Who applies

Companies that pay income tax (except for credit organizations, as well as state and municipal unitary enterprises). An exception is provided for non-profit organizations, as well as for small businesses (for information about who belongs to small businesses, see the article “How will the accounting and reporting of “simplified” organizations differ from the accounting and reporting of “regular” organizations”). Such companies have the right to choose whether to apply PBU 18/02 (approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n), or to abandon it. Whatever the choice, it must be fixed in the accounting policy.

Constant differences

PBU “Accounting for income tax calculations” talk about the relationship between income tax, which is calculated according to accounting and tax rules. PBU 18/02 is used by organizations that pay income tax, with the exception of credit organizations and government agencies. Organizations that apply special regimes may not follow the rules of this accounting standard, but then reflect the refusal to use it in their accounting policies.

If income and expenses form only accounting profit, permanent differences arise. They reveal the irremovable differences between accounting and tax accounting. Information about differences in accounting is generated based on data from primary documents. Permanent differences arise if:

- a limit is imposed on the amount of costs recognized for tax purposes;

- property is transferred free of charge;

- the resulting loss was carried forward to a future period, but over time it became impossible to take it into account for the purpose of reducing tax.

There may be other reasons for persistent differences. Article 251 of the Tax Code of the Russian Federation establishes income that cannot be taken into account when calculating the tax base, and Article 270 of the Tax Code of the Russian Federation contains a list of such expenses.

Purpose of application

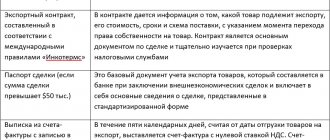

The rules for accounting for income and expenses in tax accounting (TA) and in accounting (AC) are established by different standards. For NU, the norm is the Tax Code, and for accounting regulations - various accounting provisions (in particular, PBU 9/99 “Income of the organization” and PBU 10/99 “Expenses of the organization”). Because of this, tax accounting does not always coincide with accounting.

Thus, some expenses are reflected in the accounting system in full, and in the accounting system - within the limit (for example, entertainment expenses). There are costs that are reflected only in accounting, but not in tax accounting (for example, bonuses for a holiday). Finally, the moment of recording income and expenses in accounting may differ from the moment of recording income and expenses in NU (in particular, for those who use the cash method). And these are not all cases where tax and accounting indicators diverge.

As a result, it may turn out that there is one profit (that is, the difference between income and expenses) in the income tax return, and another in the income statement. Then you should make special entries and use them to “adjust” the profit from the financial results statement to the profit from the declaration. In other words, with the help of special postings you need to show the connection between “tax” and “accounting” profit. How to create such postings is discussed in PBU 18/02.

Results

In the era of the income tax law - back in the 90s - the life of an accountant was much simpler. With the advent of Chapter 25 in the Tax Code, the approach to the formation of the tax base for the purposes of calculating income tax has completely changed. But the requirements for accounting did not change so significantly.

Legislators have tried to bring some order to the discrepancies between accounting and tax accounting, but over the course of 15 years, questions about the reflection of permanent and temporary differences in accounting have not decreased.

This is one of the most difficult areas of an accountant's job. But a competent approach to setting up accounting and choosing software for calculating and accounting for deferred assets and liabilities can significantly simplify the task. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Differences between NU and BU data

Every time any income or expense is reflected differently in tax and accounting, a so-called difference arises. There are two types of differences: temporary and permanent. It is extremely important for an accountant to determine which type a particular amount belongs to.

Temporary differences

Temporary differences are income and expenses that are reflected in accounting records in one reporting period, and in accounting records in another period. A distinctive feature of the temporary difference is that sooner or later there will come a time when the discrepancy between tax and accounting accounting will be reduced to zero.

Example 1

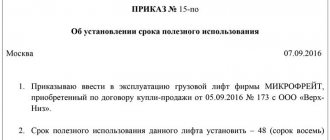

The company commissioned a fixed asset facility. Its initial cost is 120,000 rubles, its useful life is five years.

The accounting policy stipulates that for accounting purposes the linear depreciation method is used, and for accounting purposes the method of writing off value in proportion to the volume of production is used. Because of this, the amount of monthly depreciation deductions according to tax accounting data will differ from the amount of deductions according to accounting data. As a result, there is a difference every month.

