A sick leave certificate is the main document indicating that an employee has suffered an illness or been injured. Based on this document, insurance payments are calculated to the employee. In order for an accountant to correctly calculate their size, it is necessary to know the sick leave codes and their interpretation. In particular, disability codes on sick leave.

The sick leave form is approved by Order of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011 No. 347n. The same document approves disease codes. The procedure for storing and providing forms is regulated by special instructions approved by Orders of the Federal Social Insurance Fund of the Russian Federation No. 18, the Ministry of Health of the Russian Federation No. 29 dated January 29, 2004.

What are disability codes on sick leave?

This is the reason for the absence of a subordinate from the enterprise for a certain time. Each disease has a code indicated on the sick leave certificate. This type of encryption is required for many reasons.

Important: the employer does not have the right to ask a subordinate for a decoding of the disease codes indicated on the sick leave certificate, or for detailed explanations from him.

The diagnosis is displayed on the sick leave certificate using a code - to maintain medical confidentiality and unification

Codes can be two-digit - indicating the main cause of the ailment - and three-digit. The latter establish the employee’s need for special treatment/rehabilitation conditions, so they are used only when necessary.

The procedure for filling out and applying disease codes on sick leave is based on Order of the Ministry of Health of the Russian Federation No. 624n of 2011.

Decoding disease codes and other codes on the certificate of incapacity for work

What codes should an employer provide?

The employer should put the subordination code in the bulletin and fill out the “Calculation conditions” field (the codes are given on the back of the sick leave form).

Doctors indicate all other codes, in particular: reasons for disability, notes on violation of the regime and the corresponding values in the “Other” field.

IMPORTANT. If doctors filled out a sick leave certificate with errors (including incorrect disease codes), and the accounting department paid for it, the Social Insurance Fund will most likely refuse to reimburse the benefit. But the courts support policyholders in such situations.

Functions of disability codes

Codes have several functions, and protecting medical confidentiality is only one of them:

- optimization of accounting work - payments are calculated based on the numbers entered on the sheet;

- economical filling out of the form, without specifying long medical terms;

- filling out the sheet in accordance with international standards.

So, if the sickness form was opened abroad, the code indicated in it will be the carrier of one information in the territory of any country participating in international legal relations.

In what cases is a serial number given?

The sick leave number (sick leave form number) is the twelve digits written on the form. On the sick leave form it is written in two places, on the main part and on the detachable part. The tear-off part remains in the medical institution, and the personnel service employee sees the sheet number on the main part of the form.

The main reason for the appearance of a serial number on the new form of the certificate of incapacity for work is the intention to reduce the possibility of fraud with documentation. On the new forms of certificate of incapacity for work there is no document series, only a serial number.

The number is indicated at the top, on the right in the document. In the white field located under the barcode. The number consists of twelve digits. The first nine digits are ordinal, the last three are check digits.

Decoding the main disability codes

Two-digit coding is the basic information about the reason for the employee’s absence; payments will be calculated for them and entries will be made in personnel documents. The breakdown of the diseases indicated on the sick leave is as follows.

| Codes for filling out the form | Designation |

| 01 | Any disease that is treated in a hospital or outpatient setting |

| 02 | Injury, no matter whether it is domestic or industrial |

| 03 | Quarantine |

| 04 | Cause of disability code number 04 indicates unforeseen circumstances that occurred within the walls of the enterprise and their consequences |

| 05 | Maternity and childbirth leave |

| 06 | Prosthetics without a special designation, requiring the patient to be placed in a ward |

| 07 | Occupational disease and its relapse |

| 08 | Aftercare under the supervision of doctors |

| 09 | Disability code 09 stands for caring for someone in the family |

| 10 | Other related to human health |

| 11 | A disease of social significance, for example, tuberculosis, hepatitis and others |

| 12 | If a disease occurs in a child included in the list of Federal Laws |

| 13 | Disabled child |

| 14 | Post-vaccination complication or malignant formation in a child |

| 15 | HIV-infected baby |

Important: the last two points from the table are indicated only with the consent of the employee. If he does not want to provide the employer with information regarding the child’s special condition, no one has the right to insist.

