prevailing at the time of delivery. In the circumstances, position 10 applies;

- at the discount price, when the 15th position is additionally used to form the cost of these inventories.

It is recommended that the most preferred method of accounting for minimum wages be reflected in the organization’s accounting policies.

Account 15 in accounting

The main aspect of using account 15 is that this account summarizes information on the procurement and acquisition of inventories, which relate to funds in circulation:

The difference between the actual cost and the accounting price is called a deviation. To reflect deviations in accounting, account 16 “Deviation in the cost of material assets” is used.

Typical transactions for account 15 are presented in the table below:

| Dt | CT | Contents of operation |

| 60 | 51 (50) | The paid cost of the supplier's inventory is taken into account |

| 15 | 60 | The cost (excluding VAT) of inventories according to the supplier’s accompanying documents is taken into account |

| 19 | 60 | VAT paid included |

| 10 | 15 | The purchased goods and materials were credited to the warehouse at the discount price |

| 15 | 16 | The excess of the book price over the actual cost is written off |

| 16 | 15 | The excess of the actual price over the accounting cost is written off |

Application of 15 accounts in transactions

When using item 15 to record transactions, its debit part reflects the purchase price of the company's inventory according to the settlement documents received from the supplier.

Taking into account the source of origin of goods and materials and the nature of the costs of their production and delivery, account 15 is debited in correspondence with 60, 76, 71, 20, 23 and other accounts.

At the time of actual receipt and capitalization of inventories, they are written off as credit 15 of the balance sheet position and debit of 10 or 41 accounts.

In a situation where the book price of inventory exceeds its actual cost, the difference in the indicated entry must be reversed. In this case, the entry will look like this:

Dt 16

Kt 15 reversible.

The debit balance of account 15 at the end of the reporting period indicates the existence of PMZ in transit. As for Form No. 1 of financial statements, the balance of account 15 at the end of the reporting period is transferred to line 1210. If we are talking about the purchase of equipment for installation, which is subsequently reflected in account 07, then the balance of item 15 should be reflected in line 1190 balance sheet.

Conditions for using the account

When registering material assets, an enterprise can use two methods:

- posting to account 10 “Materials”;

- application together with 10 accounts 15 and 16 “Deviations in the cost of material assets.”

Together with the count 15, the count 16 is necessarily used for arithmetic alignment.

The need for accounts 15 and 16 arises if the organization uses accounting prices, that is, those established by the organization itself. Discount prices can be set:

- at actual cost in the previous period;

- at independently developed planned prices;

- at the average price for the MPZ group;

- at negotiated prices (without technical specifications).

When choosing a method for setting prices, it is important to choose the one that will give the smallest deviation from the actual cost.

Practical examples and postings

Let's imagine a situation where a certain company purchased PMZ in the amount of 2,700 pieces for a total amount of 478,000 rubles, including VAT in the amount of 86,040 rubles. The receipt of materials was carried out at the book value of the inventory in the amount of 190 rubles. for 1 unit. To support the production process, the company wrote off 600 units of inventory.

In this situation, the accounting entries for account 15 should look like this:

- Dt 60 - Kt 51 - 478,000 rubles, settlements with the supplier for PMZ;

- Dt 15 - Kt 60 - 391,960 rubles, the actual cost of purchased inventories;

- Dt 19 - Kt 60 - 86,040 rubles, accounting for value added tax;

- Dt 10 - Kt 15 - 513,000 rubles, registration at the warehouse at book value;

- Dt 15 - Kt 16 - 35,000 rubles, write-off of the difference between the accounting and actual price;

- Dt 20 - Kt 10 - 114,000 rubles, write-off of inventory items into production;

- Dt 20 - Kt 16 - 7,777.78 rubles, write-off of the amount at the end of the reporting period.

Purchase of materials and equipment at a price higher than the discounted price

ClinkerTrade LLC purchased raw materials for production from the supplier in the amount of 135,000 rubles excluding VAT, VAT is equal to 24,300 rubles. The book value of this raw material is 130,000 rubles.

