Accounting for goods in trade

A rational system of accounting for goods, combined with the efficiency of their sale, contributes to the formation of financial resources of a trading company necessary for its stable and full-fledged functioning.

Today, in conditions of an unstable economic situation, declining consumer demand, unpredictable changes in foreign exchange rates, and a tense political situation in the world, not only the rules, but also the forms of trade are changing. Mostly, forms of online trade in goods and services have recently developed. In this connection, companies began to gradually introduce the possibility of purchasing goods sold through the online store system using personal computers and various gadgets. Increased competition and excess supply of goods requires trading enterprises to adapt to new trading conditions: sell only those goods that are in demand; offer new products; create new marketing methods of promotion, etc.

Purpose of accounting for goods in trade

Due to the fact that “ the purpose of accounting for transactions for the sale of goods is to provide users with information about the results of the activities of trading organizations for decision-making, the detailing of accounts should be carried out, maximally reflecting the information system for managing the sales of goods.” Considering sales management as a methodology of market activity that determines the strategy and tactics of organizations in a competitive environment, A.O. Lebedkin and I.V. Eremina, they think it is necessary to Fr.

The activities of trade organizations, according to Yu.A. Kotlovoy “requires differentiation of accounting data for internal and external users (primarily for reporting) and increasing the efficiency of managing product sales.” This can be achieved by improving the analytical accounting system. With the help of synthetic accounts, it becomes possible to isolate from the entire income of a trading organization the income from the sale of goods and in the context of each product separately, which allows for an in-depth analysis of sales, and to decide the feasibility of purchasing and selling a particular product.

What is commodity accounting

Commodity accounting is a reflection of all operations that accompany trade: the purchase or production of goods, their storage, sale, movement, return, etc.

At any moment it should be visible how much and what goods are in stock, at what cost, what needs to be purchased, in what quantity, how trade is going in each store, to whom and what was sold, how much money was received, etc.

By properly establishing commodity accounting, a business owner will be able to get a complete picture. And on its basis you can analyze sales, plan purchases, form an assortment and make other management decisions.

Principles of accounting for goods

Goods accounting is based on the following principles :

- conclusion of an agreement. In the absence of this clause, it will be impossible to hold the financially responsible person or any other person liable;

— selection of a method of accounting for goods that is more convenient in the operating conditions of a particular organization;

— write-off, disposal, and capitalization of goods must be carried out according to a single assessment;

— filling out reports on the availability and movement of goods by financially responsible persons must be carried out in a timely manner;

— carrying out inventories of actual balances of goods and comparing them with accounting data is carried out by the organization to ensure the safety of valuables;

— control over the actions of financially responsible persons through cross-reconciliation of documents. For example, all write-offs from department store warehouses must coincide with the posting of these valuables in sections.

How are goods transferred for storage accounted for?

Companies can provide goods storage services. Such relationships are regulated by Ch. 47 Civil Code of the Russian Federation. The main actors in the storage agreement are the custodian (the person who accepted the goods for safekeeping) and the bailor (the company that gave the goods and materials for storage). In this case, the right of ownership of goods and materials does not pass to the custodian, and the goods must be returned within the terms specified in the contract.

The transfer of goods and materials is formalized by a transfer and acceptance certificate in form MX-1, and the return is accompanied by an act in form MX-3.

Forms and examples of filling out the above forms can be found in the publications:

- ;

- “Unified form No. MX-3 - form and sample.”

IMPORTANT! Organizations have the right to independently develop accounting forms taking into account their needs.

Accounting with the bailor

Since the transfer of goods and materials for storage does not imply a transfer of ownership, the goods continue to be accounted for on the balance sheet of the enterprise even after its transfer to secondary storage (physically the goods lot is in the warehouse of the custodian company). The wiring in this case will look like this:

- Dt 41 (warehouse of the custodian company) Kt 41 (sender's warehouse).

Accounting with the custodian

The custodian company records inventory items transferred for safekeeping in off-balance sheet account 002. In this case, analytical accounting is organized by owners, types, grades of goods, storage warehouses and financially responsible persons.

