Employer reporting

Current as of June 29, 2017

What are the deadlines for submitting a report on Form 4-FSS for the 2nd quarter of 2017? Which form to use: old or new (after July 9, 2017)? How to fill out the 4-FSS form for employers participating in the FSS pilot project? How to generate zero reports on contributions “for injuries”? Here is a completed example of 4-FSS for the sample. We will also answer the most pressing questions of the reporting campaign for the first half of the year.

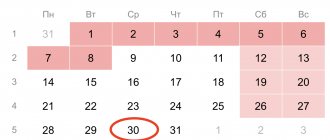

Deadline for submitting 4-FSS for the 1st quarter of 2021 and other periods

| 4-FSS for 1st quarter | April 20, 2021 on paper April 25 in electronic form |

| 4-FSS for the 2nd quarter | July 20 in 2021 on paper July 25 in electronic form |

| 4-FSS for the 3rd quarter | October 20 in 2021 on paper October 25 in electronic form |

| 4-FSS for the 4th quarter | January 20, 2021 on paper January 25th electronically |

Report submission deadline

The completed form is submitted to any territorial branch of the FSS; the place of registration of the organization does not matter.

In accordance with paragraph 1 of Art. 24 of Law No. 125-FZ of July 24, 1998, the deadline for submitting the new form 4-FSS is set as follows:

- on paper - no later than the 20th day of the month following the expired quarter;

- in the form of an electronic document - no later than the 25th day of the month following the expired quarter.

IMPORTANT!

If the reporting date falls on a holiday or weekend, then report on the first working day after it. But inspectors strongly do not recommend postponing reporting until the last day.

The procedure for filling out Form 4-FSS for the 1st quarter of 2021 (FSS order No. 381 dated September 26, 2016)

Starting from the 1st quarter, a new form 4-FSS and a new report - ERSV were approved. The first is submitted to the Social Insurance Fund, the second to the Federal Tax Service.

1. The calculation form is filled out using computer technology or by hand with a ballpoint (fountain) pen in black or blue in block letters.

2. When filling out the form, only one indicator is entered in each line and the corresponding columns. If there are no indicators provided for in the Calculation form, a dash is placed in the line and the corresponding column.

The title page, table 1, table 2, table 5 of the Calculation form are mandatory for submission by all policyholders.

If there are no indicators to fill out table 1.1, table 3, table 4 of the Calculation form, these tables are not filled out and are not submitted.

To correct errors, you must cross out the incorrect value of the indicator, enter the correct value of the indicator and sign the policyholder or his representative under the correction indicating the date of correction.

All corrections are certified by the seal (if any) of the policyholder/legal successor or his representative.

Errors may not be corrected by correction or other similar means.

3. After filling out the Calculation form, sequential numbering of the completed pages is entered in the “page” field.

At the top of each completed page of the Calculation, the fields “Registration number of the policyholder” and “Subordination code” are filled in in accordance with the notice (notification) of the policyholder issued during registration (registration) with the territorial body of the Fund.

At the end of each page of the Calculation, the signature of the policyholder (successor) or his representative and the date of signing of the Calculation are affixed.

Title page

4. The title page is filled out by the policyholder , except for the subsection “To be filled out by an employee of the territorial body of the Fund.”

5. When filling out the cover page of the Calculation form:

5.1. in the field “Insurant's registration number” the registration number of the insured is indicated;

5.2. the “Subordination Code” field consists of five cells and indicates the territorial body of the Fund in which the policyholder is currently registered;

5.3. in the “Adjustment number” field:

when submitting the primary Calculation, code 000 is indicated;

when submitted to the territorial body of the Settlement Fund, which reflects changes in accordance with Article 24 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases” (Collection of Legislation of the Russian Federation, 1998 , N 31, Art. 3803; 2003, N 17, Art. 1554; 2014, N 49, Art. 6915; 2021, N 1, Art. 14; N 27, Art. 4183) (hereinafter referred to as the Federal Law of July 24 1998 N 125-FZ) (updated Calculation for the corresponding period), a number is entered indicating which account Calculation, taking into account the changes and additions made, is submitted by the policyholder to the territorial body of the Fund (for example: 001, 002, 003,...010).

