The simplified tax system is a preferential regime with a reduced tax rate, which is chosen by many individual entrepreneurs. The tax office must be notified in a timely manner about the transition to a simplified regime. In this article you will learn how to fill out an application for the simplified tax system when registering an individual entrepreneur 2021. The form can be downloaded below in the text.

Why declare a transition to the simplified tax system?

The simplified tax system, as well as imputation and patent, are voluntary tax regimes and can be used by individual entrepreneurs and organizations at their own discretion, subject to the appropriate conditions.

When registering an entrepreneur or legal entity, it is automatically transferred to the OSNO if the notification for the transition to the simplified tax system is not provided to them within 30 days after registration.

OSNO is one of the most complex and economically unprofitable tax regimes for small businesses. In most cases, it is used when, due to the number of employees and cash turnover, a company or individual entrepreneur cannot apply the simplified tax system or UTII, or, in the case where the taxpayer cooperates mainly with counterparties interested in offsetting the “input” VAT.

If, when registering, an individual entrepreneur or organization forgot to submit a notification for the use of UTII or the simplified tax system, they will be able to switch to the special regime only next year.

The application of the simplified tax system is carried out only after notifying the tax authority about this and registering the specified person as a simplified tax payer. Without notification, you cannot switch to a simplified tax system, both during initial registration and when changing the taxation regime.

Notification form according to form 26.2-1

At the moment, there is no unified notification form that is mandatory for use when switching to the simplified tax system. An organization or individual entrepreneur can use both Form 26.2-1 recommended by the Federal Tax Service of the Russian Federation and one developed personally. However, in order to avoid possible refusals at the level of local inspectorates, we recommend drawing up and submitting a notice of transition to the simplified tax system in form 26.2-1, recommended by the Federal Tax Service.

notifications about the transition to a simplified taxation system.

There is no special procedure for filling out this document; a list of the main codes that will be needed to enter information is given at the bottom of the notification.

Advantages of the simplified tax system

The most important benefit of the simplified taxation system is the low tax rate. It depends on the chosen object of taxation:

- 6% for simplified taxation system Income;

- from 5% to 15% for simplified taxation system Income minus expenses.

This is significantly lower than the rates in force in the general taxation system:

- up to 20% on income tax for organizations or 13% personal income tax for individual entrepreneurs;

- up to 18% (and from 2021 to 20%) for value added tax.

In addition, if the tax object “Income” is selected, then the calculated tax is reduced by the amount of insurance premiums paid. Moreover, individual entrepreneurs without employees can take into account the entire amount of contributions for themselves, and employers can reduce the tax payment by no more than 50%.

You can find specific examples of how advance tax payments and the single tax on the simplified tax system are reduced here.

Another special feature of the simplified taxation system is that only one annual declaration is submitted. And if the object of taxation is “Income”, then you can handle the accounting yourself, without an accountant.

Naturally, the state does not provide such preferential conditions to all taxpayers, but only to those who can be classified as small businesses. The conditions established for the transition to the simplified tax system in 2021 are indicated in the article of the Tax Code of the Russian Federation.

Submission deadlines

The deadline for submitting a notification directly depends on the reasons for which an organization or individual entrepreneur is switching to the simplified tax system:

- When registering an LLC or individual entrepreneur for the first time, the notification must be submitted either simultaneously with the general package of documents for registration, or within 30 days after it.

As mentioned above, if a businessman forgets to submit an application to switch to a simplified tax regime within thirty days, he will automatically be transferred to the general taxation regime, which he will be able to change only next year.

- An existing organization or individual entrepreneur, when switching from another taxation system or when opening a new type of activity for which it is planned to apply the simplified tax system , must submit an application no later than December 31 of the year preceding the one from which the simplified tax system will be applied.

Who can work on the simplified system

Conditions and new criteria for choosing a simplified taxation system are established annually. True, in the last couple of years a certain stability has been established in this sense, i.e. The requirements for simplified taxation system payers do not change fundamentally.

The criteria for applying simplified taxation are specified in Chapter 26.2 of the Tax Code:

- the average number of employees is no more than 100 people;

- the taxpayer does not have the right to engage in certain types of activities (for example, banking and insurance, pawnshops, mining, except for common ones, etc.);

- annual income should not exceed 150 million rubles (a few years ago the limit was only 60 million rubles);

- the organization has no branches;

- income received by an existing business for 9 months of the current year when switching from OSNO to simplified tax system from 2021 cannot exceed 112.5 million rubles;

- the residual value of fixed assets does not exceed 150 million rubles (until 2021, the limit was set at 100 million rubles).

Regarding the latter condition, the Federal Tax Service recently expressed an ambiguous opinion. The fact is that in subclause 16 of clause 3 of Article 346.12 of the Tax Code of the Russian Federation, the limit on the residual value of fixed assets is indicated only for organizations. Accordingly, individual entrepreneurs did not comply with this limit and made the transition from the OSNO to the simplified tax system, even having fixed assets for a large amount.

However, in a letter dated October 19, 2021 No. SD-3-3 / [email protected] , the Federal Tax Service noted that in order to be able to switch from OSNO to the simplified tax system, the limit on fixed assets must be observed not only by organizations, but also by individual entrepreneurs. Moreover, this conclusion of the tax authorities is supported by judicial acts, including decisions of the Supreme Court.