When is an employee's injury not considered work-related?

Occupational injuries will not include cases that occurred to an employee outside the workplace, while performing an assignment or traveling to the place of work (business trip) on work transport (or on public transport - to the place of the business trip).

The following situations cannot be considered a work-related injury::

- the employee went on personal business during a break and had an accident;

- he got into an accident on his way to or from work in his personal transport;

- injury sustained during a corporate party;

- an employee's attempt to commit suicide during working hours will also not be considered an industrial accident;

- the cause of the injury or accident is the employee’s alcohol or drug intoxication;

- if the injury was received while committing a crime.

Decoding additional disability codes

Additional ones include three-digit codes that are used to convey to the employer a more complete picture of the employee’s problems. They also play a significant role for the Social Insurance Fund.

| Code | Decoding |

| 017 | Treatment in a special institution designed to solve problems with the gastrointestinal tract and heart |

| 018 | Rehabilitation in a sanatorium/resort boarding house after being injured in the line of duty |

| 019 | Treatment in the clinic of the research institute (health resorts, physiotherapy and rehabilitation) |

| 020 | Supplementation of leave allocated for prenatal time and childbirth if complications or multiple pregnancies arise during their process |

| 021 | Recovery from injury or complications caused by toxic, narcotic, or alcoholic intoxication |

Important: the role of additional codes is significant; thanks to their indication, the employer has a full picture of the employee’s problem, which can significantly increase payments. For example, the reason for disability code 05 020 indicates a complication during childbirth and provides a legally mandated increase in vacation pay.

If hospital code 05 is supplemented with code 020, this means that the established 70 days for pregnancy have increased:

- for 14 days in case of multiple pregnancy;

- for 16 days in case of complications during childbirth;

- for 40 days after birth for the birth of 2 or more children.

Cause of disability code 05 020 means complicated childbirth requiring longer recovery

There are two-digit codes indicating family ties. They are needed to identify the caregiver.

| Code | Designation |

| 38 | Mother |

| 39 | Dad |

| 40 | Legal guardian |

| 41 | Trustee |

| 42 | Other family members |

The “Other” category is supplemented with the following codes:

| Codes | Explanation |

| 31 | Extension of previously issued sick leave |

| 32 | Determination of disability |

| 33 | Changing an existing disability group |

| 34 | Death of an employee |

| 35 | Refusal to participate in ITU |

| 36 | Work ability |

| 37 | Referral for health improvement or recovery after hospitalization |

All stated disease codes and additions to them on sick leave are indicated by the attending physician. He must take responsibility for entering them, since not only he, but also the management of the medical institution will be responsible for incorrect information.

Disease codes in the document are filled out by a physician

Mandatory investigation and recording as a basis for issuing a BC

It is legislatively established that all accidents during work are subject to investigation , which must be undertaken by the employer himself (Article 228 of the Labor Code of the Russian Federation).

First of all, the employer, having learned about the incident, must organize first aid for the injured employee and deliver him to a medical organization, as well as take measures to prevent the development of a dangerous situation so that no one else gets hurt. Only after urgent measures will he have to proceed to the preparatory stage before investigating what happened.

What should an employer do: step-by-step instructions

Preparatory stage

If possible, the scene of the accident should be preserved as it was when the injured worker was found, unless such preservation would endanger the life or health of other workers.

Next, you need to inform the Social Insurance Fund about the incident . The message is sent in the form:

If a work-related injury has resulted in serious consequences, inform the injured worker’s relatives.

In the event of a group accident or serious consequences (including the death of the employee), the employer is also obliged to inform the following organizations:

- regional department of labor inspection;

- the prosecutor's office at the scene of the incident;

- administration of the Moscow Region;

- if the employee was sent by another employer (business trip, assignment, etc.) - it is necessary to inform him;

- control body involved in the supervision of specific types of activities (Rostechnadzor, etc.);

- trade union organization.