Receipt of goods is recorded on the debit of account 002, disposal - on its credit. Remuneration and expenses incurred in providing storage services for the custodian company are income and expenses for ordinary activities.

Methods for accepting goods for accounting

Goods are accepted for accounting at actual cost. There are three types of valuation of goods, according to the above accounting standard:

1) at the actual cost of the acquisition, including all costs associated with the acquisition;

2) at the purchase price, which consists of the contract price of the supplier, and all costs associated with the acquisition are included in the costs of sale (account 44 is used);

3) at accounting prices, in this case the deviation of the actual cost from the accounting price of the goods is taken into account on account 16.

Retail trade organizations are allowed to keep records of goods at sales prices. The selling price is formed based on the actual cost and trade margin.

Trade margin “is the amount that is added to the actual cost of acquisition, from which trading organizations cover selling costs, pay taxes and make a profit.”

Trade and its types

Trade “in general” is the resale of any material assets. A businessman buys goods and then sells them at higher prices.

The following types of trade are distinguished:

- Wholesale. In this case, goods are usually sold in large quantities. Sometimes - not very large, but in any case it is not a single product. As a rule, both the seller and the buyer in wholesale sales are legal entities or individual entrepreneurs.

- Retail. This is the sale of goods individually or in small quantities. Buyers here are usually individuals.

- Commission. It is carried out within the framework of both retail and wholesale trade. In this case, the seller (commission agent) receives the goods from its owner (committent) and sells them to third parties for a fee.

Documents on accounting of goods in accounting

Depending on the valuation in which goods are recorded, receipts are reflected differently. Most transactions in accounting are confirmed by primary documents . It is necessary to be attentive and careful in the preparation of documents related to the receipt and disposal of goods, because they reflect the material side of the activities of a trading organization. The journey of a product begins when it reaches the warehouse of a trading organization. A certain quantity of goods must be accompanied by a special document that reflects the names of the supplier and buyer, their addresses, the name of the goods supplied, units of measurement of the goods, their quantity, price and value of the goods, as well as the signatures of the responsible representatives of the supplier and buyer, certified by seals. When the buyer's representative receives the goods by proxy, the buyer's stamp may be missing. The regulatory document on this issue is “Methodological recommendations for accounting and registration of operations for the receipt, storage and release of goods in trade organizations” (approved by letter of Roskomtorg dated July 10, 1996 No. 1-794/32-5) [14]. All responsibility for the preparation of documents and further actions with them lies with the person who draws them up.

Primary documents can be filled out by hand by hand or on a printed device. If an organization carries out accounting through computer accounting programs, then the primary document must be printed. Corrections that make the text unreadable or unnecessary blots are not allowed in primary documents.

The transfer of goods from supplier to buyer is accompanied by the preparation of certain documents that regulate the terms of delivery of goods. For example, a waybill, a waybill, an invoice, an invoice, a railway waybill.

Sample invoice

One document is both a receipt and an expense. For the supplier, the invoice serves as a document that confirms the disposal of goods, and for the buyer, the same invoice is the basis for posting the goods. The document is drawn up by the financially responsible person of the supplier’s organization when goods are shipped from the warehouse.

Packing list

The invoice details require the following data: document number and date, name of the supplier and buyer, name (brief description) of the product, quantity in units of measurement, price per unit of product, total amount of goods sold including value added tax. The document is signed on the part of the supplier by the financially responsible person who delivered the goods, and upon receipt of the goods - by the financially responsible person on the buyer’s side who received the goods.

Terminology

Basic concepts are explained in State Standard R 51303-99, approved by the State Standard Resolution and put into effect in 2000. In accordance with it, trade is a type of commercial activity that is associated with the purchase and sale of products and the provision of services to customers. The wholesale mode involves the purchase of products with their subsequent resale or professional use. Retail should be understood as trade and provision of services to consumers for family, personal, home use not related to commercial activities. The commission regime involves the transfer of products to third parties under commission agreements for carrying out business transactions with them.