Delivery services amounted to 14,000, plus VAT 2,520 rubles.

| Dt | CT | Operation description | Sum | Document |

| 15 | 60 | Reflection of receipt of raw materials | 135000 | Invoice |

| 19 | 60 | Reflection of incoming VAT | 24300 | Supplier invoice |

| 15 | 60 | Reflection of transportation and procurement costs | 14000 | Invoice |

| 19 | 60 | VAT on TZR | 2520 | Supplier invoice |

| 16 | 15 | Reflection of the amount of the difference between the book price and the actual price. cost (135000+14000-130000) | 19000 | Accounting information |

| 60 | Transfer of payment to the supplier for raw materials (135000+24300) | 159300 | Payment order | |

| 60 | Transfer of payment to the transport company for delivery (14000+2520) | 16520 | Payment order | |

| 68 | 19 | Submitted for deduction of VAT from the supplier of raw materials | 24300 | Book of purchases |

| 68 | 19 | Submitted for VAT deduction to the transport company | 2520 | Book of purchases |

If the purchase price exceeds the accounting price, the deviation is reflected in Dt 16 and Kt 15 of the account. At the end of the month, this amount is written off to production costs in proportion to the amount of materials written off.

The balance of Dt in the cost variance account (16) must be written off to the cost account at the end of the month in proportion to the amount written off from account 10.

To calculate the write-off amount, the formula is used:

(Balance Kt at the beginning of the month + Turnover Dt for the month) *(Turnover Kt account 10) / (Balance Dt account 10 at the beginning of the month + Turnover Dt for the month)

Typical postings for account 16

By debit of the account

| Contents of a business transaction | Debit | Credit |

| The amount of deviations of the actual cost of received inventories from accounting prices is taken into account (savings) | 16 | 15 |

| The amount of deviations in the cost of inventories received from the head office is taken into account (in the branch’s accounting) | 16 | 79-1 |

| The amount of deviations in the cost of inventories received from the branch allocated to a separate balance sheet (in the accounting of the head office) is taken into account. | 16 | 79-1 |

| The amount of deviations in the cost of inventories received as a contribution under a joint activity agreement is taken into account (on a separate balance sheet of the joint activity) | 16 | 80 |

By account credit

| Contents of a business transaction | Debit | Credit |

| Deviations in the value of inventories used in long-term investments are taken into account as part of non-current assets, | 08 | 16 |

| The amount of deviations of the actual cost of capitalized inventories from accounting prices is taken into account | 15 | 16 |

| The amount of deviations in the cost of inventories transferred to the main production was written off | 20 | 16 |

| The amount of deviations in the cost of inventories transferred to auxiliary production was written off | 23 | 16 |

| The amount of deviations in the cost of inventories transferred for general production needs was written off | 25 | 16 |

| The amount of deviations in the cost of inventories transferred for general business needs is written off | 26 | 16 |

| The amount of deviations in the cost of inventories transferred to the needs of servicing production was written off | 29 | 16 |

| The amount of deviations in the cost of inventories spent for trading activities was written off | 44 | 16 |

| The amount of deviations in the cost of inventories transferred to a branch allocated to a separate balance sheet was written off (posting in the accounting of the head office) | 79-1 | 16 |

| The amount of deviations in the cost of inventories transferred to the head office of the organization is written off (posting in the branch accounting) | 79-1 | 16 |

| The amount of deviations in the value of inventories transferred to the participant of a simple partnership upon termination of the agreement on joint activity was written off (on a separate balance sheet of the joint activity) | 80 | 16 |

| The amount of deviations in the value of inventories disposed of as a result of sale or write-off is taken into account as part of other expenses | 91-2 | 16 |

| The amount of deviations in the cost of inventories written off as a result of emergency circumstances is taken into account as part of the organization’s other expenses | 91-2 | 16 |

| The amount of deviations related to missing or damaged inventories was written off | 94 | 16 |

| The amount of deviations in the cost of inventories spent in performing work has been written off, the costs of which are taken into account as deferred expenses | 97 | 16 |

Why do you need 10 count?