The updated Calculation is presented in the form that was in force in the period for which errors (distortions) were identified;

5.4. in the “Reporting period (code)” field , the period for which the Calculation is being submitted and the number of requests from the policyholder for the allocation of the necessary funds for the payment of insurance compensation are entered. When presenting the Calculation for the first quarter, half a year, nine months and a year, only the first two cells of the “Reporting period (code)” field are filled in. When applying for the allocation of the necessary funds for the payment of insurance coverage, only the last two cells are filled in the “Reporting period (code)” field.

Reporting periods are the first quarter, half a year and nine months of the calendar year, which are designated respectively as “03”, “06”, “09”. The billing period is the calendar year, which is designated by the number “12”. The number of requests from the policyholder for the allocation of the necessary funds to pay insurance compensation is indicated as 01, 02, 03,... 10;

5.5. in the “Calendar year” field , enter the calendar year for the billing period of which the Calculation (adjusted calculation) is being submitted;

5.6. the field “Cessation of activities” is filled in only in the event of termination of the activities of the organization - the insured in connection with liquidation or termination of activities as an individual entrepreneur in accordance with paragraph 15 of Article 22.1 of the Federal Law of July 24, 1998 N 125-FZ (Collection of Legislation of the Russian Federation, 1998, No. 31, Article 3803; 2003, No. 17, Article 1554; 2021, No. 27, Article 4183). In these cases, the letter “L” is entered in this field;

5.7. in the field “Full name of the organization, separate division/F.I.O. (the latter, if any) individual entrepreneur, individual” indicates the name of the organization in accordance with the constituent documents or a branch of a foreign organization operating on the territory of the Russian Federation, a separate division; when submitting a Calculation by an individual entrepreneur, lawyer, notary engaged in private practice, the head of a peasant farm, an individual who is not recognized as an individual entrepreneur, his last name, first name, patronymic (the latter if available) (in full, without abbreviations) are indicated in accordance with the document , identification;

5.8. in the “TIN” field (taxpayer identification number (hereinafter referred to as TIN)) the policyholder’s TIN is indicated in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation at its location in the territory of the Russian Federation.

For an individual who is not recognized as an individual entrepreneur (hereinafter referred to as an individual), an individual entrepreneur's TIN is indicated in accordance with the certificate of registration with the tax authority of the individual at the place of residence in the territory of the Russian Federation.

When an organization fills out a TIN, which consists of ten characters, in the area of twelve cells reserved for recording the TIN indicator, zeros (00) should be entered in the first two cells;

5.9. in the field “KPP” (reason code for registration) (hereinafter referred to as KPP) at the location of the organization, the KPP is indicated in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation, at the location in the territory Russian Federation.

The checkpoint at the location of the separate subdivision is indicated in accordance with the notice of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation at the location of the separate subdivision on the territory of the Russian Federation;

5.10. in the field “OGRN (OGRNIP)” the main state registration number (hereinafter referred to as OGRN) is indicated in accordance with the certificate of state registration of a legal entity formed in accordance with the legislation of the Russian Federation at its location on the territory of the Russian Federation.

For an individual entrepreneur, the main state registration number of an individual entrepreneur (hereinafter referred to as OGRNIP) is indicated in accordance with the certificate of state registration of an individual as an individual entrepreneur.

When filling out the OGRN of a legal entity, which consists of thirteen characters, in the area of fifteen cells reserved for recording the OGRN indicator, zeros (00) should be entered in the first two cells;

5.11. In the field “OKVED Code” the code is indicated according to the All-Russian Classifier of Economic Activities OK 029-2014 (NACE Rev. 2) for the main type of economic activity of the insured, determined in accordance with Decree of the Government of the Russian Federation dated December 1, 2005 N 713 “On approval of the Rules for classifying types of economic activity as occupational risk.”

Newly created organizations - insurers for compulsory social insurance against industrial accidents and occupational diseases indicate a code according to the state registration authority, and starting from the second year of activity - a code confirmed in the prescribed manner in the territorial bodies of the Fund.

