Home — Articles

If you have a “simplified” approach with the “income” object. The article was written for “simplified people” on the subject of “income minus expenses”. And the information provided in it will be needed if you want to change the object of taxation.

Even those who do nothing buy raw materials and materials. Every company and entrepreneur needs paper, stationery, and cartridges to submit reports. What can we say about those who conduct production activities? For them, the expense item “cost of inventories” is one of the most significant. And although the rules for writing off materials as expenses under the simplified tax system have not changed for several years, they remain not entirely clear to many “simplified people.” This is confirmed by both the questions received by our editorial office and the explanations from the Ministry of Finance, which are issued with enviable consistency. We offer a commentary on this topic to the next Letter of the Ministry of Finance of Russia dated July 31, 2013 N 03-11-11/30607.

Program settings

1.1 Changing the object of taxation according to the simplified tax system to “income minus expenses”

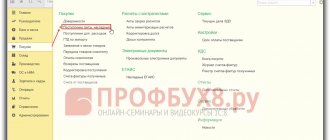

Form “Taxes and reports” (Fig. 1):

- Section: Main

–

Taxes and reports

. - In the list of taxes on the left, place the cursor on Taxation system

, then on the right side of the window follow the link

History of changes

. - Click the Create

, add a new entry, in the

Applies to

, indicate the beginning of the new tax period (“January 2021”) and set the

Taxation system

to the “Simplified (income minus expenses)” position, uncheck the “UTII” checkbox (for the current release, when a new release is released in 2021, this checkbox will be unchecked automatically and will not be available for editing). - Button Record and close

.

Rice. 1

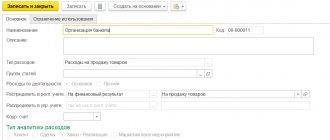

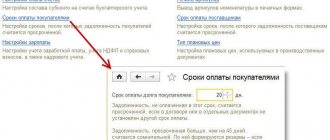

After changing the taxable object, a new entry is automatically created in the Main - Accounting Policies

, in which the switch

Method of estimating the inventory

is set to the “By FIFO” position and is not available for change (Fig. 2).

Rice. 2

What causes problems

Sometimes accountants are afraid to write off the cost of raw materials as expenses in tax accounting immediately after payment. And they wait until the valuables are released into production. The sluggishness can be explained simply: taxpayers are afraid that tax authorities will not accept premature expenses. Accountants think like this. Material expenses are taken into account in the manner prescribed by Art. 254 of the Tax Code of the Russian Federation (clause 5, clause 1, article 346.16 of the Tax Code of the Russian Federation). And in paragraph 5 of Art. 254 of the Tax Code of the Russian Federation states that the amount of material expenses of the current month is reduced by the value of the balance of valuables transferred but not used in production at the end of the month.

Note! “Simplers” can write off raw materials and materials as expenses after they are paid to the supplier and capitalized. There is no need to wait for valuables to be written off for production.

Therefore, taxpayers, in order to be on the safe side, are waiting for materials to be written off for production. And only then the costs are taken into account. It is clear that this is unprofitable, since months can pass from payment for raw materials to their write-off for production, and even years for individual raw materials.

Entering balances for materials not paid for during the period of application of the unified income tax and the simplified tax system “income”

Note! Before entering balances, close the 2020 year and perform a balance sheet reformation (processing “Month Closing”). After entering balances, do not close the month for December again.

2.1 Remains of materials not paid to suppliers have been identified

When changing the object of taxation from the simplified tax system “income” to the simplified tax system “income minus expenses”, in order to enter balances for materials and subsequent correct reflection of income and expenses, it is necessary to determine the status of all balances as of December 31 of the year preceding the change in the object of taxation, and indicate it when entering balances in the column State of consumption

:

- Not written off

- the receipt of the asset is reflected in the accounts, the costs of its acquisition are paid to the supplier; - Not written off, not paid

- the receipt of the asset is reflected in the accounting, the costs of its acquisition to the supplier have not been paid; - Not written off, accepted

- the receipt of the asset is reflected in accounting, the costs of its acquisition are recognized as tax accounting expenses according to the simplified tax system.