Accounting for product returns

Within the framework of the topic of accounting for the receipt of goods, problems may arise in accounting for: return of goods, revaluation of goods, damage to goods.

In some cases, Russian legislation allows you to return purchased goods to the seller. Most often this concerns low-quality, incomplete goods or goods of inappropriate assortment.

Clause 1 Art. 469 of the Civil Code of the Russian Federation states that “the supplier is obliged to transfer to the buyer products of proper quality. Conditions for product quality should always be specified in the contract in a standard form or according to standards/specifications/sample/preliminary inspection. If such conditions are not specified in the contract, the supplier undertakes to supply products suitable for the purposes for which the buyer requires them.”

An important point is the warranty period of the product. In some cases, as noted by I.V. Ovchinnikov, “the health, life or property of the buyer may depend on the quality of the goods; it is necessary to establish a period of guaranteed quality of the goods, shelf life and service life.” This period begins to apply from the moment the products are shipped. Sometimes the buyer cannot use the purchased products for certain reasons, depending on the commission agent. Then the warranty period is extended by the time during which the operation of the product was impossible.

LIFO method

This organization of goods accounting helps ensure consistency between current expenses and income, and also allows one to take into account the impact of inflationary processes on the company’s financial results. The LIFO method involves valuing items at the end of the month by their quantity and assuming that their cost is formed from the costs of their first purchases. The price of sales products is calculated by subtracting from the balance at the beginning of the month, including units received during the period, the amount that accounts for the number of products remaining at the end of the month. Distribution among accounts is carried out on the basis of the average cost of a sample from each type of product and the volume of products sold.

Commission sales of goods: postings, characteristics

The main feature of the sale of non-food products accepted for commission is that with the transfer of property, the rights to its ownership are retained by the principal. Relations between the parties are regulated by agreement.

For accounting purposes of products accepted for commission, account 004 is used. When goods are accepted for commission, the amount is reflected as a debit, and when written off, as a credit. The commission agent's remuneration is reflected by posting Dt 76 Kt 90.1.

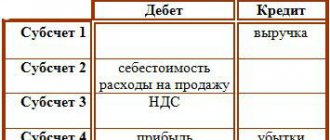

Implementation and its recording in documents is an important component of accounting. Distortion of data will entail incorrect calculation of the tax base and incorrect assessment of financial results.

Documentation

Accounting for goods in the warehouse is accompanied by filling out delivery notes, routing sheets, acts and other papers. All these documents must be signed by the head of the department who delivers the products, as well as by the person responsible for storage. Large cargo is usually accepted by the customer at the place of manufacture, assembly and packaging. The responsible person reflects information about the release of finished products and their arrival at the warehouse in a special accounting card. Its form and content are similar to the document on receipt of materials (form No. M-17).

Sales of intellectual property products: civil legal content of operations

Let's figure out what today, in accordance with the current norms of the Civil Code of the Russian Federation, are operations for the sale of products of intellectual activity as goods.

The economic reality is that the products of intellectual activity are traded as goods. At the same time, as a rule, in the minds of the buyer (and often in the minds of representatives of selling organizations) they are associated with their material carriers. We come to the store and buy books, CDs with music recordings, disks with computer programs. At the same time, the warehouses of organizations that sell or resell these products, these goods, are filled with material carriers of these values. However, according to the Civil Code, by purchasing these goods, we acquire a certain amount of rights to copyright texts, musical recordings, and computer programs. It is the fact that a particular disc or book is the bearer of these fruits of intellectual activity that determines their price on the market. And here we are dealing with the turnover, first of all, not of property rights, but of intellectual rights.

Let us turn to the contents of part four of the Civil Code of the Russian Federation.