At the end of the useful life, the original cost will be completely written off both in accounting and tax accounting. In this case, the total amount of depreciation accrued over five years, both in NU and BU, will be 120,000 rubles. This means that the discrepancy between tax and accounting will be reduced to zero. Based on this, the accountant concluded that the difference arising from the discrepancy in the monthly depreciation amount was temporary.

Example 2

The organization reflects vacation pay in accounting and tax accounting differently.

In accounting, the company creates a reserve for upcoming vacation expenses. To do this, a certain amount is written off monthly to the debit of the “cost” account and the credit of account 96 “Reserves for future expenses.”

In NU, vacation pay is written off as an expense for the month in which the vacation falls.

Thus, a difference arises monthly in the form of amounts written off as expenses in accounting.

After an employee uses vacation, tax accounting will generate costs for the full amount of vacation pay. In this case, the total amount of vacation pay according to the NU data will coincide with the amount that during the previous months was included in the reserve according to the accounting data. This means that the discrepancy between tax and accounting will be reduced to zero.

Based on this, the accountant concluded that the difference arising from the monthly recording of costs in accounting is temporary.

We add that temporary differences must be taken into account for each type of asset and liability. This means that it is necessary to organize analytical accounting of temporary differences in the context of fixed assets, reserves, etc.

Constant differences

Permanent differences are income and expenses that are reflected in only one accounting: either tax or accounting. A distinctive feature of a permanent difference is that the discrepancy between NU and BU will never be canceled.

Example 3

The company spent 200,000 rubles on advertising. In accounting, these costs are written off in full. For tax purposes, expenses were written off within 1% of sales revenue, which amounted to RUB 50,000. As a result, there was a difference equal to 150,000 rubles (200,00 rubles - 50,000 rubles).

Neither in the current nor in subsequent periods, part of the advertising costs in the amount of 150,000 rubles. will not be recognized by NU. Based on this, the accountant concluded that the difference is permanent.

Introduction to PBU 18/02 – temporary differences

Published 06.11.2018 14:25 In this article we will continue to look at the basics of PBU 18/02 and look at some of the nuances of temporary differences (we talked about permanent differences earlier in the article Introduction to PBU 18/02 - permanent differences). At the level of semantic understanding, in this case the rule works: “now we will pay more or less, but then, on the contrary, it’s a matter of time.” Thus, temporary differences arise in the presence of income and expenses that are accepted in accounting and tax accounting in different periods of time.

Important Features:

1. Temporary differences do not affect the company’s financial result, which is formed on account 99, but they affect the amount of income tax, which is formed on account 68.04.

2. To reflect deferred income taxes, there are special accounts: 09 (deferred tax assets) and 77 (deferred tax liabilities). The income tax amounts will be listed in these accounts, and when the time comes, they will be written off to account 68.04.

3. Temporary differences “defer” income tax into assets and liabilities, but in the future they will definitely be taken into account. Sooner or later there will come a time when the discrepancy “goes to zero.”

4. Temporary differences are accounted for for each type of asset and liability.

Account 09 “Deferred tax assets” can only be active, the balance is debit. When the time comes, we will write off this asset as debit 68.04 and thereby reduce income tax, i.e. we will receive a tax benefit.

In the reporting period, the deferred tax asset increases the amount of income tax (D-t 09 K-t 68.04), but then, as the temporary differences that arise are repaid, it decreases (D-t 68.04 K-t 09).

Analytical accounting of deferred tax assets is carried out by type of asset.

Account 77 “Deferred tax liabilities” can only be passive, the balance is credit. When the time comes, we will write off these obligations on credit 68.04 and thereby increase our obligation (income tax) to be paid. Analytical accounting of deferred tax liabilities is carried out by type of liability.

An organization can have balances for both account 09 and account 77 at the same time, but never for one analytical accounting object.

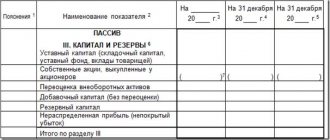

In the balance sheet (Form No. 1), deferred tax assets are shown as part of non-current assets, and deferred tax liabilities are shown as part of long-term liabilities.

The income statement (Form No. 2) shows changes in deferred tax assets and deferred tax liabilities that arose and were settled in the reporting period.