To determine the status of goods, we will use the reports:

- Account balance sheet

for account 10 (for subaccounts). - Debt to suppliers

;

Report “Account balance sheet” (Fig. 1):

- Section: Reports

–

Account balance sheet

. - Set the period to December 31, 2021, select the account on which goods are recorded (in example 10.06) and generate a report using the Generate

. In the example, as of December 31, 2020, account 10.06 includes: “A4 paper” - 45 pcs. in the amount of RUB 15,600.00;

Rice. 1

Report “Debt to suppliers” (Fig. 2):

- Section: Manager - Debt to suppliers

. - the Period

field to December 31, 2021. - Click the Show settings

on the

Grouping

and select

the Supplier

,

Contract

,

Document

. - Generate

button . - By double-clicking on the cell with the document or with the amount, decipher the unpaid balance to compare it with the balance of materials in the report Account balance sheet

.

Rice. 2

Having analyzed and compared the data from the two reports, we obtain the following summary information as of December 31, 2020:

- materials in balance not paid to suppliers: “Paper 4A” 45 pcs. for a total amount of RUB 11,700.00. (invoice No. 12 dated December 12, 2020, supplier Delta LLC, accounts receivable RUB 15,600.00);

2.2 A batch was formed to account for remaining materials using the “FIFO” method

The document is generated if, in 2021, the tax system “Simplified (income)” and the method of assessing the labor income “According to average” are installed in the program settings. If the method of assessing inventories is “FIFO”, then skip this operation and proceed to operation 2.3.

Document “Operation” (Fig. 3):

- Section: Operations - Operations entered manually

. - Create

button .

Document type - Operation

. - In the from

, indicate the date of the document - December 31, 2021. - Fill out the tabular part using the Add

: In the

Debit

, indicate the goods account (in example 10.06), item and quantity.

When filling out the third subconto, create a new Batch

with the date December 31, 2021 (in the new document, indicate only the date corresponding to the date of the “Operation” document; do not fill in the remaining fields). Select the same document in the following lines of the tabular section when entering balances for other materials. Thus, the remaining goods will be transferred to batch accounting. - In the Credit

, indicate the same data for goods, but without the batch (goods account (in example 10.06), item and quantity). - In the Amount

, indicate the amount of balances for materials. - In the same way, fill in the information for the remaining materials.

.

Rice. 3

2.3 Remaining materials have been entered for accounting for the simplified tax system

Document “Entering balances (Materials)” (Fig. 4-5):

- Section: Main

–

Balance Entry Assistant

. - If the organization previously entered initial balances on the date of start of work with the program (link Date of entry of balances

indicating the date in blue), then for documents

Entering balances

generated on the date of transition to the simplified tax system with the object “income minus expenses”, the date is set directly in each document after unchecking the

Enter accounting balances

.

If the link Set the date for entering balances

is red (i.e., at the beginning of accounting in the information base, documents for entering balances were not created), then follow it and set the date before the start of accounting in the program, and then in the document

Entering balances

after withdrawal

Enter accounting balances

checkbox , set the date to 12/31/2020. - To create a document Entering balances

, double-click the account in the list (account 10 in the example).

In the Enter balances

click the

Create

, then

the Balance entry mode

.

Uncheck the Entering balances for accounting

and

Entering balances for special registers

and click

OK

.

In the from

, indicate/check the date for entering balances – December 31, 2020.

Rice. 4

- Click the Add

to fill out the tabular part of the document.

In the Batch

the Batch

document previously created when filling out

the Operation

document (Fig. 5), (if in 2021 the “FIFO” method of assessing the inventory was used and batch accounting was carried out accordingly, then in this column select the document that reflected receipt of materials). - In the Expense Status

, select the status

Not written off, not paid

, since inventory items were not paid to the supplier in the previous tax period.

In the example: the material “A4 Paper” has not been paid to the supplier - status Not written off, not paid

.

, select the document that reflected the receipt of inventory.

, select

Accepted

.

.

Rice. 5

Click the button to see the result of posting the document - entries have been made in the “Expenses under the simplified tax system” register (Fig. 6).

Rice. 6

List of material costs

Organizations and entrepreneurs using the simplified tax system take into account material expenses in accordance with the procedure for calculating income tax provided for in Article 254 of the Tax Code.

Material costs are mainly typical for manufacturing firms. However, such costs may also be incurred by trade organizations and firms that perform work or provide services. For example, material costs include the costs of purchasing fuels and lubricants (fuels and lubricants), work clothes and safety shoes, and paying for utilities.