On account 10, they keep records of the availability and movement of materials, including raw materials, fuels and lubricants, spare parts, and so on.

This is an active account. The debit shows the increase in the cost of materials in the warehouse, for example, as a result of a purchase from a counterparty. The loan is used to write off raw materials, for example, when transferred to production or as a result of damage.

The account balance can only be in debit. This amount is transferred to the balance sheet in the “Inventories” line and reflects the cost of all materials that the company has.

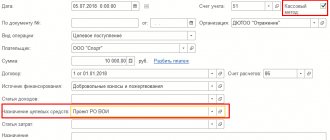

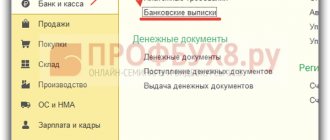

How to prepare the database for month closing

Before closing the month you must:

- calculate wages;

- check whether all documents have been entered, especially pay attention to those that are documented in the document Operation entered manually , for example: interest calculation;

- penalties under contracts.

For quarterly closing of the period (March, June, September, December) in addition to the main preparation:

- check your tax settings (section Main - Settings - Taxes and reports);

- create routine VAT transactions; for this you can use the VAT Accounting Assistant (section Operations - Period Closing - VAT Accounting Assistant).

Features of accounting for materials using accounts 15 and 16

According to the Instructions for using the Chart of Accounts, the actual cost of materials can be formed in two ways. Option 1 – using only 10 counts, Option 2 – using counts 15 and 16.

Option 1. The cost of materials, as well as the costs of their acquisition, are reflected in the debit of account 10.

Example. Polyus LLC purchases materials for use in production activities. Their cost, determined by the terms of the contract, is 354,000 rubles. (including VAT - 54,000 rubles). The transfer of ownership of the purchased materials occurred on March 15 (i.e., signing of documents - purchase), payment was made on March 16. Payment documents from the supplier were received on March 30. The materials were delivered to the enterprise and entered into the warehouse on April 2. In addition, Polyus LLC incurred the following expenses related to the purchase of materials.

Produced in March:

- travel expenses of a representative of the organization who traveled to the manufacturing plant and accepted materials - 7,400 rubles.

— costs of insuring materials in transit — 7,080 rubles.

In April:

— the transport organization provided services for the delivery of materials, the cost of which amounted to 11,800 rubles. (including VAT - 1,800 rubles).

The following entries will be made in the accounting records of Polyus LLC:

March

D 10 K 60 – 300,000 rub. materials received

D 19 K 60 – 54,000 rub. VAT reflected

D 60 K 19 – 54,000 rub. VAT on purchased materials is deductible

D 10 K 71 – 7400 rub. travel expenses are included in the actual cost of materials.

D 19 K 71 – 360 rub. VAT charged on travel expenses

D 60 K 51 – 354,000 rub. materials paid for

D 10 K 76 – 7080 rub. insurance costs reflected

D 10 K 66 – 1397 rub. interest accrued on the loan

D 91 K 66 – 2792 interest was accrued on the loan after the materials were accepted for accounting (354,000 * 18% / 365 * 16 days).

D 66 K 51 – 4190 (1397+2793) interest paid on the loan

D 66 K 51 354000 reflects the loan repayment.

April

Thus, the actual cost of purchased materials is:

(300,000 + 7,400 + 7,080 + 1,397 + 10,000) = 325,877 rubles.

When organizing materials accounting using account 10, accountants face the following problems. Firstly, the data for the formation of the actual cost of materials may not arrive at the accounting department simultaneously, but with a gap in time. For example, transportation company invoices may lag behind the date of receipt of materials, and then transportation costs are not included in the actual cost at the time of receipt of materials. This also applies to the accounts of intermediary organizations through which materials were purchased.

Secondly, the enterprise’s expenses for maintaining employees working in the warehouse must be included in the actual cost of procured materials in accordance with the principles reflected in the enterprise’s accounting policies. Moreover, such expenses are usually distributed at the end of the reporting month.