5.12. in the “Contact telephone number” field , indicate the city or mobile telephone number of the policyholder/legal successor or representative of the policyholder with the city code or cellular operator, respectively. The numbers are filled in in each cell without using the dash and parenthesis signs;

5.13. in the fields provided for indicating the registration address:

- legal entities - legal address is indicated;

- individuals, individual entrepreneurs - indicate the registration address at the place of residence;

5.14. in the field “Average number of employees” the average number of employees is indicated, calculated in accordance with the federal statistical observation forms approved by the federal executive body authorized by the Government of the Russian Federation and instructions for filling them out (Part 4 of Article 6 of the Federal Law of November 29, 2007 N 282- Federal Law “On official statistical accounting and the system of state statistics in the Russian Federation” (Collected Legislation of the Russian Federation, 2007, N 49, Art. 6043; 2012, N 43, Art. 5784; 2013, N 27, Art. 3463; N 30, Art. 4084) (hereinafter referred to as Federal Law of November 29, 2007 N 282-FZ) as of the reporting date.

In the fields “Number of working disabled people” , “Number of workers engaged in work with harmful and (or) dangerous production factors” the list number of working disabled people, workers engaged in work with harmful and (or) dangerous production factors, calculated in accordance with federal statistical observation forms approved by the Government of the Russian Federation and instructions for filling them out (Part 4 of Article 6 of Federal Law No. 282-FZ of November 29, 2007) as of the reporting date;

5.15. information on the number of pages of the submitted Calculation and the number of attached sheets of supporting documents is indicated in the fields “Calculation submitted on” and “with the attachment of supporting documents or their copies on”;

5.16. in the field “I confirm the accuracy and completeness of the information specified in this calculation”:

- in the field “1 - policyholder”, “2 – representative of the policyholder”, “3 – legal successor”, if the accuracy and completeness of the information contained in the Calculation is confirmed by the head of the organization, individual entrepreneur or individual, the number “1” is entered; in case of confirmation of the accuracy and completeness of the information, the representative of the policyholder enters the number “2”; if the accuracy and completeness of the information is confirmed, the legal successor of the liquidated organization enters the number “3”;

- in the “Full name” field (the latter if available) of the head of the organization, individual entrepreneur, individual, representative of the policyholder" when confirming the accuracy and completeness of the information contained in the Calculation: - the head of the organization - the insured/legal successor - the surname, name, patronymic (last if available) of the head of the organization is indicated in full in accordance with the constituent documents; - an individual, individual entrepreneur - indicate the surname, first name, patronymic (last if available) of the individual, individual entrepreneur; - representative of the policyholder/successor - an individual - indicate the last name, first name, patronymic (last if available) of the individual in accordance with the identity document; - representative of the policyholder/legal successor - legal entity - the name of this legal entity is indicated in accordance with the constituent documents, the organization’s seal is affixed;

in the fields “Signature”, “Date”, “M.P.” the signature of the policyholder/successor or his representative is affixed, the date of signing the Calculation; if the Calculation is submitted by an organization, a stamp is affixed (if any);

in the field “Document confirming the authority of the representative” the type of document confirming the authority of the representative of the policyholder/successor is indicated;

5.17. The field “To be filled in by an employee of the territorial body of the Fund Information on the submission of the calculation” is filled in when submitting the Calculation on paper:

- in the field “This calculation is submitted (code)” the method of presentation is indicated (“01” - on paper, “02” - by post);

- in the field “with the attachment of supporting documents or their copies on sheets” the number of sheets, supporting documents or their copies attached to the Calculation is indicated;

In the field “Date of submission of calculation” the following is entered:

- date of submission of the Calculation in person or through a representative of the policyholder;

- date of sending the postal item with a description of the attachment when sending the Calculation by mail.

In addition, this section indicates the last name, first name and patronymic (if any) of the employee of the territorial body of the Fund who accepted the Calculation, and puts his signature.

Section “Calculation of accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases” of the Calculation form

6. An insured who has independent classification units, allocated in accordance with Order of the Ministry of Health and Social Development of Russia dated January 31, 2006 N 55, submits a Calculation compiled for the organization as a whole and for each division of the insured, which is an independent classification unit.