How it works in 1C: Enterprise Accounting 3.0

Let us recall that a deferred tax asset arises if in the reporting period the organization’s current income tax is higher, but in the next or subsequent periods it will be lower. "We'll pay less in the future"

Example No. 1 . In January 2021, the organization purchased and put into operation technological equipment No. 1 worth RUB 140,000.00 (excluding VAT). The useful life (SPI) in the BU is conditionally 3 months, the useful life (SPI) in the NU is conditionally 6 months.

Let's look at the emergence of a deferred tax asset (DTA) and its settlement.

1. Appearance of a deferred tax asset:

BU 140000.00: 3 months * 20% = 9333.33

NU 140000.00: 6 months * 20% = 4666.66 (expenses in NU are lower, which means more profit, tax is higher than in BU)

SHE No. 1 9333.33 – 4666.66 = 4666.67 rubles.

As can be seen from the analysis of account 09, in the period from February to April, a deferred tax asset is accrued in the accounting system.

2. Repayment of the tax asset.

After the fixed asset is fully depreciated in accounting (accounting) (in the example, this is 3 months), repayment begins for the amount of depreciation deductions in tax accounting (TA). The ending balance goes to zero.

Let me remind you that the accrual and repayment of a deferred tax asset is carried out using the “Month Closing” operation. Here, using a calculation certificate, you can check the accrual and repayment of tax assets and liabilities.

Important:

If temporary differences arise for several objects of analytical accounting, then it becomes necessary to maintain object-by-object accounting outside the 1C program. Paragraph 3 of PBU 18/02 defines the maintenance of group accounting (by type of assets and liabilities), this accounting principle was introduced by the developers of 1C. However, tax authorities may require a breakdown of assets and liabilities. It is convenient to keep such records in Excel tables; the double entry method is not required.

Let's look at an example.

Example 2. In February 2021 the same organization bought and put into operation technological equipment No. 2 worth 50,000.00 (excluding VAT), SPI in BU - conditionally 4 months, in NU - conditionally 7 months.

BU 50000.00: 4 * 20% = 2500.00 rub.

NU 50000.00: 7 * 20% = 1428.57 rub.

SHE No. 2 2500.00 – 1428.57 rub. = 1071.43 rub.

As can be seen from the analytical accounting, the reflection is in the group “Fixed Assets” SHE No. 1 + SHE No. 2 = 5738.10 (4666.67 + 1071.43)

A deferred tax liability arises if in the reporting period the organization's current income tax is less, but in the next or subsequent periods it will be more. “We’ll pay less now.”

Let's consider an interesting case (as Olechka Shulova says).

Example 3. Organization in July 2021 purchased and put into operation technological equipment No. 3 worth RUB 230,000.00. (without VAT). The useful life (USL) in both accounting and tax accounting is set to the same - 12 months. But in tax accounting a depreciation bonus of 30% is applied.

Let's consider the emergence and repayment of a deferred tax liability (DTL).

The depreciation bonus will be 230,000.00 * 30% = 69,000.00 rubles.

In the first month of depreciation (in the example, August 2018), two events occur: the appearance of a depreciation bonus (RUB 69,000.00) and the write-off of 5,750.00 (69,000.00/12 months) {"Month closure" - "Depreciation and amortization" OS" - "Show transactions"}

Deferred tax liability (DLT) is accrued on the balance at the close of the month.

In the second month of depreciation (in the example, September 2018), the deferred tax liability is repaid.

BU 230000.00: 12 months * 20% = 3833.33 rub.

NU 230,000.00 – depreciation. bonus (230000.00 * 30%) = 161000.00;

161000.00:12 months*20% = 2683.33 rub.

IT 3833.00 – 2683.33 = 1150.00 rub. This amount will reduce the deferred tax liability monthly until it is completely written off.

In our example, at the end of 2021. the balance will be 8050.00 rub. At 7 months In 2021, the deferred tax liability will be extinguished in full.

In the annual reporting, the deferred tax liability will be reflected as follows: Form No. 1 (Balance Sheet)

Form No. 2 (Report on financial results)

If you are interested in accounting according to PBU 18/02, please write your questions and specific examples from practice in the comments. Let's figure it out together!