Thirdly, the material can be written off for production even before its actual cost is finalized.

Thus, the method of forming the actual cost of procuring materials using account 10 “Materials” is advisable to use for enterprises that have a small number of supplies of materials with a small range of materials; All data for the formation of the actual cost of materials, as a rule, is received by the accounting department in a timely manner.

Option 2 - creating the cost of materials using accounts 15 and 16

This accounting method is convenient when an enterprise uses a variety of materials in its activities, the prices of which change, with constant changes in the cost of transport services and other expenses included in the cost. In this case, materials can be accounted for at accounting (planned) prices, which are calculated and remain fixed for some time. With this accounting method, accounts 15 and 16 are used.

According to the Instructions for using the Chart of Accounts, if an organization uses accounts 15 and 16, on the basis of supplier settlement documents received by the organization, an entry is made to debit account 15 and credit accounts 60, 20, 23, 71, 76, etc. depending on where certain values came from, and on the nature of the costs of procuring and delivering materials to the organization. In this case, the entry to the debit of account 15 and the credit of account 60 is made regardless of when the materials arrived at the organization - before or after receiving the supplier’s payment documents.

The posting of materials actually received by the organization is reflected by an entry in the debit of account 10 and the credit of account 15.

The amount of the difference in the cost of acquired inventories, calculated in the actual cost of acquisition (procurement), and accounting prices is written off from account 15 to account 16.

Account balance 15 at the end of the month shows the availability of inventories on the way.

Thus, all costs that form the actual cost of materials are reflected in the debit of account 15. When materials are received by the enterprise, they are charged to account 10 at accounting prices. The difference between the actual cost of materials and their cost in accounting prices is reflected in the correspondence of accounts 15 and 16.

Enterprises are given the right to independently establish the principles for forming the accounting price. Any chosen method for forming the accounting price of materials must be enshrined in the accounting policy of the enterprise. The accounting price (at the choice of the enterprise) can be taken, for example, any of the following:

— supplier price;

— actual cost of materials according to the previous month;

— fixed price approved for a certain period of time;

— planned accounting price;

— average price of the group.

The specified operations are documented by postings:

Debit 15 Credit 60, 71, 76 - reflects the purchase price of materials and other expenses associated with their acquisition.

Debit 10 Credit 15 - materials are capitalized at accounting prices.

Debit 15 Credit 16 - the excess of the book price over the actual cost is written off.

Debit 16 Credit 15 - the excess of the actual cost over the book price is written off.

Materials in production cost accounts are written off at accounting prices, so at the end of the month you need to adjust and bring the cost of written-off materials to the actual cost.

If accounting prices are less than the actual cost, positive differences between the actual cost of materials and accounting prices (debit balance) accumulate on account 16. These differences are written off to the debit of cost accounting accounts: Debit 20, 23, 25, 26 Credit 16.

If accounting prices exceed the actual cost, then negative differences between the actual cost of materials and accounting prices (credit balance) accumulate on account 16. These amounts are reversed: Debit 20, 23, 25, 26: Credit 16 Reversal.

Deviations accumulated on account 16 are written off in groups in proportion to the cost of materials released into production at accounting prices. To do this, you need to determine the percentage of the cost of materials written off for production in the total cost of materials (the sum of the balance at the beginning of the month and the cost of received materials). The amount of deviations to be written off is determined by multiplying the resulting value by the total amount of deviations (balance at the beginning plus receipt).

Example. Let's use the conditions of example 2, in which we determined that the actual cost of purchased materials was 325,877 rubles. During the month, materials worth RUB 410,000 were written off for production. in planned accounting prices.

At the beginning of the month, the balance of materials on account 10 at planned accounting prices is 270,000 rubles; debit balance on account 16 - 10,800 rubles.

Option 1.

The accounting price of purchased materials is RUB 300,000. (below the actual cost).

Share of the cost of materials released into production in the total cost of materials: 410,000 rubles. / (270,000 + 300,000) rub. x 100 = 72%.