According to Article 254 of the Tax Code, material costs include acquisition costs:

- raw materials and supplies used in the production of goods (works, services) and for other production needs;

- components and semi-finished products subject to further processing;

- materials for packaging of goods sold (containers);

- fuel, water and energy of all types for heating buildings and industrial needs;

- works and services of a production nature performed by third parties or structural divisions of the company (for example, transportation costs);

- property that is not depreciable (that is, the cost of which is less than 40,000 rubles or the useful life of which is less than one year);

- tools, production equipment, laboratory equipment, workwear and safety footwear, etc.

What other expenses can be classified as material?

The list of material costs is not exhaustive. They may also include other documented costs that are directly related to the production and sales process.

Thus, in letter dated January 29, 2015 No. 03-11-06/2/3237, the Russian Ministry of Finance came to the conclusion that the costs of researching the market conditions of printed products to identify public opinion about printed publications can be classified as production costs. And as a result, take into account the “simplified” expenses, provided that they are justified and documented.

The simplified tax system can reduce the tax base by the amount of costs for the installation and operation of advertising structures carried out in accordance with agreements for the placement of such structures concluded with the owners of land plots, buildings or other real estate, including with the owners of premises in an apartment building. They are of a production nature for a taxpayer engaged in business activities in the field of outdoor advertising distribution. Therefore, such expenses can be taken into account as part of material expenses when determining the tax base for a “simplified” tax (letter of the Ministry of Finance of Russia dated March 17, 2014 No. 03-11-06/2/11342).

In addition, transportation and forwarding costs of a production nature performed by third-party organizations can also be reflected as part of material costs. But to confirm the costs under the transport expedition agreement, it is necessary to have forwarding documents confirming the actual provision of services.

Forwarding documents include (Law No. 87-FZ dated June 30, 2003, Decree of the Government of the Russian Federation dated September 8, 2006 No. 554, Order of the Ministry of Transport of the Russian Federation dated February 11, 2008 No. 23):

- instructions to the freight forwarder (determines the list and conditions for the freight forwarder to provide freight forwarding services to the client under the freight forwarding agreement);

- forwarding receipt (confirms the fact that the forwarding agent has received cargo for transportation from the client or from the shipper indicated by him);

- warehouse receipt (confirms the fact that the freight forwarder has accepted the cargo from the client for warehousing).

Thus, if the listed documents are available and executed in accordance with all the rules, then the costs of the transport expedition agreement can be taken into account when calculating the single tax.

Officials recommend

Some costs can equally be attributed simultaneously to several expense groups. For example, “simplified” people can take into account expenses for stationery on two grounds at once: as material expenses (clause 5 of Article 346.16 of the Tax Code of the Russian Federation) and as a separate expense (clause 17 of Article 346.16 of the Tax Code of the Russian Federation). The “simplified” person decides independently which group such expenses belong to (letter of the Ministry of Finance of Russia dated March 7, 2006 No. 03-11-04/2/57).

True, sometimes officials in their explanatory letters recommend that taxpayers classify certain expenses as specific types of expenses.

For example, in a letter dated December 25, 2015 No. 03-11-06/2/76408, the Russian Ministry of Finance indicated that the costs of the “simplified” for the purchase and refilling of cartridges can be taken into account not as part of the costs of office supplies, but as material costs.

The fact is that the Tax Code allows us to classify as material expenses, in particular, the costs of purchasing materials used for production and economic needs. Here you can take into account, for example, testing and monitoring of fixed assets, their maintenance and operation (clause 2, clause 1, article 254 of the Tax Code of the Russian Federation). In addition, as part of material expenses, you can reflect the costs of purchasing work and services of a production nature, performed by third-party organizations and individual entrepreneurs (clause 6, clause 1, article 254 of the Tax Code of the Russian Federation).

In turn, work of a production nature includes the performance of individual operations for the production of products (performance of work, provision of services), processing of raw materials or supplies, maintenance of fixed assets and other similar work.

Based on this, the Ministry of Finance comes to the conclusion that a simplified organization that produces printed products can take into account the costs of purchasing and refilling cartridges as part of material costs.

In a similar manner, it is possible to reflect as part of material expenses the costs associated with payment for the services of a transport organization for the delivery and forwarding of finished printed products to customers.

Payment to the supplier for materials purchased during the period of application of UTII and simplified tax system “income”

3.1 Paid to the supplier of materials purchased during the period of application of UTII and simplified tax system “income”

Document “Write-off from current account” (Fig. 1):

- Section: Bank and cash desk

-

Bank statements

. - Create a document using the Write-off

or open a previously created/downloaded document via “Client-Bank”. - In the Transaction type

, select “Payment to supplier.” - Complete the document. In the example, receivables are paid in the amount of RUB 15,600.