According to paragraph 1 of Article 1225 of the Civil Code of the Russian Federation, “works of science, literature and art,” “programs for electronic computers (computer programs)” and “databases” are classified as objects of intellectual property. Regarding objects of intellectual property, subjects of civil legal relations may have so-called intellectual rights. As a rule, the object of intellectual property itself and, first of all, the possibility of its use are associated with its (object’s) material carrier. In this regard, special regulations of the Civil Code of the Russian Federation distinguish between intellectual rights to the object of intellectual property itself and the rights of the subject to its (object of intellectual property) material carrier.

Almost all regulations of the Civil Code of the Russian Federation defining general provisions on rights to the results of intellectual activity, one way or another, relate to exclusive rights to the results of intellectual activity. Article 1229 of the Civil Code of the Russian Federation defines the concept of exclusive right. The Civil Code of the Russian Federation establishes that the presence of a subject of civil legal relations, that is, an individual or legal entity of an exclusive right to a result of intellectual activity or to a means of individualization, creates the opportunity to use such a result or such a means at its own discretion in any way that does not contradict the law. Thus, the owner of the exclusive right can dispose of such a right to the result of intellectual activity or to a means of individualization, which allows us to call such a right intellectual property. The ability to dispose of the right here means that the copyright holder can, at his own discretion, allow or prohibit other persons from using the result of intellectual activity or means of individualization. In this case, the absence of a prohibition is not considered consent (permission). Accordingly, other persons cannot use the corresponding result of intellectual activity or means of individualization without the consent of the copyright holder, except in cases specifically provided for by the Civil Code of the Russian Federation.

According to Article 1233 of the Civil Code of the Russian Federation, the copyright holder can dispose of the exclusive right to an object of intellectual property belonging to him in any way that does not contradict the law, including through its alienation under an agreement to another person (agreement on the alienation of an exclusive right) or by granting another person the right to use the corresponding results of intellectual activity or means of individualization within the limits established by the contract (license agreement). These two types of agreements underlie the legal circulation of exclusive rights to the results of intellectual activity. And in the case of mass sale (resale) of intellectual property products, we are dealing with just the types of licensing agreement.

According to paragraph 1 of Article 1235 of the Civil Code of the Russian Federation, under a license agreement, one party - the holder of the exclusive right to the result of intellectual activity or to a means of individualization (licensor) grants or undertakes to provide the other party (licensee) with the right to use such result or such means within the limits provided for by the agreement. The main characteristic of this type of agreement, in contrast to an agreement on the alienation of an exclusive right, is the transfer to the licensee of rights to an intellectual property object to a limited extent. In this case, the scope of rights transferred to the licensee is determined by the terms of the license agreement. The Civil Code of the Russian Federation specifically establishes that “the licensee may use the result of intellectual activity or a means of individualization only within the limits of those rights and in the ways provided for by the license agreement. The right to use the result of intellectual activity or means of individualization that is not expressly specified in the license agreement is not considered granted to the licensee.”

The provisions of Article 1238 of the Civil Code of the Russian Federation on a sublicense agreement are fully consistent with the general principles of civil legislation on the transfer of rights to the subject of a transaction by a person who, according to the concluded agreement, owns a limited amount of them. According to the Civil Code of the Russian Federation, with the written consent of the licensor, the licensee may, under an agreement, grant limited rights to use the result of intellectual activity or a means of individualization to another person (sublicense agreement). Under a sublicense agreement, the sublicensee may be granted the rights to use the result of intellectual activity or means of individualization only within the limits of those rights and those methods of use that are provided for by the license agreement for the licensee. A sublicense agreement concluded for a period exceeding the validity period of the license agreement is considered concluded for the duration of the license agreement. The licensee is responsible to the licensor for the actions of the sublicensee, unless otherwise provided in the license agreement. In this case, the rules of the Civil Code of the Russian Federation on a license agreement are applied to the sublicensing agreement.

Thus, by acquiring from the holder of exclusive rights to an object of intellectual property the right to sell (resell) them en masse, the organization enters into a license agreement that provides for the possibility of a sublicense. Subsequently, under sublicense agreements, the product reaches the end consumer directly or through a network of intermediaries: a book reader, a disc listener, an organization using a computer accounting program, etc., who uses the product as part of the execution of a sublicense agreement that does not provide for the possibility assignment of rights. Specific sales schemes, specific products, specific selling organizations (intermediaries) can form the specifics of the implementation, contractual and documentary execution of the relevant operations, but their general legal meaning, which we have disclosed above, remains unchanged.