In addition, the Ministry of Finance has established new income and employee limits for simplified tax payers from 2021. However, those who will earn more than 150 million rubles and employ more than 100 people will be required to pay tax at a higher rate: 8% for the simplified tax system for Income and 20% for the simplified tax system for Income minus expenses.

But, of course, the majority of newly registered LLCs easily fit into the simplified limits on income and number of employees. This means they have the right to switch to a preferential regime and pay taxes at a minimum.

Why is it recommended to submit a notification simultaneously with the registration of an individual entrepreneur/LLC?

The recommendation to submit a notice of transition to the simplified system along with the main package of documents is associated with eliminating the risk of transfer to OSNO if an entrepreneur or LLC forgot to submit the specified document, which happens quite often. Postponing the submission of an application “for later” threatens an individual entrepreneur or company with the need to pay three main OSNO taxes, as well as submitting a full package of documents, including tax and accounting reporting.

To prevent a possible outcome, it is recommended to submit Notice 26.2-1 along with all documents submitted for registration.

Sample filling

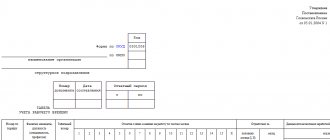

Let's briefly look at examples of filling out notifications in different situations.

Sample of filling out form 26.2-1 when submitting simultaneously with the general package of documents for registration.

For individual entrepreneurs upon initial registration

Filling procedure:

- In block 1, you must indicate the TIN of the individual.

If it is not there, then the line needs to be crossed out.

- In block 2 you need to reflect the code of the tax authority to which the application will be submitted and the taxpayer’s characteristics.

The code of the tax authority to which the application is submitted can be found using a special service on the website of the Federal Tax Service of the Russian Federation.

When submitting an application along with documents for registration, the taxpayer’s identification is indicated as “1”.

- In block 3, the full name of the individual entrepreneur submitting the specified document is indicated.

- In block 4 , code 2 is indicated, in the remaining cells dashes are placed.

- Block 5 reflects the code corresponding to the type of the selected object according to the simplified tax system: “ 1 ” - for the object “Revenue” 6% and “ 2 ” - for the object “Revenue minus expenses” 15%.

- Block 6 indicates the year the document was submitted.

- In block 7, the code “ 1 ” is entered if the notification is submitted by the future individual entrepreneur himself and “ 2 ” if his representative.

If the code “ 1 ” is entered, then the bottom 3 lines are crossed out and only the contact phone number, the date of filling out the application and the signature of the individual entrepreneur are indicated.

If the code “ 2 ” is entered, then in the bottom three lines you must indicate the full name of the individual entrepreneur’s representative, then the contact phone number and, at the very bottom, information about the document confirming the authority of the representative.

All other lines, as well as lines that are not completely filled in, are crossed out.

For LLC upon initial registration

Which type of simplified tax system to choose?

The simplified tax system has two objects of taxation and when switching to a simplified system, an individual entrepreneur must choose one of them:

- Income – 6% (tax is calculated only on income received, excluding expenses).

- Income minus expenses – 15% (tax is calculated on the difference between income and expenses).

The simplified tax system “income” is suitable for those individual entrepreneurs whose expenses are insignificant, on average no more than 60% of the income received, as well as for those who cannot document them. The “income” object is most optimal for intermediaries, freelancers, individual entrepreneurs providing services or selling goods of their own production.

The simplified tax system “income minus expenses” is suitable for entrepreneurs whose activities involve large expenses (trade, production), which can be documented.

How to confirm the use of the simplified tax system

You can confirm the application of the simplified taxation system directly from the tax authority at the place of registration by requesting the relevant document from the regulatory authority.

Since 2014, the document confirming that an individual entrepreneur or organization is on the simplified tax system is an information letter , the form of which is approved by Order of the Federal Tax Service of Russia dated November 2, 2012 N ММВ-7-3/ [email protected]

Until 2014, work on a simplified basis was confirmed by another document - a notification about the possibility of using the simplified tax system.

To receive an information letter, a simplifier must submit a written request to the inspectorate at the place of registration. The deadline for providing confirmation is 30 days from the date the tax authority receives the request.

4.9 / 5 ( 7 votes)

Common mistakes when writing an application to the tax authority

Error. When writing an application to the tax authority, the organization did not indicate its INN and OGRN.

How right. When writing any free-form applications to the tax authority, it is recommended to indicate the following information. (click to expand)

| Necessary information | Notes |

| Name of the organization | An abbreviated name is enough |

| TIN, KPP, OGRN | It is enough to indicate the TIN and OGRN of the organization. They are needed so that the tax authority can identify the taxpayer, since there may be several organizations with the same name |

| Full name of the tax authority | You can find out the full name from the tax office itself or on its official website |

| FULL NAME. head of the tax authority | The application is addressed to the manager, so this information must be indicated |

| Information about the employee who signed the application - his position, full name, contact telephone number | This information is needed to understand whether this person has the right to sign this application or not. The telephone is needed for prompt communication with the taxpayer |

| Signature, seal of the organization | Essential elements for any application. Without them, the application will not be considered an official document |

| Date of the letter | It is necessary to indicate, because the deadline for the tax office to respond to the application will be based on this date |

| Address at the location of the organization, or postal address | It is necessary to indicate so that the tax office knows to which address the response can be sent. |

| Outgoing letter number | It is not necessary to indicate, but some tax authorities require it, so it is better to indicate it. |