- Carry out

button .

Rice. 1

Click the button to see the result of document processing (Fig. 2).

In the register Book of Income and Expenses (Section I)

(tab of the same name) reflects the amount of payment (column

Expenses in total

), which at the time of posting the document is included in the expenses according to the simplified tax system (corresponding to the balance of materials in the amount of 45 pieces in the amount of 11,700 rubles, including VAT 1950 rubles).

In the register Expenses under the simplified tax system

(tab of the same name) the payment amount reflects the change in status for the material “A4 Paper”:

- The 1st line (movement Expense

) and 2nd line (movement

Receipt

) reflect the change in status -

Not written off, not paid

in the column

Statuses of payment of expenses

changes to

Not written off, accepted

when paying the supplier (thus, for inclusion in expenses under the simplified tax system for this inventory material, two conditions are met: “the goods are received and paid to the supplier).

Rice. 2

OS implementation

When implementing an OS, it is necessary to take into account the useful life of the OS and the moment of its implementation. The same rule applies to any disposal of fixed assets, except for its loss (for example, when transferring fixed assets to the authorized capital of another company).

In some cases, it will be necessary to recalculate the base according to the simplified tax system for the periods in which the costs of purchasing fixed assets being sold were taken into account. This should be done while the following conditions are met:

- The useful life of the OS is determined to be up to 15 years inclusive, and the period from the moment of its acquisition (and writing off the purchase price as expenses) is less than 3 years.

Or:

- The useful life of the OS is more than 15 years, and the period from the date of purchase is less than 10 years.

The tax base should be adjusted in the following order:

- Exclude all recorded fixed assets costs from the expenses of those years when they were taken into account when calculating the simplified tax system.

- Include in monthly expenses the amount of accrued depreciation according to the rules established by Art. 259 of the Tax Code of the Russian Federation for the period of use of the fixed assets, and the under-depreciated part of the fixed assets cannot be included in expenses.

- Calculate and additionally pay to the budget the amount of tax according to the simplified tax system and penalties for those periods when fixed assets expenses were included in the expenses for tax reduction.

You can learn how to correctly calculate the tax from the material “The procedure for calculating the simplified tax system “income minus expenses” (15 percent) .

- Submit an updated tax return for those periods in which the costs of the sold fixed assets were taken into account.

Find out how to account for the sale of a fixed asset under the simplified tax system in ConsultantPlus. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Example

Vympel LLC, located on the simplified tax system, purchased a wood carving machine worth 449,988 rubles in September 2020. without VAT. In October 20XX, the machine was fully paid for and put into operation. Vympel LLC approved the service life for the purposes of calculating depreciation - 84 months.

The cost of the machine is 449,988 rubles. was included in expenses under the simplified tax system.

In June 20XX, Vympel LLC sold the machine at a price of 300,000 rubles.

In June 20XX, the accountant of Vympel LLC:

- I excluded from last year’s expenses the costs of purchasing a machine in the amount of 449,988 rubles.

- In the expenses of the previous year, I took into account the depreciation of the machine for 2 months (November and December) of the year 20XX: 10,714 rubles. (monthly depreciation is 449,988 / 84 = 5,357 rubles, for 2 months the amount of accrued depreciation is 5,357 × 2 = 10,714 rubles).

- I recalculated and paid additional taxes for last year. The amount of tax to be paid additionally was (449,988 – 10,714) × 15% = 65,891 rubles.

- Calculated and paid the fine.

Let's assume that the additional tax payment was made on 06/17/20XX. The number of days of delay from 04/02/20XX (postponement of the payment deadline from 03/31/20XX is a day off) to the date of additional payment of the simplified tax system = 76 days.

With a key rate of 7.75%, penalties payable amounted to RUB 2,076.66, including:

- for the period from 04/03/20XX to 05/02/20XX the penalties amounted to 510.66 rubles. (RUB 65,891 × 30 days / 300 × 7.75%);

- for the period from 05/03/20XX to 06/17/20XX the fines amounted to RUB 1,566.01. (RUB 65,891 × 46 days / 150 × 7.75%).

Our Penalty Calculator will help you calculate the amount of the penalty.

- I submitted an update on the simplified tax system for last year.

- I recalculated downwards by the amount of accrued depreciation for 6 months (January - June) advance payments under the simplified tax system for the year 20XX.