The specified bodies and persons must be notified of the incident no later than 1 day.

Formation of the commission

The employer is obliged to immediately form a commission, usually of 3 people:

- representative of the organization's labor protection;

- representative from the employer;

- representative of a trade union organization.

In case of serious consequences, officials from the above organizations must be included in the composition. When a person is on a business trip, representatives from the organization in which the victim was located must also be included.

Important! The number of commission members should not be even.

The formed commission is headed by the employer himself or an official from the control body supervising the organization.

As soon as the commission is created, the employer creates a special order. The law does not establish a specific form in which it must be drawn up, because Each organization sets it independently. The order usually states :

- legislative basis (Article 229 of the Labor Code of the Russian Federation);

- commission members;

- an order to the head of the personnel department to send a notice of the accident to the relevant authorities;

- the period for conducting the investigation (in accordance with Article 229.1, such a period, depending on the severity of the consequences, is set from 3 to 15 days);

- signature of the head and seal of the organization.

Investigation process

The responsibilities of the formed commission (Article 229.2) include:

- identifying the facts of the event;

- interviewing eyewitnesses;

- interviewing persons who violated labor safety standards;

- if possible, obtain an explanation from the victim.

The commission may require the employer to allocate funds for investigative actions (involvement of specialists and experts, media filming, transport, etc.).

Preparation of trial materials

The materials include:

- order to create a commission;

- WMD protocol;

- media materials, diagrams, plans;

- characteristics of the state of the workplace and the presence of hazardous production factors in it;

- extracts from the logbook of registration of safety briefings;

- protocols of interviews with eyewitnesses and victims;

- opinions of specialists and experts;

- medical report on the health status of the injured employee;

- other materials at the request of the commission.

An industrial accident report is drawn up for the victim in 2 copies . It is established according to form N-1 (Resolution of the Ministry of Labor No. 73). One copy is sent to the employee within 3 days after completion of the investigation, the second remains in the case file. The act is signed by all members of the commission, the employer, and stamped.

Registration and accounting of accidents

Registration is carried out in the accident register established by Form 9 of the Resolution of the Ministry of Labor No. 73:

Not only the act of the victim is subject to registration, but also acts of other consequences of accidents (Form 8):

This act is sent to the labor inspectorate at the location of the organization.

Can a BC be issued without a trial?

In practice, it often happens that the attending physician assigns this code simply from the words of the injured employee.

In accordance with Art. 229.1, an employer who was not promptly aware of a work-related injury undertakes to investigate this fact in the same manner as cases notified in a timely manner. To do this, the employee must submit an application to the manager for an investigation within a month .

Otherwise, the injured worker will not be compensated. To receive it, the Social Insurance authorities must receive not only a sick leave bulletin with code 04, but also a notification of an accident and an act in form N-1.

How to pay for two sick days if the first is closed and the second is a continuation of the first?

There are situations when one sick leave has already been closed and the “Get to work” column is filled in, but the employee brings a new open sick leave, which is a continuation of the first one.

For example, if a woman spent 140 days at home during pregnancy and childbirth and closed her sick leave, but then brought a sheet with disability code 05 020, open for 16 days due to complications during childbirth.

In this case, the manager must be guided by Art. 255 of the Labor Code of the Russian Federation and calculate benefits according to the established social amounts.

In the example given, the medical institution initially prepared a sheet on pregnancy and childbirth. If complications occurred during labor, an additional sheet for 16 days was issued for the same insured event. The employer is obliged to pay these two sheets in total, taking as a basis the employee’s average daily earnings in the amount that existed before maternity leave.

Line “Other” (code 31, 36)

It contains additional information in encrypted form. Here are some of them.