Author of the article: Irina Kazmirchuk

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Irina Plotnikova 12/17/2020 15:00 I quote Ramet:

Tell me how to reflect the write-off without repayment, what should be the postings?

Rameta, good afternoon.

Unfortunately, starting from 2021, the methodology for calculating temporary and permanent differences has changed. Changes have been made to the program along with legislation. It’s so easy to write off SHE, IT won’t work. Even if you use manual entries, the accounting will be incorrect. We need to consider the issue as a whole. We recommend that you purchase our income tax course, it is updated in accordance with the legislation. Moreover, today is the last day of the New Year's sale; pleasant discounts await you. Quote 0 Rameta 12/17/2020 12:45 Tell me how to reflect the write-off without repayment, what should be the postings?

Quote

+4 Goncharova Alina 11/26/2018 00:59 thank you for the article! Very helpful!

Quote

Update list of comments

JComments

What transactions to create in case of temporary differences

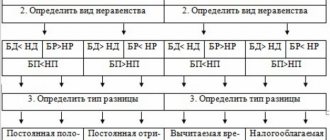

First, you need to determine whether the temporary difference is deductible or taxable. To do this, you need to understand which profit - “tax” or “accounting” - turned out to be greater after this temporary difference occurred.

If the “tax” profit is GREATER than the “accounting” profit, then the temporary difference is deductible. In this case, a deferred tax asset (DTA) should be reflected in accounting. Its value is equal to the deductible temporary difference multiplied by the tax rate. In this case, the accountant must make the following entry:

DEBIT 09 CREDIT 68 - a deferred tax asset (DTA) is reflected.

If the “tax” profit is LESS than the “accounting” profit, then the temporary difference is taxable. In this case, deferred tax liability (DTL) should be reflected in accounting. Its value is equal to the taxable temporary difference multiplied by the tax rate. In this case, the accountant must make the following entry:

DEBIT 68 CREDIT 77 - deferred tax liability (DTL) is reflected.

Permanent and temporary tax differences: formation mechanism

The occurrence of temporary differences is due to differences in the regulatory regulation of accounting systems - accounting is carried out according to the rules dictated by the current PBUs and the Law “On Accounting” dated December 6, 2011 No. 402-FZ, tax - the Tax Code of the Russian Federation. Accounting for temporary differences when calculating income tax (IIT) is precisely a reflection of these differences: often the same fact of economic activity is reflected in different time periods of different accounting systems. The presence of a time factor is the determining moment for fixing the temporary difference.

Usually they do not coincide in tax and accounting:

- Principles of classification of income and expenses, as well as methods of their recognition;

- Accounting for depreciable assets;

- Methods for assessing MPZ;

- Criteria for determining direct and indirect costs;

- The procedure for creating reserves, etc.

A classic example of temporary differences is the occurrence of temporary differences on fixed assets. In accounting, depreciation of fixed assets can be accrued by one of four methods (linear, reducing the balance, writing off the value by the sum of the number of years of the joint venture or in proportion to the volume of output), in tax - only two (linear and non-linear). Those. Only when choosing the linear method of calculating depreciation in both accounting systems in the company will there be no temporary difference.

Depending on the results of calculating the base for the tax return, a distinction is made between deductible (if the accounting profit according to the accounting book is less than the tax profit) and taxable (the opposite situation - the profit according to the accounting book is less than in the tax account) temporary differences. Deductible temporary differences will subsequently reduce the amount of tax, forming a deferred tax asset (DTA), respectively, taxable ones will increase the NTP, creating a deferred tax liability (DTA).

In the course of the company's activities, not only temporary, but also permanent differences arise. They have no time reference and remain unchanged throughout the entire period of operation of the company.

The most common situations causing permanent differences are:

- Limitation (or non-recognition) of the amounts of individual costs in accounting, along with their full acceptance in accounting;

- Non-recognition of expenses for payment of penalties in NU;

- Change in the value of fixed assets after revaluation in accounting and non-recognition of these expenses in the accounting system;

- Transfer of contributions to charity or transfer of property as a gift.

If the tax profit is less than in accounting (a rare case), a negative permanent difference arises, reducing the base of the income tax and forming a permanent tax asset (PTA). Conversely, a positive difference (when accounting profit exceeds tax profit) forms a permanent tax liability (PNO). PNA and PNO are calculated and taken into account in the period when the permanent difference was created.