Completed sample

Now let’s look at filling out 4-FSS using a specific example:

Example conditions

The LLC Charodeyka organization has only five employees. Among them is one disabled person. As of the beginning of 2021 (as of January 1), the arrears (debt) on contributions for “injuries” amounted to 290 rubles. For the first half of 2021 (from January to June inclusive), contributory payments and benefits to all employees amounted to 898,000 rubles, in particular:

- for January, February, March, April and June – 150,000 rubles each;

- for May – 148,000 rubles;

- In May, one employee was awarded temporary disability benefits in the amount of 2,000 rubles.

Insurance premiums for “injuries” are determined at an insurance rate of 0.2%. And for a disabled person at a reduced (preferential) rate of 0.12 percent (0.2 × 60%). For the period from January to June 2021, insurance premiums were paid to the Social Insurance Fund: 1,666 rubles. (for December 2021 - May 2017), including April 12 - 276 rubles, May 15 - 276 rubles, June 5 - 272 rubles.

There were no accidents in the organization, and measures to prevent injuries and occupational diseases were not funded. In the second quarter of 2021, the organization conducted a special assessment of working conditions.

We present a completed sample 4-FSS for the 2nd quarter of 2021 based on the above example with indicators for the first half of 2021.

If there is a pilot project in the region, then do not fill out line 15 of Table 2 and Table 3 in Form 4-FSS for the 2nd quarter of 2021. See “Participants in the FSS pilot project in 2021.”

Filling out Table 1 “Calculation of the base for calculating insurance premiums” of the Calculation form

7. When filling out the table:

7.1. line 1 in the corresponding columns reflects the amounts of payments and other remuneration accrued in favor of individuals in accordance with Article 20.1 of the Federal Law of July 24, 1998 N 125-FZ on an accrual basis from the beginning of the billing period and for each of the last three months of the reporting period ;

7.2. in line 2 in the corresponding columns the amounts not subject to insurance premiums are reflected in accordance with Article 20.2 of the Federal Law of July 24, 1998 N 125-FZ;

7.3. line 3 reflects the base for calculating insurance premiums, which is defined as the difference in line indicators (line 1 - line 2);

7.4. line 4 in the corresponding columns reflects the amount of payments in favor of working disabled people;

7.5. line 5 indicates the amount of the insurance tariff, which is set depending on the class of professional risk to which the insured belongs (separate division);

7.6. in line 6 the percentage of the discount to the insurance rate established by the territorial body of the Fund for the current calendar year is entered in accordance with the Rules for establishing discounts and surcharges for policyholders to insurance rates for compulsory social insurance against industrial accidents and occupational diseases, approved by the Decree of the Government of the Russian Federation dated 30 May 2012 N 524 “On approval of the Rules for establishing discounts and surcharges for insurers on insurance rates for compulsory social insurance against industrial accidents and occupational diseases” (Collected Legislation of the Russian Federation, 2012, N 23, Art. 3021; 2013, N 22 , Art. 2809; 2014, No. 32, Art. 4499) (hereinafter referred to as Decree of the Government of the Russian Federation of May 30, 2012 N 524);

7.7. line 7 indicates the percentage of the premium to the insurance rate established by the territorial body of the Fund for the current calendar year in accordance with Decree of the Government of the Russian Federation dated May 30, 2012 N 524;

7.8. line 8 indicates the date of the order of the territorial body of the Fund to establish an additional premium to the insurance tariff for the policyholder (separate unit);

7.9. line 9 indicates the amount of the insurance rate, taking into account the established discount or surcharge to the insurance rate. The data is filled in with two decimal places after the decimal point.

Fines: what are the risks?

For violation of the deadline for submitting 4-FSS, a fine is provided - 5% of the amount of “injury” contributions accrued for payment for April, May and June, for each full or partial month of delay. However, the fine cannot be less than 1000 rubles and should not exceed 30% of the specified amount of contributions. Also, the employee of the organization responsible for submitting reports may be fined from 300 to 500 rubles. according to Part 2 of Art. 15.33 Code of Administrative Offenses of the Russian Federation.

The material was prepared based on an article from the Accounting Guru website.

If you find an error, please select a piece of text and press Ctrl+Enter.