Code 31 means that a person needs long-term treatment, and although he was given a certificate of incapacity for work, he continues to be ill. In this case, he submits the primary sheet to the accounting department and receives benefits for the first part of the illness. In this document, the “Get Started” field is not filled in. And in the “Other” field there is code 31, which stands for “continues to hurt.”

Code 36 indicates the following situation. The employee, while on sick leave, missed his next doctor's appointment. And when he showed up (later than the appointed date), he was recognized as able to work. The ballot fields are filled in as follows:

- “Notes on violation of the regime” - worth 24 and the date of the missed appointment;

- “Exemption from work” - the period from the onset of illness to the date of the missed appointment is indicated;

- “Other” - costs 36;

- “Get Started” remains blank.

ATTENTION. The benefit for the ballot, in which code 36 is indicated in the “Other” field, is calculated as follows. From the onset of illness to the date preceding the absence - based on actual average earnings. For a day of failure to appear - in an amount not exceeding for a full calendar month the minimum wage established for the current year and multiplied by the regional coefficient (if any). From the date following the day of failure to appear, benefits are not accrued at all (letter from the Moscow branch of the FSS dated September 01, 2020 No. 14-15/7710-2216l; see “The capital FSS clarified how to calculate benefits if there is a note on the sick leave for violation of the regime ").

Calculate a “complex” salary with coefficients and bonuses for a large number of employees Try for free

Calculation of sick leave payment by codes

After completing the work sheet, the employee must submit it to the accounting department for calculation of payments.

Important: a payment will be made on the sheet if it is presented within 6 months from its closure. If you present the sheet even a day later, there will be no payment for sick days.

Management has 10 days to review it and calculate payments. The employee will receive the money on the next payday. The amount of payments will depend on the adopted system for calculating them and the codes indicated by the doctor in them.

In 2021, when making calculations, the accountant will take into account the following changes:

- The minimum wage for an insurance period of up to 6 months is set at 12,130 rubles;

- the calculation period will be 2021 and 2021;

- in 2021, the maximum base for calculating benefits has been increased to 1,680,000 rubles.

In addition, the number of days allocated by law for resolving health issues and recovery will be taken into account. For this purpose, the codes entered on sick leave certificates and their decoding are taken into account.

For example, for child care, code 12 is entered if the problem is from the special list, the child is under 7 years old, and the sick leave lasts no more than 90 days. But if he gets better at a dispensary, the doctor can indicate code 017, and the mother’s paid sick leave will be extended.

Calculation of sick leave payment by codes

After establishing the picture of the illness and studying the doctor’s records, the employer must indicate a code that is the basis for payments and indicating the features of their accrual.

| Codes | Decoding |

| 43 | Has been exposed to radiation and is entitled to preferential social benefits |

| 44 | For workers of the Far North |

| 45 | Disability |

| 46 | The employee is hired under a short-term employment contract (up to 6 months) |

| 47 | The occurrence of health problems within a month after the termination of the contract |

| 48 | Violation of regulations for good reason |

| 49 | Sick leave for more than 4 months |

| 50 | Sick leave for more than 5 months |

| 51 | Subordinate hired part-time |

Causes of illness and legal consequences for the employer

Sick leave codes 01, 02

Code 01 on the sick leave means that the employee was absent from work due to illness (flu, pneumonia, sinusitis, etc.).

Code 02 means that the person missed work due to injury.

Having received a bulletin with one of these codes, the personnel officer must reflect the information in the work time sheet (usually they use forms No. T-12 or No. T-13, approved by Resolution of the State Statistics Committee dated 01/05/04 No. 1). The corresponding days are marked with the symbols “B” or “19”.

Next, the accountant calculates temporary disability benefits (for more details, see: “Payment of sick leave in 2019”). In this case, the employer pays for the first three days at his own expense. The remaining days, starting from the fourth, are financed by the FSS. This is stated in paragraph 1 of part 2 of article of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

Calculate your salary and benefits for free in the web service

Sick leave code 04

Code 04 on the certificate of incapacity for work means that the person missed work due to an accident at work or its consequences.