Amount of deviations in the cost of materials to be written off: (10,800 + 25,877) rub. x 72% = 26,407 rub.

┌───────────────────────────────────────────────────┬───────────────┬──────────────┬───────────────┐

│ Contents of the transaction │ Debit │ Credit │ Amount, rub. │

├───────────────────────────────────────────────────┼───────────────┼──────────────┼───────────────┤

│The actual cost of the purchase was generated -│ 15 │ 60, 66, │ 325,877 │

│ materials │ │ 71, 76 │ │

├───────────────────────────────────────────────────┼───────────────┼──────────────┼───────────────┤

│Materials were capitalized at accounting prices │ 10 │ 15 │ 300,000 │

├───────────────────────────────────────────────────┼───────────────┼──────────────┼───────────────┤

│Excess of actual cost written off│ 16 │ 15 │ 25,877 │

│materials above the discount price │ │ │ │

├───────────────────────────────────────────────────┼───────────────┼──────────────┼───────────────┤

│Materials written off for production │ 20 │ 10 │ 410,000 │

├───────────────────────────────────────────────────┼───────────────┼──────────────┼───────────────┤

│The deviation in the cost of materials was written off │ 20 │ 16 │ 26,407 │

└───────────────────────────────────────────────────┴───────────────┴──────────────┴───────────────┘

Balance of account 10 “Materials” at the end of the month in accounting prices: (270,000 + 300,000 - 410,000) rub. = 160,000 rub.

Balance on account 16 at the end of the month (by debit): (10,800 + 25,877 - 26,407) rub. = 10,270 rub.

Option 2.

The accounting price of purchased materials is RUB 350,000. (higher than actual cost).

Share of the cost of materials released into production in the total cost of materials: 410,000 rubles. / (270,000 + 350,000) rub. x 100 = 66%.

Amount of deviations in the cost of materials to be written off: (10,800 - 24,123) rub. x 66% = - 8,793 rub.

┌─────────────────────────────────────────────────────┬──────────────┬─────────────┬───────────────┐

│ Contents of the transaction │ Debit │ Credit │ Amount, rub. │

├─────────────────────────────────────────────────────┼──────────────┼─────────────┼───────────────┤

│The actual cost of purchased items was generated│ 15 │ 60, 66, │ 325 877 │

│materials │ │ 71, 76 │ │

├─────────────────────────────────────────────────────┼──────────────┼─────────────┼───────────────┤

│Materials were capitalized at accounting prices │ 10 │ 15 │ 350,000 │

├─────────────────────────────────────────────────────┼──────────────┼─────────────┼───────────────┤

│Excess of actual cost written off│ 15 │ 16 │ 24 123 │

│materials above the discount price │ │ │ │

├─────────────────────────────────────────────────────┼──────────────┼─────────────┼───────────────┤

│Materials written off for production │ 20 │ 10 │ 410,000 │

├─────────────────────────────────────────────────────┼──────────────┼─────────────┼───────────────┤

│Reversal │ 20 │ 16 │ (8,793) │

│The deviation in the cost of materials has been written off │ │ │ │

└─────────────────────────────────────────────────────┴──────────────┴─────────────┴───────────────┘

Account balance 10 at the end of the month in accounting prices: (270,000 + 350,000 - 410,000) rub. = 210,000 rub.

Balance on account 16 at the end of the month (on loan): ((24,123 - 8,793) rubles - 10,800 rubles) = 4,530 rubles.

In conclusion, I would like to note: if materials are accounted for at planned accounting prices using accounts 15 and 16, then when reflecting the balances of materials in the balance sheet, the debit balance of account 16 is added to the value of the balances of inventories reflected in the corresponding items of the group of items “Inventories” . If the balance on account 16 is credit, then the corresponding amount is deducted from the value of the balances of the inventory. Thus, the balance sheet reflects the actual cost of inventory balances, regardless of whether they are accounted for at actual cost or at planned accounting prices.