The PNO or PNA is calculated by multiplying the resulting constant difference by the NNP rate (today it is 20%). PBU 18/02 allows the company to independently determine the criteria for accounting for permanent and temporary differences, fixing the selected algorithm in its accounting policies. One of the most acceptable options is the reflection of this information on the accounting accounts.

What postings to create in case of a permanent difference?

First of all, it is necessary to determine whether the constant difference is positive or negative. To do this, you need to understand which profit - “tax” or “accounting” - turned out to be greater after this constant difference occurred.

If the “tax” profit is BIGGER than the “accounting” profit, then the constant difference is positive. In this case, a permanent tax liability (PNO) should be reflected in accounting. Its value is equal to the positive constant difference multiplied by the tax rate. In this case, the accountant must make the following entry:

DEBIT 99 CREDIT 68 - permanent tax liability (PNO) is reflected.

If the “tax” profit is LESS than the “accounting” profit, then the permanent difference is negative. In this case, a permanent tax asset (PTA) should be reflected in accounting. Its value is equal to the negative constant difference multiplied by the tax rate. In this case, the accountant must make the following entry:

DEBIT 68 CREDIT 99 - a permanent tax asset (PTA) is reflected.

Deferred tax assets in company accounting

So, the presence of a deferred tax asset gives the right to reduce the income tax in future periods. It is taken into account on account 09, the debit of which records the creation or increase of this asset, and the credit records the write-off:

| Operation | D/t | K/t |

| Confession of SHE | 09 | 68/NNP |

| Reduction of taxable income upon payment | 68/NNP | 09 |

Let's consider how an accountant records in accounting the IT that arose due to the formation of a deductible temporary difference, and the entries compiled at the same time.

How the differences affect income taxes

According to PBU 18/02, profit according to accounting data multiplied by the tax rate (it is equal to 20%) is called a conditional income tax expense. Accordingly, the loss according to accounting data, multiplied by the tax rate, is called conditional income for income tax. The conditional income tax expense is reflected in the debit of account 99 and the credit of account 68, the conditional income for profit tax is reflected in the debit of account 68 and the credit of account 99.

Profit according to tax accounting, multiplied by the tax rate, is called the current income tax. There is no need to make any separate entry for the amount of current income tax.

The conditional income tax expense (or income) is “adjusted” to the current income tax using ONA, ONO, PNO and PNA.

Example 4

At the end of the period, the “accounting” profit amounted to 1,000,000 rubles, and the conditional income tax expense was 200,000 rubles (1,000,000 rubles x 20%). “Tax” profit for the same period amounted to 700,000 rubles, and the current income tax was 140,000 rubles (700,000 rubles x 20%).

During the period, a permanent negative difference was formed in the amount of RUB 400,000, and a deductible temporary difference in the amount of RUB 100,000. The accountant made the following entries:

DEBIT 99 CREDIT 68 subaccount “Calculations for income tax” - 200,000 rubles. – the conditional income tax expense is reflected; DEBIT 68 subaccount “Calculations for income tax” CREDIT 99 - 80,000 rubles. (RUB 400,000 x 20%) – a permanent tax asset is reflected; DEBIT 09 CREDIT 68 subaccount “Calculations for income tax” - 20,000 rubles. (RUB 100,000 x 20%) – a deferred tax asset is reflected.

As a result, in the credit of account 68 subaccount “Calculations for income tax” a balance was formed in the amount of 140,000 rubles (200,000 rubles – 80,000 rubles + 20,000 rubles), which corresponds to the amount of the current income tax.

What happens to temporary differences when the income tax rate changes?

If the tax rate changes, deferred tax assets and liabilities will have to be restated. Moreover, this must be done on the eve of the start date of the new tax rate. This clarification was given in the letter of the Ministry of Finance dated April 29, 2016 No. 03-03-03/1/25192. The resulting difference should be reflected as profit or loss and attributed to account 99.

Example

In December 2021, a taxable temporary difference in the amount of 20,000 rubles arose in the accounting of an enterprise located in one of the constituent entities of the Russian Federation, which resulted in the accrual of a deferred tax liability in the amount of 4,000 rubles by posting Dt 68 Kt 77.