In the report card in form No. T-12 or No. T-13, days of absence are marked with the symbols “B” or “19”.

Benefits under such a bulletin must be issued for the entire period up to the date of recovery or until the fact of permanent disability is established. The payment amount is calculated based on 100% of average earnings, regardless of length of service, but for a full calendar month cannot exceed the maximum amount. It is equal to the maximum monthly insurance payment approved by law, multiplied by four (Article 9 of Federal Law No. 125-FZ of July 24, 1998).

IMPORTANT. First, the organization or individual entrepreneur pays the benefit from its own money, and then can reimburse it from the Social Insurance Fund. To do this, it is necessary that the incident be investigated by a special commission, which recognized it as an accident (Article 229 of the Labor Code). Next, the accountant must reflect the costs of the benefit in Table 3 of the calculation in Form 4-FSS (approved by Order of the FSS dated September 26, 2016 No. 381).

Fill out and submit 4‑FSS online for free using the current form

Reasons for refusal to pay for sick leave

The main reason for refusal is the lack of a certificate of incapacity for work. In addition, there are several more justified reasons for completely refusing to pay for the period of illness:

- the employee took leave at his own expense, during which he fell ill;

- during the regular vacation period, the employee’s child fell ill;

- removal of an employee from performing duties without maintaining his salary;

- imprisonment of the employee, sickness benefits are not paid during this period;

- if the employee fell ill during the period of administrative arrest;

- if a forensic medical examination is carried out regarding the employee;

- when the illness occurred after the start of the plant’s downtime. If an employee has previously fallen ill and his illness continues during the period of inactivity, his sick leave is paid in full;

- Also, sick pay for caring for a relative may be denied if the employee has used more time than required by law.

In addition, the legislation identifies several points when an employee, in principle, cannot count on sick leave:

- when the employee intentionally committed a crime that resulted in illness;

- the employee deliberately inflicted serious injuries on himself.

Important: to justify the refusal to accrue benefits, a court decision is required, which will indicate the harmful intent of the subordinate.

Specialists working under a civil contract or without official registration are also deprived of payments.

Also, refusal to issue money will follow if:

- the employer will discover that the document is fake, is an old-style form, bears a fake seal and signature. For such fraud, the employer has the right to hold the employee accountable;

- the employer identified errors in filling out the sheet made by the doctor, for example, the name of the enterprise was incorrectly indicated or the diagnosis codes entered on the sick leave sheet diverged from the real picture. Errors must be corrected at the medical institution and until they are corrected, payments are not accrued.

If the employer made errors in filling out the form, the Social Insurance Fund may refuse payment.

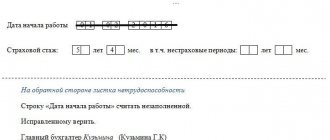

Registration procedure

There are three people involved in registration: the doctor, the employer and the employee. An employee becomes ill and goes to a medical facility. The doctor must diagnose the patient's disease and health condition. Based on this, the doctor determines the duration of sick leave and enters it into the form. To do this, use the corresponding unified codes (detailed explanation below). Then he indicates the following information about the patient:

- FULL NAME;

- Date of Birth;

- Floor;

- Name of the enterprise - according to the patient, no special documents are required. If the employer is an individual entrepreneur, then enter the full name of the individual. employer person.

If you made a mistake in spelling the name of the company, then do not rush to the hospital to get a new document, just read the article “If there is a mistake in the name of the organization on the sick leave certificate.”

The doctor must also indicate the name, address and registration number of his medical institution. After this, the sheet should be signed and stamped. If the attending physician is engaged in private practice, then he similarly indicates his full name and register. number.