Objectives of activity

Accounting provides:

- Control over product safety.

- Timely provision of information to the head of the enterprise about gross (actual) income, the state of inventory and the efficiency of its use.

The tasks that the activity involves can only be accomplished with proper planning. Deficiencies that may arise during it are the reasons for accounting lags, late submission of reports and other information. Large gaps in time between the appearance of information and its use create obstacles to increasing economic efficiency and profitability of the enterprise. Disadvantages of accounting can lead to its confusion, the formation of conditions for theft of material assets, and increased costs of maintaining responsible personnel.

Methods and procedures for keeping records of inventory items (materials and materials)

How exactly you can work with these assets is described in special guidelines number 119. Let's look at the two main subtypes.

Varietal (pros and cons)

Everything is done using cards of the appropriate type. They note the presence of this or that object, their movement and decommissioning.

You can act in any of the following ways:

- Quantitative-sum. It is believed that in this case, they simultaneously count and control changes in numbers and amounts; this is done both in warehouses and in accounting books. The item numbers of all inventory items are used.

- Baldovy. Here they track only quantitative changes by type of value. Accounting uses the sum method with monetary values. Volume tracking is carried out on the basis of primary documentation; for this purpose, card indexes and accounting books are used. Every year after the report, all documents are submitted.

It can be used when storage is carried out by variety and name. At the same time, there is no control over receipts and costs. For each subtype of nomenclature, a card must be created in a strict form. They differ from each other in:

- product brand;

- variety;

- what is it measured in?

- coloring

The created “passports” will be active and valid for 1 year. Everything about the object is included in them, they are registered in a separate register and each one is given a personal number. These processes are carried out by accounting staff. When the first sheet is completely filled, then they write further on the second and so on. Each subsequent sheet is numbered.

This method has noticeable advantages:

- Warehouse space for storage is seriously saved;

- leftovers can be managed quickly.

But there is also a serious drawback: if an enterprise has several types of the same product with different prices, then it will be very difficult to control them.

Party

This type assumes that each batch will be registered and stored separately from the rest. It is used both in warehouse accounting and accounting. For each admission, different documents are created.

These include:

- transported by one vehicle;

- has the same name;

- simultaneously received from a specific supplier.

The received products are registered in the journal and assigned an individual registration number, which will be indicated in the future in the expense statements. Two cards are opened at the same time - one will be used in the accounting department, the second in the warehouse. The forms used are determined by the type of products.

There are several advantages of this type of farming:

- the results of expenditure can be determined without conducting an inventory;

- the safety of inventory items is under increased control;

- The organization's losses are reduced.

But there are also disadvantages:

- warehouses are used irrationally and become cluttered;

- It will not be possible to quickly track changes.

Which one to choose for your company depends on production goals, the size of storage space, the skills of the accountant and the desires of the storekeeper. To quickly decide on a methodology, we advise you to contact specialists, for example, at Cleverence. Our employees will help you find software that will help automate most processes and free up your workforce. Sometimes several installed programs perform the work of an entire department with the press of a couple of keys. If you want to develop, it will be difficult to do so without such software. The Mobile SMART Engineering software product, implemented by , solves logistics problems in the oil and gas sectors, controls the movement of material flows and reduces costs.

Sales

The release and accounting of goods in the store is carried out using an invoice. Form M-15 can serve as a standard form. Enterprises involved in various manufacturing industries use specialized forms of invoices and other primary documents for registration. They contain mandatory details, reflect the main properties and characteristics of the shipped products, the name of the company division that carries out the supply, the name of the buyer and the basis for transferring the products to him. The invoice is filled out in accordance with the order of the head of the enterprise or a person authorized by him, as well as the agreement with the customer (buyer).