Let’s assume that from January 1, 2021, the regional law changed the tax rate credited to the budget of a constituent entity of the Russian Federation. If previously the general rate was 20%, now it has decreased to 15.5%. The deferred liability has therefore decreased.

It is necessary to write off the difference of 900 rubles (20,000 × 4.5%) by posting Dt 77 Kt 99. But this must be done after the reporting for 2021 is generated.

That is, when submitting reports for 2021, the opening balances in the balance sheet and turnover for the previous year in the financial results statement will not coincide with the previously submitted forms.

The liability in the balance sheet will change - the indicator in line 1420 “Deferred tax liabilities” will decrease and the amount in line 1370 “Retained earnings (uncovered loss)” will increase.

And in the financial results statement, the written-off liability will be noticeable by a decrease in line 2430 “Change in deferred tax liabilities” and an increase in line 2400 “Net profit (loss”).

A change in net profit will also affect the opening lines of the statement of changes in equity.

According to clause 10 of PBU No. 4/99, it is necessary to reflect these discrepancies in the explanations to the reports, also indicating the reason for their occurrence.

How to Repay Deferred Tax Liabilities and Assets

As mentioned above, temporary differences arise when the discrepancy between NU and BU will sooner or later be brought to zero. As it is reduced or completely eliminated, deferred tax assets and liabilities should also be eliminated. To do this you need to do the following wiring:

DEBIT 68 CREDIT 09 - deferred tax asset (DTA) is repaid; DEBIT 77 CREDIT 68 - deferred tax liability (DTL) has been repaid.

It may happen that part of the temporary difference remains unabsorbed. This will happen, for example, if the fixed asset is sold or liquidated before the end of its useful life. Then the discrepancy that arose due to different methods of depreciation in tax accounting and accounting (or for another reason) will not be completely canceled.

In such a situation, the balance of IT or ONA must be written off to account 91 “Other income expenses”. The postings will be as follows:

DEBIT 91 CREDIT 09 - the balance of the outstanding ON is written off; DEBIT 77 CREDIT 91 - the balance of the outstanding IT is written off.

Taxable temporary differences and their accounting treatment

In the event that expenses for tax purposes exceed accounting expenses in the current period, but in subsequent periods the excess amount will be compensated, taxable temporary differences arise, which are reflected in transaction Dt 68 Kt 77.

Example

In January 2021, the company purchased an executive desk for 53,985 rubles. According to PBU 6/01, furniture is classified as fixed assets (fixed assets). But the Tax Code establishes the minimum cost of depreciable property - 100,000 rubles (Clause 1, Article 256 of the Tax Code of the Russian Federation). This means that for the purposes of calculating income tax, the cost of the table will be written off at a time, and in accounting, expenses will increase as depreciation is calculated. This will result in a taxable temporary difference and, as a result, a deferred tax liability. In accounting it will look like this:

| Accounting | Tax accounting | Note | |

| January 2017 | Dt 08 Kt 60 - 45,750 rubles Dt 19 Kt 60 — 8,235 rubles Dt 01 Kt 08 — 45,750 rubles Dt 68 Kt 77 — 9,150 rubles | The purchase amount minus VAT is written off as expenses at a time - 45,750 rubles | The useful life upon commissioning was set at 61 months. Simultaneously with the expense in tax accounting of the cost of property in accounting, a deferred liability is accrued in an amount equal to the product of the cost of the table and the tax rate (in 2017 - 20%) |

| Monthly transactions starting from February 2021 until the end of the useful life of the table or disposal of fixed assets due to sale, loss, etc. | Dt 26 (44 or another account for accounting expenses) Kt 02 - 750 rubles Dt 77 Kt 68 — 150 rubles | Simultaneously with the accrual of depreciation, the deferred tax liability is reduced monthly by an amount equal to the product of accrued depreciation and the tax rate |

In the event of disposal of a fixed asset before the expiration of its useful life, the balance of the deferred liability is considered profit, which is accrued by posting Dt 77 Kt 99.

For more information about the calculation of depreciation and the emergence of deferred assets or liabilities in connection with this, read the article “Accrual of depreciation of fixed assets in 2016.”