The employee takes the form completed by the doctor to the administration at the place of work. The employer fills out information regarding payment calculations and information about his company:

- Name of organization - 29 cells are allocated, one empty cell must be left between words;

- Type of work (main or part-time);

- Registration number in the Social Insurance Fund (enterprise);

- Subordination code;

- Employee number (identification);

- Fear. number;

- Payment terms;

- Fear. employee experience;

- Avg. earnings;

- Full name of the head. accountant and company manager;

- Amount of payments - indicate three amounts: from the employer, from the Fund and the final amount (due to the employee).

In addition, the data necessary for the tax authorities is recorded. Every year, tax reports (2-NDFL) must be prepared for all employees. On sick leave, the tax code is always 2300. The benefit is not taxed, although formally it is classified as income. A 2-NDFL certificate is sometimes required for an employee to get a loan; it may be necessary in a new workplace. The employee always has the opportunity to check the correctness of payments.

Explanation of the fields on the sick leave:

The employee is also a participant in the registration process, but he practically does not fill out anything. All he needs to do is consult a doctor in a timely manner and obtain a certificate of incapacity for work. Then it is necessary (within compliance with the deadlines) to provide the completed form at the place of work.

Reasons for reducing the amount of payment for sick leave

The manager has the right to reduce the amount of payments or pay only part of the period of illness. There are the following reasons for this:

- violation by the patient of the treatment period without good reason;

- the illness or injury was caused by alcohol or intoxication;

- the patient did not appear during the period of illness for medical procedures prescribed by the doctor or for an appointment with him.

These cases of violation of the treatment regimen lead to a reduction in payments. The employee will receive no more than the minimum monthly wage established by federal law. If the minimum wage is adjusted by local regulations, the payment will correspond to its size.

If the patient maliciously ignored the doctor’s orders, this may be indicated with the corresponding code on the sick leave, which will lead to a reduction in payments

Payment reductions will be made for certain periods of incapacity:

- if the patient violates the regime established by the doctor, the payment will be reduced by the number of days of violation;

- when the illness is a consequence of the employee’s improper condition, the payment can be canceled for the entire period of illness.

The following category of codes indicates a violation of the treatment prescribed by the doctor:

| Code | Designation |

| 23 | Refusal of treatment in the hospital by one’s own decision, travel to another area for further treatment |

| 24 | Missing an appointment time |

| 25 | The subordinate began work without sick leave |

| 26 | Refusal to conduct a medical examination |

| 27 | Failure to appear at the appointed time for the medical examination |

| 28 | Other reasons for failure to meet doctor's demands |

Mode violation codes 23, 24

Significant information is contained in the field of the sick leave sheet, which is called “Notes on violation of the regime.” A two-digit code and the date of violation are entered here. The following marks are most often used.

Code 23 indicates non-compliance with the prescribed regimen, unauthorized leaving the hospital, traveling for treatment to another administrative region without the permission of the attending physician.

Code 24 indicates late attendance at a doctor's appointment.

If these values are present, then starting from the date specified in this field, the benefit must be calculated in an amount that does not exceed for a full calendar month the minimum wage established for the current year and multiplied by the regional coefficient (if any). This rule applies even if the employee’s actual average earnings exceed the minimum wage.

Example

The specialist's experience is 15 years, his average earnings are more than the minimum wage.

From February 10 to February 17, 2021, he was treated in a hospital. On February 14, the employee violated the regime, and the doctor made a note on the bulletin.

The accountant calculated the allowance:

- for the period from February 10 to February 13 - based on the actual average earnings multiplied by 100%;

- for the period from February 14 to 17 - according to the formula: minimum wage for 2021, divided by 29 (the number of days in February) and multiplied by 4 (the number of days of sick leave, starting from the date when the regime was violated).

Results

When an employee receives a work-related injury, sick leave is paid entirely from the Social Insurance Fund.

The calculation of the amount paid is made based on the average earnings of the employee for whom “unfortunate” insurance premiums are calculated in accordance with Law No. 125-FZ. A reduction factor taking into account length of service is not applied. However, restrictions in the form of a legally established amount of the maximum possible payment must be taken into account. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.